Doubleview doubles down on scandium at its Hat Project

By Ian Foreman

Doubleview Gold Corp. [DBG-TSXV] believes that the scandium contained in its wholly owned Hat Project has the potential to turn Canada’s rare earth element market on its ear.

But, before we get to why Doubleview thinks that it has the proverbial ‘tiger by the tail’, let’s get caught up with their successful discovery and advancement of the deposit.

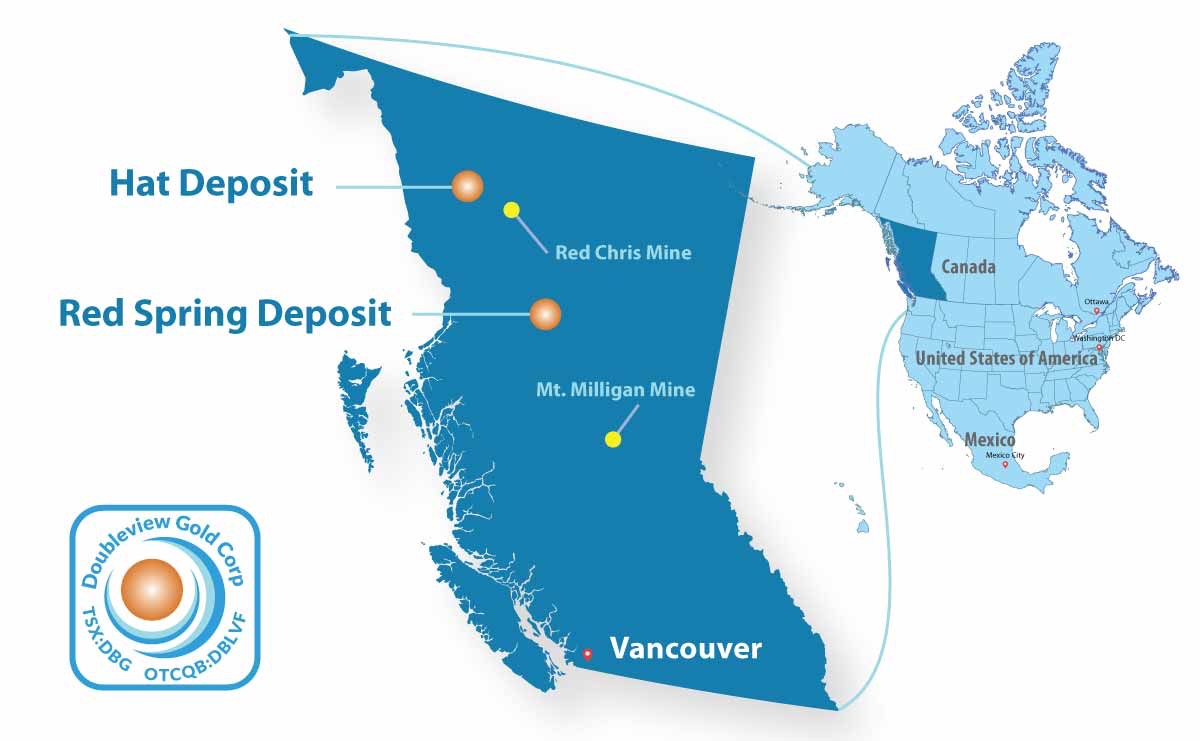

The company acquired the Hat Project in 2011. The property is 6,308 hectares in size and is located in northwestern British Columbia, 95 kilometres southwest of Dease Lake and 190 kilometres south of Atlin. Access to the property is from the Golden Bear Road, which comes within 10 kilometres of the property and Highway 37, an all-weather hard surfaced road, that is just 95 kilometres to the east. Should power be needed in the future, the Northwest Transmission Line brings electric power to within 120 kilometres of the property.

The company acquired the Hat Project in 2011. The property is 6,308 hectares in size and is located in northwestern British Columbia, 95 kilometres southwest of Dease Lake and 190 kilometres south of Atlin. Access to the property is from the Golden Bear Road, which comes within 10 kilometres of the property and Highway 37, an all-weather hard surfaced road, that is just 95 kilometres to the east. Should power be needed in the future, the Northwest Transmission Line brings electric power to within 120 kilometres of the property.

The Doubleview team discovered the Hat deposit from a greenfield prospect in its first drilling season. As with a number of this province’s porphyry deposits the initial six holes were a marginal but encouraging success. A more aggressive follow-up drilling campaign in 2014 resulted in the discovery of the Lisle Zone, a higher grade portion of the deposit. Further drilling in 2015, 2016 and 2021 confirmed the presence of a very large porphyry deposit. Although mineralization exceeds 900 metres in some drill holes, the deposit has yet to be delineated in any dimension and now has a sulphide footprint of more than eleven square kilometres.

The Hat Project is host to an alkalic-type gold copper porphyry that has many similar characteristics in genesis, host rock types, alteration and mineralization to several important British Columbia mines, including Mount Polley, Mount Milligan, and Red Chris. Sulphide mineralization, primarily chalcopyrite, occurs in fracture zones of the host dioritic intrusive as well as strongly altered andesitic volcanic and volcaniclastic rocks of upper Triassic age.

All told, the Hat deposit had all of the characteristics of being just another porphyry in the long list of BC porphyry deposits. But then, in July of 2021 the company mentioned that in addition to gold and copper, Hat mineralization carries possibly significant quantities of important strategic metals. The company stated that its ongoing exploration would also focus on important critical metals, including cobalt, palladium and scandium.

