Golden Shield drills 4.84 gpt gold over six metres and 2.58 gpt over seven metres in first holes at Toucan Creek

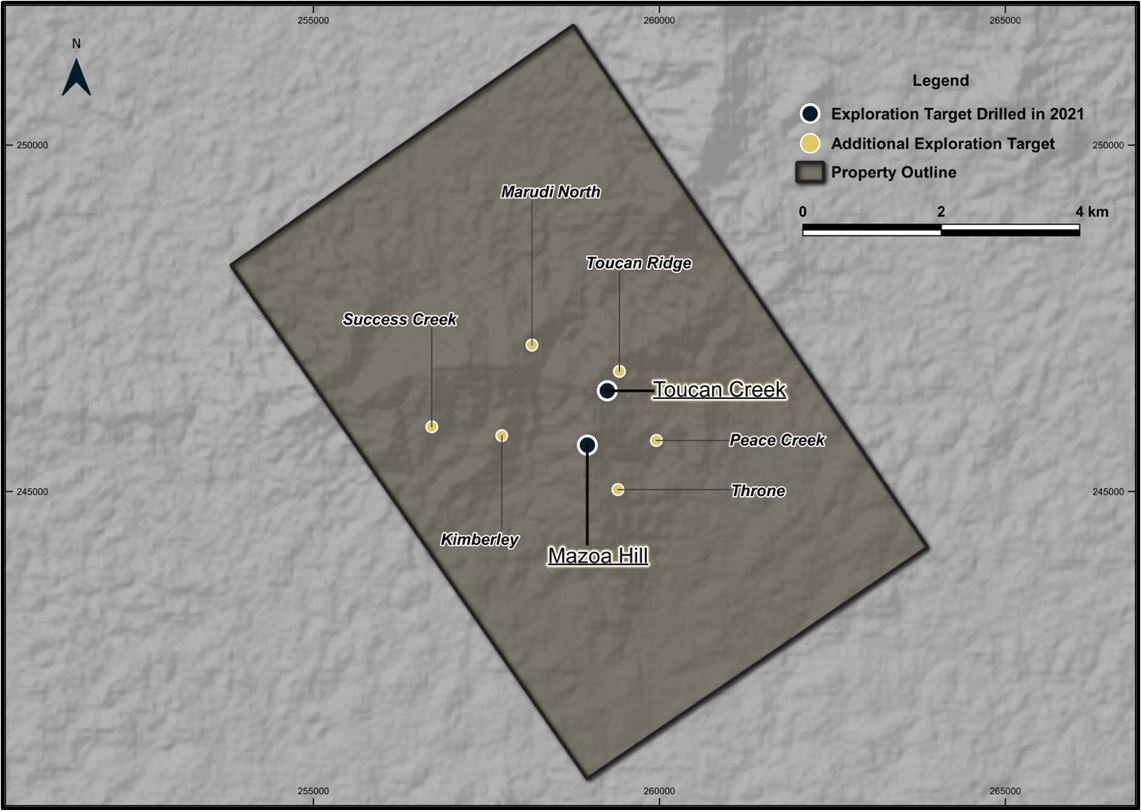

Golden Shield Resources Inc. (CSE: GSRI) (the “Company” or “Golden Shield”) is pleased to announce results of six initial diamond drill holes totalling 848 metres that were drilled at the Toucan Creek area, one of eight prospects at the Company’s flagship, 5,457-hectare, Marudi Mountain gold project located in the Rupununi District of southwestern Guyana (the “Marudi Project”).

Figure 1 – Marudi Project Map, prospects so far identified.

