Cypress Development on track to becoming a domestic producer of lithium

Nevada is known as the gambling and entertainment capital of the United States but is commonly referred to as the “silver state” after many world-famous silver discoveries back in the 19th century. However, in the last few decades the state has emerged as a prolific gold producer that now accounts for over 80% of total U.S gold production each year. It is the second largest gold producer in the world behind South Africa. The state is still a large producer of silver and is also a leading producer of barite, dolomite, magnesite and mercury.

Today, the world’s largest gold mining complex, Nevada Gold Mines, a joint venture between Barrick and Newmont mining companies and comprising eight mines, along with their infrastructure and processing facilities, is located on the Carlin Trend.

In recent years, Nevada’s potential for lithium has been in the spotlight, particularly in Esmeralda County near North America’s only lithium mine – the Albemarle Corp. [ALB-NYSE] Silver Peak Mine – in production since 1966.

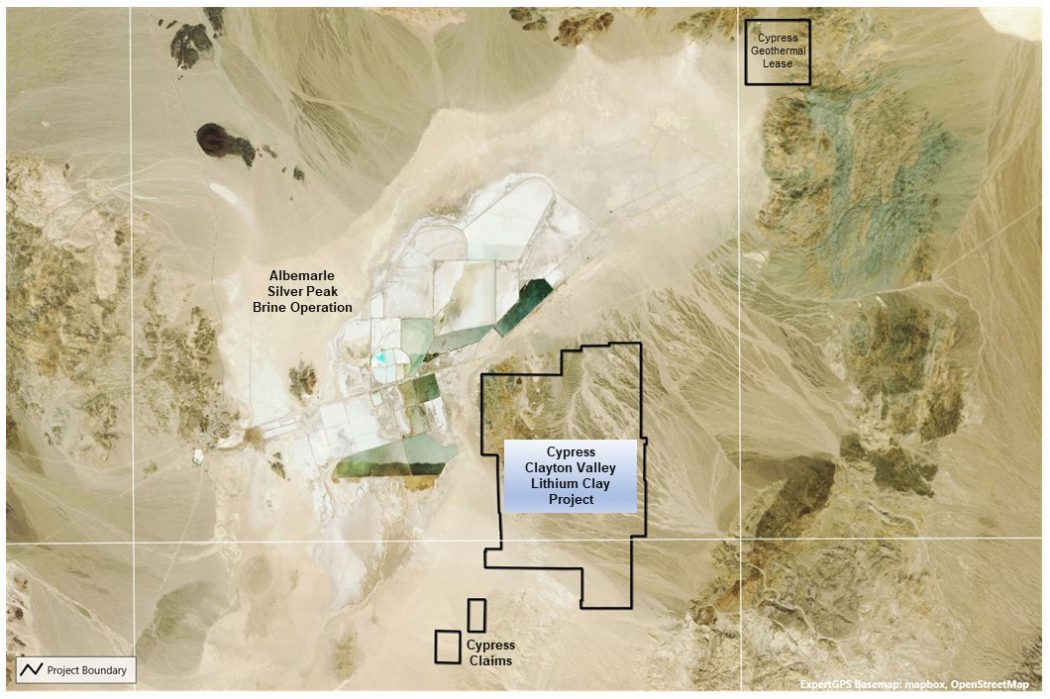

Cypress Development Corp. [CYP-TSXV] is progressing towards completing a feasibility study and permitting, with the goal of becoming a domestic producer of lithium for the growing electric vehicle and battery storage market. The company is focused on its wholly owned Clayton Valley Lithium Project that totals 5,590 acres in size. The eponymous Clayton Valley Lithium Project is located within the Clayton Valley in southwest Nevada, approximately halfway between Las Vegas and Reno.

Cypress Development Corp. [CYP-TSXV] is progressing towards completing a feasibility study and permitting, with the goal of becoming a domestic producer of lithium for the growing electric vehicle and battery storage market. The company is focused on its wholly owned Clayton Valley Lithium Project that totals 5,590 acres in size. The eponymous Clayton Valley Lithium Project is located within the Clayton Valley in southwest Nevada, approximately halfway between Las Vegas and Reno.

