New Break Pursuing Young-Davidson Model at its Moray Gold Project

New Break Resources Ltd. (“New Break” or the “Company”) (CSE: NBRK) is pleased to report on the results and findings at its Moray gold project, which appear to support the Company’s thesis of pursuing a Young-Davidson gold mineralization model at Moray. The Young-Davidson gold mine, operated by Alamos Gold Inc. (“Alamos”), is located approximately 32 km southeast of Moray. First discovered in 1916, the mine produced one million ounces of gold from 1934 to 1957 from open pit and underground development. Commercial production resumed in 2012, with current annual gold production sitting at just under 200,000 ounces.

Ore extraction at Young-Davidson has historically been derived from both the hosting mafic volcanics and the syenite intrusive rocks. New Break’s Moray property exhibits comparable geology, mineralization and alteration characteristics to Young-Davidson, including mafic volcanic hosted and syenite hosted auriferous quartz vein zones. Strong pervasive hematitic-potassic alteration and secondary fracture-controlled pyrite mineralization associated with stockwork quartz and quartz-carbonate veining occurs within the Fiset syenite at the historical Trench 1 (Fiset Area) on the Moray property. Mafic volcanic hosted quartz vein zones have been outlined in Trench 12 at the contact of the Fiset syenite.

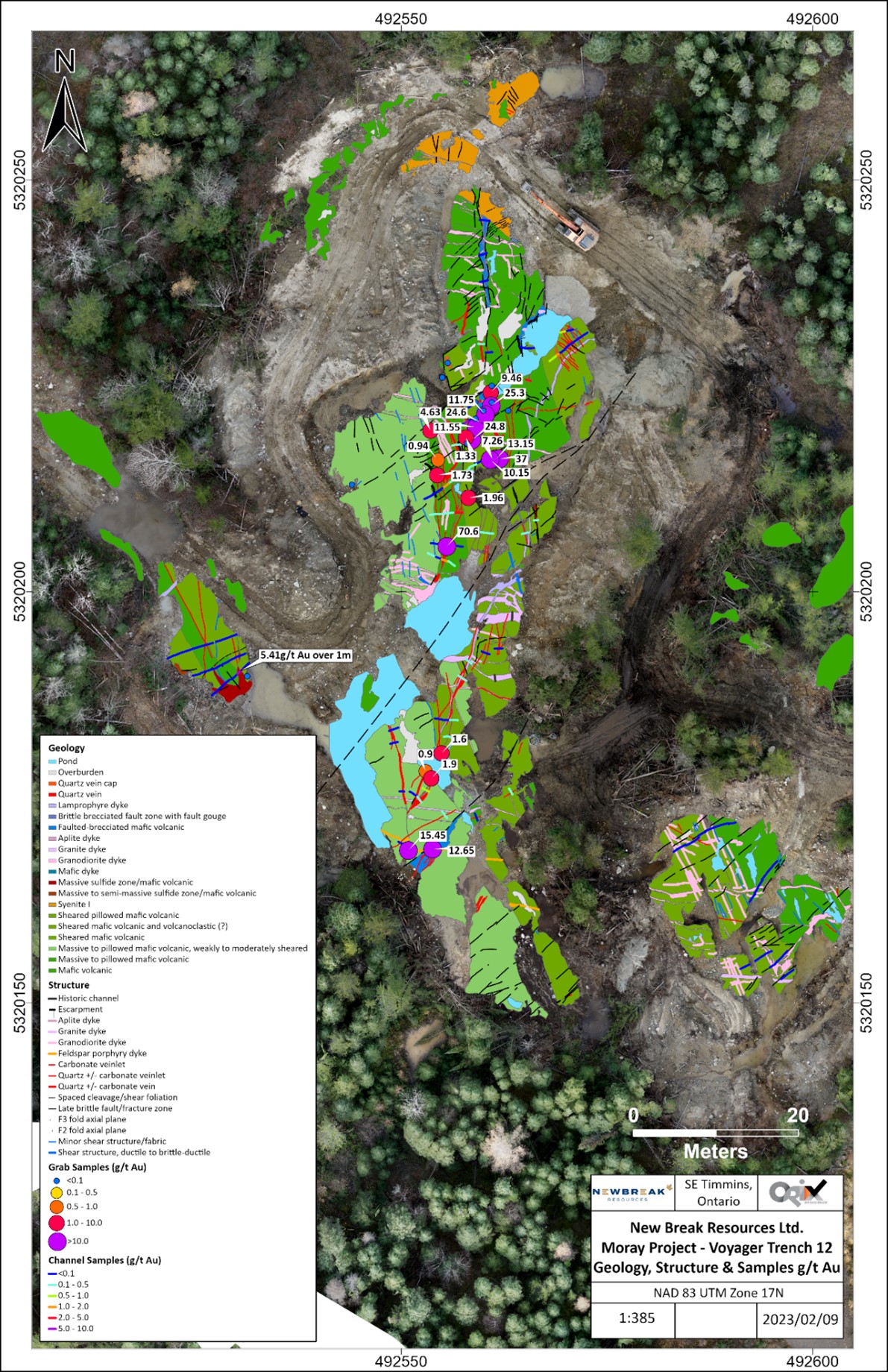

Exploration activities undertaken by New Break between June and October 2022, has significantly expanded on the previous trenching and stripping work completed by SGX Resources Ltd. (“SGX”) in 2012. New Break’s 2022 trenching efforts have uncovered an 80-metre-long mineralized section of N-S trending, moderately west dipping, extensional quartz veining in Trench 12 as well as marginally extending the main NE striking, shallow NW dipping shear-breccia vein system. Stripping and trenching at Trench 1 has exposed altered and mineralized quartz veining to the west and to the north, expanding the known mineralized zone hosted within the Fiset syenite. Additional sampling was conducted during