Cortadera Delivers Another Outstanding Intersection: 876m at 0.5% CuEq including 206m at 0.9% CuEq

Highlights

- Hot Chili has recorded another exceptional result at the Cortadera copper-gold porphyry discovery off the back of a major resource upgrade to its Costa Fuego copper hub in Chile

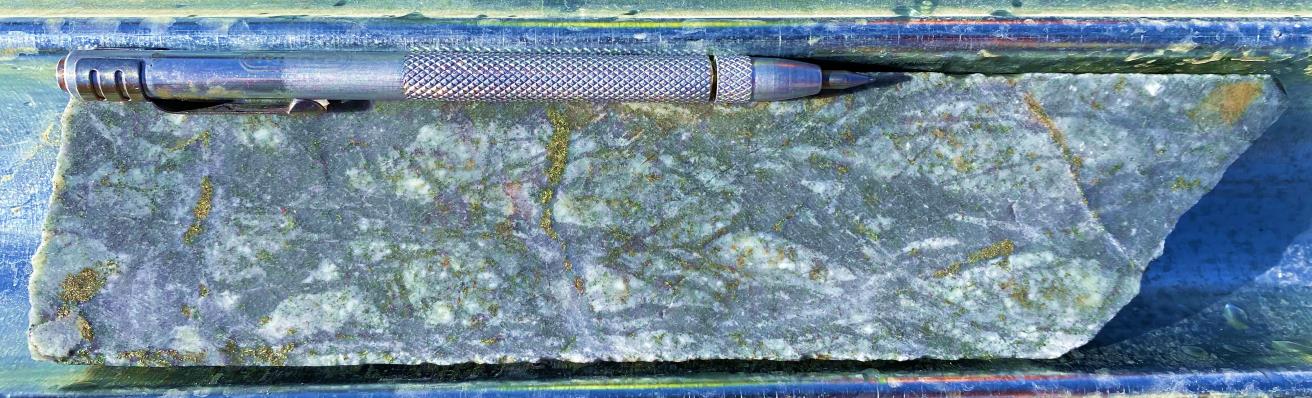

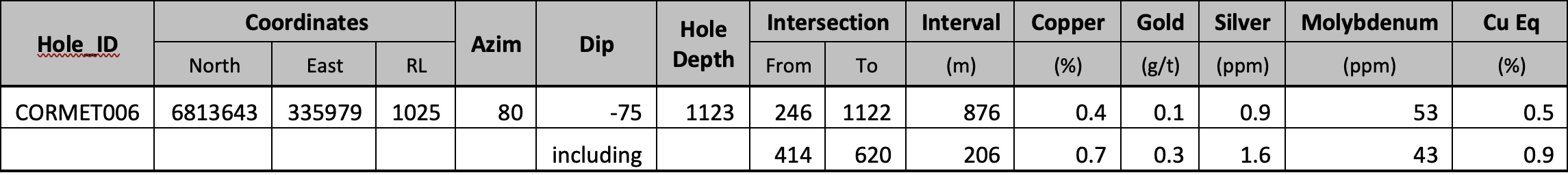

- An outstanding intersection of 876m1 grading 0.5% CuEq (0.4% copper (Cu), 0.1g/t gold (Au)) from 246m depth down-hole,including 206m2 grading 0.9% CuEq (0.7% Cu, 0.3g/t Au) from 414m depth was returned from drillhole CORMET006 (1excluding 18m unsampled and 2excluding 4m unsampled due to geotechnical test work)

- New drill result demonstrates strong continuity of high-grade resources (+0.6% Cu)Â at Cortadera ahead of the Costa Fuego Pre-Feasibility Study (PFS), forecast for release in Q3 2022

