Inflection Resources agreement with AngloGold Ashanti a complete game changer

By Peter Kennedy

Inflection Resources Ltd. [AUCU-CSE, AUCUF-OTCQB, 5VJ-FSE] is a technically driven copper-gold focused mineral exploration company with projects in Australia’s foremost copper-gold porphyry belt.

The Vancouver-based company, now backed by one of the world’s leading gold miners AngloGold Ashanti Ltd. [AU-NYSE, ANG-JSE, AGG-ASX], offers investors a window on two key exploration initiatives.

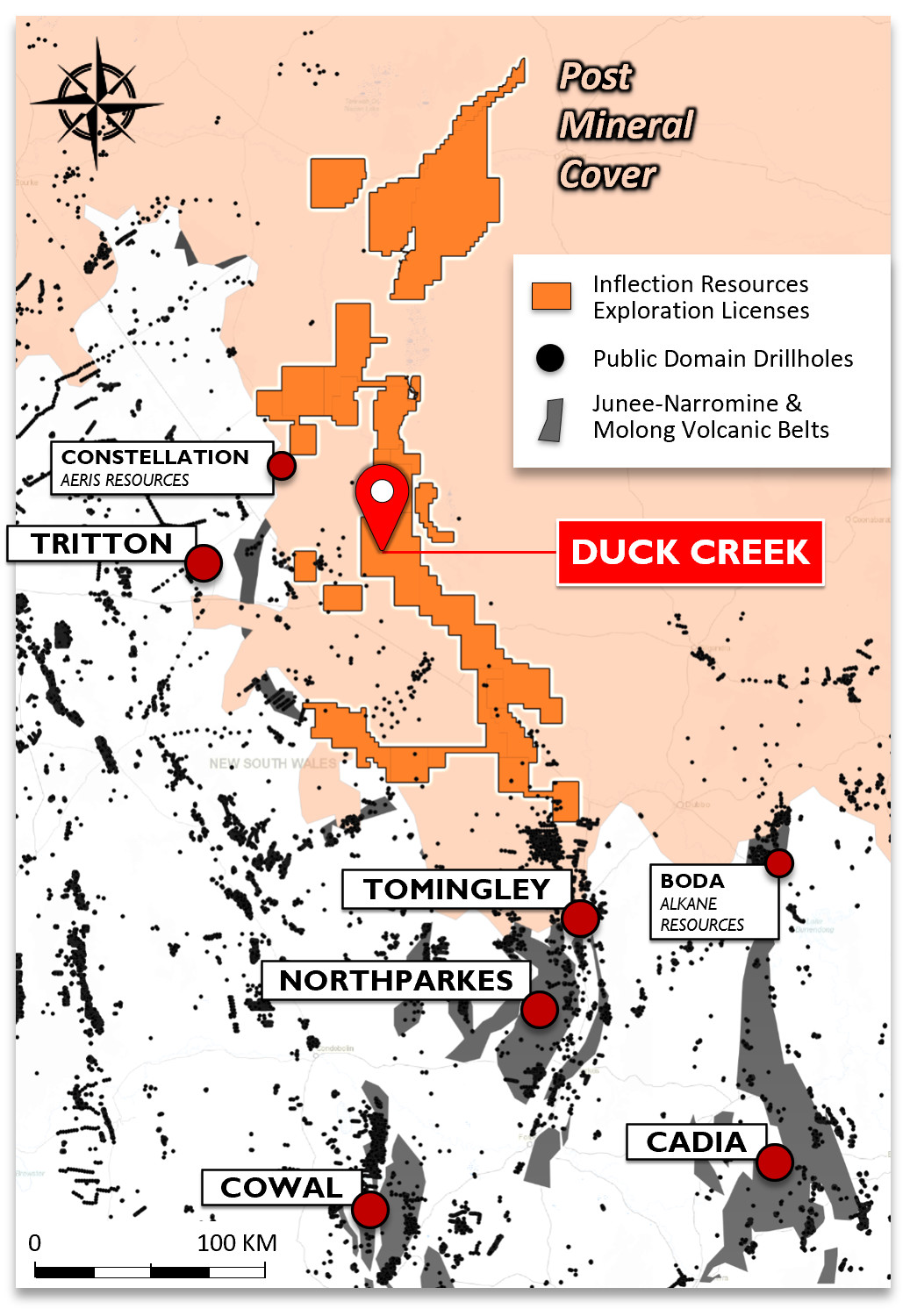

The first is the targeting of large, undercover copper-gold alkalic porphyry deposits in the northern extension of the Macquarie Arc in New South Wales, where the company is drilling a large portfolio of properties all of which are 100%-owned by the company.

