Monarch Continues To Hit High-Grade Gold Intersections On Mckenzie Break

- Monarch is reporting final assays for its 2021 diamond drilling program, which include high-grade results of 19.12 g/t Au over 1.9 m, 41.0 g/t Au over 0.5 m, 11.9 g/t Au over 1.5 m and 16.7 g/t Au over 0.89 m.

- The 2021 drilling program expanded the mineralized footprint to 600 metres by 1,100 metres to a vertical depth of 400 metres and confirmed that mineralization remains open in all directions, with additional high-grade intersections to the northeast.

- The 2022 McKenzie Break diamond drilling program, which began in April with one drill rig, consists of 20,000 metres of drilling in 65 holes. A second drill rig will be added once Monarch’s 10,000-metre Swanson diamond drill program is complete.

- Monarch is working towards updating its McKenzie Break mineral resource estimate later in 2022.

Monarch Mining Corporation (“Monarch” or the “Corporation“) (TSX: GBAR) (OTCQX: GBARF) is pleased to report the results for the last 13 holes of its 2021 drilling program on the McKenzie Break deposit, located 25 kilometres north of the Corporation’s wholly owned 750 tonne-per-day Beacon mill. The 2021 drilling program consisted of 54 holes for a total of 18,632 metres. Earlier results were reported on December 2, 2021 (73.5 g/t Au over 1.35 m), October 20, 2021 (3.93 g/t Au over 5.45 m), June 22, 2021 (70.8 g/t Au over 0.4 m) and March 22, 2021 (8.46 g/t Au over 13.8 m).

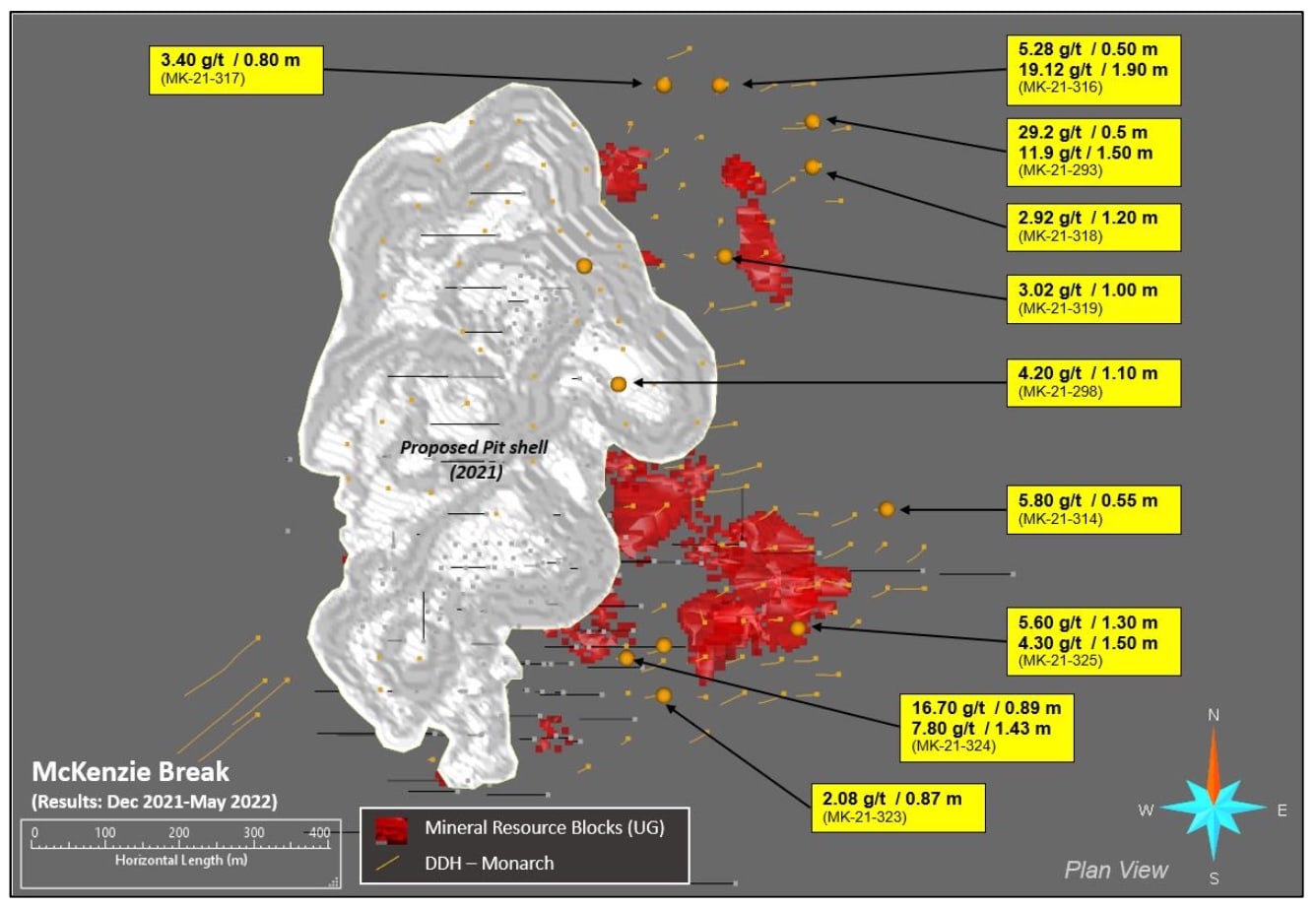

The results from the last 13 holes show several high-grade intersections, including 19.12 g/t Au over 1.9 m, 41.0 g/t Au over 0.5 m, 11.9 g/t Au over 1.5 m and 16.7 g/t Au over 0.89 m. The three best intersections are located along the northeastern extension of the current resource envelope (Figure 1). All significant assay results are provided in Table 2.

