Making the Grade – Uranium Drilling Results Primer

By Alfred Stewart

Defining thresholds for interesting drilling results for various commodities is generally just a matter of determining whether the intersection is close enough to surface and of sufficient thickness to be part of a potential open pit mine, or alternatively, whether it must be of much higher grade to be part of an underground mining scenario. Uranium however presents special challenges because the mining techniques involved range from in-situ mining (ISL extraction) to expensive underground mining using remote controlled machinery. Adding to the complexity are large shifts in price caused by shifting demand for uranium use in nuclear weapons in the 1950’s to the use for generation of electricity from the 1960’s until the present, punctuated by significant drops in demand due to the shutdown of numerous nuclear reactors due to safety concerns. Just under ten years ago, on March 11, 2011, a tsunami flooded the Fukushima Daiichi nuclear reactor in Japan, leading to a major nuclear accident and the shutdown of the entre Japanese nuclear power industry. This led to a protracted bear market in the uranium price.

Since August of 2021 uranium prices have rebounded after a multi year funk. The uranium explorers came to life and a wave of speculative financings followed. Currently, many companies are actively exploring and announcing esoteric things like CPS counts or assays for U3O8 These things will be explained. It is timely to consider what constitutes a significant drilling result and how to put these drill results in context.

First things first. Uranium assays are not quoted as assays for the element uranium. They are quoted as assays for uranium oxide, chemical symbol U3O8 commonly known as yellowcake, an intermediate product in the refining of uranium, and a widely traded commodity. Yellowcake is approximately 85% elemental uranium.

Secondly uranium is radioactive, so even before one sees chemical assays in the news releases, it is common practice to announce measurements of radioactivity from measuring instruments known as  scintillometers or more properly gamma ray spectrometers. For example, Fission Uranium announced in September 2021 that it had intersected a 50 meter intersection of over 10,000 counts per second radioactivity from drilling. In early 2022 Fission Uranium announced chemical assays of 46 meters of 8% U3O8 from the same zone. In general, over 10,000 counts per second is extreme high grade, 1000 counts per second is moderate grade, and below that is low grade for Athabasca Basin type Uranium deposits.

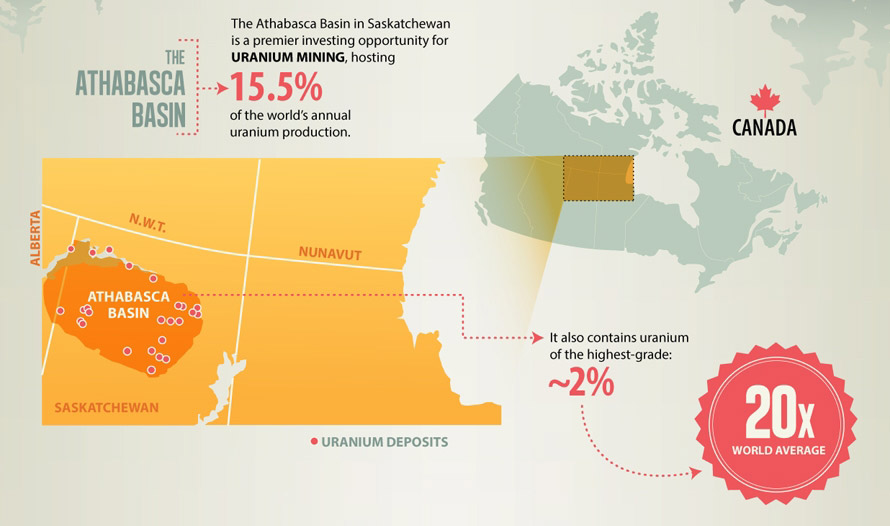

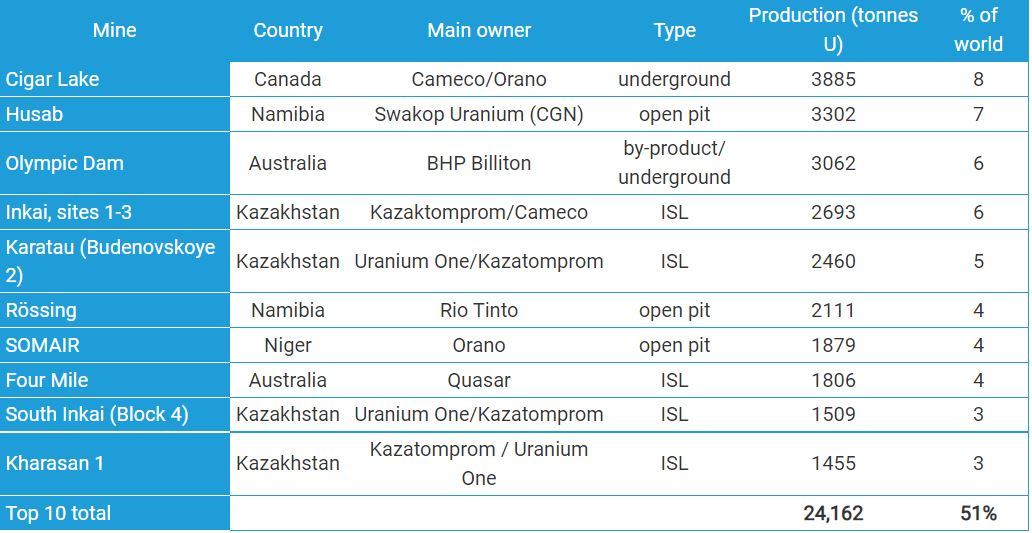

Thirdly, Athabasca Basin uranium grades are just extremely high compared to the rest of the world. The two largest mines in the Basin, Cigar Lake and MacArthur River have uranium resources calculated at grades of 18% and 17% U3O8 respectively. Whereas the Ranger 3 Deeps Zone in Australia has underground uranium resources calculated at a grade of 0.274% U3O8. Both areas are underground uranium mines of a similar style. The difference is that the Canadian mines are located below a very incompetent and porous Athabasca sandstone which causes mining challenges and inordinate expense.

The World Nuclear Association provides a useful overview of uranium mining and discusses typical mining grades from uranium mines around the world in the article linked below.

Canada is blessed with the highest-grade uranium ores in the world, up to 20% U3O8. I consider a drill intersection of plus 10% U3O8 over three meters or more to be exciting for an underground mining scenario i.e. where the intersection is more than 100 meters deep and requires underground mining. For an open pit case, I would consider 30 meters of 0.5% to be exciting, in a shallow drill hole under 100 meters vertical depth.

In lower cost areas such as the southwest United States, or Australia, sandstone deposits can be economic at grades of 0.05% to 0.4% depending on whether ISL can be used or more conventional mining techniques are required, with associated higher costs.

Currently, ISL extraction technology is growing in popularity. From 16% of global production in 2000 to 58% of global production in 2020 ISL production, mostly from Kazakhstan has dominated the uranium market.

The country that has lost market share is Canada. It needs to find high grade ores in areas without the difficult sandstone cover, which could provide outstanding economics. The Patterson Lake South Triple R, the Roughrider Zone and the Arrow deposits are all high grade Athabasca deposits in the basement Precambrian rocks which are competent, and which could provide lower cost mining than the challenging unconformity deposits.