Inflection is also targeting high-grade orogenic lode gold veins along trend from the historic Croydon Goldfields in Queensland (northeastern Australia)

The company recently achieved a major milestone when AngloGold Ashanti, signed a heads of agreement on a multi-year earn-in deal across a number of Inflection’s copper-gold projects in New South Wales. If AngloGold exercises all of its options, it could earn up to a 75% interest individually in up to five copper-gold projects in return for spending up to AUD$135 million and completing pre-feasibility studies. Under the deal, that would leave Inflection with a 25% interest and a 2.0% or 1.0% net smelter return royalty interest in the each designated project and AngloGold holding just under 10% of Infection’s outstanding shares.

In an interview, Inflection President and CEO Alistair Waddell described the deal as “a complete game changer” for his company.

He said it will provide the necessary capital to aggressively drill test Inflection’s property portfolio within the northern extension of the Macquarie Arc. “They have been watching what we have been doing for a very long time,’’ he said.

The Macquarie Arc is Australia’s premier porphyry gold-copper province and host to Newcrest Mining Ltd. [NCM-TSX, ASX, PNGX] Cadia deposits, the China Molybdenum Co. Ltd. (CMOC) Northparkes deposits, and Evolution Mining Ltd.’s [EVN-ASX] Cowal deposits, plus numerous exploration projects, including Boda, a recent discovery made by Alkane Resources Ltd. [ALK-ASX].

The company is exploring the northern covered extension of this Arc, where it disappears under a veneer of young, unmineralized sediments that is masking the underlying prospective geology.

With the recently announced financial backing from AngloGold Ashanti, Inflection aims to discover large Tier-1 alkaline porphyry copper gold deposits that are amenable to block cave mining, essentially a method of mining large, relatively low-grade deposits without the use of large open pits.

Inflection is part of the NewQuest Capital group of companies, which also includes Headwater Gold Inc. [HWG-CSE, HWAUF-OTCQB] FinEx Metals[Private], and the soon to be listed Red Canyon Resources.

The company is led by a highly accomplished technical team including Chairman Wendell Zerb, a geologist with 30 years of experience in the field. He was previously a well-known mining analyst with Canaccord and PI Financial.

The company was founded by the President and CEO Alistair Waddell a geologist who is a former vice-president of Greenfields Exploration Ltd. at Kinross Gold Corp. (K-TSX, KGC-NYSE). He is also a founder of GoldQuest Mining Corp [GQC-TSXV] and Headwater Gold.

On May 10, 2023, Inflection shares were trading at 25 cents in a 52-week range of 27 cents and $0.075, leaving the company with a market cap of just under $22 million based on 88 million shares outstanding.

Of that amount, 29% are held by management, with institutions owning 23% and retail 41%. Investors include asset management firm Crescat Capital, which placed the lead order in a non brokered private placement that raised $1.64 million in August, 2022.

Inflection is the largest owner of exploration licenses in the Northern Macquarie Arc, holding 7,000 square kilometres of ground.

The initial targets were identified by Dr. Douglas Haynes, a renowned Australian geologist, who has been involved in a number of very significant discoveries, including Olympic Dam (Australia), and Ivanhoe Mines Ltd.’s [IVN-TSX, IVPAF-OTC] Kamoa deposits in the Democratic Republic of Congo.

He came up with a model of exploring for these very large porphyry deposits underneath the sedimentary sequence using a regional magnetic survey that had been completed by the Government of New South Wales.

He built an interpretive geological map and identified numerous large targets that have the potential for Tier-1 discovery and critically have never been drilled before.

