Hertz Energy Enters Agreement to Acquire Cominco Uranium Property

Hertz Energy Inc. (the “Company”) (CSE: HZ; OTCQB: HZLIF; FSE: QE2) is pleased to announce that it has entered into a Property Purchase and Sale Agreement dated February 2, 2024 (the “Definitive Agreement”) with BullRun Capital Inc. (the “Vendor”) pursuant to which the Company has agreed to acquire the Cominco Uranium Project, located in Bathurst Inlet, Nunavut, Canada (the “Cominco Property”).

PURCHASE AGREEMENT

The Company has entered into the Definitive Agreement to acquire the Cominco Property. Pursuant to the terms and conditions of the Definitive Agreement and as consideration for the acquisition of a 100% undivided interest in the Cominco Property, the has agreed to:

- pay the Vendor cash consideration of $75,000; and

- grant the Vendor a two percent (2%) net smelter returns royalty on the Cominco Property.

Mr. Kal Malhi, CEO of Hertz states, “Hertz was always founded and positioned to explore for mineral deposits that will power the future. We started with our Lucky Mica project and have added the AC/DC Lithium Project, while also obtaining options to acquire the Snake and Patriota Lithium Projects, since our listing in April 2023. Adding the Cominco Property fits extremely well with our energy metals offering and we aim to aggressively explore both the lithium and uranium mineral projects and continue to offer investors a well-diversified energy metals project portfolio.”

The Vendor is wholly-owned by Kal Malhi, a director and officer of the Company. Accordingly, the Company’s acquisition of the Cominco Property constitutes a “related party transaction” as defined in Multilateral Instrument 61-101 – Protection of Minority Securityholders in Special Transactions (“MI 61-101”). The Company is relying on the exemption from valuation requirement and minority approval pursuant to subsection 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, for its acquisition of the Cominco Property, as the value of the consideration to be paid by the Company for the acquisition of the Cominco Property does not represent more than 25% of the Company’s market capitalization, as determined in accordance with MI 61-101.

