Equity Metals advances Silver Queen project in Skeena Arch region in British Columbia

By Peter Kennedy

The Skeena Arch is a geological feature in northwestern British Columbia that has been associated with significant mineral deposits, including large precious-metal-enriched epithermal vein deposits and porphyry copper deposits. Epithermal vein deposits are valuable sources of silver, gold, copper and zinc, while porphyry deposits contain copper, molybdenum and gold.

This region has attracted attention from mining companies and exploration efforts due to its mineral potential. It’s known for hosting several important mining projects and prospects. These mineral deposits have been of interest to both local communities and the mining industry, contributing to the economic development of the area.

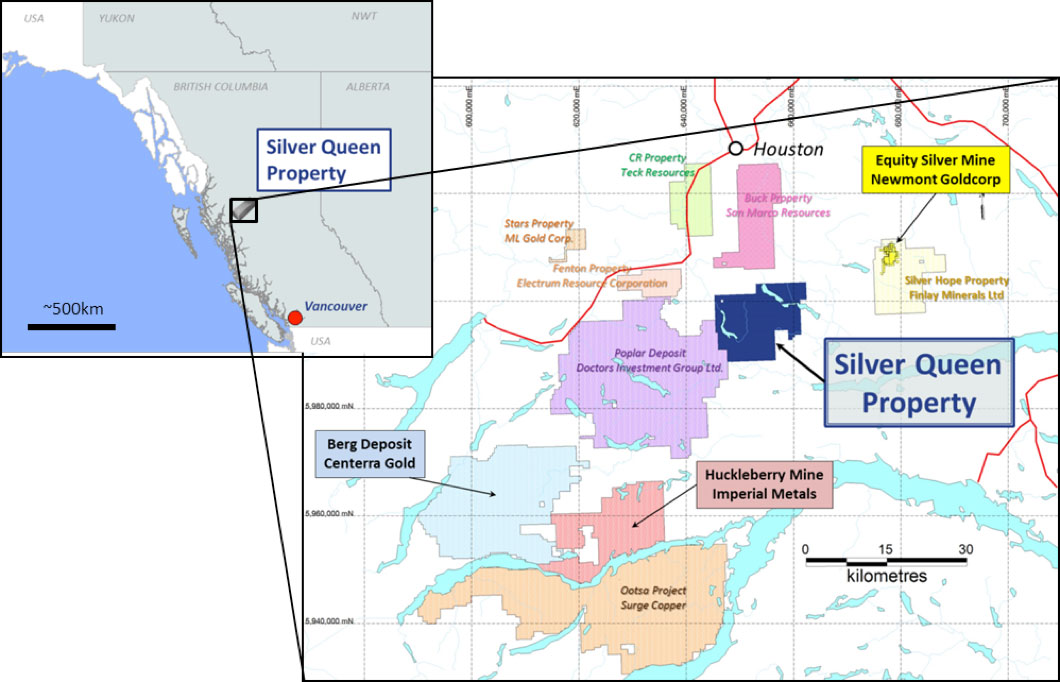

Equity Metals Corp. [EQTY-TSXV; EQMEF-OTCQB; EGSD-FSE] is a company that aims to create shareholder value by fast-tracking exploration at its flagship Silver Queen gold-silver property located in the Skeena Arch porphyry copper region in British Columbia.

Equity Metals Corp. [EQTY-TSXV; EQMEF-OTCQB; EGSD-FSE] is a company that aims to create shareholder value by fast-tracking exploration at its flagship Silver Queen gold-silver property located in the Skeena Arch porphyry copper region in British Columbia.

The property hosts high-grade, precious and base-metal epithermal veins that the Company interprets as being related to a buried porphyry system, which has only been partially delineated by previous management.

Having so far outlined an indicated resource of 62.8 million silver equivalent ounces (AgEq) and an inferred resource of 22.5 million silver equivalent ounces, the company aims to grow the resource to 120 million silver equivalent ounces by completing 25,000 meters of drilling by the end of next year.