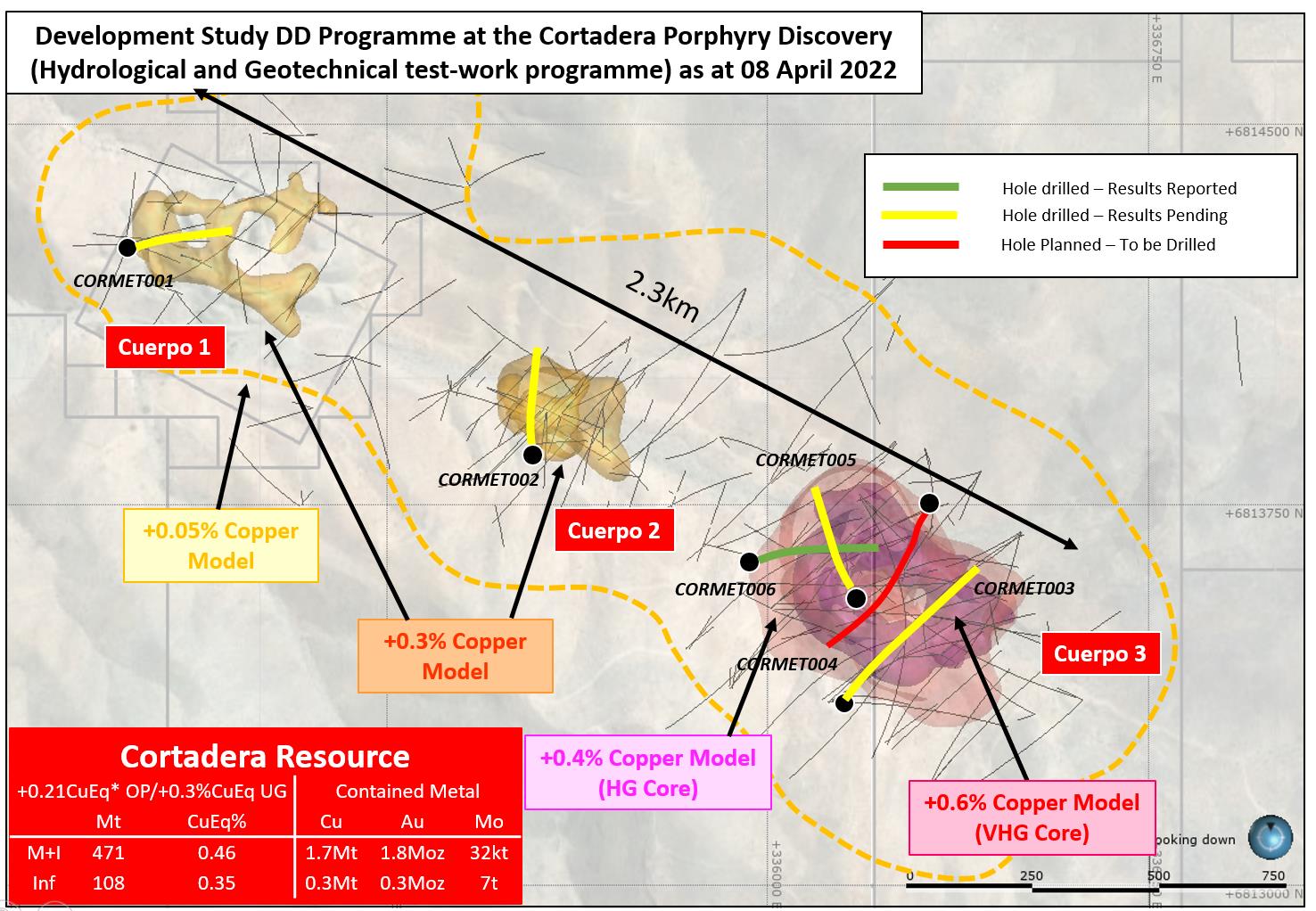

- CORMET006 is the first of five – development study diamond drill holes, already completed at Cortadera for hydrological and geotechnical modelling, a sixth diamond drill hole is planned

- The remaining four diamond drill holes already completed have visually recorded wide, strongly mineralised, intersections with assay results pending

- Three drill rigs in operation with an exploration update and first drill results from Productora expected shortly

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%.

Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) (“Hot Chili” or “Company”) is pleased to announce continuing strong results from its Cortadera porphyry discovery, the centrepiece of the company’s low-altitude, Costa Fuego senior copper development in Chile.

Five development study Diamond Drill (DD) holes, of a six-hole programme, have been completed at Cortadera this year in preparation of the Costa Fuego PFS, forecast for completion in Q3 2022.

Assay results returned from the first (CORMET006) of these five diamond drill holes have delivered an outstanding intersection of 876m1 grading 0.5% CuEq (0.4% copper (Cu), 0.1g/t gold (Au)) from 246m depth down-hole, including 206m2 grading 0.9% CuEq (0.7% Cu, 0.3g/t Au) from 414m depth (1excluding 18m unsampled and 2 excluding 4m unsampled due to geotechnical test work).

This latest significant drilling intersection from the main porphyry (Cuerpo 3) at Cortadera provides further confidence in the recently announced resource upgrade for Costa Fuego (see announcement dated 31st March 2022).