September and October 2022 (see September 29, 2022 news release for the results of July and August trench 12 grab and channel samples, which included a grab sample grading 70.6 grams per tonne gold (“g/t Au”) located at the south end of the main trench 12). Grab and channel sample results from the entire June to October program are included in Appendix I, along with a recap of results from grab samples taken by SGX in 2012, which are included in Appendix II. Assay results from New Break’s work at trench 12, including a depiction of the structural geology is presented below in Figure 1.

Exploration work completed by New Break, yielded the following observations with respect to the gold mineralization at the historical trenches 1 and 12:

- The syenite contact has been observed at the north end of trench 12, but not along the main northeast trending gold bearing shear vein;

- Very low frequency (“VLF”) geophysical survey results mirror the direction of the main shear vein with the conductor/structure trending northeast into the Fiset syenite;

- SGX drillhole ML12-01, which was collared close to the southern end of trench 12, was drilled parallel to the NE – SW trending shear structure, and intercepted 2.47 g/t Au over 1.5 metres proximal to the volcanic syenite contact and 0.494 g/t Au over 12.1 metres in the syenite at the volcanic-syenite contact. Drilling did not test the main shear structure;

- In the historical trench 1 area, there is a noted increase in hematitic/potassic alteration in the altered syenite adjacent to the NOR vein. The magnetic susceptibility drops between the unaltered syenite (8-17) and the altered syenite (1-6);

- The gold bearing shear structure at trench 12 trends to the northeast, towards the contact with the Fiset syenite. This structure has not been tested by historical drilling; and

- The syenite hosted gold mineralization at trench 1 was indirectly tested by Newmont in drillhole Z-80-05, however no assays were reported in the assessment filing.

(Figure 1 – Outcrop, boulder and channel samples at Trench 12, Voyager area – Moray Project,

Including structural geology)

