Grid Metals Makes Significant Palladium Discovery at East Bull Lake

Grid Metals Corp. (the “Company“) (TSXV:GRDM) is pleased to announce  a significant drill hole result at its 100% owned East Bull Lake (“EBL”) palladium property (the “Property”) in Ontario.  The Company is exploring for palladium mineralization on the >20 km long East Bull Lake Intrusion with a specific focus on potential feeder structures and other structural trap sites for palladium-rich sulfides. The Property covers approximately 85% of the East Bull Lake Intrusion, which hosts widespread palladium mineralization and is located approximately 80 km west of Sudbury, Ontario.

Highlights

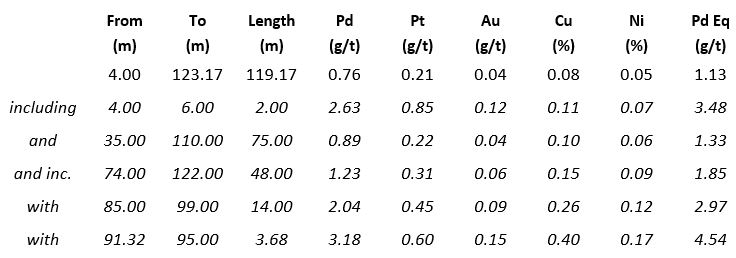

• Drill hole EBL20-13 intersected 119 metres averaging 0.75 g/t Pd, 0.21 g/t Pt, 0.04 g/t Au, 0.08% Cu and 0.05% Ni (1.13 g/t palladium equivalent grade = Pd Eq) with significant higher-grade sections including 48.0 metres averaging 1.85 Pd Eq that contains 14.0 metres of 2.97 g/t Pd Eq and 3.68 metres averaging 4.54 g/t Pd Eq;

• The values obtained in EBL20-13 represent the best intercept of palladium-dominant mineralization obtained by Grid on the Property and are of significant grade-thickness;

• The mineralization extends from surface to ~100 metres vertical depth and occurs directly above the base of the intrusion in an interpreted structural embayment adjacent to a likely feeder structure;

• A >2km long target area based on coincident geophysical anomalies, favourable structures and prospective geology has been identified and will be used to explore the mineralization intersected in hole EBL20-13 along strike;

• Assays are pending for two other holes (14 and 15) located ~75 metres northeast of hole EBL20-13. Overall these holes had less visible sulfide content than EBL20-13 but intersected favourable stratigraphy. Of note, EBL20-14 intersected a 2.5 metre interval of semi-massive magmatic sulfides that is coincident with a previously untested >1 km trend of enhanced conductivity noted in an airborne EM survey;

• Step out drilling from EBL20-13 is expected to resume in January.

Analytical results for drill hole EBL20-13 from the central Parisien Lake target area. Based on current 3D geological interpretations, the true thickness is estimated to be approximately 70-80% of the length of the reported mineralized intervals. Pd Eq is the palladium equivalent grade that is calculated using the following long-term consensus price forecasts ($US) sourced from S&P Global Metals and Mining Research and dated October 30, 2020: Pd – $1,813.90/oz; Pt – $955.55/oz; Au – $1,832.01/oz; Cu – $2.96/lb; Ni – $6.87/lb.

Dr. Dave Peck, the Company’s Vice-President of Exploration and Business Development stated “We are now seeing the type of palladium grades and thicknesses we have been searching for. The results from EBL20-13 validate our exploration model and represent a significant discovery.  The mineralization in EBL20-13 appears to be part of a structural depression that coincides with the eastern end of a >2 km target trend. This trend has been defined from 3D analysis of our recent MT survey results and previously completed magnetic, EM and IP survey data. Property wide, several similar target trends have been delineated using the same criteria.   We are now preparing a systematic drilling plan to define the extent of the high-grade mineralization intersected in hole EBL20-13.“

Dr. Dave Peck, the Company’s Vice-President of Exploration and Business Development stated “We are now seeing the type of palladium grades and thicknesses we have been searching for. The results from EBL20-13 validate our exploration model and represent a significant discovery.  The mineralization in EBL20-13 appears to be part of a structural depression that coincides with the eastern end of a >2 km target trend. This trend has been defined from 3D analysis of our recent MT survey results and previously completed magnetic, EM and IP survey data. Property wide, several similar target trends have been delineated using the same criteria.   We are now preparing a systematic drilling plan to define the extent of the high-grade mineralization intersected in hole EBL20-13.“