The 2021 drilling program was a surface program aimed at continuing to expand the McKenzie Break gold deposit and supplementing the recent mineral resource estimate (the “2021 MRE“, effective February 1, 2021 and amended October 14, 2021, available on the Corporation’s website) with holes drilled on 50-metre centres down to a vertical depth of 400 metres. Based on recent results outside the 2021 MRE envelope, the current program has succeeded in expanding the gently dipping deposit, particularly to the northeast. The mineralized footprint now measures 600 metres by 1,100 metres and has been tested to a vertical depth of up to 400 metres. The 2021 program also confirmed that the mineralization is continuous and remains open in all directions.

The 2022 drilling program on the McKenzie Break property, which began in April with one drill rig, consists of 20,000 metres of drilling in 65 holes. A second drill rig will be added once Monarch’s Swanson 10,000-metre drilling program is complete. Monarch will continue testing the deposit with holes at 50-metre centres. The 2022 program is aimed at expanding the current underground resource to the north and east, increasing the size of the currently proposed resource pit shell up-dip through expansion to the south and west and testing additional exploration targets along the volcanic-intrusive contact to the south.

Later this year, Monarch will update the mineral resource estimate to include the additional 18,632 metres drilled in 2021 and several strategic holes to be drilled in 2022, as well as a new interpreted geological model.

“McKenzie Break continues to show strong exploration potential in all directions as we continue to encounter high-grade gold mineralization,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch. “We expect 2022 to be another busy year on McKenzie Break and are looking forward to the results of the updated mineral resource estimate later in the year.”

About McKenzie Break

Gold mineralization occurs in an elongated diorite unit or lens within a shallow embayment of the Pascalis Batholith. Monarch continues to have drilling success beyond the limits of the current resource envelope, recently updated by Geologica and GoldMinds (effective February 1, 2021, and amended October 14, 2021, available on the Corporation’s website) (see Table 1). The mineralized envelope currently measures 1,100 metres by 600 metres and has been tested down to a vertical depth of 400 metres. In 2022, the Corporation will drill 20,000 metres to continue testing the limits of the defined pit shell and mineralized envelope and to test other priority targets on the property, including targets along the volcanic-intrusive contact to the south. The 2022 drilling program began in April with one drill rig, with a second rig to be added later in the year.

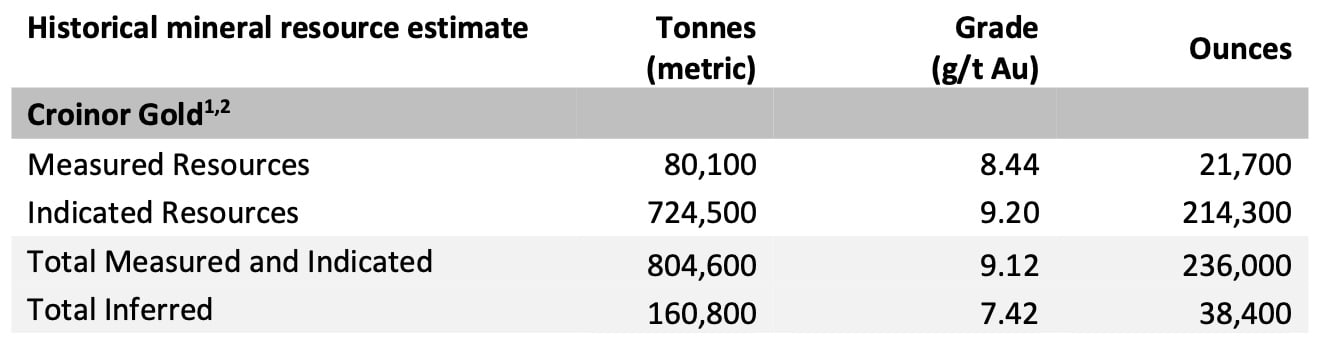

Table 1: 2021 mineral resource estimate for the McKenzie Break depositÂ

Mineral resource estimate notes:Â

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to a Measured and Indicated Mineral Resource and must not be converted to a Mineral Reserve. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported inferred resources are uncertain in nature and there has not been sufficient work to define these inferred resources as indicated or measured resources.

- The database used for this mineral estimate includes drill results obtained from historical records and up to the recent 2018-2020 drill program.

