LATIN AMERICA: Peru Project Roundup

By Ellsworth Dickson

Peru has a long history of gold mining dating back to pre-Columbian times; however, the country is endowed with other metals too being the world’s third largest producer of copper, silver, zinc and tin. It is also the seventh largest producer of gold. Copper accounts for 60% of exports.

As with other exploration and mining operations elsewhere, the COVID-19 pandemic has resulted in some delays and suspensions of activities that are now gradually returning to normal or near-normal.

Below is a selection of Peruvian exploration and mining activities.

Auryn Resources Inc. [AUG-TSX, NYSE American] has three projects in Peru: Sombrero, Curibaya and Huilacollo. The Sombrero copper-gold project in southern Peru consists of the North Sombrero and South Sombrero properties, comprising over 130,000 hectares owned or optioned by Auryn Resources. The main targets at Sombrero are copper-gold skarn and porphyry systems and precious metal epithermal deposits. Drilling is planned.

Auryn Resources Inc. [AUG-TSX, NYSE American] has three projects in Peru: Sombrero, Curibaya and Huilacollo. The Sombrero copper-gold project in southern Peru consists of the North Sombrero and South Sombrero properties, comprising over 130,000 hectares owned or optioned by Auryn Resources. The main targets at Sombrero are copper-gold skarn and porphyry systems and precious metal epithermal deposits. Drilling is planned.

At the 100%-owned Curibaya Project, a new zone of mineralization with grades of up to 946 g/t silver and 1.96 g/t gold has been identified approximately 1 km northeast of previous sampling. Drill permits are expected in 2020.

The Huilacollo epithermal property features intense hydrothermal alteration that is consistent with epithermal gold-silver mineralization over a 4Â km by 6Â km area. Contiguous to the Huilacollo property are the Tacora and Andamarca properties, which the company acquired in August 2017.

Bear Creek Mining Corp.‘s [BCM-TSX] 100%-owned Corani silver-lead-zinc deposit is one of the largest, fully permitted silver deposits in the world and is highlighted by its substantial base metal credits, location in a mining-friendly jurisdiction, and overwhelming community support.

Bear Creek Mining Corp.‘s [BCM-TSX] 100%-owned Corani silver-lead-zinc deposit is one of the largest, fully permitted silver deposits in the world and is highlighted by its substantial base metal credits, location in a mining-friendly jurisdiction, and overwhelming community support.

Camino Minerals Corp. [COR-TSXV, CAMZE-OTCQB, XC01-FSEankfurt] has released the results of surface sampling at its Los Chapitos copper discovery in southern Peru.

Camino Minerals Corp. [COR-TSXV, CAMZE-OTCQB, XC01-FSEankfurt] has released the results of surface sampling at its Los Chapitos copper discovery in southern Peru.

Sampling at the Adriana Zone near copper-mineralized outcrop returned: 41.5 metres of 0.78% copper, 68 metres of 1.27% copper and four segments totalling 86 metres of 0.65% copper over 140 metres. Sampling at the Lourdes Zone returned 32 metres of 0.72% copper and 13 metres of 1.16% copper.

Candente Copper Corp. [DNT-TSX] is developing the large scale Canariaco Norte copper deposit in northern Peru. The deposit contains measured and indicated resources totaling 752.4 million tonnes, grading 0.45% copper, 0.07 g/t gold and 1.9 g/t silver (0.52% copper equivalent), containing 7.53 billion pounds of copper, 1.7 million ounces of gold and 45.2 million ounces of silver. In addition, the deposit contains 157.7 million tonnes of inferred resources containing 1.434 billion pounds of copper.

Candente Copper Corp. [DNT-TSX] is developing the large scale Canariaco Norte copper deposit in northern Peru. The deposit contains measured and indicated resources totaling 752.4 million tonnes, grading 0.45% copper, 0.07 g/t gold and 1.9 g/t silver (0.52% copper equivalent), containing 7.53 billion pounds of copper, 1.7 million ounces of gold and 45.2 million ounces of silver. In addition, the deposit contains 157.7 million tonnes of inferred resources containing 1.434 billion pounds of copper.

A second mineralized copper porphyry, Canariaco Sur, has also been discovered adjacent to Canariaco Norte. The company has said it sees evidence of a third porphyry deposit at the Quebrada Verde target, both of which offer the potential to significantly expand the scope of the Canariaco copper project.