COMINCO URANIUM PROPERTY

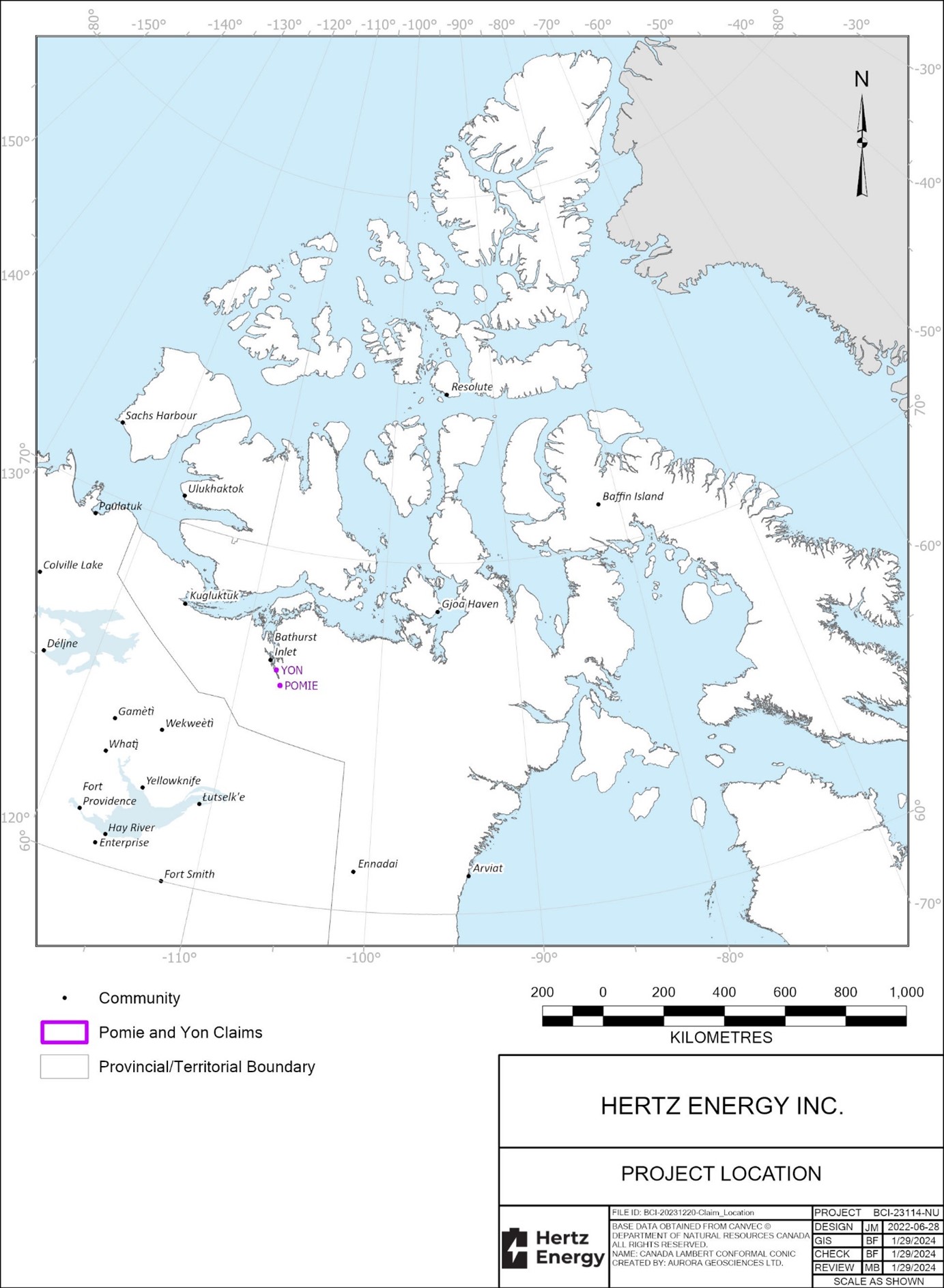

The Cominco Property is focused on two main uranium showings of interest, the Pomie and the Yon showings in Nunavut (see Figure 1 below). Additional showings of uranium, copper, gold, nickel, and lead are known in the area. The Pomie and Yon showings were both explored in the mid 1970s by Cominco and Noranda and no work using modern exploration technologies has taken place since.

