Juggernaut’s Highway of Gold Reveals Over 200 Mineralized Veins Amid Glacial Retreat

By Peter Kennedy

Juggernaut Exploration Ltd. [JUGR-TSXV, JUGRF-OTCQB, 4JE-FSE] is a company that offers an investment window on one of the most significant new grass roots gold-silver discoveries in British Columbia’s Golden Triangle area in recent years.

“This is a unique situation that is backed by $12.5 million in funding and a strategic investment by Crescat Capital and Dr. Quinton Hennigh (who are 19% shareholders of Juggernaut and are providing technical support the company)” said Juggernaut CEO Dan Stuart.

Juggernaut’s flagship Big One property is situated in a region that is well known for hosting world class precious metal and porphyry deposits, including Newmont Corp.’s [NGT-TSX, NEM-NYSE, ASX, PNGX] nearby Galore Creek project, which is estimated to host 12.2 million ounces of copper, 9.4 million ounces of gold and 174.08 ounces of silver.

Aside from Galore Creek, Big One is thought to be part of the same forces that gave rise to large gold deposits at Seabridge Gold Inc.’s [SEA-TSX, SA-NYSE] KSM project and Newmont’s Brucejack mine.

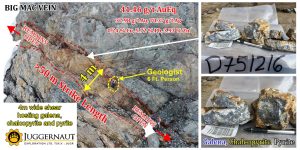

The new discovery at Big One has yielded assays up to 79.01 g/t gold and 3,157 g/t silver from over 200 gold-silver-copper-rich polymetallic veins measuring up to 8.0 metres wide and striking for 500 metres that remain open. These veins were identified along the newly discovered 11-kilometre Highway of Gold surrounding the Eldorado gold system on the Big One property.

The new discovery at Big One has yielded assays up to 79.01 g/t gold and 3,157 g/t silver from over 200 gold-silver-copper-rich polymetallic veins measuring up to 8.0 metres wide and striking for 500 metres that remain open. These veins were identified along the newly discovered 11-kilometre Highway of Gold surrounding the Eldorado gold system on the Big One property.

Extensive high-grade veining confirmed at surface may indicate the presence of a common buried gold-silver-copper rich porphyry feeder source at depth, the company has said.

The discovery is located in an area of glacial and snowpack abatement and is accessible year-round via helicopter from the Glenora/Telegraph Creek Road at the Barrington mine (33 kilometres to the northeast), as well as the Galore Creek Road (15 kilometres to the southeast). The Canadian government committed $20 million to extend and improve the road to within 12 kilometres of the Big One property, which is 2.0 kilometres from the Scud River airstrip, which was use in the early days of Galore Creek.

In late July, 2025, Juggernaut launched a surface exploration program that was designed to systematically advance and expand upon five inaugural, drill-ready targets and to generate additional new targets for a fully-funded maiden drill program that is scheduled for 2026.

In an interview with Resource World, Juggernaut Stuart said the program has gone so well this year that it is being extended for an extra week into early September.

Stuart is leading an exploration team that is taking advantage of glacial abatement in the Golden Triangle region, a phenomenon caused by global warming, which is creating opportunities for companies like Juggernaut, by exposing mineralized systems that were previously inaccessible.

Stuart is leading an exploration team that is taking advantage of glacial abatement in the Golden Triangle region, a phenomenon caused by global warming, which is creating opportunities for companies like Juggernaut, by exposing mineralized systems that were previously inaccessible.

“I just flew in a helicopter [over the exploration area] and I could see glaciers melting everywhere,” said Stuart.

One of the most exciting discoveries at the 33,693-hectare Big One property is the Highway of Gold, an 11-kilometre stretch of newly exposed rock on the edge of the Geology Ridge Ice Field and the Decker Creek Glacier. It is part of a larger system known as the Eldorado System, covering about 7.5 square kilometres. It is located an area that contains over 200 gold-silver-copper-rich polymetallic veins measuring up to 8.0 metres wide and striking for up to 500 metres.

