Gold Bull’s Sandman Project in Nevada increases Resource Estimate by 60%

Gold Bull Resources Corp. (TSX-V: GBRC) (“Gold Bull” or the “Company“) is pleased to announce a Mineral Resource Estimate (MRE) for the Sandman Project, located near the town of Winnemucca in Nevada, USA.

The effective date of this MRE is January 20, 2021 and the associated NI43-101 technical report will be filed on the Company’s website and SEDAR within 45 days of this disclosure. For additional Sandman maps & figures please view the Company’s website.

HIGHLIGHTS:

• Sandman NI43-101 resource estimate increased by 60% from the 2007 estimate

• 21.8Mt @ 0.7g/t gold, comprising of:

» Indicated Resource of 18,550kt @ 0.73g/t gold for 433kozs of gold

» Inferred Resource of 3,246kt @ 0.58g/t gold for 61kozs of gold

• Resource extension potential – several resources remain open in multiple directions

• Majority of mineralisation <100m from surface

Gold Bull CEO, Cherie Leeden commented:

This resource estimate incorporated the additional drilling that has been completed at the project since the 2007 resource estimate which totalled 309,000 ounces. Since acquiring the project from Newmont in December 2020, it is a fantastic outcome to have grown our resource base to 494,000 ounces of gold (comprised of 443,000 ounces of Indicated plus 61,000 ounces of Inferred) before we even commence our drill program!

Future resource estimates may also consider silver, which tends to be associated with the gold at a ratio of about 10:1 and has not been adequately investigated yet.

The Mineral Resource Estimate (MRE), for the Sandman Project, was completed by Steven Olsen, who is an Independent Consultant and is a qualified person under NI 43-101. This MRE was derived from 249 historical surface diamond drill holes and 650 RC drill holes totaling 20,201 m of diamond drilling and 75,573.3 of RC drilling.

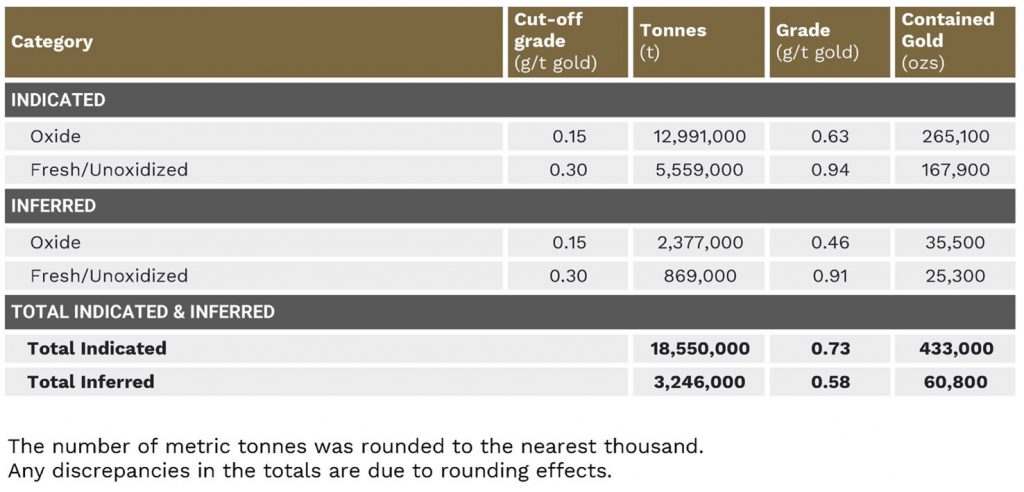

Pit Constrained Resources

The MRE was constrained within an open pit design which was used for the purpose of restricting the MRE to gold mineralization that has “reasonable prospects” for eventual economic extraction. The MRE has been reported from within this open pit constraint, and all material outside of this pit constraint has been excluded from the MRE (Table 1 and Table 2).

The cut-off grade applied to the MRE is based on estimated processing costs and gold recoveries which are commensurate with a gold price of approximately US$1,800 per ounce (US$1690 for fresh and US$1814 for oxide).

Metallurgical information completed to date from Sandman indicates that different processing methods and operating costs will be required for the oxidized rock compared with the unoxidized rock, also known as fresh rock. A cut-off grade of 0.15g/t gold has been applied to the oxide rock which compares with the cut-off grade for unoxidized (fresh) rock of 0.30g/t gold.

Table 1: Indicated and Inferred pit-constrained resources.

Table 2: Detailed Indicated and Inferred pit-constrained resources broken into deposits.