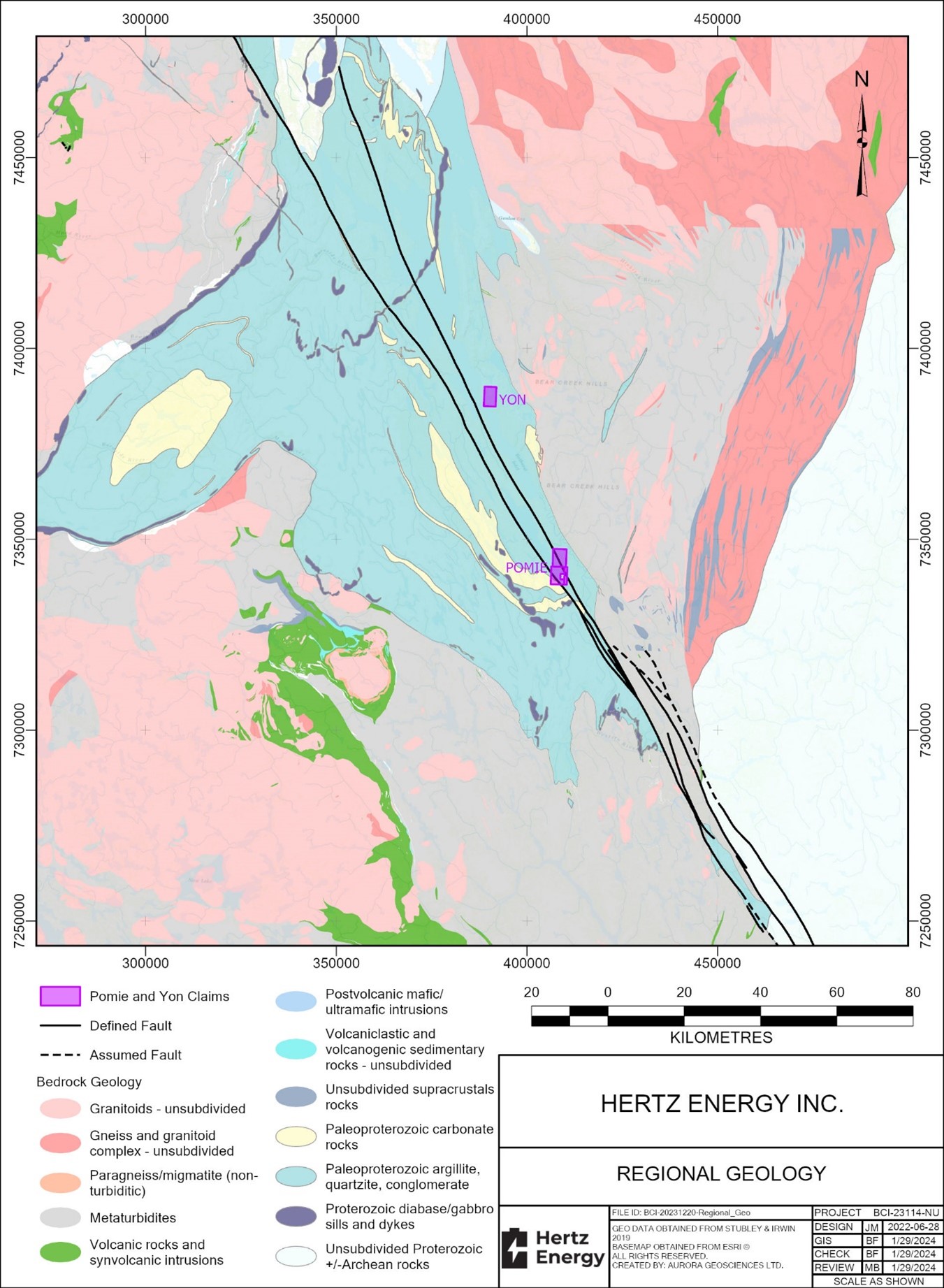

Previous regional work in the area by the Geological Survey of Canada (GSC) identified mineral potential for uranium in the area (Roscoe, 1984), based on the presence of the above showings and favourable stratigraphy for the formation of Unconformity Related Uranium (URU) deposits, similar to the stratigraphy found in the Athabasca and Thelon basins.

The Cominco Property covers the Yon and Pomie “Advanced Exploration” stage showings and is comprised of four licensing spanning 5,046.25 hectares covering favourable geology.

The two main uranium showings on the Cominco Property, the Yon and Pomie showings, are described in greater detail below. There are other smaller occurrences usually associated with copper mineralization in the region.

Figure 1: Geographical map highlighting location of Pomie and Yon showings

Pomie Uranium Showing

The Pomie showing lies at the south end of Bathurst Lake, located near the Western River outflow into Bathurst Inlet (see Figure 2 below). The Pomie showing was explored by Cominco Ltd. in 1976 and 1977, following a regional airborne radiometric survey conducted in 1975 (Wright and Heddle, 1977). In 1977, Cominco drilled seven BQ-sized holes totalling 420m on the Pomie showing and determined that the mineralization was associated with the basalt.

The following summary is quoted from Nunavut Mineral Occurrence Database for the Pomie showing ID 076JSW0003.

Capsule Geology – Cominco Ltd 1977

“The Pomie prospect has the most significant uranium mineralization in bedrock discovered to date in the Bathurst Inlet region. There are two favourable intracratonic sedimentary basins in the region, namely the Kilohigok and Elu basins of Paleoproterozoic and Mesoproterozoic age, respectively. Main uranium exploration thrust in the region was during 1975-’81, which involved mostly the reconnaissance type work by major companies, namely Cominco, E & B Explorations, Noranda, S.E.R.U. Nucleaire, Aquitaine, Essex, Gulf and Giant Yellowknife.”

Deformation/Setting

“Open folding and fracturing in the host strata of Pomie prospect are related to the Bathurst Inlet faults. The strata are part of the uppermost formation of the Goulburn Group. The group is essentially coeval with the Coronation Supergroup of the Wopmay orogen to the west deposited during 2000-1890 Ma, as well to the Great Slave Supergroup to the southwest. NNW-trending Bathurst faults are coeval with the ENE-trending faults of the Great Slave Shear Zone. Both are related to the terminal collision in the north-trending Wopmay orogen ca. 1883 Ma. Fanglomerates and associated sediments were deposited in grabens formed by these faults. They comprise the Mesoproterozoic Tinney Cove Formation in Bathurst Inlet and Et-Then Group in East Arm of Great Slave Lake. Basal unconformity of these sediments is marked by paleo-weathering. Hence they are favourable for Unconformity-associated uranium mineralization. This also applies to the Ellis Formation overlying the Tinney Cove Formation. Whether the mineralization at Pomie prospect is related to unconformity is debatable. The 1022 Ma pitchblende age reported here is permissive in this regard.”