Nevada’s Clayton Valley is now synonymous with lithium exploration in Nevada, and for good reason, but the discovery of lithium in the Clayton Valley wasn’t what initially brought prospectors to the area as the first recorded mining activity in the area was in the 1860’s with the discovery of silver near the town of Silver Peak. It wasn’t until the 1950’s that lithium was discovered, which led to the production of lithium carbonate from brine being initiated in the 1960’s – that has continued to the present. The occurrence of lithium in sediments of the Clayton Valley wasn’t reported until the 1970’s. However, significant exploration for the source of the lithium didn’t materialize until recently, which has led to the discovery of multiple clay hosted deposits, an important future source for lithium production in Nevada.  Â

As a lithium-bearing claystone deposit, the Clayton Valley Lithium Project joins a growing list of clay hosted lithium deposits, one the three most common types of lithium deposits – the other two being brine hosted and hard rock hosted. Brine hosted deposits are best known from the ‘lithium triangle’ of Bolivia, Argentina and Chile while hard rock lithium deposits are well known in Australia. Nevada, as it turns out, is endowed with more than just gold and silver as the state is host to one of world’s largest concentrations of lithium as well.Â

As a lithium-bearing claystone deposit, the Clayton Valley Lithium Project joins a growing list of clay hosted lithium deposits, one the three most common types of lithium deposits – the other two being brine hosted and hard rock hosted. Brine hosted deposits are best known from the ‘lithium triangle’ of Bolivia, Argentina and Chile while hard rock lithium deposits are well known in Australia. Nevada, as it turns out, is endowed with more than just gold and silver as the state is host to one of world’s largest concentrations of lithium as well.Â

Lithium in Nevada occurs in both brine and claystone deposits. The Clayton Valley, the epicentre of lithium exploration, is a closed, fault bounded basin near the southwestern margin of the Basin and Range geo-physiographic province of western Nevada. The floor of the Clayton Valley is the lowest in elevation of a series of regional valleys and its 100 square kilometres receives surface drainage from an area of about 1,300 square kilometres. This is a natural location for the concentration of lithium in ground water.

Cypress’s Clayton Valley Lithium Project is located immediately east of the Silver Peak lithium brine operation, which has been in continuous production since 1966 and is recognized as the only producing lithium mine in North America. The Silver Peak production site is owned by the international conglomerate Albemarle Corp., which bought the previous owner for US$6.2 billion.

Cypress acquired the rights to their project in 2015 and initial sampling revealed high concentrations of lithium in surface sediments.  Subsequent drill programs lead to the discovery of a potential world-class resource of lithium-bearing claystone on the east and south side of Angel Island, an outcrop of Paleozoic carbonates that protrudes up through the lakebed sediments that are host to the Silver Peak lithium brine operation.Â

Cypress acquired the rights to their project in 2015 and initial sampling revealed high concentrations of lithium in surface sediments.  Subsequent drill programs lead to the discovery of a potential world-class resource of lithium-bearing claystone on the east and south side of Angel Island, an outcrop of Paleozoic carbonates that protrudes up through the lakebed sediments that are host to the Silver Peak lithium brine operation.Â

The lithium bearing sediments of the Clayton Valley Lithium Project primarily occur as silica-rich, moderately calcareous, interbedded tuffaceous mudstone, claystone, and siltstone of the Esmeralda Formation. Elevated lithium concentrations, generally greater than 600 ppm, are encountered from surface down to at least 142 meters.

Since the first positive lithium results, Cypress has been setting a torrid pace to advance the property. At present, the company is in the pilot stage of testing the lithium-bearing claystone material and is progressing towards completing a feasibility study and permitting. Importantly, they recently acquired the water permit for the project, a singular milestone that secures a majority of the project’s future water requirements.

Their recent prefeasibility study is based on a probable reserve of 213 million tonnes averaging 1,129 ppm lithium (1.28 Mt LCE) based on a cut-off grade of 900 ppm and an indicated resource of 1,304 million tonnes averaging 905 ppm lithium (6.28 Mt LCE) based on cut-off grade of 400 ppm.

Their recent prefeasibility study is based on a probable reserve of 213 million tonnes averaging 1,129 ppm lithium (1.28 Mt LCE) based on a cut-off grade of 900 ppm and an indicated resource of 1,304 million tonnes averaging 905 ppm lithium (6.28 Mt LCE) based on cut-off grade of 400 ppm.

