Major Expansion of 27.3m oz Gold Eq Deposit in BC’s Prolific Golden Triangle Has Just Begun

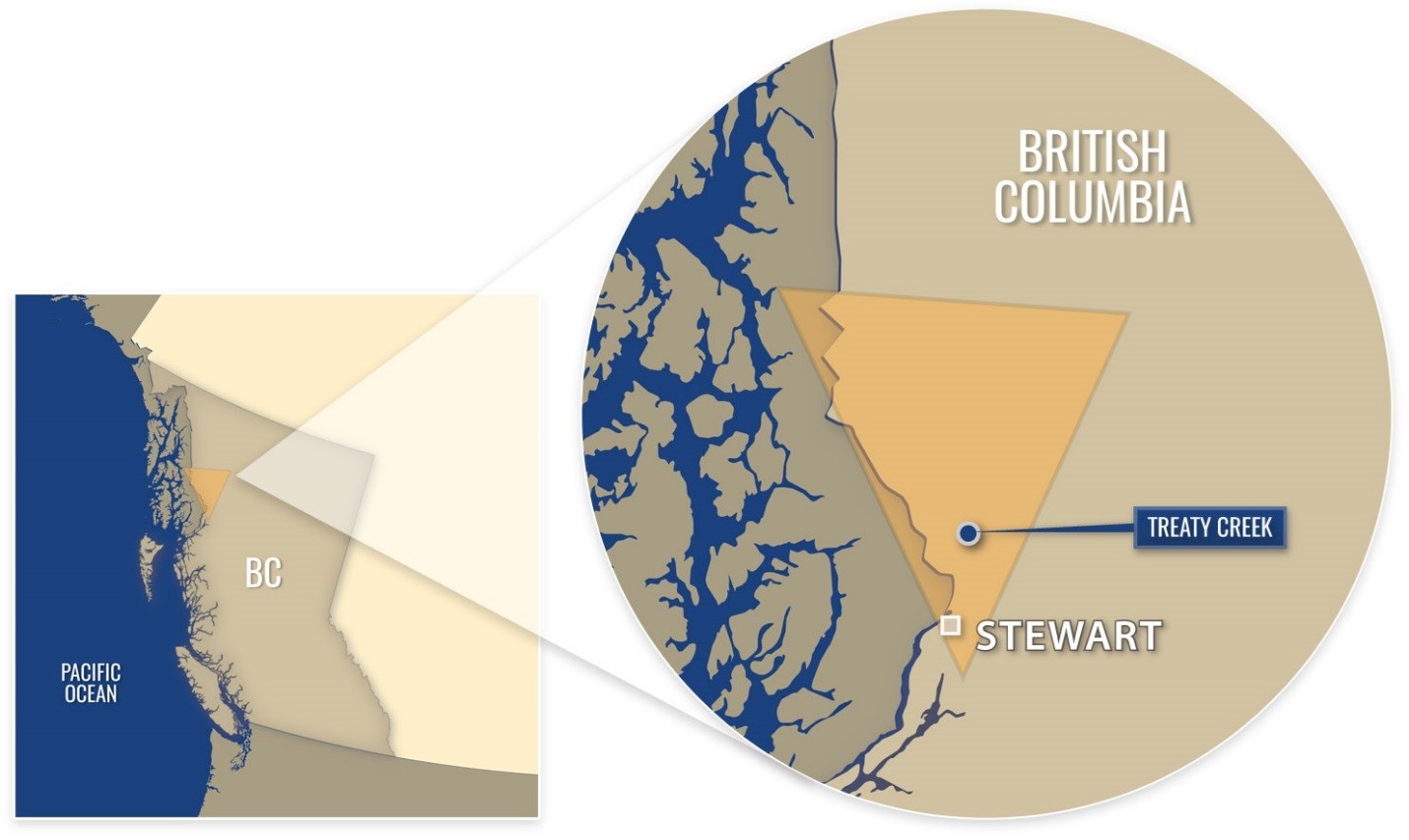

British Columbia’s Golden Triangle is one of the world’s hottest exploration and mining districts right now. This region boasts an incredible endowment of mineral riches combined with one of the most mining friendly and politically stable jurisdictions in the world (an increasingly important factor of late). With over 50 exploration / mining companies presently working in the Triangle there is as much money being spent in this concentrated area as the rest of the province put together.

The Golden Triangle’s history of rich mines is being eclipsed by new high-grade mines and world-scale deposits moving towards production. The latest example is an initial resource calculation of *27.3M oz AuEq making it one of the world’s largest gold discoveries in the last 30 years!