Mineralization

“A sample of arkose from Trench 9 assaying 87 lbs U3O8 per ton (36.888 kg U/metric tonne or 3.689 % U) was examined in polished section (Wright, 1976; Roscoe, 1984). Radioactive material is extremely fine grained and disseminated in matrix of quartz grains, clay minerals and minor sulphides (pyrite and chalcopyrite). A sample of basalt from Trench 9 assaying 130 lbs U3O8 per ton (5.512 % U; note: check assay of 89 lbs U3O8 /ton) gave essentially the same result, mineralization being finely disseminated in the matrix and coating grains of sulphides. A linear concentration of fracture-filling was noted. A scanning electron microscope study of this radioactive material indicated mainly U with minor Si, Fe and Ca suggesting that uraninite is the uranium mineral with minor impurities of quartz, iron oxides and calcite. The best grade encountered at surface was 41.96 lbs U3O8/ton (1.779 % U) over 13.0 feet (3.96 m) in Trench 9 at the south end of the main mineralized zone adjacent to a large area of drift and muskeg.”

Yon Uranium Showing

The Yon showing was explored by Noranda commencing with radiometric surveys and reconnaissance work conducted in 1976 followed by mapping, prospecting, and trenching in 1977.

The Yon showing lies on the eastern side of Bathurst Inlet and is hosted in the Western River Formation (see Figure 2 below). Vein-hosted mineralization occurs within brecciated Western River Formation rocks. Mineralization is fault controlled, bounded to the east and west by the Grizzly and McLaughlin faults and occurs above the east trending Coliver fault.

The following summary is quoted from Nunavut Mineral Occurrence Database for the Yon showing ID 076JNW0005.

Capsule Geology: Noranda Inc. 1977

“A regional airborne radiometric survey in 1976 by Noranda detected anomalies in a thick sequence of green and grey siltstones, which on the ground gave readings of total 6000 to 10000 cpm on McPhar TV-1 spectrometer. However, these anomalies led to discovery of mineralized talus to the southwest on the east face of a sandstone ridge. The showing was explored by mapping and trenching during 1976 -1977. Further prospecting led to located veins on both sides of the ridge. Considerable surface exploration was done on the prospect in 1977, but no drilling has been done. 13 trenches in 350 x 400 m area; best assay from a 1.5 m channel sample across a vein: 0.33 % U and 0.4 % Cu.”

Mineralization

“Widely spaced fracture-filling suggests a large but weak mineralizing system. The country rocks and host rocks include a large proportion of sandstones that are favourable for sandstone-type uranium mineralization. They are faulted and locally highly tilted but are essentially unmetamorphosed. The YON prospect is close to the basal unconformity of the Western River Formation with the Archean basement, and there is some development of paleoregolith on the basement. Granitoid rocks in the basement are potential source rocks for the uranium seen in the veins. One of the 11 grab samples assayed in 1976 gave the following best metal values: 0.644 % U3O8 (0.456 % U), 1.23 % Cu, 0.62 oz/ton Ag and 0.005 oz/ton Au.”

Figure 2: Geological map highlighting the Pomie and Yon showings

UPDATE ON THE COMPANY’S PROPERTIES

AC/DC Lithium Project – James Bay, Canada

The AC/DC Lithium Project is district size at 265km2 and adjoins and shares similar geology to Rio Tinto’s Kaanaayaa Lithium Project in James Bay, Quebec. The AC/DC Lithium Project is also amidst large lithium discoveries by Patriot Battery Metals’ 109Mt Corvette lithium discovery, Winsome Resources’ 59Mt Adina Discovery, Brunswick Exploration Mirage lithium discovery, Loyal Lithium Trieste lithium discovery and Azimut Exploration and Midland/Rio Tinto’s respective Galinee Projects.

Snake Lithium Project – James Bay, Canada

The Snake Lithium Project spans 217km2 located next to drill ready lithium discoveries by Brunswick Lithium’s Arwen (Elrond) lithium discovery, Harfang Exploration’s Serpent lithium discovery and Quebec Precious Metals’ Ninaaskumuwin lithium discovery. The Company holds an option to acquire the Snake Lithium Project from Sirios Resources Inc.

Lucky Mica Lithium Project – Arizona, USA

The Lucky Mica Project covers 939 hectares in Maricopa Country, Arizona along the Arizona Pegmatite Belt and sits between Patriot Lithium’s projects. The area is easily accessible through the public road network and is approximately 105 km northwest of Phoenix. SGS Canada Inc. has defined a target envelope tonnage of between 330,000 and 551,000 tonnes to a depth of 60m with average grades between 0.3% and 2.5% Li2O.

