Explorers and developers targeting cobalt projects

By Ellsworth Dickson

Historically, the metal cobalt was a by-product of mines that were mainly concerned with other metals, for example, silver. That was the case for the1903 silver rush around the Town of Cobalt in northeastern Ontario. The hundreds of veins in the camp featured high-grade silver values accompanied by several cobalt minerals.

The silver rush was slow to get started but by 1906 there were 263 mining companies in the Cobalt district. Many famous mines were built such as the Coniagas, Nipissing 407, Agaunico, Silverfields, O’Brien, Glen Lake Mines, Deer Horn Mines, Agnico, Temiskaming, Trethaway, Hi-Ho, Cart Lake and more.

Silver mining continued into the 1980s with cobalt still of secondary interest. The Cobalt area mines lay dormant until about 2017 when the rising price of cobalt resulted in a staking rush with both cobalt and silver of interest. Since 2017, there have been a number of activities in the Cobalt camp – exploration and drill programs, staking, new discoveries, consolidations, changes of plans, and so on. The initial fever has naturally given way to people in it for the long haul. (more later on)

Cobalt is used to make superalloys, high-temperature alloys, cutting tools, magnetic materials, petrochemical catalysts, pharmaceuticals, steels and glaze materials. Back in the 1990s, only 1% of cobalt demand was from its use in rechargeable batteries.

Today, the cobalt market is largely being driven by “new economy” drivers, including lithium-ion batteries, consumer electronics, Electric Vehicles (EVs) and Energy Storage Systems (ESS) that are the dominant uses for lithium-ion batteries, representing 64% of cobalt demand in 2020.

Various world governments have actually mandated the manufacture of EVs and the tapering off of internal combustion engines, resulting in an EV sales growth forecast of 30%. Consequences of the COVID virus have sometimes affected the cobalt marker but that will eventually end. Cobalt is currently trading at US$24.03 per pound, up about 57% from a year ago. Consequently, cobalt explorers and developers have targeted projects in various locales around the world.

Cobalt, being a fairly rare metal, means that there are not that many cobalt projects or mines – either as a primary commodity or as a secondary product, usually with copper, nickel or silver Cobalt is not like, say, the gold or copper sector that generates many projects and mines.

Commodity trader and miner Glencore Plc [GLEN-LSE] recently said it will restart operations at the world’s largest cobalt mine, Mutanda in southeast Democratic Republic of Congo (DRC), towards the end of this year and return to production in 2022.

The DRC (Kinshasa) continues to be the world’s leading source of mined cobalt, supplying approximately 70% of global mine production. The use of child labour at artisanal mines is a big problem.

According to the United States Geological Survey, 2020 mine production was DRC: 95,000 tonnes; Russia: 6,300 tonnes; Philippines: 4,700 tonnes; Canada: 3,200 tonnes; China: 2,300 tonnes; U.S.: 600 tonnes; and Australia: 5,700 tonnes. In 2020, total global production in 2020 was 140,000 tonnes with world reserves pegged at 7.1 million tonnes.

Thanks to the burgeoning EV industry, cobalt demand is expected to steadily increase as manufacturing ramps up which bodes well for the cobalt sector.

Besides northeastern Ontario, there are not a great number of other cobalt projects in North America. One company that stands out is Fortune Minerals Limited [FT-TSX] that has attracted investor interest because its flagship NICO project in Canada’s Northwest Territories that is one of the most advanced cobalt development assets outside the Democratic Republic of Congo (DRC).

Fortune is one of only a handful of global companies that could emerge as a possible supplier of “ethical cobalt” to consumers seeking an alternative to the DRC, currently the source of over 60% of the world’s production.

Amnesty International has warned electric car companies to seek out alternatives to the DRC, which is well known for its mineral wealth, but also civil wars and corruption.

However, Fortune is more than just a play on cobalt. The unique metal assemblage of the NICO deposit includes open pit and underground proven and probable reserves of 33 million tonnes, containing 1.1 million ounces of gold, 82 million pounds of cobalt, 102 million pounds of bismuth, and 27 million pounds of copper.

According to a 2014 feasibility study and recent optimizations, that material could support average annual production for the first 14 years of a 20-year mine life (2020 mine plan), including 1,800 tonnes per year of cobalt in battery grade cobalt sulphate, 47,000 ounces per year of gold in doré bars, 1,700 tonnes per year of bismuth in ingots and oxide and 300 tonnes per year of copper in cement precipitate.

The study suggest that ore can be extracted from a proposed open pit and underground mine and mill that will produce a bulk concentrate for shipment to a refinery that the company plans to construct in southern Canada.

The products that would be produced at the proposed refinery include cobalt chemicals used to make high performance rechargeable batteries, bismuth metals and chemicals, as well as gold.

It is worth noting that the company has received environmental assessment approval and key permits to construct and operate the NICO mine and concentrator in the Northwest Territories.