Â

Interpretation

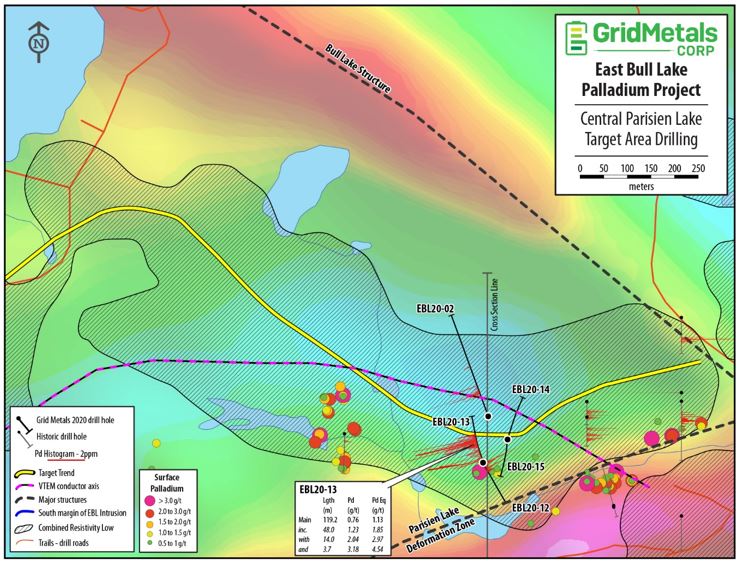

Hole EBL20-13 was drilled from the same setup as hole EBL20-12 (Figure 1; see Appendix for collar coordinates). Both holes were designed to test a trend of coincident geophysical anomalies and anomalous palladium values obtained from both drill core and surface samples. EBL20-13 was drilled on a northerly azimuth to test for sulfide accumulations directly north of the Parisien Lake deformation zone and intersected >120 metres of disseminated sulfides hosted by the lower stratigraphy of the intrusion. EBL20-12 was drilled to the south to test for sulfide accumulations in the Parisien Lake deformation zone. It intersected ~30 metres of sparsely mineralized lower stratigraphy before entering the structure (Figure 2), including a 6.0 metre interval of >1.0 g/t Pd (see Company’s November 24th news release).

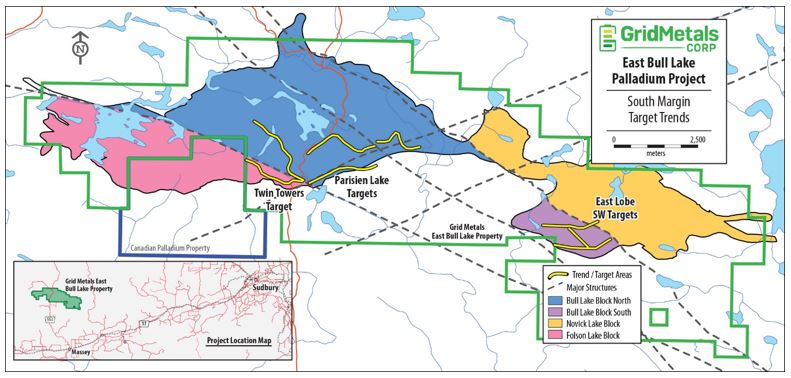

Maximum PGE grades for individual samples in EBL20-13 are 3.72 g/t Pd and 1.03 g/t Pt over 1.04 metres from 85.00 metres downhole depth. Maximum base metal grades are 0.62% Cu and 0.23% Ni over 1.00 metres from 105.00 metres downhole depth.  A total of 20 samples returned palladium grades of >1.0 g/t. Ten samples returned palladium grades of >2.0 g/t. Five samples returned palladium grades of >3.0 g/t. These results represent the thickest drill intersection of consistently anomalous palladium values as well as the best grade times thickness intersection obtained to date on the Property. They provide confidence in the Company’s targeting methodology, which has been continually refined as new results have been received. Exploration on the Property is now specifically focused on areas where resistivity lows and magnetic lows coincide with potential feeder structures and anomalous palladium values. Numerous, similar trends to that which hosts EBL20-13 are now recognized on the Property, including several in the greater Parisien Lake target area (Figure 3). One of these trends (Twin Towers) appears to connect to the interpreted eastern extension of Canadian Palladium’s (BULL.CN) Valhalla Zone.

