Inomin Mines offers investors exposure to major critical minerals and precious metals discoveries

Drilling at La Gitana gold-silver project in Oaxaca, Mexico.

By Peter Kennedy

Inomin Mines Inc. [MINE-TSXV] is a company that offers investors a window on significant critical minerals, including magnesium-nickel-chromium-cobalt, and precious metals discoveries on well-located properties in British Columbia and Mexico.

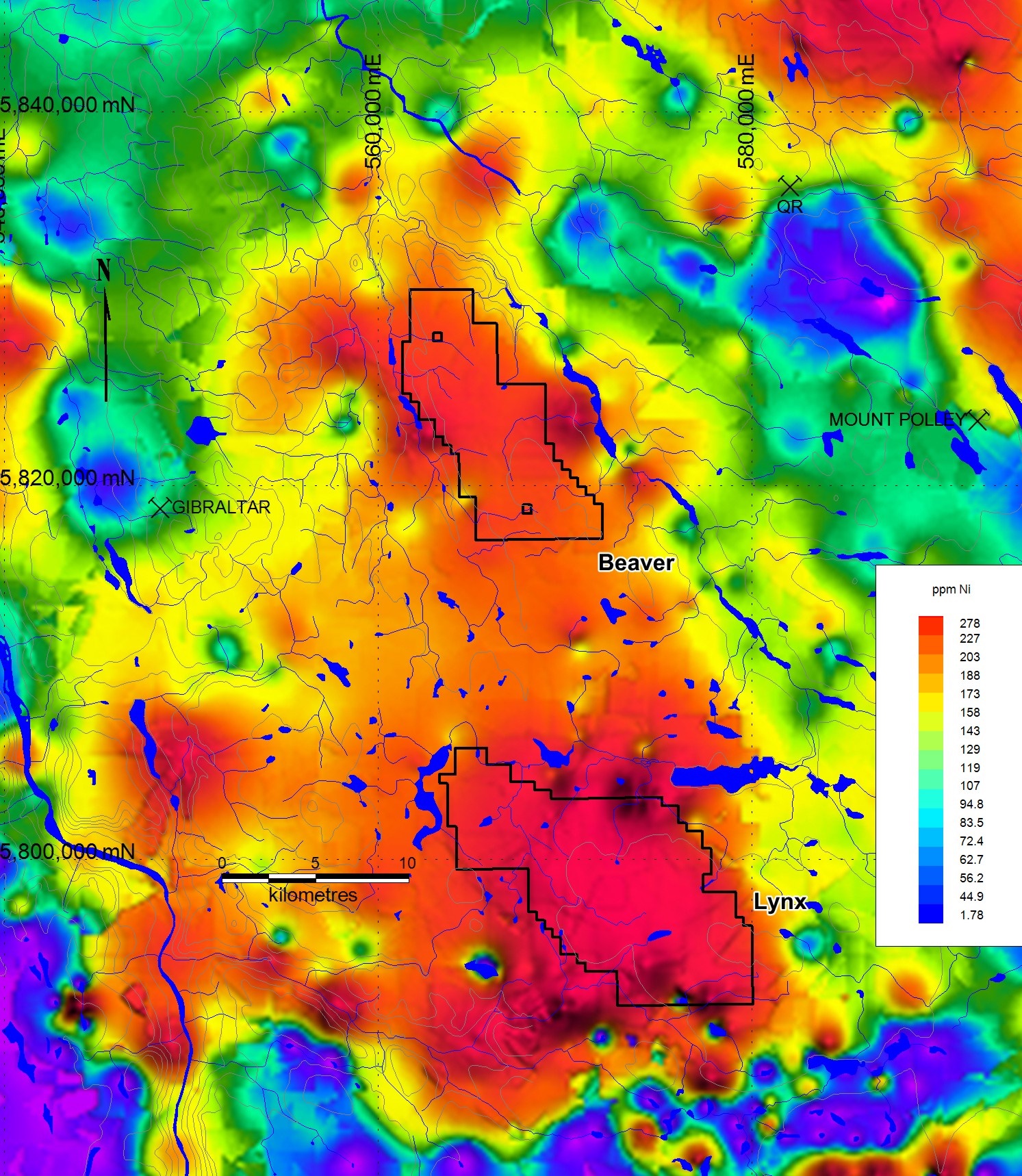

The company’s flagship Beaver-Lynx project is situated in south-central B.C., 50 kilometres north of Williams Lake and 15 kilometres east of the Gibraltar mine, the second largest open-pit copper mine in Canada.

The property is accessible by paved roads, benefits from proximity to nearby hydro-electric power, and may offer a carbon capture opportunity.

Previous drilling suggests that Inomin could delineate large magnesium and nickel resources at Beaver and the nearby Lynx area, making the project a potential district-scale source of critical minerals for the battery sector.