Patriota Lithium Project – Minas Gerais, Brazil

The Patriota Lithium Project is located in Minas Gerais, Brazil. The tenements cover 2,963.7 hectares in proximity to areas of economically significant lithium deposits including Sigma Lithium’s green lithium mine, Ionic Lithium’s Itinga and Salinas projects and CBL’s Cachoeira mine. The Company holds an option to acquire the Patriota Lithium Project from Brascan Resources Inc. and RTB Geologia e Mineracao LTDA.

2024 EXPLORATION STRATEGY

The Company is committed to advancing its well diversified energy metals portfolio and recently closed a $1.5M charity flow-through financing which will be solely dedicated to its lithium projects in Quebec. The Company also recently closed a $1.037M non-flow-through financing which will be dedicated towards its extraction technology, exploration at its Lucky Mica Project, consulting/management fees, marketing/IR, the acquisition of the Cominco Property, and general and administrative matters.

The company will remain heavily focused on its lithium assets located in James Bay, Quebec. Lithium is not a fad but foundational to the energy transition away from fossil fuels. We firmly believe that as the cost of electric vehicles continues to fall, adoption rates will continue to soar. Governments have implemented policies that virtually ensure widespread adoption across much of the world.

Despite new lithium mines coming online, demand remains relentless as growth in EVs continues to outpace expectations.

LITHIUM SUMMARY

As of January 31, 2023, lithium prices and capital markets valuations for lithium explorers have taken a dip from the high lithium prices of early 2023. The Company continues to believe that lithium is the metal of our generation and will continue to be needed to meet the expanding demand. A recent quote from respected industry advisor John Kaiser summarized lithium as the metal for the future shift to electric power and the upcoming technologies that will make EV’s affordable by the government mandates to eliminate gas powered vehicles from the roads across the world.

ABOUT LITHIUM

“As nationalism of critical metals is in FastTrack mode, especially in China, the West remains committed to the energy transition. Not only must exploration and development within these territories replace supply that came from the East, but also secure supply to meet the extra demand created by these energy transition needs. Since the EV sector growth is something that comes in waves, there tends to be regular imbalance between surges in supply and demand. China has been the primary driver of lithium demand because its EV deployment has been driven by the desire to escape import dependency on oil as a transportation fuel.

The current reality is that for ordinary people good EV’s like Tesla’s are too expensive, and the cheap models such as BYD products are inferior in terms of how long one can drive before refueling, where to refuel and how long to refuel. This is the reason Toyota avoided charging into the EV sector and instead chose to focus on hybrids while working on hydrogen leapfrog technology. The latter, however, is for a future decade because there is nothing happening to create widespread hydrogen refueling stations whereas electricity supply is ubiquitous, you just need a place to park and plug in.

TOYOTA DEVELOPMENT

- The Japanese brand was late to the EV party but plans a dramatic expansion in models and innovative battery technology; it’s planning to sell 3.5 million EVs annually across 30 different Toyota and Lexus model lines by 2030.

- Long-range battery packs will provide up to 500 miles of range by 2026 and 620 miles by 2027.

- Toyota is aiming to introduce solid-state batteries in 2027, which will be capable of ultra-fast 10 minute recharge times from 10 to 80 percent state of charge.

If Toyota is committed to their new technology, and has figured out how to build a solid state lithium-ion battery that uses lithium as the anode instead of graphite, which facilitates ranges over 1,000 km on 10 minute charge times, and, because it is based on a manufacturing breakthrough rather than some new configuration which requires a scarce and expensive input such as scandium or even worse iridium, has the potential to undergo further efficiencies just as has happened with solar panels. Toyota will be able to offer affordable an EV Camry and Corolla by 2030, provided there is enough lithium supply in place to do so.