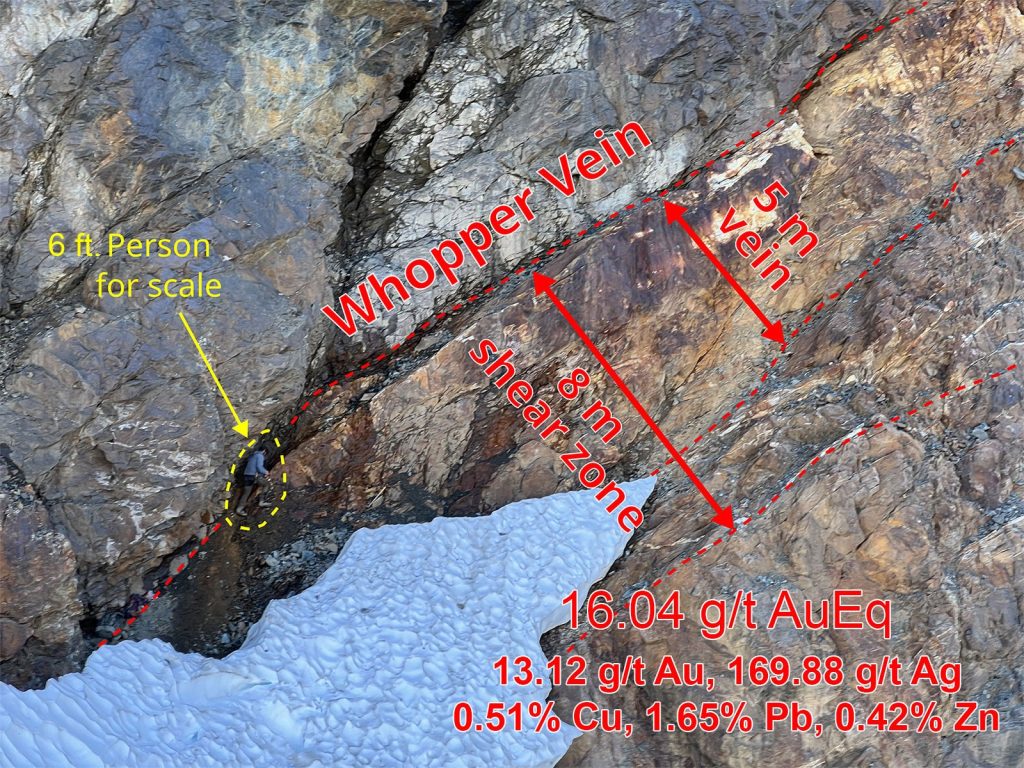

The Whopper vein, for example, is exposed on surface for 100 metres and remains open along strike where it goes under snowpack and ice. Grab samples from the 5.0-metre-wide quartz-sulphide vein hosted in an eight-metre-wide mineralized shear zone returned 13.12 g/t gold, 169.99 g/t silver, as well as 10.62 g/t gold, 206.32 g/t silver, 6.01 g/t gold and 121.97 g/t silver.

The company has said the high-grade Whopper vein’s geochemical and geophysical signatures are indicative of a porphyry source at depth. “This target is drill ready,” the company said in a press release.

It is worth noting that exploration at the Big One is led by Project Manager Bill Chornobay and Chief Consulting Geologist Lele Lazzarotto. Both were instrumental in the development of Goliath Resources Ltd.’s [GOT-TSXV, GOTRF-OTCQB, B41F-FSE] Surebet gold discovery, which is also located in the Golden Triangle and where a 60,000-metre program is currently underway (with nine rigs active).

“This Discovery was made by an exploration group with a proven track record. We have done it before and we are doing it again,” said Stuart. “Stay tuned for more exploration results.”

Stuart said the company’s strategy is clear: “Our goal is to develop a resource, as major mining companies have already shown a willingness to back the project through the next stages of exploration.”

However, he acknowledged the exploration season is short (June to early September) and it could take three to five years to outline a resource. Even so, he remains optimistic. “The sheer scale of the system, with over 200 mineralized veins exposed at surface by glacial abatement, all point towards a powerful, district-scale mineralized engine at depth,” Stuart said.

Quinton Hennigh, an economic geologist who has worked for a raft of global mining companies, has said the The Big One gold-silver project has a very similar feel to Goliath Resources Ltd.’s [GOT-TSXV, GOTRF-OTCQB, B41F-FSE] Surebet gold discovery.” “Early indications suggest there is a genetic association of veins with late-stage magmatism in the area, an association seen at Surebet,” Hennigh said. In the 2025 exploration season, he predicted that Juggernaut would have a clear mandate to follow up on these results with detailed mapping and channel sampling, much like Goliath did during the early days of the Surebet discovery. “The company’s mission is to get as many targets as possible ready for drill testing either late season or for 2026,” he said. “I am very eager to see if a new “Surebet” type discovery is in hand.

On the markets, Juggernaut maintains a tight structure with 29.4 million shares outstanding. As of August 19, 2025, the stock was trading at $0.90 within a 52-week range of $1.25 to $0.45. With gold at US$3,336.18 per ounce on August 14, Stuart believes the macro backdrop is favorable. “I think we could see US$5,000 an ounce by the first quarter of 2027,” he said.