Sandman Gold Property Mineral Resource Estimate Notes:

The mineral resources disclosed in this press release were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) standards on mineral resources and reserves definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council.

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves.

- As defined by NI 43‑101, the Independent and Qualified Person for the Sandman MRE is Steven Olsen has reviewed and validated the Sandman MRE. The effective date of the MRE is January 20, 2021.

- Resources are reported in-situ and undiluted within an open pit constraint and are considered to have reasonable prospects for eventual economic extraction.

- In accordance with NI 43-101 recommendations, the number of metric tonnes was rounded to the nearest thousand. Any discrepancies in the totals are due to rounding effects.

- Metallurgical recoveries of 80% for oxide (assuming heap leach processing at a cost of US$7 per tonne) and 92% (assuming convention grinding and CIL processing at a cost of US$15 per tonne) for fresh rock were utilized in the determination of cut-off grades and also used as input assumptions for the pit constraints.

- The mining assumptions used for the pit constraints included an overall pit slope angle of 50 degrees, a mining cost per tonne of US$2 and a General and Administrative (G&A) charge of US$1 per tonne processed.

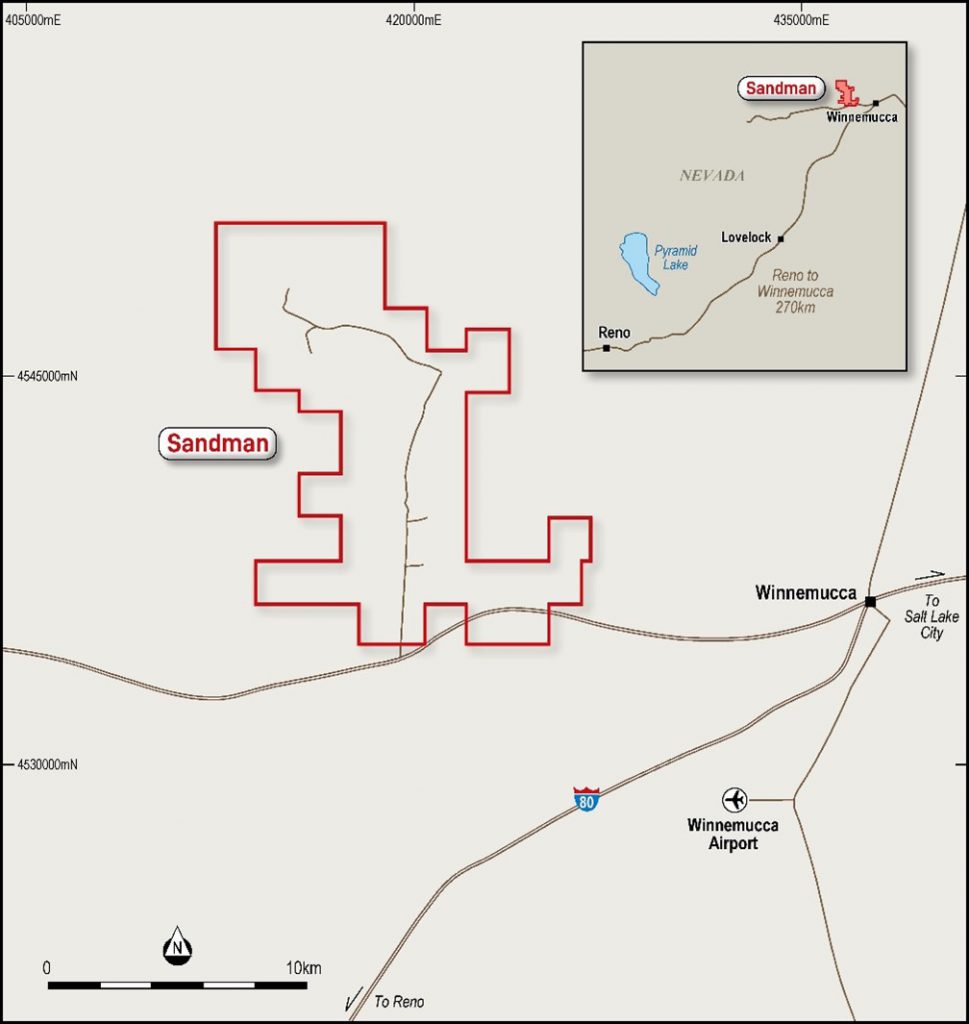

Location

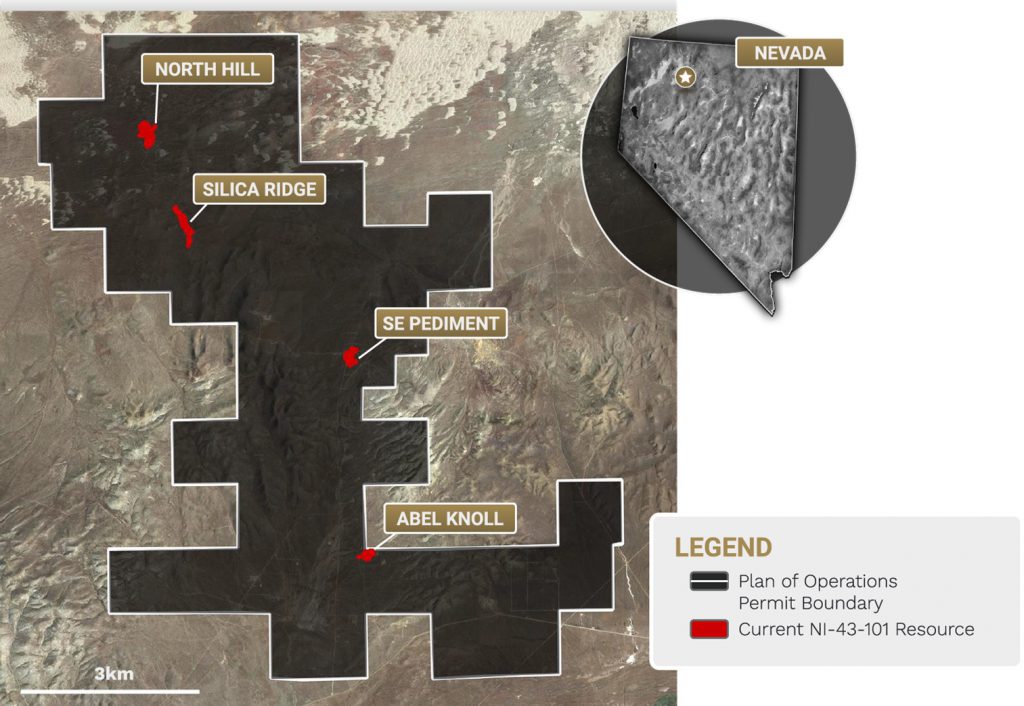

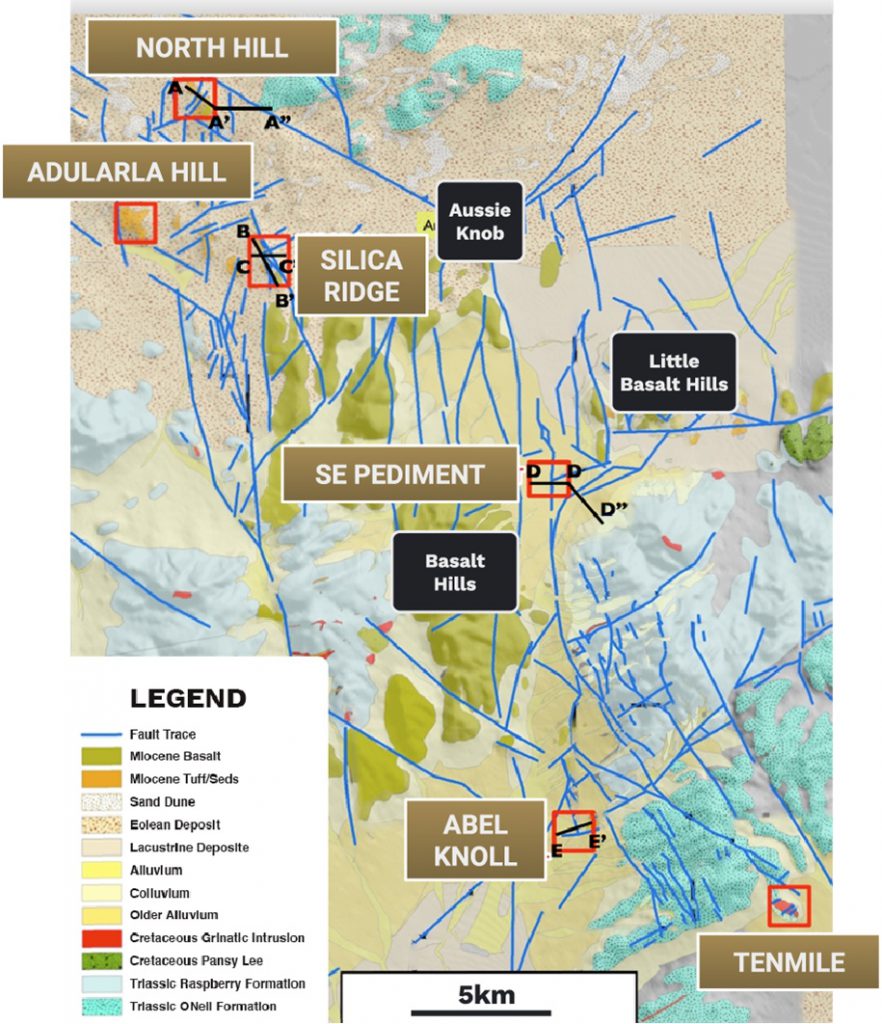

Sandman is located in Townships 36 and 37 North, Ranges 35 and 36 East, Mount Diablo Meridian, Humboldt County, Nevada, USA. The property is situated south of the Slumbering Hills and west of the Tenmile