Lomiko Metals up 21% on graphite PEA

Lomiko Metals Inc. [LMR-TSXV, LMRM– OTCQX, DH8B-FSE] shares rallied strongly Friday after the company released a positive preliminary economic assessment (PEA) for its 100%-owned La Loutre graphite property in Quebec.

The shares advanced on the news, rising 20.8% or $0.025 to 14.5 cents on active volume of 1.24 million. The shares are currently trading in a 52-week range of 28 cents and $0.035.

Lomiko says it aims to initiate a preliminary feasibility study to advance its La Loutre project towards production as part of a staged development strategy, while continuing its aggressive drilling programs to maximize value creation.

“La Loutre has shown it has the potential to become a highly profitable graphite mine in one of the most prolific producing regions of Canada,” said Lomiko President and CEO Paul Gill in a press releases that came after the close of trading on July 29, 2021.

The PEA supports an open pit project with production spanning 14.7 years with robust economics at a US$916 per tonne Cg (graphitic carbon) sale price, with very attractive cash costs and all in sustaining costs (US$406 per tonne), low CAPEX and low capital intensity the company said.

The first eight years will target production averaging 108 kt/annum (kt=1,000 metric tonnes) payable graphite concentrate, peaking at 112 kilotons per /annum in year 4.0..

Initial capital is forecast at $236.1 million, including mine pre-production, processing, infrastructure, including power line, tailings facility, ancillary buildings and water management.

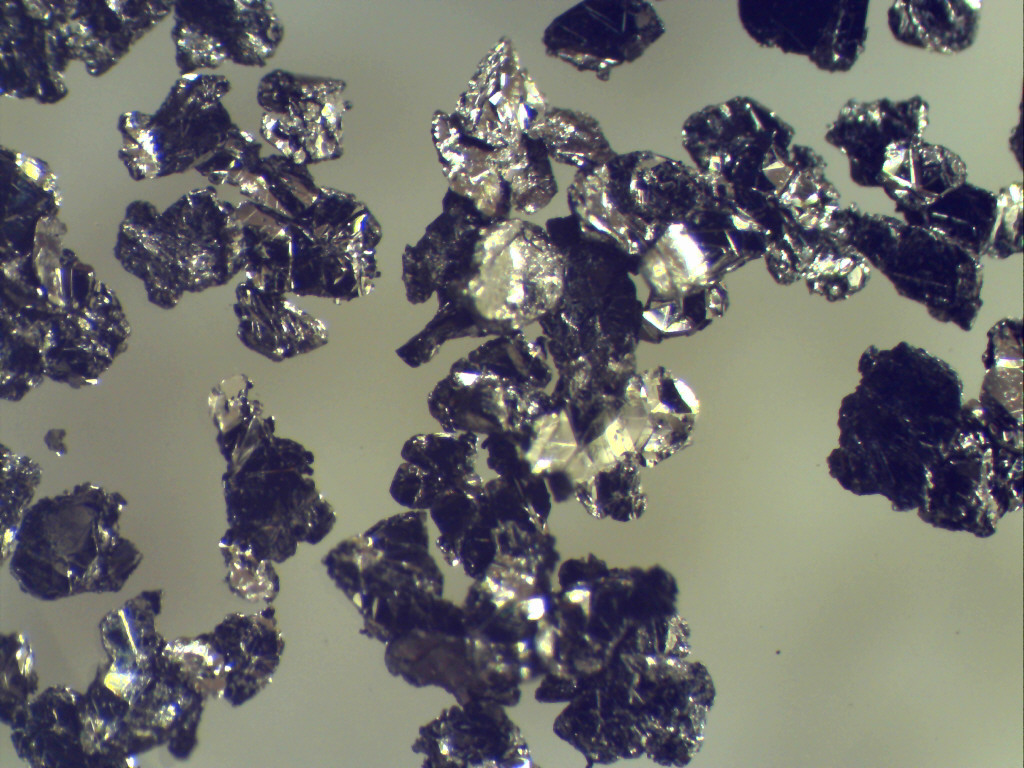

The study is based on a measured and indicated resource at a base case cu-off grade of 1.5% Cg and 23,165 kilotons at a 4.51% Cg grade for 1.04 million tonnes of graphite.

On top of that is an inferred resource at a base case cut-off grade of 1.5% Cg and 46,821 kilotons at a 4.01% Cg grade or 1.9 million tonnes of graphite.

Lomiko said the PEA indicates the property has the geological potential to extend the mine life beyond the 14.7 years envisaged in the PEA as well as the opportunity to expand the scale and production by increasing the mineral resource through ongoing exploration and drilling.

Next steps include a preliminary feasibility study and environmental impact studies. The company will also continue to explore the geological potential of the property.

Lomiko aims to capitalize on growing demand for electric vehicles, a key driver of investor interest in Lithium and Graphite, two of the major components of a lithium-ion battery.

Graphite demand is expected to increase exponentially for natural graphite material as more is used in the production of spherical graphite for the graphite anodes of electric vehicle lithium batteries.