Desert Star acquires BC copper project, changes name

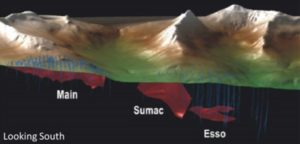

A simplified geological cross-section showing the mineralized zones at the Kutcho Project in northwest British Columbia. Source: Desert Star/Kutcho Copper Corp.

Kutcho Copper Corp. [KC-TSXV] announced Friday that it has completed the acquisition of the Kutcho copper-zinc-silver-gold project in northern British Columbia. Kutcho Copper, which has just changed its name from Desert Star Resources Ltd. [DSR-TSXV], acquired a 100% interest in the Kutcho Project from Capstone Mining Corp. [CS-TSX], six months after announcing a cash ($28.8 million) and stock deal that resulted in Capstone agreeing to own a 9.9% stake in Desert Star.

On Friday December 15, Kutcho Copper also said it has closed a $20 million subordinated secured convertible term debt loan and a US $65 million early deposit precious metals purchase agreement with Wheaton Precious Metals Corp. [WPM-TSXV, WPM-NYSE]. In addition, Kutcho has announced the subsequent release of escrowed funds and conversion of its $14.7 million private placement that was announced on December 8, 2017.

The Kutcho Project is located approximately 100 km east of Dease Lake, northern British Columbia. Mineralization on the 17,060-hectare property is hosted in three known volcanic massive sulphide (VMS) deposits. The largest is the Main deposit. The other two are Sumac and Esso.

According to an updated Pre-Feasibility Study that is based on a 1% cut-off copper grade, measured an indicated reserves at the site stand at 16.8 million tonnes grading 1.89% copper, 2.87% zinc, 0.36 g/t gold and 32.8 g/t silver. In addition to that is an inferred mineral resource of 5.8 million tonnes grading 1.33% copper, 1.64% zinc, 0.24 g/t gold and 23.2 g/t silver for a 1.79% copper equivalent.

By lowering the resource cut-off grade to 1% copper from previous estimates at 1.5% the company increased the measured and indicated resource by 50% or 5 million tonnes, currently not included in the project economics.

The updated Pre-Feasibility Study used the same mine plan as an earlier pre-feasibility study based on copper cut-off grades of 1.5% for Main Zone and 1.0% for Esso Zone. This pegs the probable mineral reserve at 10.4 million tonnes, averaging 2.01% copper, 3.19% zinc, 0.37 g/t gold and 34.61 g/t silver or a 2.71% copper equivalent.

The current probable reserve is expected to support a 12-year mine life with a 2,500 tonne-per-day production rate. Total payable production over the life of the mine would be 378 million pounds of copper, and 473 million pounds of zinc, plus by-product gold and silver.

Average annual production is forecast at 33 million pounds of copper and 42 million pounds of zinc, plus by-product gold and silver.

However, the company aims to double the production rate from 2017 forecasts to 100 million pounds of copper equivalent annually. Initial capital costs, including a 15% contingency, are estimated at $220.7 million.