Fortune also owns the satellite Sue-Dianne copper-silver-gold deposit, located 25 kilometres north of the NICO mine site and other exploration projects in the Northwest Territories, and maintains the right to repurchase the Arctos anthracite coal deposits in northwest British Columbia that were previously bought by a British Columbia Crown corporation.

Fortune sees Sue-Dianne as a potential future source of incremental mill feed that could extend the life of a NICO mill and concentrator

Sue-Dianne hosts an indicated resource of 8.4 million tonnes grading 0.80% copper, 3.2 g/t silver and 0.07 g/t gold. On top of that is an inferred resource of 1.62 million tonnes of grade 0.79% coper, 2.4 g/t silver and 0.07 g/t gold.

“Cobalt has a critical role in the accelerating transition to e-mobility, and advanced assets like our NICO Project are needed to help satisfy the growing demand and diversify the supply chain,” said Fortune President and CEO Robin Goad.

The NICO project is located 160 kilometres northwest of Yellowknife and 50 kilometres north of Whati, a First Nations community in the North Slave region

Due to the remote location, the Tlicho Highway, under construction for the NWT government, is a key enabler for the NICO development and is nearing completion and expected to open to the public later this year. The $213 million, 97-kilometre all-season road to the community of Whati, together with the spur road that Fortune plans to construct, will allow metal concentrates to be trucked from the mine to the rail head at Hay River or Enterprise, NWT for railway delivery to the company’s planned hydrometallurgical refinery.

Fortune has talked about a total project cost of around $775 million. But the focus now is on various optimizations and refinery sites aimed at delivering a more financially robust project compared to the one envisaged in the 2014 feasibility study.

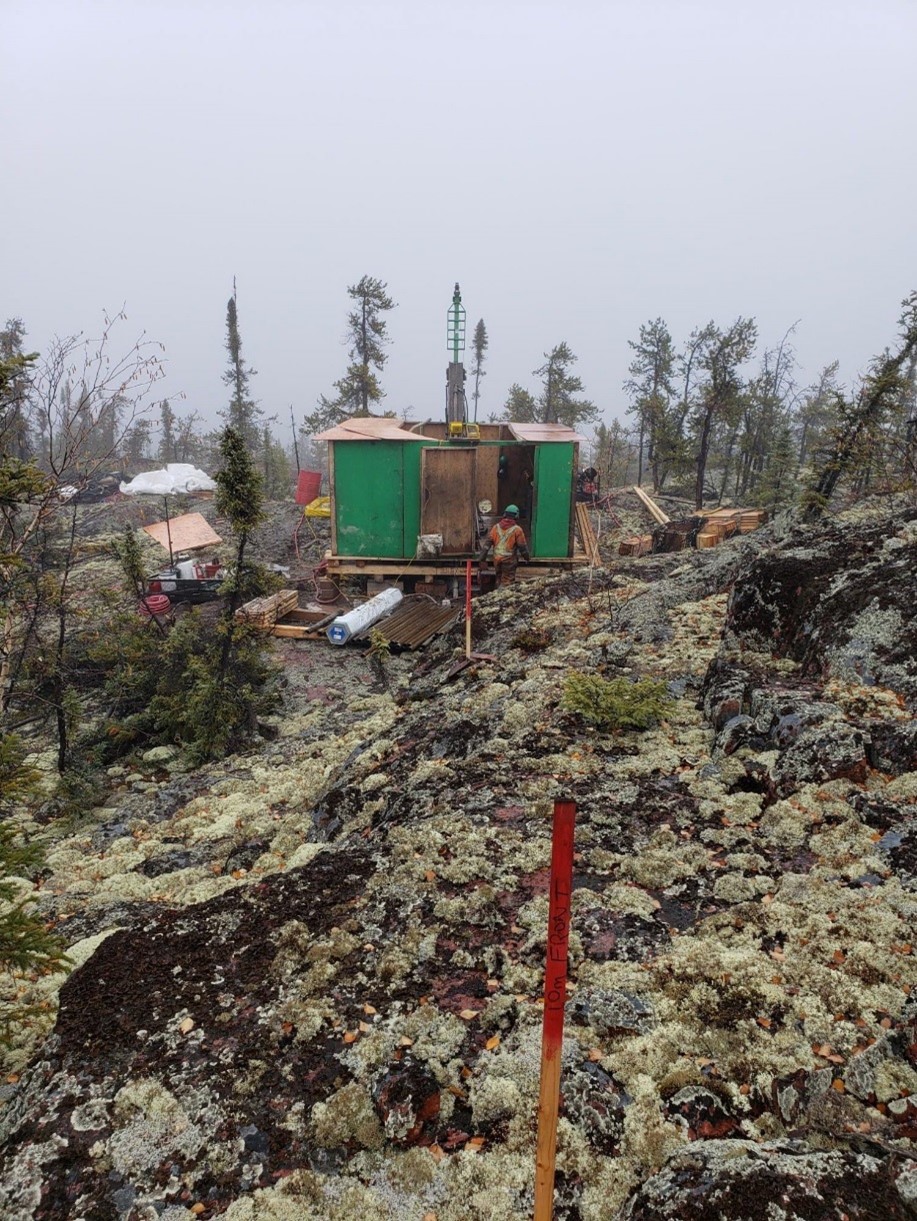

In keeping with that effort, Fortune recently launched a 3,000-metre drill program to test for a potential expansion of the NICO deposit at the east end of the deposit. It said exploration crews will also test up to four additional targets defined by previous geology and geophysics programs.