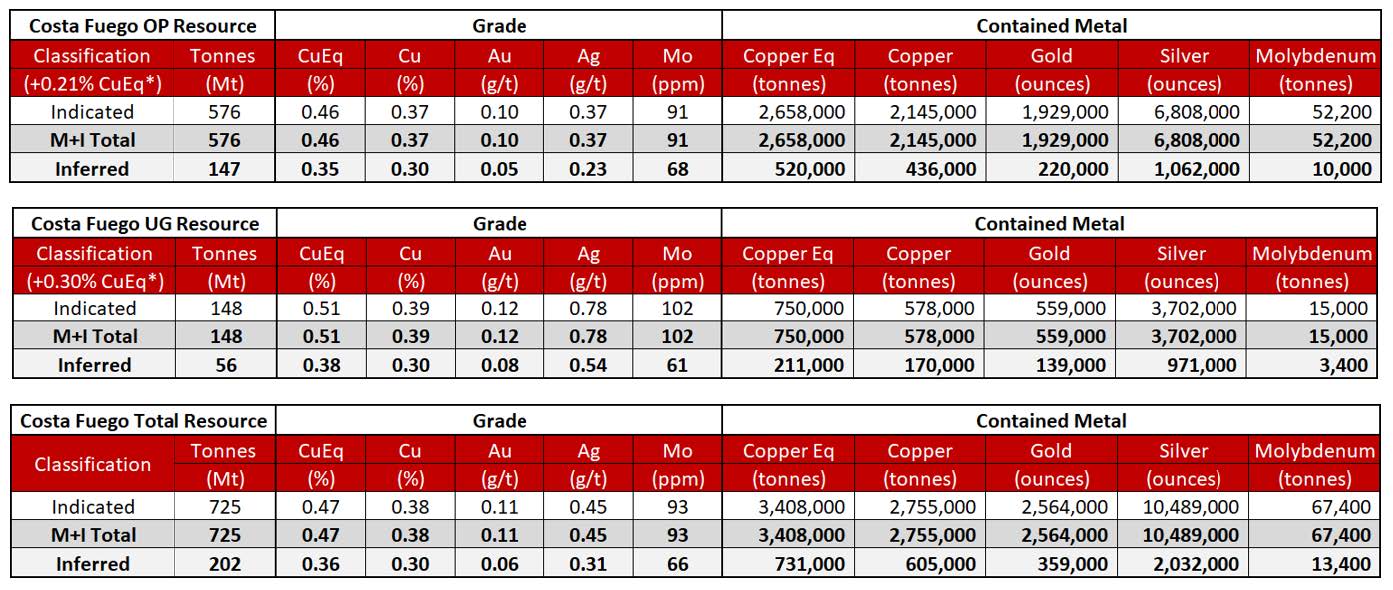

Costa Fuego’s High Grade (+0.6% CuEq) Indicated resources have grown by 53% and now account for over one third of contained copper and gold (previously 20%). High Grade Indicated resources stand at 156Mt grading 0.79% CuEq for 1.0Mt Cu, 0.85Moz Au, 2.9Moz Ag & 24kt Mo.

A significant component of the recently announced resource upgrade was driven by the definition of a large high grade core extending over 1 km vertically at Cuerpo 3.

Results from CORMET006 have confirmed the estimation of the Cuerpo 3 high grade core is robust, while also providing critical hydrological and geotechnical testwork for mining studies.

Two DD rigs are in operation (development drilling) and one Reverse Circulation (RC) drill rig is undertaking exploration drilling at Productora, located 14km from Cortadera.

The Company looks forward to pending assay results from remaining development study DD holes completed at Cortadera, having all visually recorded wide intersections of strong mineralisation.

Assay results being returned from exploration drilling at Productora are also expected to be released shortly.

1Reported on a 100% Basis – combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground. Refer to Announcement “Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates.

2Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

1Â excluding 18m unsampled due to geotechnical test work

2Â excluding 4m unsampled due to geotechnical test work

Significant intercepts are calculated above a nominal cut-off grade of 0.2% Cu. Where appropriate, significant intersections may contain up to 30m down-hole distance of internal dilution (less than 0.2% Cu). Significant intersections are separated where internal dilution is greater than 30m down-hole distance. The selection of 0.2% Cu for significant intersection cut-off grade is aligned with marginal economic cut-off grade for bulk tonnage polymetallic copper deposits of similar grade in Chile and elsewhere in the world.

Down-hole significant intercept widths are estimated to be at or around true-widths of mineralisation

* Copper Equivalent (CuEq) reported for the drill holes were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. Average Metallurgical Recoveries used were: Cu=83%, Au=56%, Mo=82%, and Ag=37%

Qualifying Statements

Costa Fuego Combined Mineral Resource (Reported 31st March 2022)

Reported on a 100% Basis – combining Mineral Resource estimates for the Cortadera, Productora and San Antonio deposits. Figures are rounded, reported to appropriate significant figures, and reported in accordance with CIM and NI 43-101. Metal rounded to nearest thousand, or if less, to the nearest hundred. Total Resource reported at +0.21% CuEq for open pit and +0.30% CuEq for underground. Refer to Announcement “Hot Chili Delivers Next Level of Growth” (31st March 2022) for JORC Table 1 information related to the Costa Fuego Mineral Resource estimates.

