Gold Projects Roundup

by Peter Kennedy

Late last year, when Equinox Gold Corp. [EQX-TSXV; EQXGF-OTC] agreed to merge with Leagold Mining Corp., the plan was to create a leading gold mining company with operations located entirely in the Americas.

By joining forces, the two were aiming for the kind of scale and operational diversity they believe will attract large investment funds, which have been pushing for consolidation in the gold mining sector.

In spite of the obvious challenges associated with having to integrate their operations in the midst of the COVID-19 pandemic, the decision to merge is paying off.

Since the deal was announced in December, 2019, the shares have jumped by almost 50% to $12.14 on May 1, 2019, leaving Equinox with a market cap of $2.74 billion.

“When you look at the two companies, they almost fit together like a glove,” said Equinox CEO Christian Milau, during an interview with Resource World. He was referring to the fact that both had operations in Brazil, offices in Vancouver, and a similar working culture.

The combined company has six operating mines in Mexico, Brazil and the U.S., with forecast production of 540,000 to 600,000 ounces of gold this year and plans to increase that output to one million ounces by 2023.

While the COVID-19 pandemic has resulted in a government-mandated suspension of mining activity at the company’s largest mine – Los Filos in Mexico – Milau said the rising price of gold and a sharp drop in energy prices is giving him reason to feel optimistic.

“In the next months as we get more clarity, we could come out very well at the other end of [the pandemic],” he said.

The following is a list of other companies who can are currently engaged in gold exploration and development.

Alamos Gold Inc. [AGI-TSX, NYSE] is a Canadian-based intermediate gold producer with diversified production from four operating mines in North America, including the Young-Davidson and Island Gold mines in northern Ontario, and the Mulatos and El Chanate mines in Sonora Mexico.

The company produced 494,500 ounces of gold last year, meeting its production targets for the fifth year in a row. Alamos has previously said it expects its annual production to increase to 600,000 ounces in 2021. The expected increase in 2021 will reflect a full year of production from the Kirazli project in Turkey. The company recently repurchased a 3% net smelter return (NSR) royalty on its Island Gold mine.

Alamos also has an advanced gold project near Lynn Lake, Manitoba where it is updating a positive feasibility study.

Alio Gold Inc. [ALO-TSX, NYSE American] and Argonaut Gold Inc. [AR-TSX] recently announced a friendly merger deal that they said will create an intermediate gold producer with four operations and annual production of 235,000 ounces of gold equivalent annually.

The combined entity expects to benefit from an enhanced asset portfolio and improved geographical diversification with assets in Mexico, Canada and the United States. Argonaut said the merger deal was driven by its desire to create the next quality mid-tier gold producer in the Americas with a production target this year of 175,000 to 185,000 gold equivalent ounces.

Amex Exploration Inc. [AMX-TSXV; AMXEF-OTCQX] has made a significant gold discovery in Quebec at is 100%-owned, high-grade Perron Gold Project. Since January 2019, Amex has intersected significant gold mineralization in three different zones that stretch over 3.2 km of lateral strike along the Perron Fault Zone. Amex’s project portfolio also includes the 100%-owned Eastmain River gold properties in James Bay, Quebec, and the 100%-owned Lebel-sur-Quevillon gold project in Lebel-sur-Quevillon, about 150 km northeast of Val d’Or, Quebec.

Aura Minerals Inc. [ORA-TEX; ARMZF-OTC] is a mid-tier copper and production company focused on the development and operation of gold and base metal projects in the Americas. The company’s producing assets include the San Andreas gold mine in Honduras, the Ernesto/Pau-a-Pique gold mine in Brazil, the Aranzazu copper-gold-silver mine in Mexico, and one pre-operational gold mine in the U.S., known as Gold Road. In addition, the company has two additional gold projects in Brazil, Almas and Matupa, and one gold project in Colombia, Tolda Fria.

Aurania Resources Ltd. [ARU-TSXV; AUIAF-OTCQB] is a junior exploration company with a focus on gold and copper. Its flagship asset is The Lost Cities – Cutucu Project, which is located in the Jurassic Metallogenic Belt in southeastern Ecuador.

The Lost City Project consists of 208,000 hectares in 42 concessions, occupying the central part of the Cordillera de Cutucu. The concessions extend for roughly 95 km along the Cordillera.

