Grid Battery Metals is staged for success as it explores for lithium in Nevada

By Ian Foreman

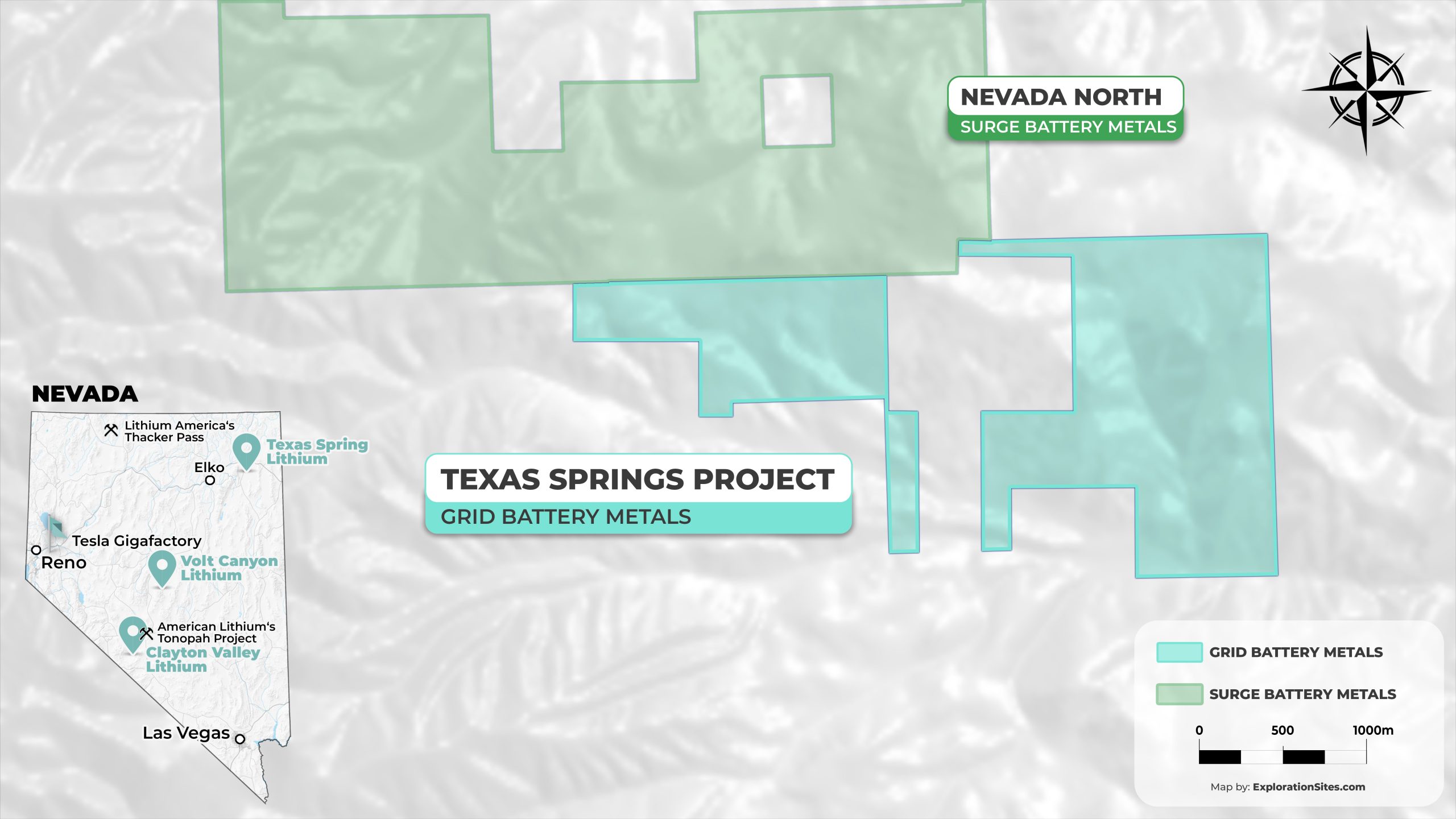

The management team behind Grid Battery Metals [TSXV: CELL; OTCQB: EVKRF] is leveraging its knowledge of the battery metals sector to create their next winner. As a group, they have been successfully exploring for metals used in the production of electric vehicles for over a decade. They have had a number of successful exits from companies that they have created – the most recent of which was Surge Battery Metals [TSXV-NILI; OTCQX-NILIF] where they were responsible for the discovery of the Nevada North Lithium Project which Surge recently announced results of up to 8,070 parts per million lithium.