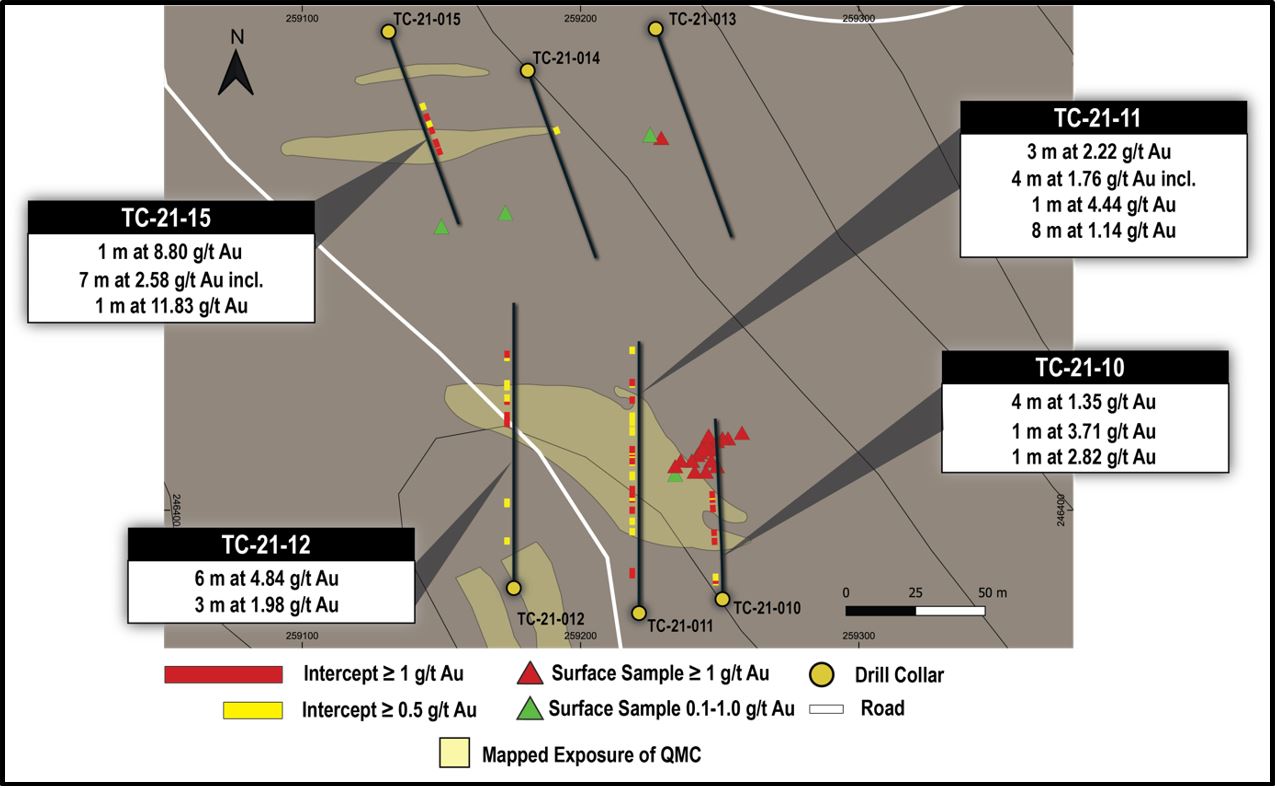

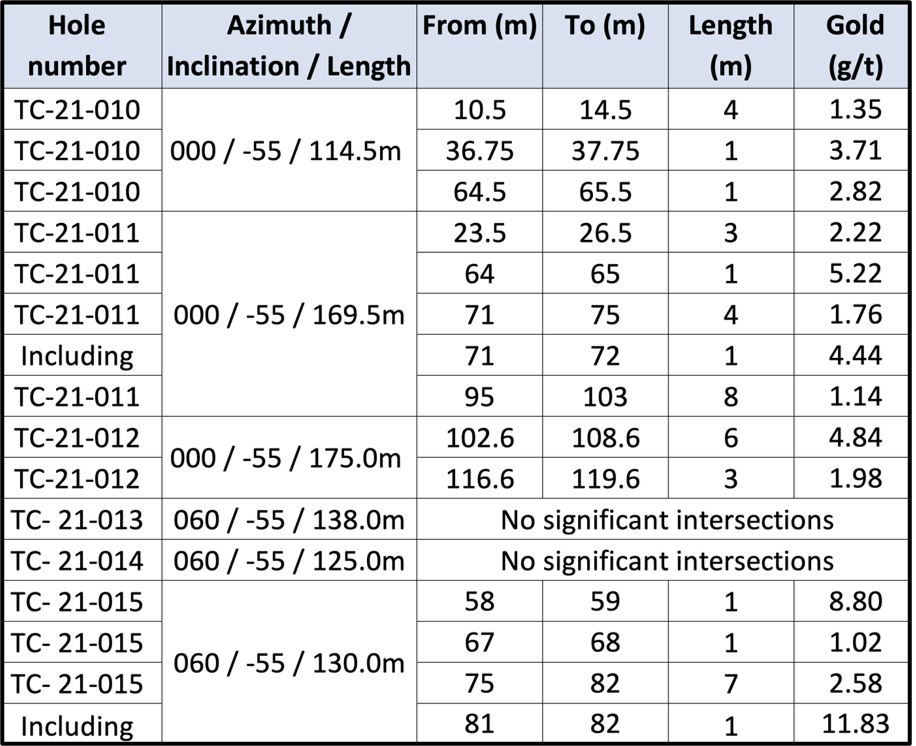

This first round of drilling at Toucan Creek intersected multiple intervals in four of the six holes drilled, see Table 1. Â All reported intervals are hosted within quartzite-metachert (“QMC”), which is also the host rock to gold mineralization at Mazoa Hill. Golden Shield geologists were drawn to the area by outcrops of QMC that are visibly mineralised with oxidised pyrite returning anomalous gold values in surface sampling.

Figure 2 – Toucan Creek drill plan with mapped geology and surface sample results.

Golden Shield will integrate these results with surface data to identify targets for follow up drilling. Dr Colin Porter, Vice President, Exploration of Golden Shield, commented, “We are very pleased to have received initial drill results back from our new Toucan Creek prospect and are encouraged by the potential of this target. The Toucan Creek prospect is located approximately 1.5km from Mazoa Hill, which is now where the drill is currently operating. To date, we have defined eight priority prospects at the Marudi Mountain gold project and are actively generating additional prospects”.

Results from trenching at the Kimberley, Success Creek and Throne prospects are pending, as well as additional recce samples. The current drill program will focus on expanding the newly recognised extensions at Mazoa Hill.

Table 1 – Diamond Drill Hole results

*Lengths are drill indicated core length, as insufficient drilling has been undertaken to determine true widths at this time. The highest assay used for weighted average grade is 15.51g/t gold and top-cutting is not deemed to be necessary. Average widths are calculated using a 0.50 g/t gold cut-off grade with < 4 m of internal dilution below cut-off grade. Sample lengths are 1m unless reduced below this to respect geological contacts.

Qualified Persons

Leo Hathaway, P. Geo, Executive Chair of Golden Shield, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, verified, and approved the scientific and technical information in this news release and has verified the data underlying that scientific and technical information.

About Golden Shield

Golden Shield Resources was founded by experienced professionals who are convinced that there are gold mines yet to be found in Guyana. The company is well-financed and has three wholly controlled high-grade gold projects: Marudi Mountain, Arakaka and Fish Creek.

For further information please contact:

Leo Hathaway

Executive Chair

Email: info@goldenshield.ca

Telephone: +1 778-654-9665

This news release includes certain “Forwardâ€Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forwardâ€looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forwardâ€looking statements or information. These forwardâ€looking statements or information relate to, among other things: the exploration and development of the Company’s mineral projects; and release of drilling results.

Forwardâ€looking statements and forwardâ€looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of Golden Shield, future growth potential for Golden Shield and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Golden Shield’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Golden Shield’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forwardâ€looking statements or forward-looking information and Golden Shield has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mineral exploration activities in Guyana; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified in the Company’s public disclosure documents available on www.sedar.com. Readers are cautioned against attributing undue certainty to forwardâ€looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forwardâ€looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.