Filo Mining rallies on latest drilling results

Filo Mining Corp. [FIL-TSXV, NASDAQ First North] has announced impressive results in the final assays from a 2019 drill program at its 100%-owned Filo del Sol Project that straddles the border of Region 111, Chile and San Juan Province, Argentina.

The seven holes drilled during the past season extend along a north-south distance of 1,800 metres, and all intersected high-grade mineralized zones and ended in mineralization, with the exception of FSDH031, the company said in a press release that was issued after the close of trading on May 28, 2019.

Highlights include drill hole FSDH030, which returned 378 metres of 0.44% copper and 0.89 g/t gold, including 12 metres of 12.60 g/t gold, 0.54% copper and 260 g/t silver.

Investors reacted Wednesday by sending Filo shares up 11.3% or 29 cents to $2.85. The shares are currently trading in a 52-week range of $2.00 and $2.99.

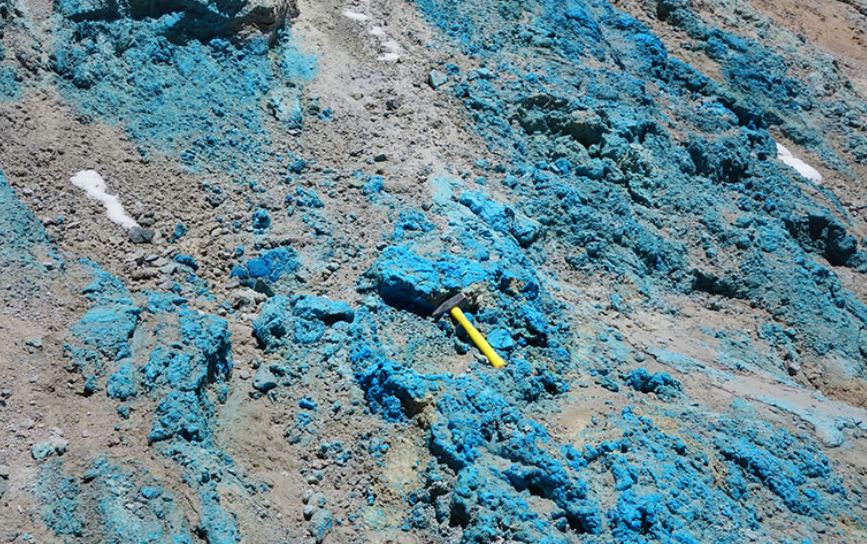

Filo Mining is a member of the Lundin Group of companies. The Filo del Sol project is a high-sulphidation epithermal copper-gold-silver deposit associated with a large porphyry gold system.

It is located in the Andes Mountains, 140 km southeast of the Chilean city of Copiapo and was recently the subject of a pre-feasibility study that is based on proven and probable reserves of 259.1 million tonnes, grading 0.39% copper, 0.33 g/t gold, 15.1Â g/t silver, or 2.2 billion pounds of copper, 2.7 million ounces of gold and 126 million ounce of silver.

The prefeasibility study envisages annual production of approximately 67,000 tonnes of copper (including copper as a precipitate), 159,000 ounces of gold and 8.6 million ounces of silver at a cost of US$1.23 per pound of copper equivalent.

The pre-production capital cost is estimated at $1.27 billion. Over a 14-year mine life (including pre-stripping) the operation is expected to produce almost 1.75 billion pounds of copper as cathode, and 1.92 million ounces of gold and 104 million ounces of silver as doré over a 13-year leach feed schedule.

Additional copper is also expected to be recovered as high-grade copper precipitate.

The prefeasibility study contemplates that Filo del Sol would be mined using conventional open pit methods. It is forecast that ore would be trucked from the open pit to a conventional two-stage crusher, designed to process 60,000 tonnes per day of ore, followed by hydrometallurgical processing to produce copper cathodes and gold-silver doré.

That material would be transported by truck to Puerto Caldera, located about 245 km by road from the plant site.

In the May 28, 2019 press release, Filo CEO Adam Lundin said the company is pleased to deliver more excellent drill results and to wrap up what he described as transformational season. “The 2018/2019 exploration program provided a step change in our understanding of the Filo del Sol system and continued to demonstrate that the ultimate size of the deposit could be well beyond our current mineral resources estimate,” he said.

“This season we have extended the depth of mineralization 530 metres deeper than previously known and still almost every hole has ended in mineralization.”

Lundin went on to say that exploration crews have outlined continuous mineralization over a 3-km north-south distance, and the deposit remains open in both directions beyond this.

“We look forward to drilling this system further with the rigs turning again this fall,” he said.

Commenting on drill specifics, the company said drill hole FSDH030 was planned to a depth of 1,000 metres, but was terminated short of this goal in competent rock with strong mineralization.

The decision to terminate was due to ground condition problems within the shallow oxidized portion of the hole. The company said the last 20 metres of the hole averaged 0.54% copper and 0.35 g/t gold.

The company said the top 450 metres of this hole is within the mineral resource with the last 62 metres outside of it.