Grid’s new president and CEO, Tim Fernback told Resource World “Grid’s management and geological team has been actively exploring for EV battery metals in Nevada for over a decade, and we have been very successful in finding and funding new lithium discoveries. Our team has been very adept at finding great properties in great locations.”.

Grid’s new president and CEO, Tim Fernback told Resource World “Grid’s management and geological team has been actively exploring for EV battery metals in Nevada for over a decade, and we have been very successful in finding and funding new lithium discoveries. Our team has been very adept at finding great properties in great locations.”.

Under Mr. Fernback’s guidance Grid has shifted its focus to Nevada. “It is safe to say that we know Nevada and we know Lithium”, continued Mr. Fernback.

Grid now has three highly prospective lithium properties in Nevada: Texas Springs, Clayton Valley, and Volt Canyon.

The Texas Spring Property, located in Elko County, covers approximately 2,500 hectares and is contiguous with and immediately south of Surge’s Nevada North Lithium Project property.

The company has recently completed the first phase of its initial exploration program at Texas Springs. A detailed 50 by 100 metre spaced soil sampling program was undertaken with the goal of determining if the favourable volcanic tuff and tuffaceous sediments of the Humbolt Formation contain significant lithium concentrations at surface. In addition, a controlled-source audio-frequency magnetotellurics (or ‘CSAMT’) geophysical survey was conducted in order to identify geological features at depth that could be favourable for the accumulation of lithium.

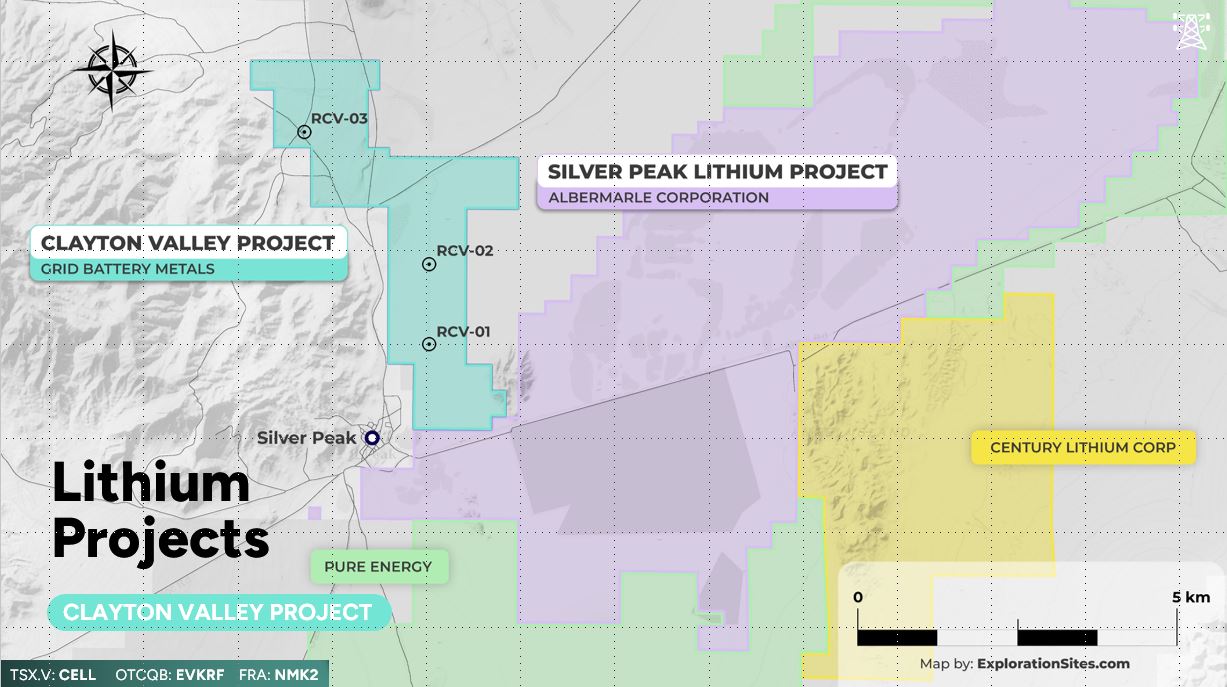

Grid’s second prospective property, the 2,300 acre Clayton Valley Property, is immediately north of the Silver Peak Lithium Project that belongs to Albemarle Corporation (NYSE: ALB) and home to North America’s only producing lithium mine.