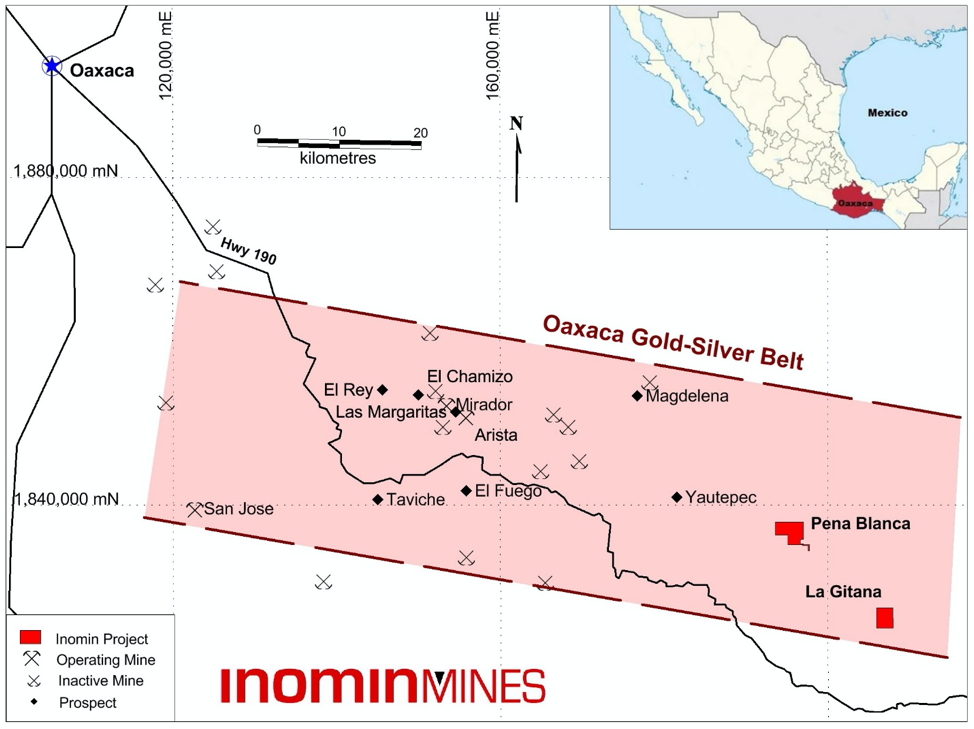

The La Gitana project in Mexico is an advanced-stage epithermal gold-silver exploration project formerly owned jointly by Chesapeake Gold and Goldcorp, a company that was swallowed by Newmont Corp. [NGT-TSX, NEM-NYSE], the world’s leading gold producer.

La Gitana is located in the Oaxaca gold-silver belt, which hosts several operating mines, including Fortuna Silver Mines Inc.’s [FVI-TSX, Lima; FSM-NYSE; F4S-FSE] San Jose gold-silver mine, and Gold Resource Corp.’s [GORO-NYSE American] Arista and Mirador gold-silver mines.

Inomin staked the Beaver claims (8,826 hectares) back in 2019; the company also computer staked the 13,610-hectare Lynx nickel property, located just 11 kilometres south of Beaver. The Lynx area is geologically similar to Beaver with even larger prospective target areas.

Inomin President and CEO John Gomez said the company staked the project because he wanted exposure to battery metals and knew that past drilling intersected long intersections of near-surface nickel sulphide and cobalt in relatively uniform amounts over all the drill tested areas.

At Beaver, the ultramafic rock hosting the nickel, delineated by magnetic surveys and drilling, covers a large 4.0-kilometre by 8.0-kilometre footprint. This is an indication that the property has the potential to host large, bulk tonnage, near-surface nickel and other metals, the company has said.

The previous operator was looking for gold, which they found, but nickel was more predominant. At the time, the price of nickel was US$3 – $4 pound. Today the metal fetches US$10 – $13 per pound and demand is growing significantly for electric vehicle batteries.

In 2021, following ground magnetic survey programs, Inomin completed its first drilling program at Beaver, consisting of five holes, totaling 716 metres, over a large 5.7-kilometre-long area.

Drilling discovery at Beaver project.

In March 29, 2022, Inomin announced the inaugural drilling program hit significant mineralization in all holes, including hole B21-02, which intersected 252.1 metres grading 20.6% magnesium, 0.16% nickel and 0.33% chromium. All completed drill holes intersecting greater than 20% magnesium content. A single uncompleted hole hit 649 g/t silver and 0.28% copper.

B21-02 is the longest mineralized hole ever drilled at Beaver and the first-ever drilling in the Spur zone, one of five mineralized areas at the property.

All holes ended in mineralization leaving the discoveries open to expansion in all directions.

News of the discovery sent Inomin’s share price up to 73 cents in late March 2022. The shares have since slipped back to around $0.09, in a 52-week range of 26 cents and $0.045, leaving the company with a market cap of $2.8 million, based on 30.9 million shares outstanding.

Now the company is planning follow-up drilling at Beaver to test multiple targets, as well as maiden drilling at Lynx.

“The plan is to go back this year and complete a two-phase program,” said Gomez, who is considering an initial program of five to eight holes, followed by more drilling later in the year.