Chakana Copper Corp. [PERU-TSXV] has advanced the mineral occurrence and geological model of breccia pipe 1 (Bx 1) at its Soledad project in Ancash, Peru. Bx 1 is one of 23 outcropping breccia pipes at Soledad and part of a cluster of 92 targets awaiting drill testing. Chakana can earn a 100% interest from Condor Resources Inc. [CN-TSXV].

Chakana Copper Corp. [PERU-TSXV] has advanced the mineral occurrence and geological model of breccia pipe 1 (Bx 1) at its Soledad project in Ancash, Peru. Bx 1 is one of 23 outcropping breccia pipes at Soledad and part of a cluster of 92 targets awaiting drill testing. Chakana can earn a 100% interest from Condor Resources Inc. [CN-TSXV].

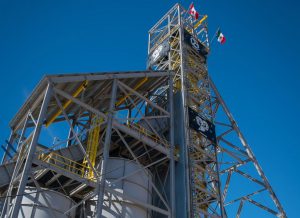

Dynacor Gold Mines Inc. [DNG-TSX; DNGDF-OTC] is a gold producing corporation engaged in production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor produces and explores in Peru. In 2019, Dynacor produced 80,677 ounces of gold, in line with 2018 (81,314 ounces).

Dynacor Gold Mines Inc. [DNG-TSX; DNGDF-OTC] is a gold producing corporation engaged in production through the processing of ore purchased from the ASM (artisanal and small-scale mining) industry. At present, Dynacor produces and explores in Peru. In 2019, Dynacor produced 80,677 ounces of gold, in line with 2018 (81,314 ounces).

On March 16, 2020, Dynacor temporarily stopped its operations following the state of emergency declared by the Peruvian authorities in response to the COVID-19 pandemic. Due to the high level of ore inventory at the end of 2019 and despite the temporarily shut-down since the third week of March, the plant was able to process 22,901 tonnes of ore in Q1-2020.

Fortuna Silver Mines Inc. [FVI-TSX; FSM-NYSE] has a 100% interest in the producing Caylloma silver-lead-zinc mine 240 km northwest of Arequipa. The underground mine production rate is 1,430 tonnes per day. Due to the uncertainties related to the impact of the government constraints on the company’s business and operations due to the COVID-19 pandemic, Fortuna has withdrawn its production and cost guidance for 2020. Q1-2020 silver production was 249,111 oz and gold production was 471 oz.

Fortuna Silver Mines Inc. [FVI-TSX; FSM-NYSE] has a 100% interest in the producing Caylloma silver-lead-zinc mine 240 km northwest of Arequipa. The underground mine production rate is 1,430 tonnes per day. Due to the uncertainties related to the impact of the government constraints on the company’s business and operations due to the COVID-19 pandemic, Fortuna has withdrawn its production and cost guidance for 2020. Q1-2020 silver production was 249,111 oz and gold production was 471 oz.

Great Panther Silver Ltd. [GPR-TSX; GPL-NYSE American], on June 30, 2017, closed the acquisition of the Coricancha Mine in the central Andes of Peru from Nyrstar NV [NYR-BR]. The Mine is located in the Province of HuarochirÃ, approximately 90 km east of Lima.

The Coricancha Mine is fully permitted to re-start operations. The project includes an operational 600 tonne-per-day flotation and gold BIOX® bio-leach plant along with supporting mining infrastructure. The mine has been on care and maintenance since August 2013 when it was closed due to falling commodity prices.

Gold-silver-lead-zinc-copper mineralization (approximately 80% gold-silver by value) occurs as massive sulphide veins that have been mined underground by cut and fill methods. Great Panther completed a Preliminary Economic Assessment in May 2018 and a Bulk Sample Study in June 2019. Planned production is 3.1 million oz AgEq per year.

HudBay Minerals Inc. [HBM-TSX, NYSE] experienced operational and supply chain disruptions, including a temporary suspension of operations at its 100%-owned Constancia Mine 100 km south of Cusco for a period of approximately eight weeks as a result of a government declared state of emergency in March.

On May 14, Constancia received recognition and approval from Peru’s Ministry of Energy and Mines for its restart protocols and is planning to ramp up operations shortly at the open pit copper-molybdenum-silver-gold mine.

During Q1-2020, the Constancia Mine produced 19,290 tonnes of copper, 8,254 oz precious metals and 354 tonnes of molybdenum. Production results were lower than Q4-2019 2019 as a result of planned lower copper grades, in line with the mine plan, and lower ore production due to the temporary suspension of operations in March following a government declared state of emergency in Peru.