Lithium within the Clayton Valley occurs both as brines contained within underground reservoirs, or aquifers and as clay hosted deposits. Exploration with the company’s Clayton Valley Property has focused on both. Work competed within the property has inferred the existence of a graben that may be a sub-basin of the larger Clayton Valley basin and, in turn, may represent a secondary trap for lithium brines.

Lithium within the Clayton Valley occurs both as brines contained within underground reservoirs, or aquifers and as clay hosted deposits. Exploration with the company’s Clayton Valley Property has focused on both. Work competed within the property has inferred the existence of a graben that may be a sub-basin of the larger Clayton Valley basin and, in turn, may represent a secondary trap for lithium brines.

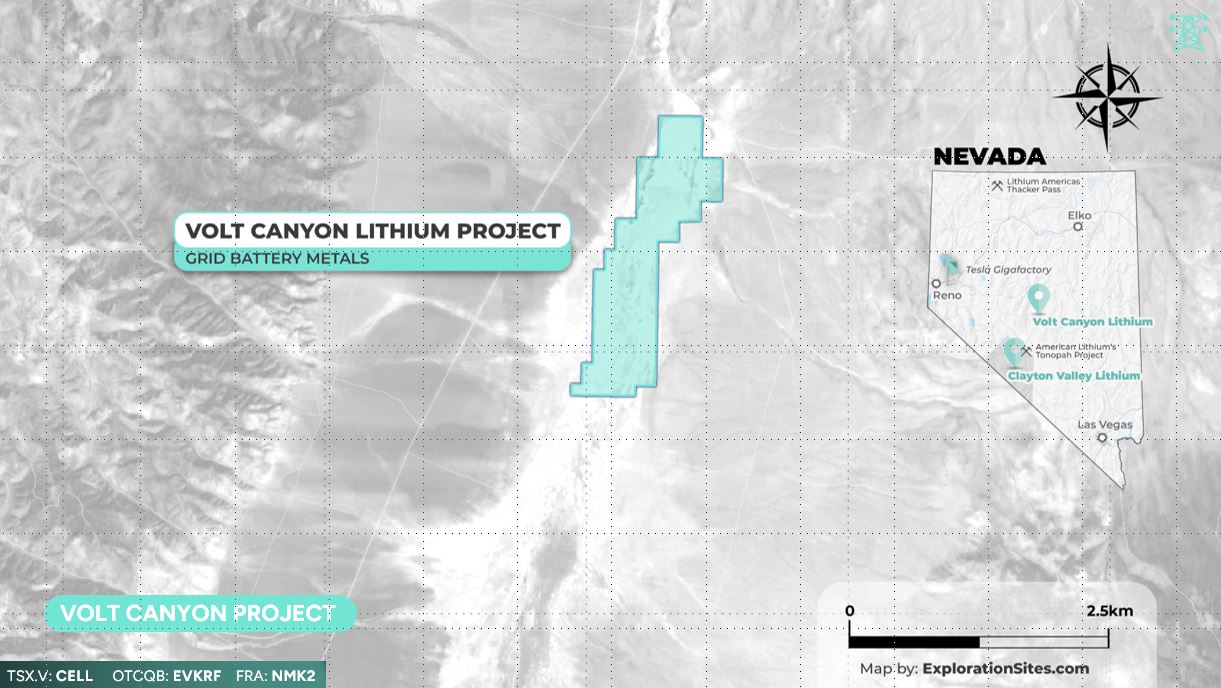

The company’s newest project, the Volt Canyon Lithium Property, has a unique exploration target. Grid has staked 80 placer claims covering approximately 635 hectares of alluvial sediments that are believed to have been sourced from claystone deposits.

This property features sediment-hosted lithium clay targets and has excellent accessibility, enabling exploration and exploitation throughout the year. Although limited exploration has been conducted in the immediate area, regional sediment samples in the region taken by the US government returned up to 108 parts per million lithium near the property.

This property features sediment-hosted lithium clay targets and has excellent accessibility, enabling exploration and exploitation throughout the year. Although limited exploration has been conducted in the immediate area, regional sediment samples in the region taken by the US government returned up to 108 parts per million lithium near the property.

Future exploration programs on these projects are fully funded through to the end of 2024 as Grid is sitting on an enviable treasury of $9 million. The treasury is made up of a combination of cash and shares in other public companies. These include a sizeable position in Surge, which recently traded as high as $1.55 per share.