Program Plans

The Company intends to resume drilling on the Property in the New Year. The next drilling campaign is expected to involve systematic drilling across the North Parisien Lake trend to test for lateral continuity of the near surface, higher-grade palladium mineralization intersected in hole EBL20-13 – initially targeting a strike length of 500 metres. In addition, the Company is evaluating initial drill testing of one or more property-wide targets.   Target criteria include favourable stratigraphy, proximity to major structures, surface sample palladium grades and magnetic and geophysical features.

Nickel Assets

The Company also plans to release an update on its nickel properties in the near future including a new 43-101 Technical Report on its 100%-owned Bannockburn nickel project located ~70 kilometres south of Timmins, Ontario. The exploration-stage Bannockburn property contains a serpentinized dunite-hosted disseminated nickel sulfide zone having similar characteristics to Canada Nickel’s (Crawford project, also located in the Timmins area.

Quality Assurance and Quality Control

Grid Metals applies best practice quality assurance and quality control (“QAQC”) protocols on all of its exploration programs.  For the current drilling program, core is logged and sampled at a core facility located in the town of Massey, Ontario – approximately 30 km south of the property. NQ-size drill core samples are cut into halves using a diamond saw.  Standard sample intervals of 1.00 metre length are used unless a major geological, structural or mineralization boundary is encountered. Samples are bagged and tagged and transported by courier to, for this news release, the Actlabs Thunder Bay analytical facility.  Actlabs analyzes each sample for Pd, Pt and Au using a lead collection fire assay on a 30 g pulp split and an ICP finish. Copper, Ni and Co are analyzed using a total fusion acid digestion and an ICP finish. The Company uses two PGE certified reference materials (“CRMs”) and one analytical blank purchased from Canadian Resource Laboratories to monitor analytical accuracy and check for cross contamination between samples. One of the CRMs or the blank are inserted every tenth sample within a given batch. The analytical results for the two CRMs and the blank for the sample batches reported here did not show any significant bias compared to the certified values and the results fell within the acceptable limits of variability.

Dr. Dave Peck, P.Geo., has reviewed and approved the technical content of this release for purposes of National Instrument 43-101.

About Grid Metals Corp.

Grid Metals Corp. is an exploration and development Company that has a diversified portfolio of projects in the nickel-copper-platinum group metal sectors. These commodities are vital to the emerging battery metals, energy storage and automotive sectors. Â All of Grid’s projects are located in secure North American mining jurisdictions. The Company is focused on timely advancement of its property portfolio through prudent exploration and development activities.

To find out more about Grid Metals Corp., please visit  www.gridmetalscorp.com.

On Behalf of the Board of Grid Metals Corp.

Robin Dunbar – President, CEO & Director Telephone: 416-955-4773 Email:Â rd@gridmetalscorp.com

David Black – Investor Relations Email:Â info@gridmetalscorp.com

We seek safe harbour.

This news release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of the Securities Act (Ontario) (together, “forward-looking statements”). Such forward-looking statements may include the Company’s plans for its properties, the overall economic potential of its properties, the availability of adequate financing and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements expressed or implied by such forward- looking statements to be materially different. Such factors include, among others, risks and uncertainties relating to potential political risk, uncertainty of production and capital costs estimates and the potential for unexpected costs and expenses, physical risks inherent in mining operations, metallurgical risk, currency fluctuations, fluctuations in the price of nickel, cobalt, copper and other metals, completion of economic evaluations, changes in project parameters as plans continue to be refined, the inability or failure to obtain adequate financing on a timely basis, and other risks and uncertainties, including those described in the Company’s Management Discussion and Analysis for the most recent financial period and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

This news release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent U.S. registration or an applicable exemption from U.S. registration requirements.

Appendix. Drill hole specifications for the September – November diamond drilling program at East Bull Lake. Easting and northing collar coordinates are based on a NAD83 UTM Zone 17 projection.

Figure 1. Plan view map showing the location of EBL20-13 within a largely untested and >2 km long drill target (Parisien Lake North) featuring coincident structure, anomalous Pd grades and geophysical anomalies – including resistivity lows and conductivity highs.

Figure 2. Vertical cross section showing the geology intersected in several 2020 drill holes in the southwest part of the Parisien Lake North trend.  Palladium grade histograms for hole EBL20-13 and initial assay results from hole EBL20-12 are also shown and are plotted on a linear scale with the maximum value being 3.7 g/t in hole EBL20-13. The background image is a coloured inversion model of magnetic susceptibility generated from the 2007 VTEM survey over the Property.

Figure 3. Plan view map of EBL property showing updated high priority exploration trends based on coincident geophysical and geochemical anomalies and major structures along the southern margin of the East Bull Lake Intrusion.