Mineral resource expansion at one of the largest precious metal and polymetallic deposits in British Columbia

Rokmaster Resources Corp. [RKR-TSXV, RKMSF-OTCQB, IRRI-FSE] is focused on developing the Revel Ridge project, one of the largest precious metal and polymetallic deposits in British Columbia.

Rokmaster is headed by President and CEO John Mirko, a 40-year veteran of the mineral exploration sector. He is recognized for permitting, constructing, and operating mines, including through receipt of the E.A. Scholtz Medal for Excellence in Mine Development from the Association for Mineral Exploration of British Columbia, and the Mining and Sustainability Award from the Mining Association of British Columbia. Mr. Mirko was the founder & President of Canam Alpine Resources Ltd. prior to its recent sale to Vizsla Silver Corp. in September 2019.

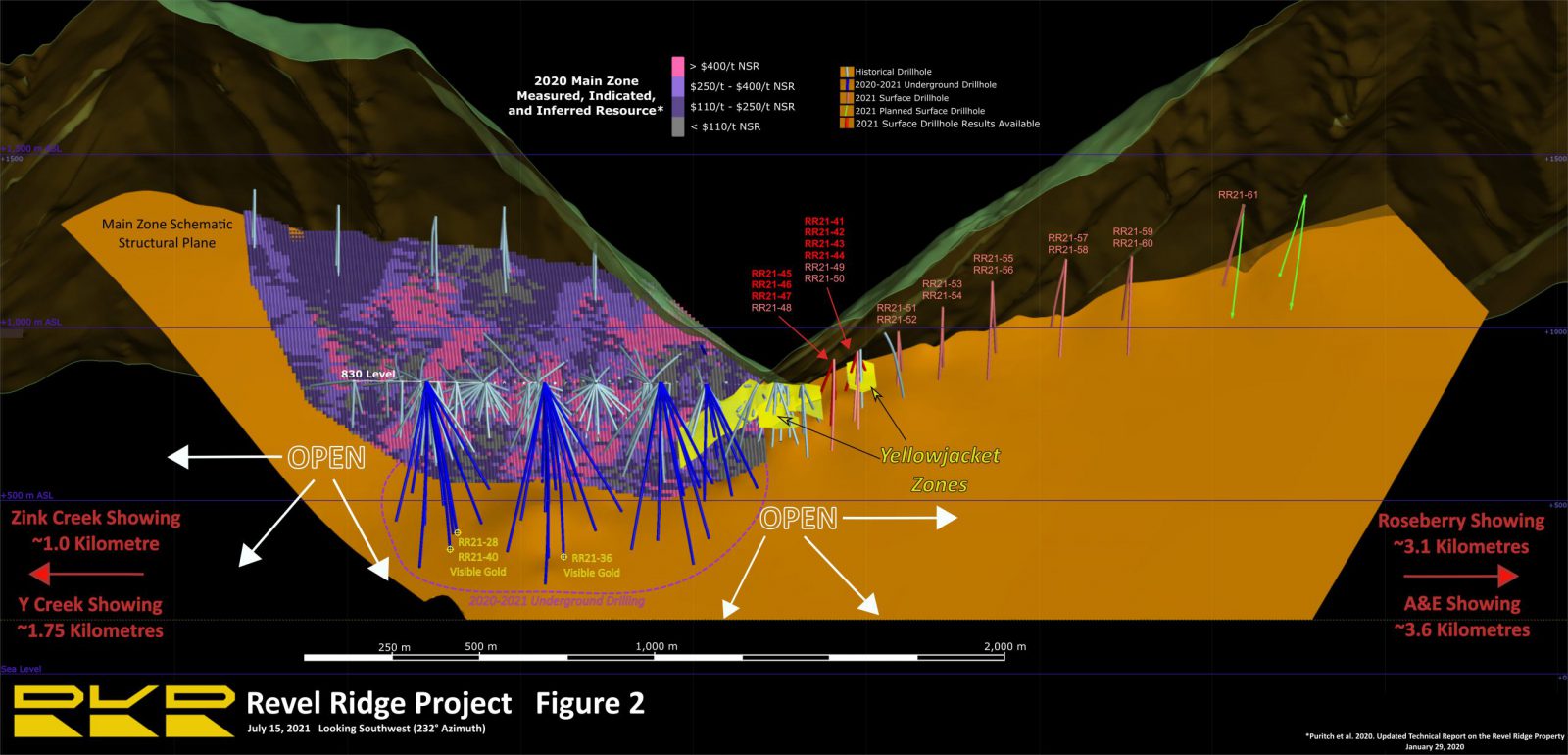

Mineral resource expansion at Revel Ridge is top of mind for Mr. Mirko and Rokmaster, who expect an updated resource estimate by year’s end. The project has an existing measured and indicated resource in the Main Zone of 1.1 million ounces of AuEq at a grade of 8.07 g/t AuEq, and an inferred resource of 961,000 ounces of AuEq grading 6.55 AuEq (excluding Hanging Wall and Footwall Zone resources).

