Fission Uranium arranging $82.2 million private placement

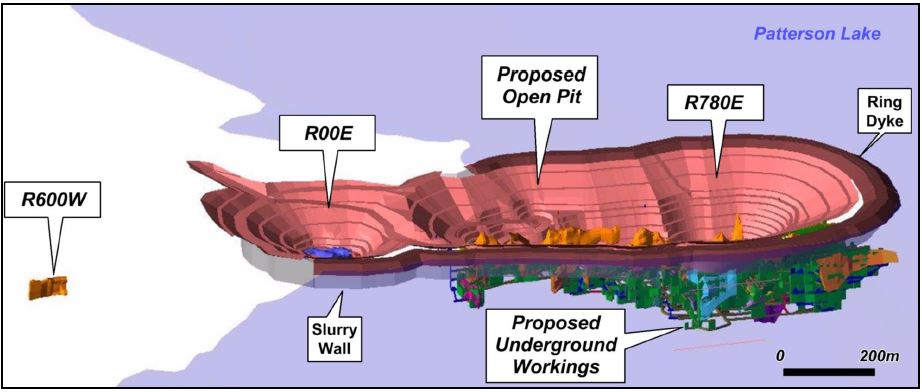

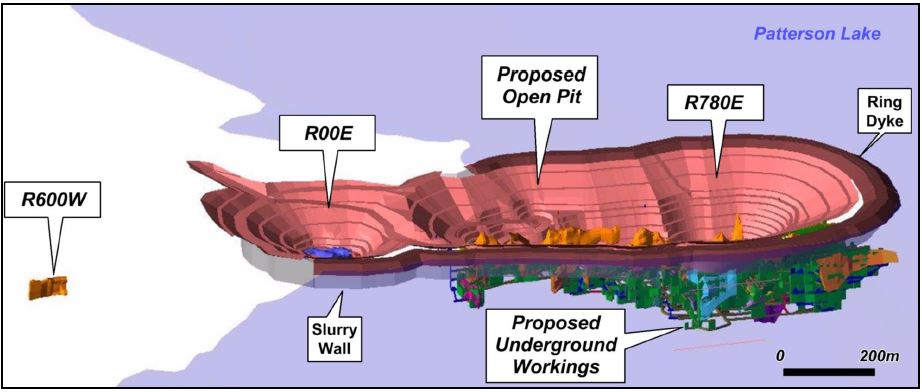

The proposed mining plan for Fission Uranium's Patterson Lake South Project in the Athabasca Basin of northern Saskatchewan. Source: Fission Uranium Corp.

Fission Uranium Corp. [FCU-TSXV; FCUUF-OTCQX; 2FU-FSE] has entered into a binding letter of intent (LOI) with CGN Mining Company Limited. Pursuant to the agreement, Fission and CGN Mining have agreed to proceed towards a CDN $82,226,059 private placement in which CGN Mining would make a strategic investment in Fission which will result in CGN Mining owning approximately 96,736,540 common shares of thec plus an additional number of common shares equal to 19.99% of the number of common shares issued by Fission prior to the closing of the offering pursuant to the exercise of outstanding convertible securities of Fission (subscription shares). The subscription shares will be issued pursuant to a subscription agreement between Fission and CGN Mining at a price of CDN $0.85 per subscription share on a private placement basis. The subscription shares may not be traded for a period of four months plus one day from the closing of the offering.

Fission Uranium has defined substantial uranium resources at its Patterson Lake South (PLS) uranium property – host to the world-class Triple R uranium deposit – located in the Athabasca Basin of northern Saskatchewan.

Fission and CGN Mining have also agreed to proceed towards entering into an offtake agreement pursuant to which CGN Mining will agree to purchase uranium production from the company’s PLS property.

Dev Randhawa, Chairman and CEO, of Fission Uranium, said, “This is an historic moment for Canada’s uranium industry. It is the first time a Chinese company has invested directly in a Canadian uranium company. We are thrilled that CGN Mining has chosen to invest in Fission, PLS and the Triple R deposit. CGN Mining’s understanding of the uranium business is superb and we are excited at the opportunity to work with them. CGN Mining’s knowledge and expertise will be invaluable as we progress PLS and add to shareholder value.”

Xing Jianhua, CFO of CGN Mining, said, “CGN Mining and Fission Uranium have worked hard together to forge this partnership. Both companies have a strong drive to cooperate and achieve the synergy which will result in sustained, mutual benefit.”

CGN Mining is an investment holding company listed on Hong Kong Stock Exchange (HKSE) and mainly engaged in the trading of natural uranium. In order to become a resource development and energy services company with a focused business with clear development direction, and assets with high sustainability, CGN Mining acquired 100% equity interests in Beijing Sino-Kazakh Uranium in 2014.

The controlling shareholder of CGN Mining is China Uranium Development Company Limited, a fully-owned subsidiary of China General Nuclear Power Corp., which is a leading global clean energy corporation in China.

The LOI provides that Fission and CGN Mining intend to enter into a transaction agreements by 2pm Pacific time, January 11, 2015. Upon closing of the offering, CGN Mining will have the right to nominate two of nine representatives to the board of Fission.

The offering is scheduled to close on or about January 29, 2016, Pacific time, and is subject to signing of the transaction agreements, the achievement of certain conditions to closing, and regulatory approvals, including the approval of the Toronto Stock Exchange, the Hong Kong Stock Exchange and approval of the Chinese government.