It is a strategy led by a highly experienced management team, including Chairman Lawrence Page who has been involved in a number of major discoveries, including Eskay Creek, B.C., and Hemlo, Ontario.

The Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located adjacent to power, roads, and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property contains two historic declines into the No 3 Vein, a camp and a maintained tailings facility.

The property covers 45 mineral claims, 17 Crown grants, and two surface Crown grants totaling 18,852 hectares with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6.0 km2 area.

More than 20 different veins have been identified on the property, forming an extensive network of zoned Cretaceous to Tertiary age epithermal vein systems, which remain under explored.

According to an independent resource estimate released in December 2022, indicated resources at the site now stand at 62.8 million ounces of AgEq (silver equivalent) or 765,000 ounces of AuEq (gold equivalent), amounting to 21 million ounces of silver, 237,000 ounces of gold, 18 million pounds of copper, 48 million pounds of lead and 267 million pounds of zinc.

In addition, there is an inferred resource of 22.5 million ounces of AgEq or 273,000 ounces of AuEq, including 10.3 million ounces of silver, 50,000 ounces of gold, 10 million pounds of copper, 23 million pounds of lead and 84 million pounds of zinc.

The estimate is based on 78 holes for 25,659 metres of drilling completed by the company in six successive exploration phases starting in late 2020. Five separate target areas were tested in part, and thick intervals of high-grade gold, silver and base metal mineralization have been identified in each of the Camp Vein, the Svenson Target, No. 3 Vein and NG-3 Vein system.

“The MRE remains open for additional delineation west of the Camp Target and within the Sveinson Target,’’ said Equity Metals President Joe Kizis. “In addition, there are several targets that have been only tested by a few drill holes and remain very attractive targets for new discoveries and MRE increase,” he said.

In a press release on June 20, 2023, the company said crews have resumed drilling at Siver Queen, marking the second phase of drilling this year, one that will focus on the delineation of new targets located to the northeast of, and not included in, the recent mineral resource estimate.

The company said up to 4,000 metres is planned for an initial test of the Cole Lake and George Lake vein systems, which have been partially tested by previous drilling.

The next Phase of drilling follows the Spring 2023 drilling program, which successfully extended veins along strike and at depth in the Camp Deposit and filled a significant gap in the Sveinson vein system. Nine holes covering 4,038 metres were completed.

“The Summer 2023 program marks our expansion to test two high-priority targets that have encouraging drill intercepts from historic drilling,” said Kizis. “George Lake mineralization could be particularly significant as historic underground access exists, potentially providing a source of increased mill feed,” he said. “Though currently flooded, that access could be dewatered for inexpensive access to another part of the mineralized vein system.”

Having recently raised $814,204 by issuing 6.26 million flow-through units priced at 13 cents each, the company is fully funded for the next phase of drilling on the Cole Lake vein where surface chip sample assay results returned 55.2 g/t gold, 5,049 g/t silver, 3.2% lead and 0.12% zinc.

Up to 3,000 metres is planned to test two segments of the vein that were traced by mapping over 700 metres of strike length. Drilling is a continuation of a spring program that was suspended in mid-July due to wildfire fire risk in the area.

On September 14, 2023, Equity Metals shares closed at 12.5 cents and are currently trading in a 52-week range of 28 cents and $0.035, leaving the company with a market cap of $18.4 million based on 127 million shares outstanding.

Aside from its 100% interest in Silver Queen, the company also has interests in two highly prospective diamond properties in the Lac de Gras area northeast of Yellowknife, Northwest Territories. Lac de Gras ranks as one of Canada’s most prolific diamond producing areas.

Equity Metals holds an unwavering dedication to conducting responsible exploration activities while safeguarding the natural environment in proximity to its operations. Moreover, the company places paramount importance on actively nurturing relationships with the communities neighboring its exploration projects in addition to the meticulous application of policies and strategic management plans geared towards fostering sustainable mining exploration.

THIS IS NOT A RECOMMENDATION TO BUY OR SELL ANY SECURITY.