Bonterra Resources Inc. [BTR-TSXV; BONXF-OTCQX; 9BR1-FSE], having acquired Metanor Resources Inc. in September 2018, has said it was planning to create a new gold exploration and development company with a focus on Quebec’s Urban Barry mining camp.

By attaining control of three advanced high-grade gold deposits (Gladiator, Moroy and Barry) and the only permitted gold mill in the region, Bonterra said the combined company would be in an excellent position to rapidly and cost-effectively become a significant Quebec-based gold producer.

Caldas Gold Corp. [CJC-TSXV] was recently spun out by Gran Colombia Gold Corp. [GCM-TSX] to contain Gran Colombia’s Marmato gold assets in the Department of Caldas, Colombia. The Marmato Project contains a mineral resource of 2.0 million ounces of gold in the measured and indicated categories and 3.3 million ounces inferred. In 2019, the Marmato underground mine produced 25,750 ounces of gold. Caldas is currently advancing a pre-feasibility study for a major expansion and modernization of the underground mining operations at Marmato, where production is expected to increase to 150,000 ounces annually between 2024 and 2027.

Corvus Gold Inc. [KOR-TSXV; CORVF-OTCQX] is a North American gold exploration and development company. Its key assets are the wholly-owned North Bullfrog and Motherlode projects in Nevada. As of September 18, 2018, the combined projects contain a measured mineral resource of 9.3 million tonnes averaging 1.59 g/t gold, containing 475,000 ounces of gold. On top of that is an indicated resource for the mill of 18.2 million tonnes at an average grade of 1.68 g/t gold, containing 988,000 ounces.

In addition, the two projects contain a measured mineral resource for oxide, run of mine, heap leach of 34.6 million tonnes at an average grade of 0.27 g/t gold, containing 305,000 ounces.

Eldorado Gold Corp. [ELD-TSX; EGO-NYSE] is a mid-tier gold and base metals producer with an international portfolio that includes mining, development and exploration projects in Turkey, Canada, Greece, Romania and Brazil. Key operations include the Kisladag and Efemcukuru mines in Turkey, the Olympias Mine in Greece, and the Lamaque Mine in Quebec. Together they produced 395,331 ounces of gold last year, including 113,940 ounces from Lamaque.

Evergold Corp. [EVER-TSXV], a British Columbia-focused exploration company, recently completed an initial public offering that raised $3.45 million for exploration drilling at the company’s flagship Snoball and Golden Lion properties, which are located in B.C.’s Golden Triangle and Toodoggone regions respectively.

Gold Terra Resource Corp. [YGT-TSXV] says it has assembled a highly prospective district-scale land position on the doorstep of the City of Yellowknife in the Northwest Territories. The company is currently focused on expanding and delineating gold resources at its Yellowknife City Gold Project which covers 790 km2 of contiguous land. In November 2019, the company announced an inferred mineral resource estimate of 735,000 ounces of gold.

Gran Colombia Gold Corp. [GCM-TSX] is a Canadian gold and silver producer with a focus on Colombia, where it is currently the largest underground gold and silver producer, with several underground mines in operation at its Segovia and Marmato operations. The majority of the company’s production comes from the Segovia Operations, which are located in the Segovia-Remedios mining district in Antioquia, roughly 180 km east of Medellin, northwest Colombia. Segovia produced 214,241 ounces of gold in 2019.

The company met its 2019 production guidance by producing 240,000 ounces of gold, an increase of 10% over 2018. That figure includes production from the Marmato assets which were recently spun out into a new publicly listed vehicle named Caldas Gold Corp. as noted above.

GT Gold Corp. [GTT-TSXV; GTGDF-OTC] is focused on B.C.’s Golden Triangle area and is backed by Newmont Goldcorp. Corp. [NGT-TSX; NEM-NYSE], which recently increased its stake in GT Gold to 14.9%.

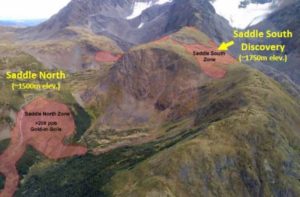

GT’s flagship asset is the Tatogga property located in the Stikine region of northwestern B.C., 14 km west of the Imperial Metals Red Chris copper-gold mine and less than 1 km from the town of Iskut. Tatogga contains a high-grade gold discovery known as the Saddle prospect. It consists of two parts: a high-grade, near surface epithermal gold-silver vein system at Saddle South and, close by at Saddle North, a largely covered, porphyry copper-gold-silver mineralized system.