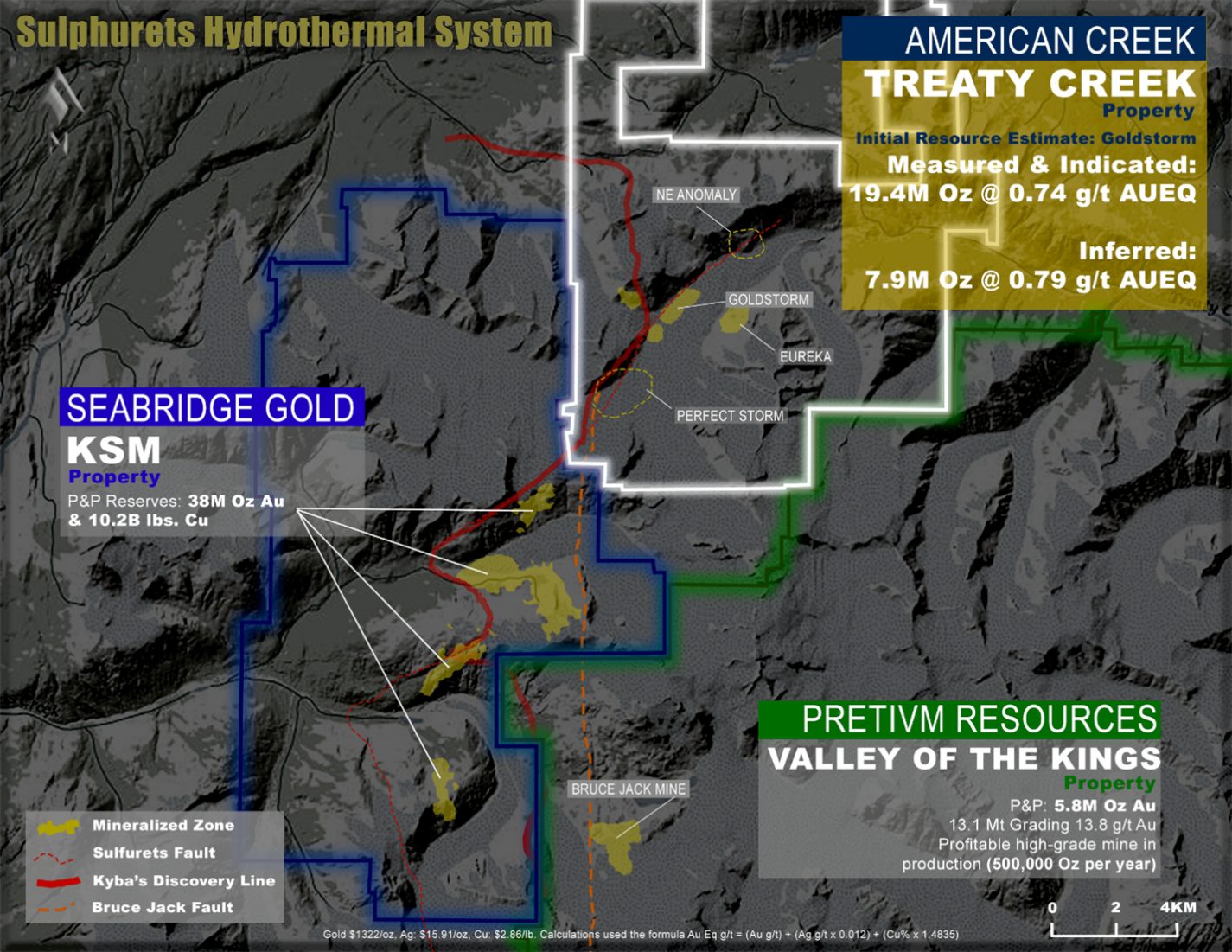

The project is called Treaty Creek and is part of the same large hydrothermal system as Seabridge Gold’s KSM deposit (the largest undeveloped gold project in the world by reserves) and Pretium’s Brucejack Mine (one of the highest-grade mines in the world). The deposit is called the Goldstorm and it is currently open in all directions and at depth. Remarkably, it’s only one of several potential mega-deposits on the property.

Phase 1 of a major 2021 drill program to expand the 19.4 million ounces of 0.74 g/t AuEq of Measured & Indicated mineral resources and 7.9 million ounces of 0.79 g/t AuEq of Inferred mineral resources began in May, with assays pending. While Phase 1 is concentrating on moving the close to 8 million ounces AuEq of Inferred resources over to Measured & Indicated and expanding the overall size of the Goldstorm, it is only part of the overall program utilizing six drills for a planned 50,000+ meters of core.

