Ero says Brazil copper mine is now 70% complete

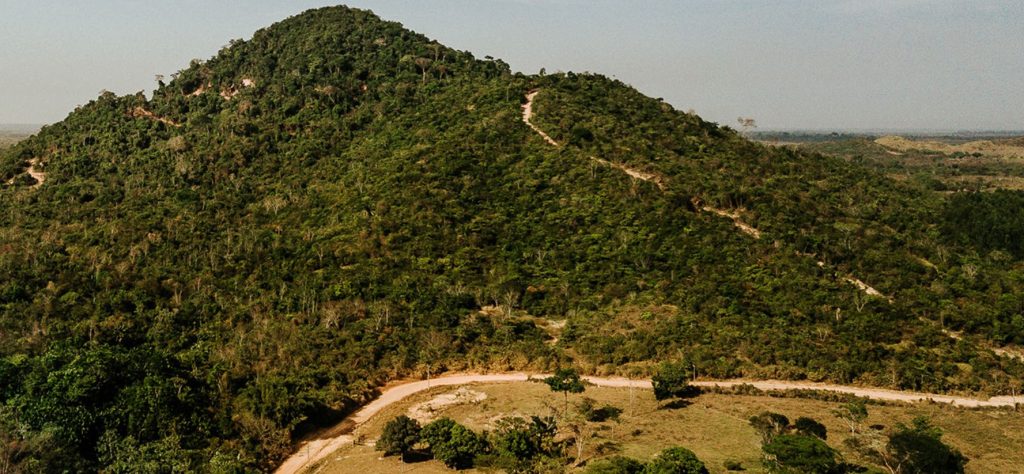

Ero Copper Corp. [TSX- ERO, NYSE] said its Tucumã project in Brazil, formerly known as Boa Esperanca, has achieved a major milestone with physical construction now 70% complete. The company said it remains on track to launch the first phase of plant commissioning by the end of 2023, with the first sulphide ore expected to be reached in early November. The first copper concentrate production is anticipated by the second half of 2024.

Meanwhile, the project’s capital expenditure budget remains within current guidance of $305 million.

Ero is a Brazil-focused base metals mining company. Its key asset is a 99.6% stake in Mineracao Caraiba S.A. (MCSA), a long-established Brazilian copper mining company with 40 years of operating experience in the Curaca Valley of Bahia, Brazil. MCSA’s primary assets are the fully integrated mining and processing operations of the Caraíba Operations in northeastern.

The Caraíba Operations produced 21,331 tonnes of copper in concentrate in the first six months of 2023. The company also reported 24,776 ounces of gold production in the same period.

In addition, MCSA owns 100% of the “turn key” Tucumã project (formerly Boa Esperanca), development project, an IOCG-type copper deposit located in Para State.

“With over 70% of the physical work completed, critical pieces of infrastructure in place or nearing completion, and main equipment installations progressing according to plan, we are confident that a major inflection point for the project has been reached,’’ said Ero CEO David Strang.

Strang has said the project will play an integral role in the company’s plans to become a 100,000 tonne-per-year copper producer.

Results of an optimized feasibility study announced in September, 2021, indicated up front capital costs of US$294 million. The study envisioned life of mine average annual copper production of 27,000 tonnes at a cash cost of US$1.36 per pound.

Significant exploration upside identified within an under-explored area within the final pit limits, known as the “Gap Zone,” is expected to enhance the project by confirming continuity of mineralization between near-surface high-grade zones and high-grade zones near the pit limits at depth. Material currently classified as waste is expected to be upgraded to the mineral resource category.

“One of the most compelling aspects about this project is its expected ability to double Eros’s annual copper production at a low upfront capital investment of approximately US$300 million,’’ said Strang.

On October 18, 2023, Ero shares closed at $19.91 and currently trade in a 52-week range of $32.12 and $13.20.

The company also holds a 97.6% of the Xavantina Operations, an operating gold and silver mine in Mato Grosso, Brazil. Ero recently announced details of a US$110 million streaming agreement with unit of Royal Gold Inc. [NASDAQ-RGLD], involving gold production from the Xavantina Operations.

Key components of the deal included an upfront cash consideration of US$100 million for the purchase of 25% of the gold produced until 93,000 ounces has been delivered, decreasing to 10% of gold produced over the remaining life of the mine.