Electric cars, battery materials and disruptive technology

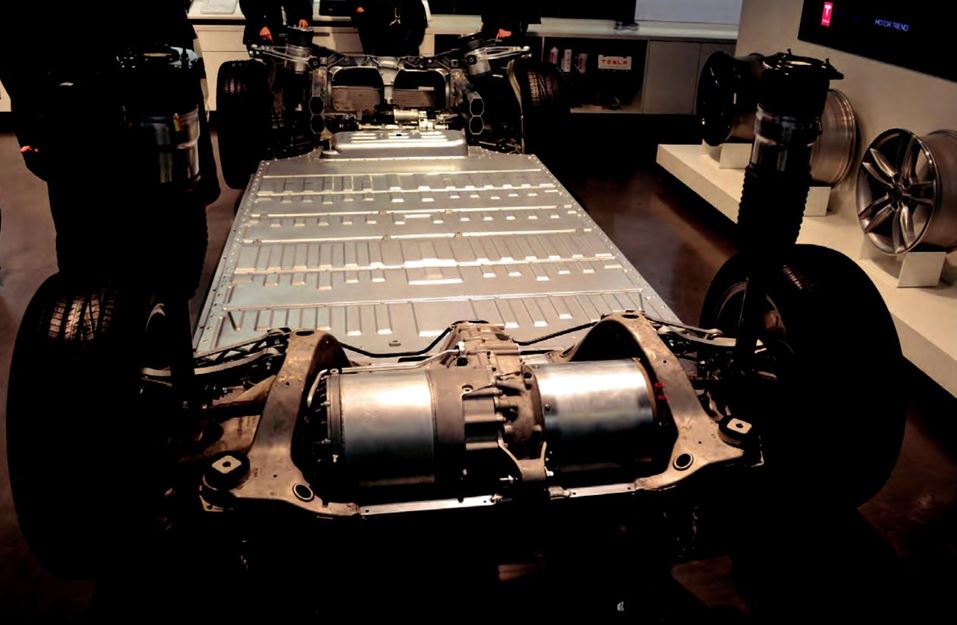

Tesla electric automobiles utilize lithium-ion batteries. Photo courtesy Tesla, Inc.

by Alf Stewart

Will Battery Powered Vehicles (BEVs) displace Internal Combustion Engine Vehicles (ICEVs) as the preferred choice for personal transportation? Will regulators force a shift in vehicle technology to electric propulsion for environmental reasons? I believe the answer is yes to both questions, and the rate at which electric vehicles are adopted depends on the evolution of battery technology. If BEVs can achieve a 300 km range, recharge in 20-30 minutes, and compete on price with ICE vehicles in the same price category, then wide-spread adoption will happen quickly, if not, the change will be more gradual with BEVs being introduced primarily through autonomous ride sharing services, i.e. an Autonomous “UBER type” service where the longevity and low operating costs of BEVs eclipse ICE vehicles.

Let’s consider the state of the art in electric vehicle technology, the different approaches that the major players in the industry are taking, and what materials may be in particular demand based on which company succeeds in the market:

TESLA, INC.

First off the mark is Tesla [TSLA-NASDAQ], a fledgling California-based company that has grown from a niche manufacturer of an electric sports car to the largest North American auto manu-facturer, by market capitalization, in less than 10 years. Its business plan is merely to change the world by forcing the auto-mobile industry to adopt electric vehicle technology faster than would otherwise happen. Tesla has started at the high end of the auto market with a luxury sedan for about $100,000 and a large SUV for about $200,000, and has proceeded to introduce a more affordably priced sedan in the $50,000 range.

All three of these vehicles use the same battery chemistry, a Nickel-Cobalt-Aluminum (NCA) Lithium Ion battery formulation which Tesla has produced in small format cylindrical cells. It takes about 9,000 of these cells packaged into a large rectangular floor pan to make a Tesla battery pack.

The performance characteristics of these packs are incredible. Tesla users have combined their usage data together in a massive spreadsheet which shows these packs will likely last 500,000 miles or more. Jeffrey Dahn, a professor at Dalhousie University in Halifax who carries out exclusive battery research for Tesla, has reported a tweak to the chemistry of these batteries which could double the battery life. This means a Tesla battery pack could potentially last 1,000,000 miles. Does this mean Tesla taxis instead of Priuses?

Besides longevity, the Tesla battery design provides a high energy density, delivers massive acceleration, and quick recharging. One Tesla option, “Ludicrous Mode” enables the Model S to do 0 to 60 miles per hour in under three seconds. Recharging of these cars at Tesla’s proprietary Supercharges can be done to the 80% charge level in less than half an hour, and the range per charge exceeds 300 km.

In a recent long distance test in Italy, a Tesla Model S P100D (with a lawyer-sealed charging port) drove 1,078 km on a single charge over 29 hours.

OK, so Tesla can tick all the boxes on the performance characteristics for its batteries but when packaged in a car they are still too expensive for the mass market. The median sales price for a new ICE car in the US is CDN $38,000. Tesla’s new Model 3 is being marketed to hit this price with government subsidies. Its unsubsidized price starts at US $35,000 or CDN $45,000, and currently there is a US $7,500 federal tax credit subsidy. The tax credit will be phased out over the next year since Tesla will have sold over 200,000 electric vehicles in the US triggering a sunset of the tax credit. So Model 3’s, ordered today, will be significantly more expensive than the median US ICE vehicle. They are, after all, premium sedans competing with BMWs and Audis. The key question is: Can Tesla make a profit on the Model 3 while producing several hundred thousand of these per year? It has built a massive battery plant in Nevada it calls a Gigafactory and plans to build several more of these glob-ally in the next few years, thinking that massive manufacturing economies of scale will drive costs down. The jury is out for Tesla as a world class vehicle maker.