The separate Yellowjacket Zone is a stacked series of subparallel carbonate hosted silver-zinc-lead zones. It contains an indicated resource of 771,000 tonnes of grade 9.93% zinc, 2.61% lead, 0.09 g/t gold and 62.8 g/t silver. The mineral resource estimate does not include results from the company’s recent and ongoing drill program.

The separate Yellowjacket Zone is a stacked series of subparallel carbonate hosted silver-zinc-lead zones. It contains an indicated resource of 771,000 tonnes of grade 9.93% zinc, 2.61% lead, 0.09 g/t gold and 62.8 g/t silver. The mineral resource estimate does not include results from the company’s recent and ongoing drill program.

Rokmaster’s underground drill program saw an exceptional 85% of drill holes with completed assays intercept above-threshold net smelter return gold equivalent grades. The company also identified visible, particulate gold grains in deeper drillholes. This is important for mineral economics as potentially free milling particulate gold that isn’t locked into a sulphide phase has a high probability of being recovered by standard and lower cost metallurgical processes, including gravity.

In a June 2021 update, the company said exploration data suggests that the volume of mineralized rock outside of the 2020 resource area may be significantly larger than the volume of rock within the 2020 resource domain.

With an active surface drill program currently underway, results continue to confirm and expand on the exceptional continuity of the gold-rich Main Zone mineralization and the silver-zinc rich Yellowjacket style mineralization. Recently returned assays cored 3.9 m of 1,093 g/t AgEq within 14.38 m of 482.4 g/t AgEq. Drilling and geochemical sampling are demonstrating that the Revel Ridge orogenic gold system extends for kilometers beyond historical diamond drill holes.

“Every successful drillhole in this greenfields exploration environment further expands the larger scale potential of the Revel Ridge camp, and in these drill holes we are effectively looking for a new mine,” Mr. Mirko said in a July 16, 2021 news release. “Results from the first seven surface diamond drill holes (RR21-41 to RR21-47) document the significant contribution that the expanded silver-rich, carbonate hosted Yellowjacket Zone will provide to the net resource at Revel Ridge. ”

In recent media, Mr. Mirko said the company hopes to release a revised 43-101 Gold equivalent resource once the drilling is complete. Drilling is still underway with assay results pending.

“A welcome challenge for our team is seizing on the impressive size and growing number of tier-one targets,” Mr. Mirko said, adding “This is an enviable position for any junior explorer and a position which is likely unique for many projects in the Western Cordillera.”

Targeting mine development, Rokmaster released a preliminary economic assessment (PEA) in December, 2020 demonstrating that Revel Ridge has the potential to become a long life, low-cost, robust polymetallic gold-silver mine with strong project economics with a base case price of US$1,561 an ounce gold. Preproduction capital expenditures are forecast to be $396 million.

Targeting mine development, Rokmaster released a preliminary economic assessment (PEA) in December, 2020 demonstrating that Revel Ridge has the potential to become a long life, low-cost, robust polymetallic gold-silver mine with strong project economics with a base case price of US$1,561 an ounce gold. Preproduction capital expenditures are forecast to be $396 million.

The PEA leverages Revel Ridge’s extensive infrastructure, including all-weather access roads, local hydroelectric facilities, 3.0 kilometres of underground development, permitted waste rock storage facility, full camp facility, and proximity to the City of Revelstoke.

Key project infrastructure would include a 2,300 tonne per day mill comprising crushing-sorting-grinding-gravity-flotation-POX plant, producing gold/silver doré and saleable zinc and lead concentrates. See a conceptual video of Rokmaster’s mine site and process plant for more.

On July 30, 2021, Rokmaster shares were trading at 51 cents in a 52-week range of 76 cents and 20.5 cents, leaving the company with a market cap of $54 million, based on 104.9 million shares outstanding.