The Perfectstorm Zone, located on Treaty Creek approximately 2.5Km SW of the Goldstorm, has the same type of geological and geophysical markers as the other deposits found in the Sulphurets Hydrothermal system including the Seabridge KSM deposits. However, the geophysics is showing the potential for the Perfect Storm to be an even larger deposit than the Goldstorm. It also contains the intersection of the Sulphurets Thrust Fault (responsible for all the deposits in the system) and the Brucejack fault (responsible for Brucejack Mine) giving it potential for both styles of mineralization (hence the name “Perfect Storm”). A portion of the drilling is being planned to begin to test and define this massive target.

Tudor Gold (TSX-V: TUD) is the operator at Treaty Creek and has JV partnerships with American Creek Resources (TSX-V: AMK) and Teuton Resources (TSX-V: TUO). Tudor owns 60% and American Creek and Teuton each have 20% fully carried interests until a notice of production is given.

Tudor’s primary objectives for the 2021 program are listed in their newly released Corporate Presentation including:

- Convert 7.9 Moz Au Eq of Inferred resources to M&I

- Find limits of Goldstorm mineral system as it remains open in all directions

- Focus additional exploration on the high potential Perfectstorm and Eureka systems

- Advance baseline studies toward economic feasibility

Following 2021 exploration – update initial resource and roll out PEA (Preliminary Economic Assessment). You can find the details of this year program by clicking the image below:

Logistics are very good, especially for a project of this scale. Details can be found by clicking the image above or clicking here for a summary of the project.

Concerning Treaty Creek, last year prior to the Maiden Resource coming out, billionaire metals investor Eric Sprott stated:

“It certainly looks like they have 20 million ounces and they could easily get to 30 or 40 or 50 million ounces (of gold)“

– Eric Sprott, July 24, 2020 –

With an initial resource exceeding Eric’s expectations and an even bigger program being executed this year, it looks like this project is well on it’s way towards his larger predictions. As pointed out by Eric, this project is clearly in the Discovery Stage where the biggest profits are made within the lifecycle of exploration and mining.

Timing is everything in the metals industry and right now Tudor Gold is currently at an undervalued price compared to it’s recent highs and when considering the scale and potential of the project. Tudor becomes even more undervalued when considering they are discovering gold at $1.00/oz CAD opposed to the industry average of $42.00/oz USD; making it one of the most leveraged plays in the gold industry.

Within this project there is a way to increase that leverage even further as the former operator, American Creek Resources, is currently trading at a discount to the value of their 20% fully carried interest. As the agreement implies, American Creek is getting a full ride on all costs until a Production Order is produced. Should the project be sold prior to that, American Creek would incur no exploration or advancement costs.

American Creek’s and Tudor’s ounces are the exact same ounces in the ground. It’s only a question of ownership, and American Creek’s discovery cost is presently $0/oz gold! At current market prices, investors could almost double their leverage with this play by taking a position in American Creek and benefitting as the project advances and Tudor’s value increases.

With the gold market softening over most of the last year, share prices are down but, the fully-funded program is full steam ahead with five drills already turning on the project. This situation has created a strategic point of entry into this play, given newsflow is expected to pick up soon and continue through Q1 of 2022.

Considering that close to 8 million ounces of gold equivalent is being upgraded at the Goldstorm, that the Goldstorm is being expanded (open in all directions), and that the potentially much larger Perfectstorm will be drilled, there is likely to be a significant amount of newsflow starting shortly. Prior to that steady stream of news is a critical time to investigate what has the potential to become one of the world’s largest gold deposits in a politically stable jurisdiction with good logistics.

Tudor Gold’s Vice President of Exploration and Project Development, Ken Konkin, has worked in the Golden Triangle for 30 years. In particular, he was the head geologist for Pretium while putting the Brucejack mine (just south of Treaty) into production in 2017. Konkin goes into detail on Treaty Creek and the 2021 program in this recent interview.

Concerning his first two years of drilling and the massive initial resource calculation at Treaty Creek, he stated: “This is just the first chapter of a very good book!”

Given how good the first chapter looks, this may turn out to be a best seller.

*Metal prices used were US$1,625/oz Au, US$19/oz Ag, US$2.80/lb Cu with process recoveries of 88% Au, 30% Ag and 80% Cu. A C$16.50/tonne process and C$2 G&A cost were used. 90+ % of the AuEq is gold.