- Mineral resources are reported at a cut-off grade of 0.50 g/t Au for the pit-constrained and underground mineral resources are reported at a cut-off grade of 2.38 g/t Au within reasonably mineable volumes.

- These cut-offs were calculated at a gold price of C$1,980 ounce.

- The pit-constrained resources were based on the following parameters: mining cost $3.5/t, processing, transportation + G&A costs $27/t, Au recovery 95%, pit slopes 15 degrees for overburden and 50 degrees for rock.

- The underground reasonably mineable volumes were based on the following parameters: mining cost $98/t, processing, transportation + G&A costs $27/t, Au recovery 95%, dilution of 15% at 0 g/t Au with a minimum stope dimension of 10m x 10m x 5m.

- The geological interpretation of the deposits was based on lithologies and the typical mineralized interval mainly composed by diorite hosted shear zones.

- The mineral resource presented here was estimated with a block size of 5m x 5m x 5m for the pit-constrained and for underground.

- The blocks were interpolated from equal length composites calculated from the mineralized intervals. Prior to compositing, high-grade gold assays were capped to 60 g/t Au applied on 0.6-metre composites.

- The mineral estimation was completed using the inverse distance squared methodology utilizing two passes. For each pass, search ellipsoids followed the geological interpretation trends were used.

- Tonnage estimates are based on rock specific gravity of 2.77 tonnes per cubic metre for all the zones. Results are presented undiluted and in situ.

- Estimates use metric units (metres, tonnes and g/t). Metal contents are presented in troy ounces (metric tonne x grade / 31.10348).

- This mineral resource estimate is dated February 11th, 2021, and with an amended date of October 14th, 2021. The effective date for the drillhole database used to produce this updated mineral resource estimate is February 1st, 2021. Tonnages and ounces in the tables are rounded to the nearest hundred. Numbers may not total due to rounding.

- No economic evaluation of the resources has been produced.

The resource estimate was prepared by Alain-Jean Beauregard, P.Geo., Daniel Gaudreault, P.Eng. of Geologica Groupe-Conseil Inc., and Merouane Rachidi, P.Geo., Claude Duplessi, P.Eng. of GoldMinds GeoServices, all qualified persons under National Instrument 43-101.Â

Sampling consists of sawing the NQ-size core into equal halves along its main axis and shipping one of the halves to AGAT Laboratories in Mississauga, Ontario or ALS Canada in Val d’Or, Quebec for assaying. The samples are crushed, pulverized and assayed by fire assay, with atomic absorption finish. Results exceeding 3.0 g/t Au are re-assayed using the gravity method, and samples containing visible gold grains are assayed using the metallic screen method. Monarch uses a comprehensive QA/QC protocol, including the insertion of standards and blanks.

The technical and scientific content of this press release has been reviewed and approved by Louis Martin, P.Geo., the Corporation’s qualified person under National Instrument 43-101.

About Monarch

Monarch Mining Corporation (TSX: GBAR) (OTCQX: GBARF) is a fully integrated mining company that owns four projects, including the Beaufor Mine, which has produced more than 1 million ounces of gold over the last 30Â years. Other assets include the Croinor Gold, McKenzie Break and Swanson properties, all located near Monarch’s wholly owned 750 tpd Beacon Mill. Monarch owns 29,504 hectares (295 km2) of mining assets in the prolific Abitibi mining camp that host a combined measured and indicated gold resource of 478,982 ounces and a combined inferred resource of 383,393 ounces.

Forward-Looking StatementsÂ

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarch’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this press release.

Table 2: McKenzie Break 2021 drilling program significant assay results

Table 3: McKenzie Break drill hole locations

Figure 1: Significant assay results (Dec 2021 – May 2022)

Table 4: Monarch combined gold resources

1 Source: NI 43-101 Technical Report and Mineral Resource Estimate for the Beaufor Mine Project, October 13, 2021, Val-d’Or, Québec, Canada, Charlotte Athurion, P. Geo., Pierre-Luc Richard, P. Geo., Dario Evangelista, P. Eng., BBA Inc.

2 Source: NI 43-101 Technical Evaluation Report on the McKenzie Break Property, October 14, 2021, Val-d’Or, Québec, Canada, Alain-Jean Beauregard, P.Geo., Daniel Gaudreault, P.Eng., Geologica Groupe-Conseil Inc., and Merouane Rachidi, P.Geo., Claude Duplessi, P.Eng., GoldMinds GeoServices Inc.

3 Source: NI 43-101 Technical Report and Mineral Resource Estimate for the Swanson Project, January 22, 2021, Val-d’Or, Québec, Canada, Christine Beausoleil, P. Geo. and Alain Carrier, P. Geo., InnovExplo Inc.

4Â Numbers may not add due to rounding.

1Â Source: Monarch Gold prefeasibility study (January 19, 2018). This resource was completed for Monarch Gold and has not been reviewed by a qualified person for Monarch Mining as required under National Instrument 43-101 and is thus considered as an historical estimate. Furthermore, a qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves; and therefore, Monarch is not treating the historical estimate as current mineral resources or mineral reserves.

2Â Numbers may not add due to rounding.