Higher phosphate prices and early sales underscore Chatham transformation

Over the past year New Zealand-based Chatham Rock Phosphate Limited [NZX-TSXV; GELGF-OTC; CRP- NZX] has transformed from a single project company facing an uncertain and expensive permitting hurdle to a rapidly expanding group of projects much closer to generating operating cash flows with prospects further boosted by phosphate prices at 10-year highs.

The acquisition of Avenir Makatea was the first step in the company’s strategy to build an international phosphate mining and trading house with a focus on low cadmium, organic phosphate. The Makatea Project in French Polynesia is planned to produce 250,000 tpa with an expected start date of 2024.

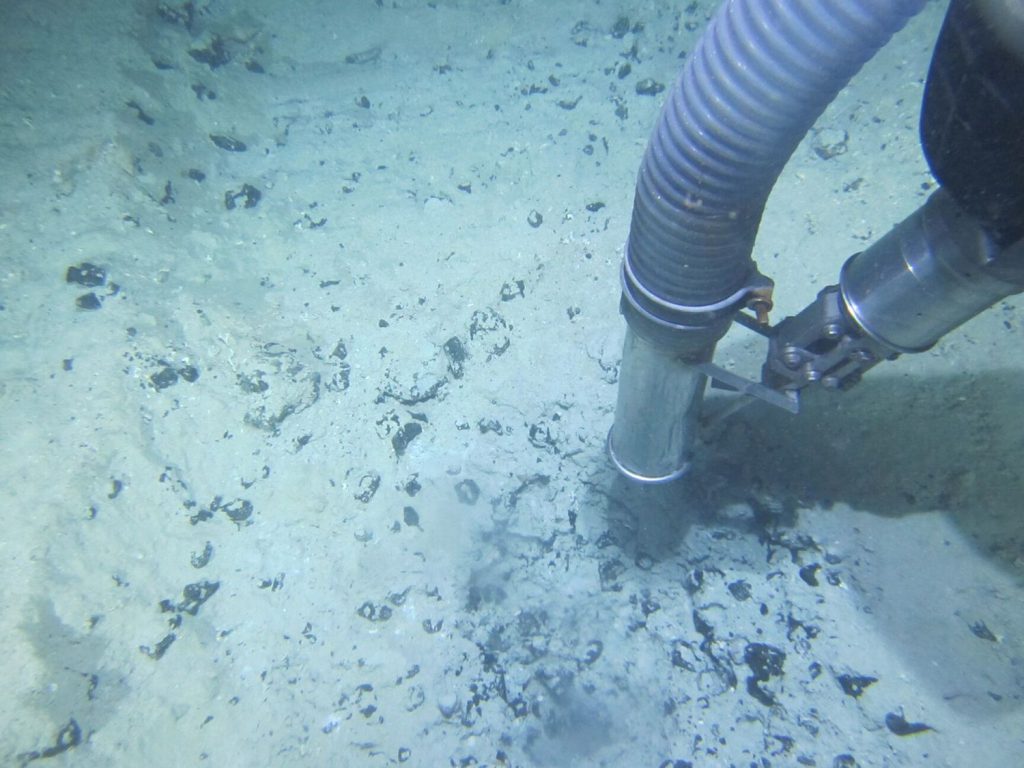

The second step was the acquisition of the fully permitted Korella phosphate mine in Queensland, Australia with its ability to generate positive cash flows starting in 2022. The Korella Mine is planned to produce 250,000 tpa commencing in 2022.

The third step was the application for an exploration permit over a substantial area adjacent to the Korella phosphate mine to potentially increase phosphate reserves and associated rare earths.

The fourth step, announced last week, was the decision to take another value-adding step to its phosphate production with planned manufacturing of Dicalcium Phosphate (DCP) at Korella South. The DCP plant is planned to produce 30,000 tpa of DCP starting in 2025.

Further initiatives including trading rock phosphate, phosphate handling facilities and establishing rare earth related strategic partnerships will be announced as they occur.

Planned levels of traded rock phosphate, while potentially commencing in 2022 with a single shipment of 30,000 tonnes, has the potential to reach 400,000 tpa by 2026.

The presence of rare earth elements within Korella and potentially Korella South provides the impetus for the Company’s wholly owned Pacific Rare Earths Limited to pursue strategic partnerships to beneficiate REE from these two projects.

By 2026 Chatham expects to be deriving substantial operating income from Avenir Makatea, the trading of granulated fertilizers, and from the Dicalcium Phosphate manufacturing facility. The company will then look to commence the payment of dividends as well as financing the reapplication for a Marine (environmental) Consent for the Chatham Rise project, where we already hold a granted Mining Permit.

There is the potential for Chatham Rise to be fully permitted and in production by 2027 at a rate of 1.5 million tpa. With Chatham Rise in operation, the company’s overall plan is for annual total sales of 2.43 million tonnes of phosphate/phosphate-based products.

However, the first cash flows are expected to be generated during calendar 2022 from the Korella Mine, and from phosphate rock trading.

Chris Castle, president and CEO, commented, “It’s an exciting time for the Company, with rock phosphate prices currently at 10-year highs. We look forward to updating Chatham shareholders as the Company continues to make progress in creating these new phosphate-based businesses that will generate cash flow.”