Hills, circa 24 km northwest of the town of Winnemucca, Nevada (Figure 2). The property lies 23 km south of the Sleeper Mine. Sandman is accessed by driving west from the town of Winnemucca on Jungo Road for 15 km, and then an additional eight km to the north on dirt roads that lie largely within the property boundaries.

General Geology

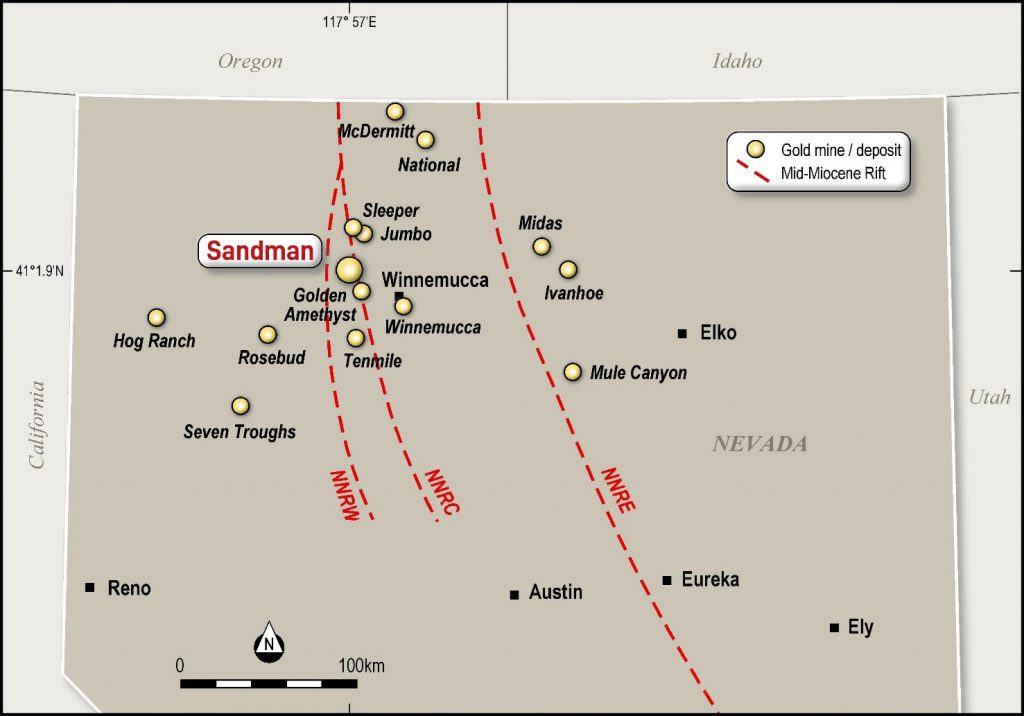

The Sandman deposits belong to a series of deposits that are dated between 14 and 17 million years old. Many of these deposits have formed on major regional faults or rift zones and are interpreted to have formed as a result of the same geological rifting event (Figure 3).

The Sandman deposit is located on a large regional fault known as the Central Northern Nevada Rift (NNRC) and is located some 23 km south of the significant Sleeper deposit on the same interpreted major structure.