Lida Resources Inc. [LID-CSE] owns and operates the San Vicente Project near Trujillo. In the development stage, the underground lead-silver-zinc-gold mine has tunnels driven on three veins. Currently, bulk samples are being extracted and processed in the concentrating plant. The objective is to place San Vicente into commercial production.

Lida also owns the exploration stage Las Brujas gold project near Cajamarca.

Miramont Resources Corp. [MONT-CSE; MRRMF-OTCQB] executed a definitive agreement with Kuya Silver Corp., whereby it will acquire all of the issued and outstanding shares of Kuya in exchange for shares of Miramont.

Miramont Resources Corp. [MONT-CSE; MRRMF-OTCQB] executed a definitive agreement with Kuya Silver Corp., whereby it will acquire all of the issued and outstanding shares of Kuya in exchange for shares of Miramont.

Kuya is a privately held Canadian-based silver-focused mining company, earning into an 80% interest in the Bethania silver mine in central Peru. Bethania was in production until 2016, toll milling its ore at various other concentrate plants in the region, and Kuya’s plan was to implement an expansion and construct a concentrate plant at site before restarting operations.

Miramont also has two 100%-optioned projects in Peru: the Cerro Hermoso gold project and the Lukkacha copper project.

Newmont Mining Corp. [NEM-NYSE] reported that on March 17, the Yanacocha operation safely ramped down in response to travel restrictions imposed by the Peruvian government. Limited personnel remained on-site to perform essential work, including security, water treatment, environmental protection, and gold production continued from leach pads. In early May, the operation began remobilizing following the confirmation that the Peru Economic reactivation plan allowed surface mining. The site is implementing a safe restart plan with milling operations starting on May 16th and surface mining activities expected to begin by the end of May.

Newmont Mining Corp. [NEM-NYSE] reported that on March 17, the Yanacocha operation safely ramped down in response to travel restrictions imposed by the Peruvian government. Limited personnel remained on-site to perform essential work, including security, water treatment, environmental protection, and gold production continued from leach pads. In early May, the operation began remobilizing following the confirmation that the Peru Economic reactivation plan allowed surface mining. The site is implementing a safe restart plan with milling operations starting on May 16th and surface mining activities expected to begin by the end of May.

Pan American Silver Corp. [PAAS-TSX, NASDAQ] has a number of operating mines and exploration projects in Peru. Shahuindo is an open-pit, 36,000 tonne-per-day heap leach gold mine. Commercial production began in 2016 with current estimated mine life until 2028. Proven and Probable Reserves are 1,763,000 oz gold. Cash costs are $570/oz.

The 100%-owned La Arena open pit, heap leach, 36,000 tpd gold-copper mine is 480 km northwest of Lima. Proven and Probable Reserves are 410,000 oz. Cash costs are $644/oz.

The 99.94%-owned La Huaron open pit, 2,500 tpd silver, lead, zinc, and copper mine is 320 km northeast of Lima. Proven and Probable Reserves are 53.7 million oz silver.

The 92.3%-owned Morococha silver-lead-zinc-copper mine at Yauli has Proven and Probable Reserves of 31.9 million oz silver.

Panoro Minerals Ltd. [PML-TSXV, Lima; PZM-FSE] has completed the sale of the Cochasayhuas gold project to Mintania SAC of Peru for a total of US$2.45-million to be paid in instalments plus a 5% NSR for 15 years from start of commercial production.

Panoro is advancing its flagship Cotabambas Project in the fast developing copper mining district in Southern Peru. The project is a porphyry copper-gold-silver deposit, located 48 km south west of Cuzco and is comprised of two clusters of mineralized areas. A Preliminary Economic Assessment was filed in April 2015 and updated in September 2015.

A mineral resources estimate for the Cotabambas Project tallied 117.1 million tonnes at 0.42% Cu, 0.23 g/t Au and 2.74 g/t Ag and 0.0013% Mo as Indicated and 605.3 million tonnes at 0.31% Cu, 0.17 g/t Au, 2.33 g/t Ag and 0.0019% Mo as Inferred .

The 3,600-hectare Humamantata polymetallic property is located in Southern Peru where two exploration campaigns have been completed.

Plateau Energy Metals Inc. [PLU-TSXV; PLUUF-OTCQB; QG1-FSE] has completed a preliminary test work program for the recovery of potential by-products such as sulfate of potash (SOP), caesium and rubidium from its Falchani Lithium Project in southern Peru. The program was conducted by ANSTO Minerals, based in Sydney, Australia.