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

** Note: Silver (Ag) is only present within the Cortadera Mineral Resource estimate.

Competent Person’s Statement- Exploration Results

Exploration information in this Announcement is based upon work compiled by Mr Christian Easterday, the Managing Director and a full-time employee of Hot Chili Limited whom is a Member of the Australasian Institute of Geoscientists (AIG). Mr Easterday has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a ‘Competent Person’ as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code). Mr Easterday consents to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Competent Person’s Statement- Costa Fuego Mineral Resources

The information in this report that relates to Mineral Resources for Cortadera, Productora and San Antonio which constitute the combined Costa Fuego Project is based on information compiled by Ms Elizabeth Haren, a Competent Person who is a Member and Chartered Professional of The Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Ms Haren is a full-time employee of Haren Consulting Pty Ltd and an independent consultant to Hot Chili. Ms Haren has sufficient experience, which is relevant to the style of mineralisation and types of deposits under consideration and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code of Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Ms Haren consents to the inclusion in the report of the matters based on her information in the form and context in which it appears. For further information on the Costa Fuego Project, refer to the technical report titled “Resource Report for the Costa Fuego Technical Report”, dated December 13, 2021, which is available for review under Hot Chili’s profile at www.sedar.com.

Reporting of Copper Equivalent

Copper Equivalent (CuEq) reported for the resource were calculated using the following formula: CuEq% = ((Cu% * Cu price 1% per tonne * Cu_recovery)+(Mo ppm * Mo price per g/t * Mo_recovery)+(Au ppm * Au price per g/t * Au_recovery)+ (Ag ppm * Ag price per g/t * Ag_recovery)) / (Cu price 1% per tonne). The Metal Prices applied in the calculation were: Cu=3.00 USD/lb, Au=1,700 USD/oz, Mo=14 USD/lb, and Ag=20 USD/oz. For Cortadera and San Antonio (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=56%, Mo=82%, and Ag=37%. For Productora (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=43% and Mo=42%. For Costa Fuego (Inferred + Indicated), the average Metallurgical Recoveries were: Cu=83%, Au=51%, Mo=67% and Ag=23%.

For further detailed information please visit www.SEDAR.com

This announcement is authorised by the Board of Directors for release to ASX.

About Hot Chili

Hot Chili Limited is a mineral exploration company with assets in Chile. The Company’s flagship project, Costa Fuego, is the consolidation into a hub of the Cortadera porphyry copper-gold discovery and the Productora copper-gold deposit, set 14 km apart in an excellent location – low altitude, coastal range of Chile, infrastructure rich, low capital intensity.The Costa Fuego landholdings, contains an Indicated Resource of 391Mt grading 0.52% CuEq (copper equivalent), containing 1.7 Mt Cu, 1.5 Moz Au, 4.2 Moz Ag, and 37 kt Mo and an Inferred Resource of 334Mt grading 0.44% CuEq containing 1.2Mt Cu, 1.2 Moz Au, 5.6 Moz Ag and 27 kt Mo, at a cut-off grade of 0.25% CuEq.The Company is working to advance its Costa Fuego Project through a preliminary feasibility study (followed by a full FS and DTM), and test several high-priority exploration targets.

Certain statements contained in this news release, including information as to the future financial or operating performance of Hot Chili and its projects may include statements that are “forward-looking statements” which may include, amongst other things, statements regarding targets, estimates and assumptions in respect of mineral reserves and mineral resources and anticipated grades and recovery rates, production and prices, recovery costs and results, and capital expenditures and are or may be based on assumptions and estimates related to future technical, economic, market, political, social and other conditions.These forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by Hot Chili, are inherently subject to significant technical, business, economic, competitive, political and social uncertainties and contingencies and involve known and unknown risks and uncertainties that could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward-looking statements.

Hot Chili disclaims any intent or obligation to update publicly or release any revisions to any forward-looking statements, whether as a result of new information, future events, circumstances or results or otherwise after the date of this news release or to reflect the occurrence of unanticipated events, other than as may be required by law. The words “believe”, “expect”, “anticipate”, “indicate”, “contemplate”, “target”, “plan”, “intends”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule” and similar expressions identify forward-looking statements.

All forward-looking statements made in this news release are qualified by the foregoing cautionary statements. Investors are cautioned that forward-looking statements are not a guarantee of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Contact Details

Investor Relations

Graham Farrell

+1 416-842-9003

Graham.Farrell@harbor-access.com

Investor Relations

Jonathan Paterson

+1 475-477-9401

Jonathan.Paterson@harbor-access.com

Managing Director

Christian Easterday

admin@hotchili.net.au

Company Website

https://www.hotchili.net.au/investors/