The Southeast Pediment, Silica Ridge, North Hill, and Abel Knoll Au+Ag mineralization at Sandman are classified as low-sulfidation, quartz-adularia, epithermal deposits. The mineralization is hosted by Tertiary volcanic rocks, primarily in tuffaceous units, andesite porphyry, tuffaceous sedimentary units, and basalt. Northwestern Nevada contains a number of similar middle Miocene Au-Ag deposits that occur in silicic volcanic or subvolcanic rocks, including the Sleeper, Tenmile, National, and Hog Ranch deposits (Conrad et al., 1993).

In general, higher-grade gold mineralization at Sandman can be stratigraphically controlled along contacts between basalt flows, interbedded fluvial conglomerates and tuffaceous rocks (e.g., North Hill Deposit), or structurally controlled as lens-shaped pods, with high-continuity, lower-grade disseminated gold in sediments and volcanics (e.g., Silica Ridge and SE Pediments Deposits). Quartz-adularia alteration dominates the ore zones, whereas propylitic, argillic, and sericitic alteration are associated with the known resource areas more distally.

Much of the property area is covered by windblown sand deposits which effectively covers the underlying prospective rocks to the gold mineralisation. Mapping, exploration drilling, and shallow auger drilling through the sand indicate that they are underlain by the hosts to the gold mineralisation of Tertiary tuffaceous rocks and andesite, which in turn overlie Late Triassic to early Jurassic metasedimentary clastic and subordinate carbonate rocks (Figure 4).

Next Steps

Gold Bull has identified 42 drill hole targets for approximately 8000 m. The Company will commence with a Phase 1 drill program consisting of 3000 m for 17 drill holes in February 2021 (or as soon as permit transfers have been completed). The initial drill program will consist of 1500 m of resource development drilling aimed at extending known resources and 1500 m of exploration drilling aimed at testing undrilled targets. The Company will then seek to obtain assay results for the initial 3000 m prior to embarking on Phase 2 drill program.

The Company recently completed a ground geophysics (induced polarization) survey at the project and is awaiting the data. This data is anticipated to guide Phase 2 drill targets.

Gold Bull Background

Gold Bull’s Nevada based geology team conducted a comprehensive project generation review of the regional geology surrounding Sandman. The Company has increased its land holding to capture previously open Bureau of Land Management (BLM) ground that is considered highly prospective to host gold mineralisation, based on scientific datasets such as geochemistry, geophysics, and geological mapping. The Company conducted site visits to verify the prospectivity of the targets. The new targets are adjoining to the Company’s Sandman project. Gold Bull’s Sandman land holding now covers >11709 hectares (>117 km2).

Qualified Person

The NI 43-101 Mineral Resource estimate for the Sandman Gold Property was prepared under the direction of Steven Olsen, a Qualified Person under NI 43-101, who has reviewed and consented to the information in this news release that relates to the reported Mineral Resource estimate.

Mr Olsen is an independent consultant and has no affiliations with Gold Bull except that of an independent consultant/client relationship. Mr Olsen is a member of the Australian Institute of Geoscientists (AIG) and is the Qualified Person under NI 43-101, Standards of Disclosure for Mineral Projects, who has reviewed and approved the scientific and technical content of this press release.

About Gold Bull Resources Corp.

Gold Bull Resources Corp. is a gold focused mineral exploration company that strives to generate and advance high-reward project acquisitions in regions with proven mineral wealth. Gold Bull’s mission is to grow into a US focussed mid-tier gold development Company. The company’s exploration hub is based in Nevada, USA, a top-tier mineral district that contain significant historical production, existing mining infrastructure and an established mining culture.

Gold Bull is led by a Board and Management team with a track record of exploration and acquisition success. Gold Bull’s objective is to generate stakeholder value and superior investment returns through the discovery and responsible development of mineral resources.

Cherie Leeden

President and CEO, Gold Bull Resources Corp.

For further information regarding Gold Bull Resources Corp., please visit our website at www.goldbull.ca or email admin@goldbull.ca.

Cautionary Note Regarding Forward-Looking Statements

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed “forward-looking statements” with respect to the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential”, “indicates”, “opportunity”, “possible” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although Gold Bull believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, the Company’s ability to raise sufficient capital to fund its obligations under its property agreements going forward, to maintain its mineral tenures and concessions in good standing, to explore and develop its projects, to repay its debt and for general working capital purposes; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations, future prices of copper and other metals, changes in general economic conditions, accuracy of mineral resource and reserve estimates, the potential for new discoveries, the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company’s plans and business objectives for the projects; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company’s operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry. Forward-looking statements are based on the reasonable beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.