The lithium is amenable to leaching with dilute sulfuric acid followed by filtration, solution purification, concentration, and electrolysis to produce high-purity lithium. Metallurgical testing indicates low-cost processing can be achieved by leaching with low acid consumption resulting in a recovery of over 85%.Â

However, the company has now decided to bypass the use of sulphuric acid as a processing option and is instead using hydrochloric acid for its Feasibility Study as a greener alternative. Hydrochloric acid is produced on site, thus requires no trucking, provides easier filtration, and uses less water.

In addition to positive metallurgical testing, the deposit has a number of other very favourable characteristics.  The sediments that host the lithium are flat lying, have minimal overburden and do not have interbedded waste. These factors allow for a low strip ratio of 0.29 to 1.  The consolidated sediments are free digging, which means that blasting will not be required so mining would utilize track excavators, semi-mobile feeder-breakers and conveyors.Â

The company’s prefeasibility study states that the deposit can support a 40-year mine life with production of 15,000 tonnes per day, which would produce 27,400 tonnes lithium carbonate equivalent annually.Â

In March 2021, Cypress announced the development of a lithium extraction pilot plant at the del Sol Refining & Extraction facility, south of Beatty, Nevada. The operation of the pilot plant will provide essential data for a planned Feasibility Study and enable Cypress to produce marketing samples to support negotiations with potential offtake and strategic partners.

In March 2021, Cypress announced the development of a lithium extraction pilot plant at the del Sol Refining & Extraction facility, south of Beatty, Nevada. The operation of the pilot plant will provide essential data for a planned Feasibility Study and enable Cypress to produce marketing samples to support negotiations with potential offtake and strategic partners.

All of Cypress’s diligent work coincides with an increasing demand for lithium. Â The United States government has designated lithium as a Critical Mineral of strategic importance to the nation’s economic and national security. The Critical Mineral designation favors domestic sources of lithium that offer a secure, reliable source of supply.

The recent development of the Tesla and Panasonic battery Gigafactory near Sparks, Nevada only brings more attention to local sources of lithium. This leads the company to believe that their Clayton Valley Project is ideally positioned to become a significant player in the North American lithium market. “We feel that the Clayton Valley Lithium Project is the right commodity, in the right location at the right time. It is only a question of when lithium production from clays happens in Nevada and we are striving to be one of the first to do so,” stated Spiros Cacos, Vice President Investor Relations of Cypress Development Corp.

Other noteworthy lithium projects include Schlumberger Technology Corp. [SLB-NYSE] which has an option to earn a 100% interest in the Pure Energy Minerals Ltd. [PE-TSXV; PEMIF-OTCQB; A111EG-FSE] Clayton Valley project next to Albemarle’s lithium mine.

Nevada Sunrise Gold Corp. [NEV-TSXV; NVSGF-OTC] recently reported significant values of lithium in water samples from boreholes GEM22-01 and GEM22-02, drilled in the inaugural 2022 drilling program at its 100%-owned Gemini Lithium Project located in the Lida Valley basin in Esmeralda County. Water samples from borehole GEM-22-01 averaged 327.7 milligrams/litre (mg/L) lithium over 220 feet (67.07 metres) from 600 to 820 feet with a peak value of 519 mg/L lithium.

Nevada Lithium Resources Inc. [NVLH-CSE; NVLHF-OTCQB; 87K-FSE] and 50% partner, Iconic Minerals Ltd. [ICM-TSXV; BVTEF-OTCQB; YQGB-FSE] are drilling the Bonnie Claire Lithium Project in Nye County.

American Lithium Corp. [LI-TSXV; LIACF-OTCQB; 5LA-FSE] has been extracting lithium, achieving 97.4% extraction utilizing warm sulphuric acid leach on its advanced 100%-owned Tonopah lithium claims (TLC) claystone mineralization 12 km northwest of Tonopah in the Esmeralda lithium district.

And finally, Tesla Inc. [TSLA-NASDAQ] CEO Elon Musk recently announced that Tesla “might actually” follow through with its previous announcement of getting into lithium mining and refining. The company owns 10,000 acres of lithium prospects in Nevada. “[The] price of lithium has gone to insane levels! Tesla might actually have to get into the mining and refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”