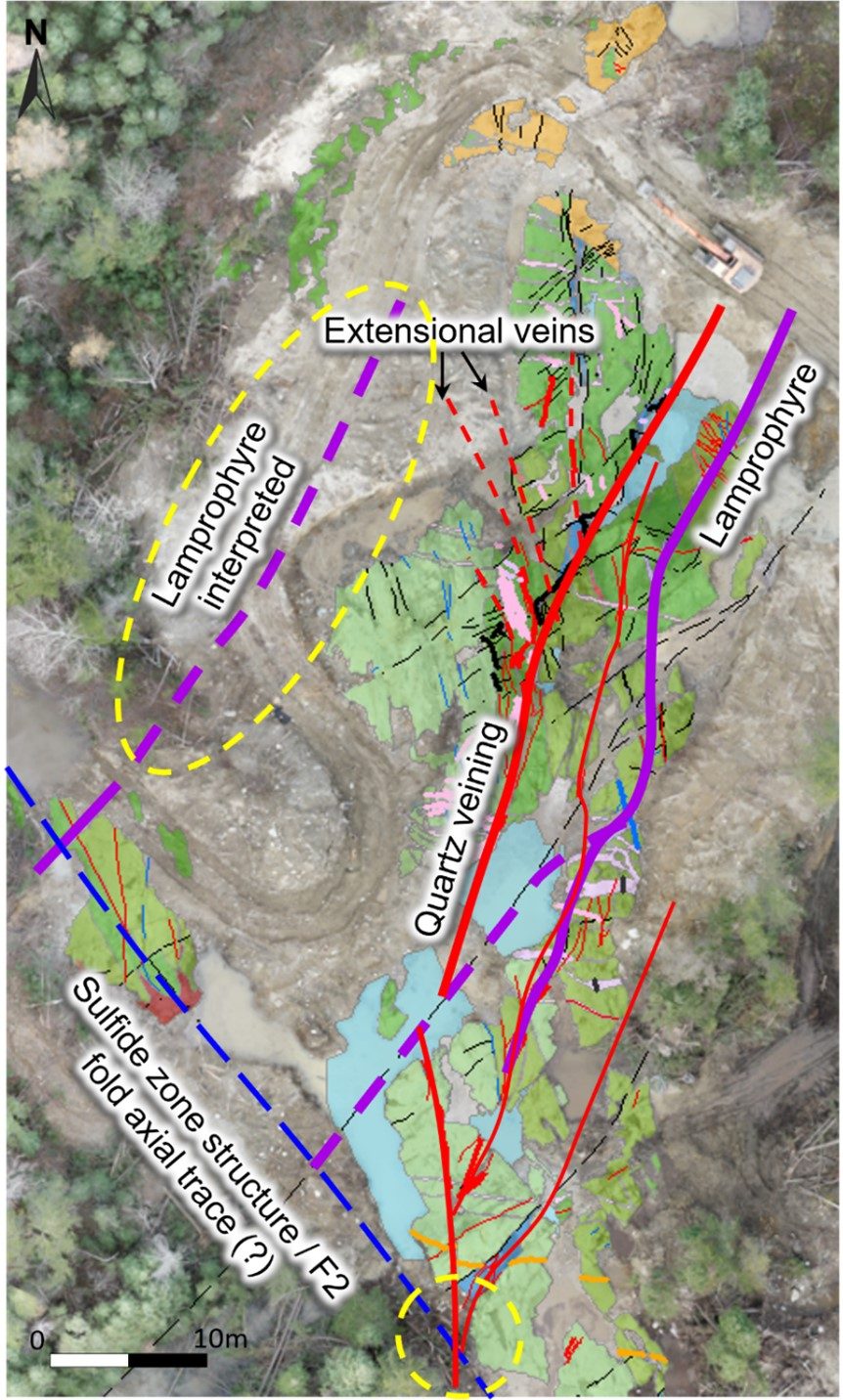

Trench 12 Observations from Structural Mapping

- A NNE to NE-striking shear-breccia veining system occurs in the foot-wall of the main fault zone with a close spatial relationship with the NNE-striking lamprophyre dyke.

- A similar NE-striking lamprophyre dyke was mapped at the western corner of the sulfide trench that can be interpreted towards the NE at the western parts of trench 12 where there is no exposure. There is a possibility for similar parallel quartz veining at the west side of trench 12 in the hanging-wall zone that is associated spatially with an interpreted lamprophyre dyke (yellow dashed ellipsoid).

- The intersection between the southern strike of the quartz veining zone in trench 12 with the NW-striking sulfide zone might be a dilatational site that potentially enhances the mineralization (yellow dashed circle).

(Figure 2 – Lamprophyre – Quartz Veining – Sulfide Zone- Trench 12, Voyager area – Moray Project)

Next Phase of Exploration – Drill Targets Resulting from Structural Interpretation

- Trench 12 – The intersection of the extensional and shear veins should be tested by a drillhole that is collared on the western edge of the stripped area with a west-east azimuth. The drillhole should also test the potential extension of the Lamprophyre (note Figure 2 above) and potentially new shear veins.

