McEwen vows to regain NYSE compliance

McEwen Mining Inc. [MUX-TSX, NYSE] said Friday March 27 that its share price has fallen below the continued listing requirements of the New York Stock Exchange, but added that it is committed to regaining its compliance status.

The NYSE requires that the average closing price of a listed company’s common stock be above US$1 per share, calculated over a period of 30 consecutive trading days. The company was notified by the NYSE on March 24, 2020, that the average price of its common stock for the previous 30 trading days was below US$1 per share.

McEwen said in a press release it intends to take steps to regain compliance with NYSE continued listing requirements. “Under the NYSE’s rules, the company has a period of six months to bring its share price and 30-day average closing share price above US$1,” the company said. “During this period, the company’s common shares will continue to trade on the NYSE, subject to all other listing requirements,” it said.

“At the end of the six-month period, if the share price has not recovered, the company’s stock will be subject to NYSE suspension and delisting procedures.”

Meanwhile, the company’s listing on the Toronto Stock Exchange is unaffected by any actions of the NYSE. On the TSX Friday, McEwen Mining was down 2.8% or $0.03 to $1.02. The shares are currently trading in a 52-week range of 76 cents and $2.84.

McEwen has said it aims to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer with a focus on the Americas, including the U.S., Canada, Mexico and Argentina.

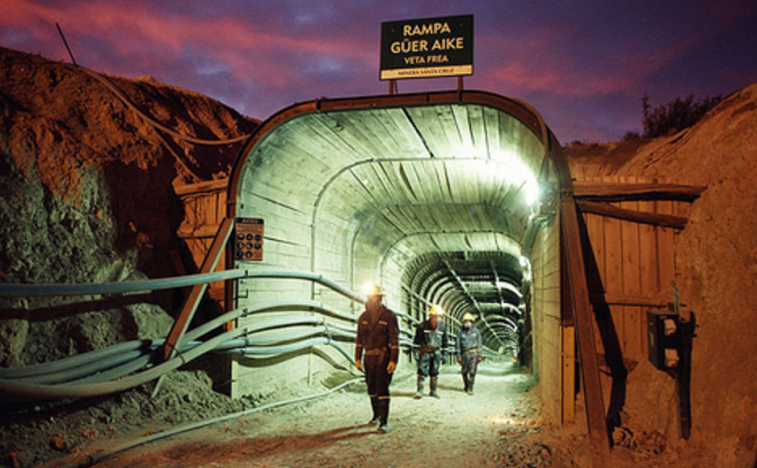

Its key assets are the San Jose Mine in Santa Cruz, Argentina, the Black Fox Mine in Timmins, Ontario, the El Gallo Fenix Project in Mexico, the Gold Bar Mine in Nevada, and the Los Azules copper project in San Juan, Argentina.

Bay Street financier Robert McEwen owns 22% of McEwen Mining’s 362 million outstanding shares. The company produced 174,420 gold equivalent ounces in 2019, compared to 175,640 in 2018.

However, as a result of the uncertainty related to the COVID-19 pandemic, McEwen recently withdrew its previously announced production and cost guidance for 2020.

In a March 26, 2020 press release, McEwen also said that in order to protect the health of its workforce, their families, and the nearby communities from the spread of COVID-19, both its Black Fox and Gold Bar mines will scale down operations for a period of two weeks.

Certain production and exploration activities will continue at Gold Bar in areas where social distancing can be observed, including ore crushing, irrigation of the heap leach pad, and operation of the process plant.

At Black Fox, the company said it expects to continue development activities related to the Froome access ramp.