Fortune recently raised almost $542,000 from a private placement offering of 3.9 million issued that were issued at 14 cents per unit. It also received a grant of $144,000 from the Government of the NWT.

On October 22, 2021, Fortune shares were trading at $0.13 in a 52-week range of 27 cents and $0.06, leaving the company with a market cap of $47.58 million based on 366 million shares outstanding.

Other companies within the cobalt mining space worth mentioning include:

Canada Silver Cobalt Works Inc. [CCW-TSXV; CCWOF-OTC] recently reported high-grade cobalt assays from its Castle East discovery located 1.5 km from its 100%-owned, past-producing Castle Mine near Gowganda in the silver-cobalt district northeast of the Town of Cobalt where the company has completed 42,000 metres of a 60,000-metre drill program aimed at significantly increasing its 43-101 resource estimate. Canada Silver Cobalt Works recently discovered a major high-grade silver vein system at Castle East. The company also has a pilot plant and processing facility.

Kuya Silver Corp. [KUYA-CSE] has given notice of intention to exercise an option to earn a 70% interest in all of First Cobalt Corp.‘s [FCC-TSXV; FTSSF-OTCQX] remaining mineral rights in the Cobalt camp. Kuya previously acquired a 100% interest in a property package surrounding the Kerr Lake area for $4-million.

First Cobalt owns a hydrometallurgical cobalt refinery in the Town of Cobalt. The refinery has the potential to produce either a cobalt sulfate for the lithium-ion battery market or cobalt metal for the North American aerospace industry or other industrial and military applications.

With permits and building infrastructure already in place, the First Cobalt Refinery will be operational as early as 2022. Once operational, the Refinery will produce 25,000 tonnes of battery-grade cobalt sulfate per annum, representing more than 5 per cent of all cobalt produced around the world.

Cruz Battery Metals Corp. [CRUZ-CSE; BKTPF-OTC; A2DMG8], formerly Cruz Cobalt Corp., completed a three-hole, 837-metre diamond drill campaign at the Hector Silver-Cobalt property. The company is a large mineral land holder in the Cobalt area and also includes the Bucke, Coleman, Johnson and Lorraine prospects.

Fuse Cobalt Inc. [FUSE-TSXV; FUSEF-OTC; 43W3-FSE], formerly Lico Energy Metals, recently reported that the government of Ontario announced a joint $10-million investment in the First Cobalt refinery in Cobalt Ontario. Significantly, this refinery is located approximately 1,500 metres west of the company’s cobalt exploration property. Fuse holds the Teledyne Cobalt property in Bucke and Lorrain Townships as well as the Glencore Bucke property located on the west boundary of the Teledyne property.

Brixton Metals Corp. [BBB-TSXV; BBBXF-OTCQB] has 100% interests in the Langis-Hudbay silver-cobalt project near the Town of Cobalt. The Langis Mine produced 10.4 Moz silver at 25 oz/ton and 358,340 lbs of cobalt between 1908 and 1989. Between 1903 and 1953 the Hudson Mine produced 4 million ounces of silver and 185,570 lbs cobalt.

iMetal Resources Inc. [IMR-TSXV; ADTFF-OTC] reported grab sample values of 67.9, 29.6 and 11.3 g/t gold from its flagship Gowganda West property.

The Eagle mine of Lundin Mining Corp. [LUN-TSX; LUNMF-OTC; LUMI-Sweden] in Michigan produces a cobalt-bearing nickel concentrate.

Jervois Global Ltd. [JRV-TSXV, ASX; JRVMF-OTC] is constructing the Idaho cobalt project (ICP) about 40 km from Salmon, east-central Idaho. It is a primary cobalt deposit with production estimates of 1,200 tons per day of super-alloy grade high-purity cobalt metal over a 7-year mine life.

The company has committed more than US$30-million toward equipment, materials and labour costs, both on-site and for detailed engineering. Construction, procurement and engineering schedule is on time with plan and commissioning of the mine expected from mid-2022. Currently, underground construction has commenced.

The company said that this historic step marks the first time in decades that the United States will have a primary cobalt mine within its borders.

Bryce Croker, CEO of Jervois, said, “Cobalt is a crucially important material for both defense and civilian applications. The electrification of the United States and global transportation sectors are currently and expected to continue driving exceptional cobalt demand growth.”

Some analysts are predicting a 17% increase in cobalt demand this year over 2020 and even more demand in the future due to the electrification of the world’s vehicle fleet. For example, the Ford Motor Company [F-NYSE] recently announced a US$11 billion investment to build electric vehicles in Tennessee and Kentucky, creating 11,000 new jobs. News doesn’t get much better than that.