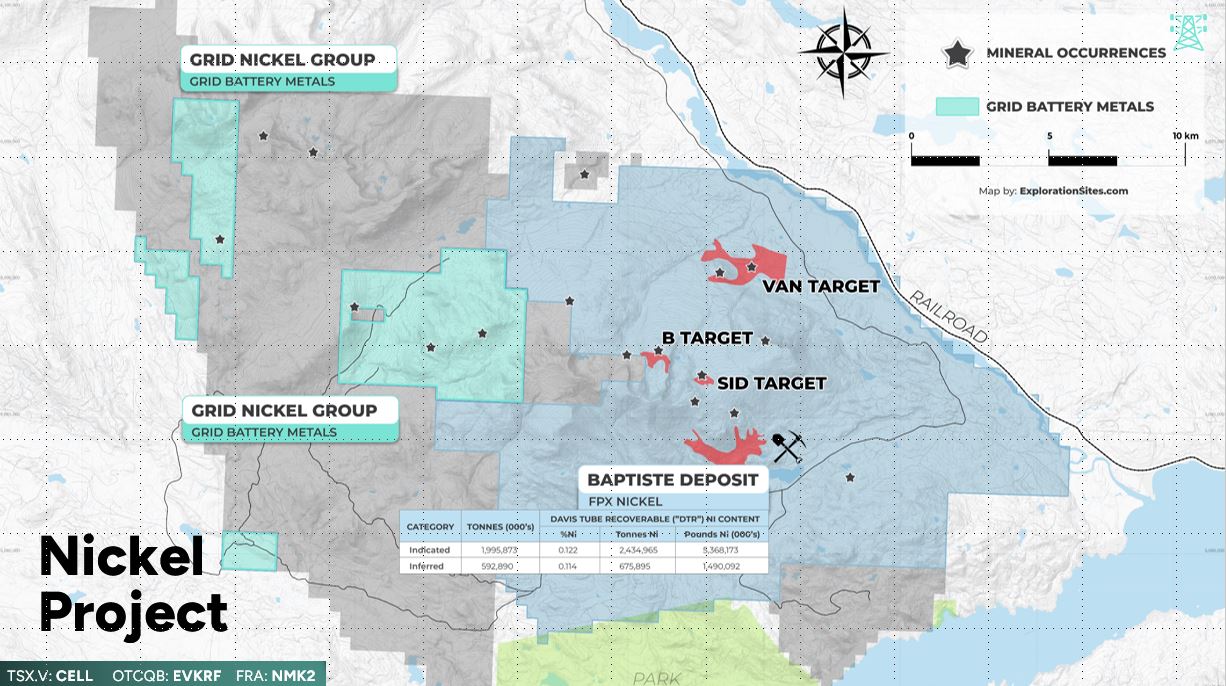

Shareholders will soon benefit from another transaction that the Company is completing. Grid is planning a new SpinCo that will own its British Columbia nickel properties that are in close proximity to FPX Nickel’s Decar Nickel District, which contains the Baptiste deposit. The transaction will be for 9,339,040 common shares of SpinCo and Grid will dividend those shares out to its shareholders.

Shareholders will soon benefit from another transaction that the Company is completing. Grid is planning a new SpinCo that will own its British Columbia nickel properties that are in close proximity to FPX Nickel’s Decar Nickel District, which contains the Baptiste deposit. The transaction will be for 9,339,040 common shares of SpinCo and Grid will dividend those shares out to its shareholders.

Tim Fernback commented, “In order to continue to create additional shareholder value, we are separating our Nevada-based lithium properties from our British Columbia-based nickel property, and plan on separately financing and taking the B.C. nickel property public on the CSE… We believe this is a win for our shareholders, giving each shareholder an equity interest in a new public company at no additional cost to them.”

“As a management team, we are singularly focused on creating shareholder value. Every move we make takes shareholder value into account. The recent CSE listing announcement for our subsidiary is a case in point. It is a big win for the shareholders as we focus these companies on our world-class exploration assets.”

With the spin out underway, the management of Grid is now able to give its undivided attention to following up on their recent success exploring for lithium in Nevada.

With the spin out underway, the management of Grid is now able to give its undivided attention to following up on their recent success exploring for lithium in Nevada.

“We have been together as a group for a long time. We have been exploring for lithium and battery metals for over a decade. We know the battery metals space and know how to explore for battery metals and that is what we are going to concentrate on with Grid”, concluded Tim Fernback.

Grid Battery Metals shares closed at $0.095 on October 17, 2023, leaving the company with a market cap of $10.3 million, based on 108,713,650 million shares outstanding (157,824770 fully diluted). The shares are trading in a 52-week range of 0.215 cents and $0.04.