GT Gold’s exploration vice-president Charles Greig agreed to vend four properties into the company in exchange for shares and a small royalty.

The Snoball and Golden Lion properties are subject to a 0.5% net smelter return royalty (NSR) on any minerals that are extracted from the properties The royalty is payable to C.J. Greig Holdings (a company owned by Charles Greig), with no buyout option.

Liberty Gold Corp. [LGD-TSX; LGDTF-OTC] is focused on advancing a pipeline of Carlin-style gold deposits in the Great Basin region, which covers parts of Nevada, Utah and Idaho. The company recently announced the start of the 2020 exploration season at its Carlin-style Black Pine oxide property in southern Idaho. Drilling in 2019 resulted in two discoveries of high-grade oxide gold mineralization beneath the limit of shallow historical drilling.

Orla Mining Ltd. [OLA-TSX; ORRLF-OTC] is funding exploration and development at its Camino Rojo Oxide gold project in Zacatecas, Mexico. The Camino Rojo Oxide Gold Project is an advanced gold and silver open-pit heap leach project. The project is 100%-owned by Orla and covers over 200,000 hectares.

Hosting 1.03 million ounces of gold and 20.1 million ounces of silver reserves Camino Rojo will be Orla’s first mine. It is expected to produce 97,000 ounces of gold annually at an all-in-sustaining cost of US$575/oz.

Orla acquired Camino Rojo from Newmont Goldcorp Corp. which now owns a 19.9% stake in Orla.

Roxgold Inc.‘s [ROXG-TSX; ROGFF-OTCQX] key asset is the high-grade Yaramoko gold mine located in the province of Bale, southwestern Burkina Faso, about 200 km southwest of Ouagadougou.

After completing a feasibility study in 2014, Roxgold has developed a significant high-grade gold discovery at Yaramoko’s 55 Zone, which is expected to produce 652,000 ounces over the next seven years, at a life-of-mine average of 11.5 grams per tonne.

Roxgold has also outlined an inferred resource of 220,000 ounces gold in the Bagassi South Zone, a satellite discovery located 1.8 km south of Zone 55. The company produced 142,204 ounces of gold in 2019.

Skeena Resources Ltd. [SLE-TSXV; SKREF-OTCQX] is bidding to revive two of Canada’s most successful high-grade precious metal mines – Snip and Eskay Creek. Both are located in northwest British Columbia in the Golden Triangle.

Skeena acquired a 100% interest in the former Snip mine in July 2017 from Barrick Gold Corp. [ABX-TSX; GOLD-NYSE]. Six months later, it secured an option to acquire a 100% stake in Eskay Creek from Barrick. Skeena recently released the results of an initial preliminary economic assessment (PEA) for Eskay Creek, which produced 3.3 million ounces of gold and 160 million ounces of silver from 1994 until closure in 2008.

Teranga Gold Corp. [TGZ-TSX; TGCDF-OTCQX] holds a 90% interest in the Massawa Gold Project in Senegal. It acquired the asset last year from Barrick Gold Corp. and Barrick’s Senegalese partner for an upfront payment of US$380 million.

Massawa is one of the highest-grade undeveloped open pit reserves in Africa, hosting 2.6 million ounces of gold or 20.9 million tonnes at 3.94 g/t gold. Those “historical” reserves are located within trucking distance of Teranga’s flagship Sabodala Gold Mine in Senegal, a scenario that creates the opportunity for significant capital and operating synergies, Teranga has said

The Government of Senegal holds the remaining 10% stake in the project.

Galway Metals Inc. [GWM-TSXV] has been expanding the George Murphy (GMZ) and Richard Zone discoveries at its 100%-optioned Clarence Stream gold project 70 km south of Fredericton, New Brunswick. Recent drill results from hole 88 at the GMZ returned 6.5 g/t gold over 14.05 metres, 9.7 g/t over 2.0 m, 1.2 g/t over 11.0 m, 4.9 g/t over 2.35 m, and 1.3 g/t over 3.95 m- extending the zone by 230 metres to the west and represents the deepest hole vertically to date. Other drill results have been encouraging with many assays still pending.

A September 2017 resource estimate totaled M&I at 390,000 ounces plus 277,000 ounces Inferred that did not include the GMZ, Jubilee and Richard Zones. More drilling is planned.

The company also has the 100%-owned Estrades polymetallic (gold-zinc-copper-silver) project in the Abitibi region of Quebec which has strong gold credits.