Plateau Energy Metals Inc. [PLU-TSXV; PLUUF-OTCQB; QG1-FSE] has completed a preliminary test work program for the recovery of potential by-products such as sulfate of potash (SOP), caesium and rubidium from its Falchani Lithium Project in southern Peru. The program was conducted by ANSTO Minerals, based in Sydney, Australia.

“These preliminary results are encouraging and support potential by-products that our Falchani project could supply in addition to lithium carbonate,” stated Dr. Laurence Stefan, President and COO.

Plateau’s Macusani uranium-lithium project has an NPV of US$603 million, an IRR (8%)Â of 40.6% and a payback of 1.8 years. Measured and Indicated Resources are 52.9 million lbs U3O8 with Inferred Resources at 72.1 million lbs U3O8.

Sierra Metals Inc. [SMT-TSX, Lima; SMTS-NYSE American] reports that the Peruvian government has activated Phase two of its economic recovery plan effective June 5, 2020. Phase two includes mining and mining-related activities. Sierra Metals will begin to recall required furloughed employees and contractors and will start to progressively ramp the mine operations back up to full capacity.

Sierra Metals Inc. [SMT-TSX, Lima; SMTS-NYSE American] reports that the Peruvian government has activated Phase two of its economic recovery plan effective June 5, 2020. Phase two includes mining and mining-related activities. Sierra Metals will begin to recall required furloughed employees and contractors and will start to progressively ramp the mine operations back up to full capacity.

Proven and Probable Reserves are 1,257 million ZnEq lbs. Measured and Indicated Resources are 2,034 million ZnEq lbs. A preliminary economic assessment released in June 2018, studies increasing production to 5,500 tonnes per day in 2021.

Sierra Metals also has a number of exploration projects in Peru.

Southern Copper Corp. [SCCO-NYSE, Lima] has several producing mines in Peru: the Cuajone copper mine, Tantahuatay gold-copper mine, Toquepala copper mine as well as the Los Chancas exploration projects.

Southern Copper Corp. [SCCO-NYSE, Lima] has several producing mines in Peru: the Cuajone copper mine, Tantahuatay gold-copper mine, Toquepala copper mine as well as the Los Chancas exploration projects.

SSR Mining Inc. [SSRM-TSX, NASDAQ] has the 100%-owned San Luis development project, located in the Ancash Department, central Peru. The project is centered on a high-grade, gold-silver vein, the Ayelén vein.

SSR Mining Inc. [SSRM-TSX, NASDAQ] has the 100%-owned San Luis development project, located in the Ancash Department, central Peru. The project is centered on a high-grade, gold-silver vein, the Ayelén vein.

Indicated Resources are 9.0 million oz silver averaging 578 g/t and 0.35 million oz gold grading 22.40 g/t. Inferred Resources are 0.2 million oz silver averaging  270 g/t. A Feasibility Study was completed in Q2-2010.

Highlights of the Feasibility Study include:

• Mine life: The underground mine planned to exploit the Ayelén vein has an estimated life of 3.5 years.

• Robust project economics: A net present value of $39.2 million (5% discount rate) at base case metal prices and an internal rate of return of 26.5% at base case metal prices (gold price of $800/oz and silver price of $12.50/oz).

• Capital expenditures: $90.4 million (+/- 15%) for a 400 tonne/day underground mine.

Tinka Resources Ltd. [TK-TSXV] is now able to resume exploration at its Ayawilca property in the Pasco region of central Peru. The state of emergency in Peru is expected to continue until June 30. As such, reactivation of exploration activities will require additional and carefully planned logistics.

The next phase of the drill program at Ayawilca is planned to start in August and continue until December, all going well. This program is expected to include at least 7,000 metres of infill and step-out drilling, with a focus on growing and upgrading the high-grade zinc-silver resources at the West and South zones.

Ayawilca is one of the largest undeveloped zinc-silver resources in a junior  with strong fundamentals: PEA in 2019 showed strong economics with a modest CAPEX, and opportunities to optimize further.

Trevali Mining Corp. [TV-TSX, Lima; TREVF-OTCQX, 4T1-FSE] owns and operates the Santander Mine approximately 215 km northeast of Lima  and is comprised of an underground mine, a 2,000-tonne-per-day processing mill, a conventional sulphide flotation mill, and associated infrastructure.

Trevali is currently mining the Magistral North, Magistral Central and Magistral South deposits.