Lupaka Gold down 60% as creditor terminates loan

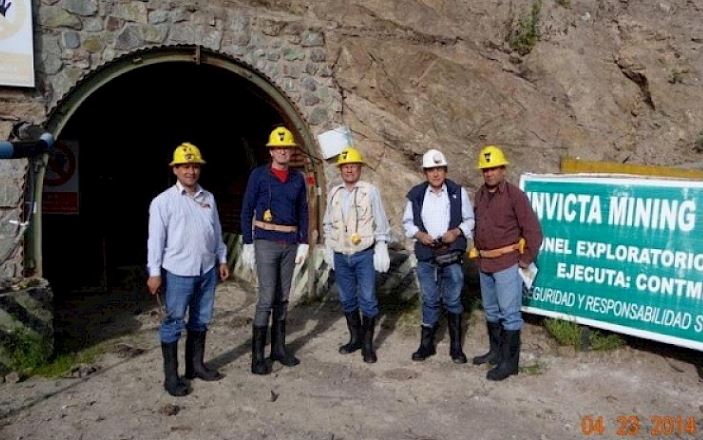

Invicta Gold Project in Peru. Source: Lupaka Gold Corp.

Lupaka Gold Corp. [LPK-TSXV; LQP-FSE] shares were down 60% Wednesday July 3 after a key creditor declared early termination of a US$15.6 million loan and requested immediate repayment.

Lupaka said it has been unable to make scheduled payments under a prepaid gold purchase agreement with PLI Huara Holdings L.P. as a result of a blockade at its Invicta Gold Project in Peru.

“The illegal road blockade, which commenced in October 2018, prevents the company, all employees, contractors, and local community workers from accessing the Invicta Gold Project site,” the company said in a press release on Wednesday.

As a result, all project related development and operating activities were suspended in October, 2018, just three months before payments against the PLI financing were scheduled to start.

Investors reacted to the news by dumping their shares, sending the stock down 60% or $0.03 to $0.02 on volume of almost 1.5 million. The shares had previously traded in 52-week range of $0.045 and 21 cents.

The company said it is currently assessing its options to resolve the matter and has initiated discussions with Lonely Mountain S.A.C.

In a July 2, 2019 press release, Lupaka said PLI has been sold to Lonely Mountain Resources S.A.C. by the previous owner Pandion Mine Finance. “Numerous attempts have been made to resolve the blockade, including requests for support from various levels of the Peruvian government, however to-date law and order have not been restored in the region,” the company said in a press release.

Lupaka has a 100% interest in the Invicta Gold Project, which consists of six mining concessions and covers an area of 4,700 hectares. The flagship asset is an advanced stage gold-copper polymetallic underground deposit located approximately 120 km north of Lima within the boundaries of Paran, Lacsanga and Santo Domingo de Apache peasant communities. Over $15 million of capital has been spent by previous owners on development and infrastructure at Invicta.

The company said it expected to start production in the second half of 2018 by using third-party mining contractors and utilizing the existing adit and underground workings. In August 2018, the company said 6,500 tonnes of mineralized development material was transported to two local toll milling facilities. By that point, the company said 1,900 tonnes had been processed.

Lupaka has said the project is fully permitted. It also said community agreements were in place.

It said the property contains an indicated resource of 558,000 ounces within 2.9 million tonnes at a grade of 5.78 g/t gold equivalent. On top of that is an inferred resource of 98,000 ounces contained within 577,000 tonnes of grade 5.29 g/t gold equivalent.

That material is enough to support a 350 tonne-per-day underground mining operation, the company has said. It said the initial six-year mine life commencing in 2018 was expected to produce 669,813 tonnes of mineralized material, yielding 145,765 ounces of payable gold equivalent, including 19,487 ounces in 2019 and 26,822 ounces in 2020.

However, in a March 21, 2019 press release, Lupaka said it was unable to access the project after discussions between the company and community leaders from the nearby community of Paran had been abandoned by the President of Paran.

“Unfortunately, they have demanded that all social and economic benefits from Invicta should go exclusively to the community of Paran, which contradicts the existing community agreements that the company has in place with Lacsanga and Santa Domingo,” Lupaka said in a press release. “Lupaka has put forward alternate proposals, including investment strategies; however, Paran remains adamant that all benefits must accrue solely to their community,” the company said.