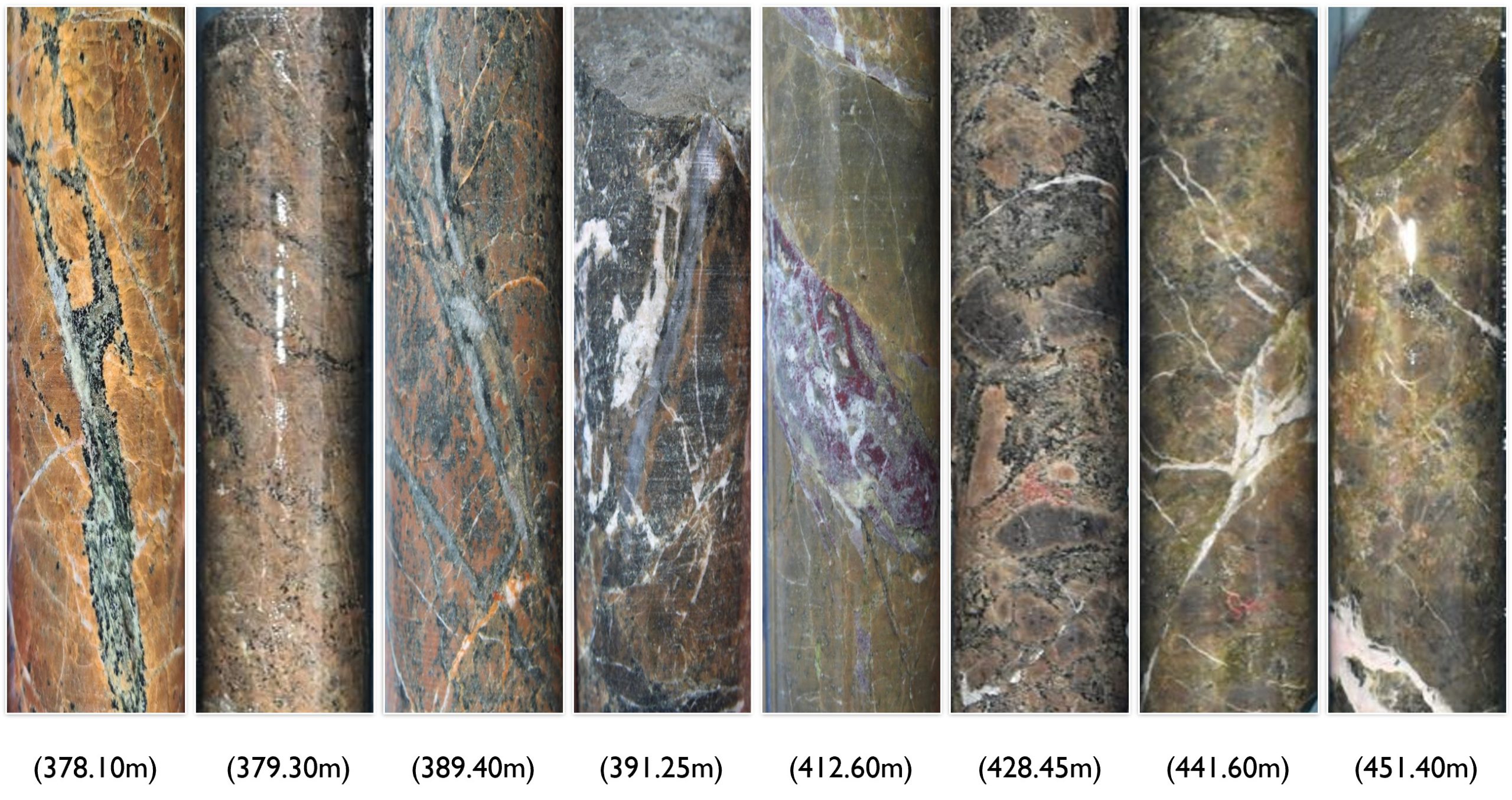

Inflection is using a technology called mud rotary drilling to cut through unmineralized sedimentary cover that is typically less than 200 metres thick but can be up to 360 metres in some areas. The goal is to cut through the sediments as quickly and cost-effectively as possible before drilling relatively short diamond core holes (10-30 metres) in multiple target areas. The aim is to analyse the core samples for key geological attributes in the form of favourable alteration, mineralisation or geochemistry that suggest that drill crews are on top of, or in proximity to an alkalic copper-gold porphyry system.

“If we are not seeing favourable geochemistry or favourable alteration, then we drop the target and move on,’ Waddell said. “It’s a very disciplined approach to testing a lot of very large targets as quickly and as cost effectively as possible.’’

The most recent drilling has been focused on Duck Creek, a large alkalic porphyry-related copper-gold-style target. The principal target area covers favourable magnetic and gravity features which the company considers to be part of the prospective Macquarie Arc sequence.

Drilling to date has intersected strong hydrothermally altered rocks with similar characteristics to those adjacent to mineralized alkalic copper-gold systems such as Newcrest’s Cadia mine, one of Australia’s largest gold mining operations, and the Northparkes mine complex.

Inflection has said it plans to target mineralization at Duck Creek with a campaign of deeper diamond drilling which will now be fully funded by AngloGold Ashanti.

Meanwhile, the company is exploring for high-grade orogenic lode gold along trend from Croydon Goldfields, a historic gold camp in Queensland that has yielded 1.0 million ounces of gold production with average grades of 35 g/t gold.

The company currently owns 50% of the Carron gold project, which covers 61,200 hectares of exploration licenses. It can increase its ownership to 70% from 50% by investing AUD$500,000 and retains a pathway to get to 100%.

In a press release on March 31, 2022, the company said it has been focused on two high priority orogenic lode gold targets along trend from the historic Croydon gold mining district. At that time, the company said it had completed two additional scout drill holes into the Carron project and said it had drilled four holes totalling 1,030 metres on the project.

It said three of the four holes intersected widely spaced, orogenic, quartz vein lode systems with sphalerite and galena hosted in graphitic metasedimentary rocks. The sphalerite and galena hosted in graphitic metasediments at Carron are typical of that seen at Croydon.

The company said drilling has increased confidence levels in the exploration model and the ability to successfully target blind, orogenic quartz veins through barren, post-mineral cover.