Glencore removes production overhang fears from zinc market

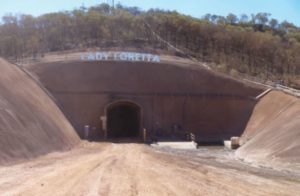

Glencore's Lady Loretta zinc mine in Australia. Source: Glencore PLC/PYBAR Mining Services.

By Peter Kennedy

Investors in select zinc stocks can breathe a sigh of relief today after Swiss metals giant Glencore PLC [GLEN-LSE, GLN-Jo’burg; GLNCY-OTC] indicated that it was not about to restart roughly 500,000 tonnes of production that was taken off the market back in 2015.

Rather, the metals trader revealed in an investor day update that while it will restart its Lady Loretta Mine in Australia, its targeted production of 1,090,000 tonnes in 2018 will actually be down slightly from its 2017 target of 1,105,000 tonnes.

The move is viewed as positive news because Glencore’s idled production, together with the winding down of some major producers in recent years has made zinc a top performer on the base metals scene. Trading at US $1.40 a pound this week, the price of zinc has rallied from around 64 cents in early 2016.

“The market had been fearing (on a worst-case scenario basis) that up to 400,000-500,000 tonnes of production would be added in 2018,” said Scotiabank in a report. “This is not the case.”

Glencore’s zinc production between 2018 and 2020 is expected to jump 21% due to the Lady Loretta restart and anticipated higher grades at the Antamina mine in Peru, due to sequencing, as well as initial production from the Zhairem mine in Kazakhstan.

The latest forecasts do now include previously owned Glencore zinc assets which will still be in production next year. They are the Perkoa Mine in Burkina Faso and Rosh Pinah Mine in Namibia which were acquired by Trevali Mining Ltd. [TV-TSX, TREVF-OTCQX, TV-BVL, 4T1 FSE] in August, 2017.

Zinc is coveted for its corrosion resistant properties, primarily in the global steel industry where it is used to prolong the life of metal by preventing rust.

Analysts have been predicting a long term supply deficit because there isn’t much in the pipeline to replace production from the big mines which recently closed down. Those include the Lisheen Mine in Ireland, the Century Mine in Australia and others.

Companies with exposure to the price of zinc include Inzinc Mining Ltd. [IZN-TSXV], which holds a 100% interest in the advanced stage West Desert zinc-copper-iron-indium project in western Utah. Results of a preliminary economic assessment released in April, 2014, indicate that the project has the potential to support a low cost, long live zinc mine, producing 1.6 billion pounds of the metal over a 15-year period. InZinc shares rose 3.45% or $0.005 to 15 cents on Tuesday December 12.

Last month, the company announced that it is increasing the size of a previously announced non-brokered private placement and now hopes to raise $3 million from an offering of 30 million units priced at $0.10 per unit. Proceeds are earmarked for the advancement of the company’s exploration projects and for general corporate purposes.

Also poised to benefit from any zinc price rally is Pasinex Resources Ltd. [PSE-CSE, PNX-FSE]. Pasinex been able to get its high grade Turkish zinc mine into production without going through all the usual development and financing hoops. Its aim is to quickly transform itself into a mid-tier zinc producer while looking ahead to discovering more metal in the vicinity of its flagship Pinargozu mine in Turkey.

The company released its third quarter results on November 27, 2017 saying the Pinargozu Mine produced 15,760 tonnes of direct shipping material with an average grade of 35% zinc in the third quarter. That marked a 10% increase compared to the second quarter, the company said.

On December 7, 2017, Pasinex said it had signed an option deal with Cypress Development Corp. [CYP-TSXV] and Silicon Systems Inc. allowing it to earn up to an 80% stake in the Gunman zinc project in White Pine County, Nevada.

To earn the interest, Pasinex needs to pay out US $1.5 million in cash and shares over a four-year period during which it must also spend US $2.95 million on exploration.

Pasinex shares were unchanged at 22 cents on Tuesday.