All told, the Hat deposit had all of the characteristics of being just another porphyry in the long list of BC porphyry deposits. But then, in July of 2021 the company mentioned that in addition to gold and copper, Hat mineralization carries possibly significant quantities of important strategic metals. The company stated that its ongoing exploration would also focus on important critical metals, including cobalt, palladium and scandium.

And it is the scandium that moved the needle for the project.

Scandium is classified as a Rare Earth Element with the symbol Sc. Scandium is an important strategic element and is in short supply around the world. According to the US Geological Survey Mineral Commodities Summary 2020 the global trade of scandium oxide is only 15 to 20 tonnes per year, however, the demand is about 50 percent higher. Yet with more production, the demand for the metal keeps increasing. Applications for scandium were not developed until the 1970’s with its primary application being its use in strengthening aluminum alloys. More recent applications are in the global electrical industries and more uses for scandium continue to be found due to its diagonal relationship with magnesium.

Farshad Shirvani, president and CEO of Doubleview, was approached by a prominent fund manager from New York who wanted a piece of the company – a big piece! The subsequent $3,000,000 financing has decidedly changed the fortunes of the company, and has allowed Mr. Shirvani to aggressively move forwards with showing the potential value that scandium brings to the Hat Project.

And did he ever deliver…

Scandium occurs throughout the deposit in surprisingly consistent quantities. Examples are drill hole HO26, which averaged of 29.2 g/t scandium over 799.5 metres and drill hole HO45, which averaged 29.5 g/t scandium over 459.0 metres. The company has now released the results from 51 drill holes and they all have measurable levels of scandium.

Scandium occurs throughout the deposit in surprisingly consistent quantities. Examples are drill hole HO26, which averaged of 29.2 g/t scandium over 799.5 metres and drill hole HO45, which averaged 29.5 g/t scandium over 459.0 metres. The company has now released the results from 51 drill holes and they all have measurable levels of scandium.

But still, the market seemed dubious – maybe they had a fear that the scandium was un-recoverable, which is the case with many scandium deposits because scandium can get caught up in the lattice of clay minerals (and the reason why scandium is only produced from a handful of mines worldwide). Or maybe it was simply that markets have been tough for most exploration stage companies in 2022 and 2023.

Doubleview’s initial metallurgical extraction tests demonstrated that 89 percent of the scandium could be recovered. Quantitative mineralogical investigations in relation to the Hat porphyry showed that the scandium is primarily associated with rock-forming minerals such as clinopyroxene and amphibole, which should dismiss the fears that the scandium is associated with clays. Subsequently, the first attempt at recovering scandium in a sequential purification process was successful in recovering 56 percent scandium in a phosphate precipitate.

Test work showed that 99.5 percent of the scandium associated with the gangue minerals reported to the flotation tailings created by the extraction of copper. The scandium grade of the tailings from the flotation tests assayed 65 grams per tonne. The company’s initial tests treated these flotation tailings in sulphate media at elevated temperatures, which extracted the scandium into solution and created a scandium oxide.

These results, which the company believes can be improved, significantly changes the value of the mineralization within the Hat deposit. Scandium phosphate is a high-value product that currently trades for approximately $35 per gram (in comparison gold currently trades at approximately $60 per gram).

The company has the potential to increase the value of the scandium by converting it into powder form, or a ‘salt’, which has three different formulations: scandium fluoride, scandium iodide or scandium chloride. Each of these salts has considerable value that are reported to be worth between $112 and $190 per gram.

Additional test work will be completed in order to optimize the recovery of the scandium.

“We may have the largest extractable, environmentally safe source of scandium in the world. If we can get to a production decision then we have the potential to dominate the scandium market”, stated Mr. Shirvani. “We now have to prove to the market the extraordinary value that the scandium adds to the Hat deposit.”

The company has now included scandium, along with gold and cobalt, into its copper equivalent calculation when reporting the grade of their drill holes. The scandium has singlehandedly doubled, and even tripled, the copper equivalent values.

The company has now included scandium, along with gold and cobalt, into its copper equivalent calculation when reporting the grade of their drill holes. The scandium has singlehandedly doubled, and even tripled, the copper equivalent values.

The copper equivalent value for an early drill hole such as HO08, which returned 356.7 metres of 0.28% Cu Eq, now has a copper equivalent value of 0.90% when the value of the scandium is included. Drill hole HO26 now has a copper equivalent value of 0.78% over an impressive 799.48 metres. Drill hole HO34’s copper equivalent more than doubled to 0.89% over 692.25 metres. And many of the drill holes have intervals in excess of 1.0 % copper equivalent over several hundreds of metres.

According to the Joint Ore Reserves Committee, or JORC, “the metal chosen for reporting on an equivalent basis should be the one that contributes most to the metal equivalent calculation.” To further demonstrate the value that scandium brings to the deposit, maybe the results should be reported as a scandium equivalent grade.

The company recently announced that a maiden resource estimate is underway. ABH Engineering has been tasked with the geological modelling, resource estimation and preparation of the final report. The company hopes to be able to announce a resource exceeding 350 million tonnes. This will be the first independent report that will include the measurable contribution of scandium to the value of the project.

The company expects this estimate will show the true potential value of a large recoverable North American source of scandium. If the numbers prove out, then Doubleview could have an overnight success – a decade in the making.