NISSAN-RENAULT-MITSUBISHI ALLIANCE

Nissan introduced the LEAF to global markets in 2011 and it has become the bestselling global electric vehicle in the last six years. It is a mid-market hatchback which sells for less than the median price for an ICE car. Renault has just launched the 300-km range ZOE, a small hatchback for the European market which is proving extremely popular. Mitsubishi produces an economy hatchback, the IMIEV, and a plug-in Hybrid SUV in various markets around the world.

Collectively the Nissan-Renault-Mitsubishi Alliance is the world’s largest electric vehicle producer based on sales to date. Nissan’s battery technology utilizes Lithium-Nickel-Manganese oxide (LMO) formulation packaged in a rectangular pouch style cell aggregated in a large box under the rear seat of the LEAF.

The battery is expected to last eight years or about 120,000 miles, similar to ICE drivetrains with one major caveat. The LMO battery is subject to rapid degradation in either hot climates, or multiple rapid charge/discharge cycles, or a combination of both since Nissan did not put a battery cooling circuit in the LEAF. The advantage of the LMO battery is low cost (no expensive cobalt), and reasonable battery life and energy density. Also, there is abundant material globally to vastly increase the production of these batteries if demand grows.

The Alliance is on the cusp of introducing a new LEAF this year, rumored to have a 300 km range and an approximate $40,000 price tag. Nissan has just announced the sale of its in-house battery plants to a Chinese battery company, giving it flexibility on sourcing its battery requirements.

GENERAL MOTORS

GM produces two notable electric vehicles, the Chevy BOLT EV, a BEV, and the Chevy VOLT an electric/ICE hybrid. The VOLT uses a blend of LMO and lithium-nickel-manganese-cobalt oxide (NMC) in its battery packs while the BOLT uses just NMC. Like Nissan’s Leaf, the Chevy battery packs get their power from groupings of large format pouch cells packs, but with the added feature of built in battery pack cooling.

As a consequence, the batteries in the GM vehicles have better longevity. GM’s batteries are made by an external supplier, LG Chem of Korea. GM’s electric vehicles are world class in engineering, but take a back seat to GM’s ICE vehicles in marketing. GM only expects to sell about 30,000 BOLTs each year in contrast to 500,000 Teslas. In my opinion, GM wants a horse in the electric vehicle race, but thinks ICE vehicles will continue to be preferred by consumers for the near term future, so it does not aggressively market its electrics.

BYD COMPANY LIMITED

BYD is China’s largest manufacturer of electric cars, with the best performance specs among its Chinese domestic competitors. BYD is also the largest exporter of BEV municipal buses (e-buses). Their success in China parallels that of Tesla in North America except that they have been producing more affordable electric cars for the mass market using Lithium-Iron-Phosphate batteries, LiFePO4 that are best known as LFP.

LFP has lower energy density than NMC and NCA but is considered safer and has greater longevity. Whereas 1,000 charge/ discharge cycles are considered to be a reasonable life for most LMO, NMC and NCA batteries, LFP achieves 4,000 charge/ discharge cycles. LFP’s cost, safety and longevity are well suited for commercial applications such as electric buses, trucks, taxis, and stationary storage.

The energy density provided by NMC and NCA are better suited to emerging trends in consumer vehicles where range extension and acceleration require bigger battery packs. To address this trend, BYD and other Chinese automakers have already begun shifting their consumer vehicle fleets from LFP to NMC. Despite this shift, the LFP market is projected to grow as the large commercial applications take hold.

A local Vancouver company, Nano One Materials Corp. [NNO-TSXV] is pioneering manufacturing technology to lower the cost of producing cathode materials such as NMC, NCA and LFP. Their approach uses lower cost lithium inputs, reduces complexity and eliminates waste streams in the production of cathode materials such as LFP. I feel this is significant as incremental cost improvements will be vital in the coming years for battery makers.

American Manganese Inc. [AMY-TSXV] has successfully completed the recycling of 100% of cathode materials (cobalt, nickel, manganese, aluminum) and 92% of lithium from its US patent-pending recycling application. In early 2018, the company intends to build and begin operating a pilot plant to prove continuous recovery of cathode material, with the ability to scale up and design a full-scale recycling plant.

EVOLUTION OF THE BATTERY MARKET

Demand for battery materials will con-strain the electric vehicle market with limited cobalt supplies and high cobalt prices, limiting the use of Tesla’s NCA high cobalt content battery to premium vehicles only, in my opinion. Market acceptance of the premium Tesla Model 3 will change consumer attitudes towards BEVs and generate demand for lower cost alternatives. NMC and LFP will see continued growth in the burgeoning Chinese market and for lower cost vehicles globally.

The consequence of this evolution is strong demand for lithium, cobalt, manganese, nickel, iron, phosphate and graphite. Supply constraints are significant in the cobalt market, somewhat significant in the lithium market, and reasonable for other materials. In the next 10 years incremental improvements are expected across the entire battery space as the growth of demand for electric vehicles brings more research effort. The dark horse in this evolutionary horse race is entirely new battery formulations but I see those developments as five to 10 years down the road.