Galleon Gold amends $8.0 million financing

Galleon Gold Corp. [GGO-TSXV], a company owned 23% by financier Eric Sprott, said Tuesday September 22 that it has amended the terms of an $8.0 million brokered private placement financing.

The company said the private placement will now consist of up to $3.5 million worth of units priced at 12 cents per unit. That’s up from a proposed $3.0 million worth of units when the financing was originally announced on September 16, 2020. The balance will consist of traditional flow through units priced at 13.5 cents and charitable flow-through units priced at 17 cents each.

Each unit will consist of one common share and one common share purchase warrant. Each flow through unit will consists of one flow-through common share and one warrant. Each warrant is good to buy one common share for 18 cents for 36 months after the closing date of the offering, scheduled for October 14, 2020.

Proceeds are earmarked for exploration and general working capital purposes. Galleon’s flagship asset is the 100%-owned West Cache Gold Project 13 km from Timmins, northeast Ontario. Previously known as the Timmins Porcupine West Project, it covers 3,200 hectares and is contiguous to the Timmins West Mine (now owned by Pan American Silver Corp. [PAAS-TSX, NASDAQ]), where Timmins West Mining intersected 83.40 metres of 12.75 g/t gold in 2009.

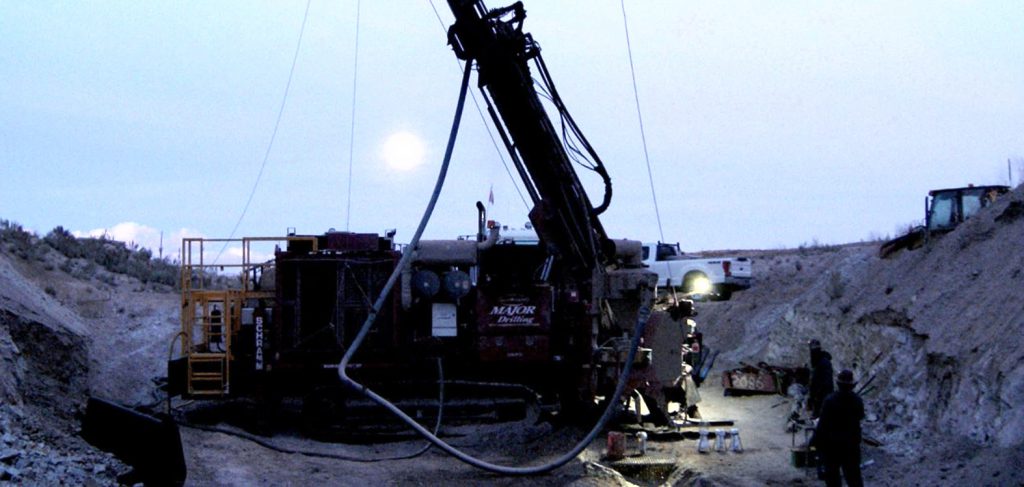

The property has been explored since 1927 by numerous ground geophysical surveys and up to 111 diamond drill holes. In 1984, Dome Exploration discovered and delineated a gold mineralized zone approximately 350 metres long and 45 metres wide. Drill programs by Teck Resources Ltd. [TECK.B-TSX; TECK.A-TSX; TECK-NYSE] and others extended the mineralization to a depth of 350 metres.

“The gold mineralization to date appears to be associated with a major porphyry unit,” the company said.

In a September 9, 2020, press release, the company said results from a 15,000-metre infill drilling program included hole WC-20-030, which returned 9.7 metre zone of 7.16 g/t gold that included a higher-grade sub-interval of 14.75 g/t gold over 3.0 metres.

Additional drilling in the area around WC-20-030 is planned as part of an ongoing 2020 drill program, the company said.

In addition to owning 23% of the company’s shares, Sprott is Galleon’s partner on the Neal Gold project in Idaho. In June, 2020, Galleon acquired an additional interest in the Neal Development Ltd. Partnership, a company formed to own and operate the Neal Gold Project 27 km southeast of Boise.

As a result, Galleon said it would own 53% of the Neal Limited Partnership, leaving Sprott with a 47% retained interest. Galleon can earn another 27% interest in the partnership. The project contains three historic underground mines and was the most productive gold producer in the Neal Mining District, which is estimated to have yielded 30,000 oz gold, mostly from the Neal property.

On Tuesday, Galleon Gold shares eased $0.01 to 14 cents in light trading. The shares are trading in a 52-week range of 20 cents and $0.03.