“We want to drill test several targets at Beaver to expand the discovery, as well as conduct inaugural drilling at Lynx. If drilling at Lynx delivers similar results as Beaver, the mineral size potential of Beaver-Lynx becomes enormous.”

“Given the nature of the mineralization, we are fairly confident that further drilling will deliver more excellent results.” If that proves to be the case, he expects the company can fund subsequent drilling at higher share values.

If drill crews deliver the expected results, Gomez believes Inomin should attract the interest of major mining industry players seeking large-scale nickel sulphide and other critical mineral projects.

Anglo American Plc [AAUKF-OTCQX], for instance, has demonstrated an appetite for sulphide nickel and other metals by recently taking a 9.9% stake in Canada Nickel Company Inc. [CNC-TSXV], which is advancing its flagship Crawford nickel sulphide project near Timmins, Ont.

Anglo American is a global mining giant with interests in platinum, palladium, and diamonds via its 85% stake in De Beers Group.

Giga Metals Corp. [GIGA-TSXV, HNCKF-OTCQX, BRR2-FSE] and Japanese partner Mitsubishi Corp. recently formed a joint venture company, Hard Creek Nickel Corp. to jointly develop Giga’s flagship Turnagain project in north central B.C. The company says Turnigan ranks among the largest sulphide nickel deposits in the world, and could cost under $1 billion to develop (the estimate excludes the cost of hydro-electric power).

Major mining companies are targeting these types of projects because sulphide nickel, also known as class 1 nickel, is the preferred type of nickel for electric vehicle batteries. Nickel and other critical minerals are key materials for the transition to clean energy. Clean energy technologies, such as electric vehicle (EV) batteries, need substantial quantities of minerals, notably nickel, cobalt, lithium, manganese, and graphite.

Nickel is increasingly used in EV batteries as a cathode material as it plays a vital role in increasing energy density. The more nickel the battery has, the longer the EV can drive. Depending on battery type, a typical 60kwh EV battery has about 6kg of lithium, 12kg of cobalt, and around 30kg of nickel – five times the amount of lithium.

Gomez was mindful of this massive unfolding growth scenario when Inomin picked up the Beaver and Lynx properties in 2019.

Magnesium as a metal is also integral for clean energy. The silver-colored metal is 75% lighter than steel and 33% lighter than aluminum with a comparable strength to weight ratio to aluminum. Used largely in vehicles and planes, its strength and lightness increase energy (fuel) efficiency of automobiles and aircraft. Magnesium’s properties also make it used in other popular high-tech products including smartphones and laptop computers.

The Inomin CEO says major players may also be attracted by the fact that metallurgical tests for the extraction of magnesium from Beaver drill core samples achieved excellent recoveries of 99% using hydrochloric acid (HCI) leaching. HCl leaching also recovered 95% of the iron and between 52% – 58% of the nickel.

The metallurgical test results demonstrate the ability to extract a very high level of magnesium using conventional processing. The company expects further studies to optimize extraction techniques will increase recoveries.

Another positive attribute for the project is its potential to generate carbon credits.

As ultramafic rocks with high magnesium content are among the largest carbon dioxide (CO2) storage reservoirs on earth, Inomin sees the Beaver project as a carbon capture and storage opportunity.

That’s because ultramafic mine tailings can be reactive to CO2 and therefore have the potential to reduce or eliminate the greenhouse gas (GHG) footprint of a mine operation. While mining contributes between 4.0% and 7.0% of the world’s man-made greenhouse gases, carbon capture could potentially make a mining operation at Beaver net carbon negative.

The company said initial testing by researchers at the University of British Columbia (UBC) demonstrated that samples from the Beaver discovery contain key minerals that sequester CO2 from the atmosphere.

They include magnesium-rich minerals such as brucite and hydrotalcite group minerals that react quickly with CO2 in air.

UBC spin-off company ARCA is commercializing the technology, and Inomin intends to complete further work to develop this unique potentially very valuable aspect of the project.

Given the excellent drilling results, positive metallurgical recoveries, and carbon capture test results – plus district mineralization size – the Beaver-Lynx project has the potential to be among the world’s largest greenest deposits of high-grade magnesium, nickel, and other critical minerals, the company has said.

Meanwhile, Inomin officials are working to strengthen relations with the community where its La Gitana project is located.

La Gitana is an advanced gold-silver exploration project where exploration, including diamond drilling by past joint project owners – Chesapeake Gold and Goldcorp, delineated a substantial near-surface, low-sulphidation, epithermal gold-silver deposit.

Drilling highlights include 133.5 metres, grading 1.78 g/t gold and 100.7 g/t silver starting just 21 metres from surface.

Inomin says it looks forward to reaching an agreement with the community and continuing to advance the project for the benefit of all stakeholders.

Worth noting that in January 2022, Gustavo Allende Igarashi was named Inomin’s Head of Corporate Development – Mexico. Allende Igarashi is the former Director of Industry and Mining for Oaxaca State.