But groups like Albermarle, SQM and Australia based mineral exploration titan Gina Reinhart know, which is why Gina and SQM are paying the equivalent of AUD $2.7 billion to buy out Azure Minerals which doesn’t even have a resource estimate yet. They know lithium will be a $200 billion annual market during the 2030s and spodumene pegmatites are the most predictable supply source today while we wait to see what the salars, claystones and oil brine fields can deliver at what unit cost. The idea of Lithium Mania 2.0 is tied to the solid-state lithium-ion breakthrough which turns EVs into an affordable and acceptable option for ordinary people, and we will not hit that inflection point until 2030, which means exploring for pegmatites has to go full throttle today. If Toyota delivers on this promise, EVs cease to be a “political” choice. When will lithium stock prices reverse their decline? Should one buy now or wait for it to fall lower? In the case of lithium, we know there will be drill results coming from many discoveries in 2024 to excite the lithium investment market and the expansion of EV vehicle technologies and sales numbers will continue to skyrocket.” – John Kaiser, Kaiser Research Online

LITHIUM RELATED LINKS

CNBC

A worldwide lithium shortage could come as soon as 2025

FORTUNE

ATLAS PUBLIC POLICY

EV Sales data is now in for September 2023. Here’s three stories:

1. Strongest month on record with 136,000 sales, up nearly 67% from September 2022

2. EV market share of 11% for new sales

3. Nearly 59,000 Tesla sales, the second highest ever for Tesla

BLOOMBERG

URANIUM SUMMARY

Uranium is Powering Up the Future.

Spot uranium prices recently reached a peak not witnessed since 2007, standing strong at $101 per pound, per Numerico data. This upswing signifies a constrained nuclear fuel market, growing expectations for future demand, and the imperative for additional mine restarts and new constructions, according to experts in the uranium industry.

Need for nuclear.

The rising price comes after the US Department of Energy (DOE) announced its US$500 million plan to build domestic uranium supply for advanced nuclear reactors, as part of President Joe Biden’s ‘Investing in America Agenda’. US Secretary of Energy Jennifer Granholm says nuclear energy provides nearly half of the US carbon-free power and continues to play a ‘significant’ role in transitioning to a clean energy future.

The unpredictable fossil fuel prices and go-getter goals for decarbonisation have driven the US, along with other countries to announce their nuclear power will be tripled by 2050. The S&P Global reports the rally started due to geopolitical instability, everlasting supply cuts, and companies renewing their long-term uranium supply contracts.

Other factors influenced this now-bull market, including a change in global sentiment as plans were in the works for restarting or extending the operational life of nuclear power plants. The key role that nuclear energy will play in reaching net zero by 2050 was recognised at COP28. Some 22 countries, led by the US and other leading nuclear nations, including France, South Korea, Canada, Britain, Japan, Sweden and the UAE, signed a declaration to triple nuclear energy capacity by 2050.

The Company’s proposed acquisition of the Cominco Property offers investors a diversification alongside its lithium portfolio to offer a truly diversified “energy” investment opportunity.

Qualified Person

Peter Webster P.Geo. CEO of Mercator Geological Services Limited is an Independent Qualified Person as defined under National Instrument 43-101 and has reviewed and approved the technical information related to the Pomie and Yon projects disclosed in this news release.

About the Company

Hertz Energy is a British Columbia based junior exploration company primarily engaged in the acquisition and exploration of mineral properties. The Company recently entered into the Definitive Agreement to acquire the Cominco Uranium Property located in Bathurst Inlet, Nunavut, Canada. Hertz rebrand to “Hertz Energy” to better reflect the Company’s commitment to critical mineral exploration in support of the global green energy transition. The Company’s lithium exploration projects include the Lucky Mica Lithium Project, the ACDC Lithium Project and the Patriota Lithium Projection. The Lucky Mica Project is 939 hectares located within the Arizona Pegmatite Belt in the Maricopa County of Arizona, USA. The ACDC Project is 26,500 hectares located in the renowned James Bay Lithium District in Quebec, Canada, just 26kms southeast of the Covette Lithium Project owned by Patriot Battery Metals and is contiguous to Rio Tinto’s Kaanaayaa project claims. The Patriota Lithium Project is 2,963 hectares located within the Eastern Brazilian Pegmatite Province in Minas Gerais, Brazil and host to similar geology as Sigma’s “Green Lithium Mine”. The Company also holds a long-term, exclusive license for a patent-pending process for extracting lithium directly from lithium-bearing materials, including but not limited to alpha-spodumene and other hard rock hosted minerals. Such process was invented by researchers affiliated with Penn State and is co-owned by the Penn State Research Foundation and North Carolina State University.

For further information, please contact Mr. Kal Malhi or view the Company’s filings at www.sedarplus.ca.

On Behalf of the Board of Directors

Kal Malhi

Chief Executive Officer and Director

Phone: 604-805-4602

Email: kal@bullruncapital.ca

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Statement Regarding “Forward-Looking” Information

This news release includes certain statements that may be deemed “forward-looking statements”. All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.