- Trench 12 – A drillhole should be planned to test the intersection of the NW-SE sulphide zone and the southern end of the stripped area.

- Trench 12 – Consideration should also be given to testing the NE strike of the main shear vein in light of the potential proximity of the contact between the mafic volcanics and the Fiset syenite. There is an expectation of a “competency” contrast between the brittle syenite and the more ductile mafic volcanics.

- Trench 1 – The gold bearing NOR 1 vein has not been properly tested by diamond drilling. Newmont drillhole Z-80-05 (no assays disclosed) reported variably mineralized sections of mafic syenite from 71.3 to 303.9 metres which implies that there is mineralized syenite northeast of Trench 1.

William Love, Vice-President Exploration of New Break stated, “We’d like to thank CXS Canadian Exploration Services Ltd. for their excellent field work during 2022, which included stripping, expanding historical trenches, washing and channel sampling. In addition, our understanding of the geology and structure of the gold mineralization at Moray could not have been possible without the incredible work performed by the geological team at Orix Geoscience Ltd. Orix completed two drone surveys, oversaw the grab and channel sampling programs and completed all of the structural mapping and interpretation. We were also extremely fortunate in our fall program, to be assisted by Randy Salo, who previously oversaw the 2012 exploration program for SGX Resources. Randy’s knowledge of the property has been invaluable in assisting New Break advance our exploration efforts. We’d also like to thank the Government of Ontario for awarding New Break a $200,000 grant under the Ontario Junior Exploration Program, which assisted in funding our 2022 exploration program. We have taken a methodical approach to exploration at Moray to understand the geology and structure prior to drilling. With this work now completed, we plan on conducting a drilling program at Moray as soon as possible.”

About the Young-Davidson Gold Mine

Young-Davidson produced 195,000 ounces of gold in 2021 and 192,200 in 2022 from processed grades of 2.15 to 2.35 g/t Au. Alamos has forecast 2023, 2024 and 2025 gold production to be 185,000 to 200,000 ounces at total cash costs of US$900 – US$950 per ounce and all in sustaining costs of US$1,175 to US$1,225 per ounce, providing annual free cash flow in excess of US$100 million, at US$1,800 gold. Mining at such a low grade underground, yet doing so extremely profitably, is entirely due to the competent nature of the syenite host rock that allows for bulk mining. As at December 31, 2021, Young-Davidson had NI 43-101 compliant Mineral Reserves of approximately 3.394 million ounces contained in 43.69 million tonnes at an average grade of 2.42 g/t Au at a gold price of US$1,250 per ounce and a cut-off grade of 1.5 g/t Au. The estimated Mineral Reserves and Mineral Resources are hosted in volcanic rocks and altered syenite, with the infrastructure at Young-Davidson developed down to 1,500 metres or 1.5 km from surface (Source of statistics: Alamos website at www.alamosgold.com).

Quality Assurance and Quality Control (QA/QC)

Samples collected in the 2022 channel and grab sampling program were delivered to ALS Global (“ALS”) in Timmins, Ontario for preparation and were assayed for gold by ALS Global in Vancouver, British Columbia.

New Break implemented a strict QA/QC protocol in processing all channel and grab samples collected from the Moray property to ensure best practice in the sampling and analysis of the surface samples. Channel sample lines were located and measured perpendicular to shear vein trends and marked at 1.0 metre to 1.5 metre intervals. Blanks and certified standards were inserted into the channel sample stream at batch intervals of 10 assay tags. Final GPS control of the sample lines was determined from drone imagery. The 20th sample in the grab sample sequence was either a blank or a certified standard.

All channel rock samples were put in sturdy plastic bags, tagged, and sealed in the field by CXS personnel under the supervision of Orix professional geologists and Peter C. Hubacheck P. Geo. and QP. The channel sample bags were then put in rice pouches before being transported by CXS personnel to their secure facility in Larder Lake. The grab samples were collected by Orix professional geologists and transported in rice pouches to the ALS preparation lab in Timmins. The channel samples were transported by truck by CXS to ALS at their Timmins, Ontario facility for sample preparation where the samples were crushed to better than 70% passing 2mm, 1kg riffle split and pulverized to 85% passing 75 microns. Pulps were forwarded to ALS Global in Vancouver, British Columbia for analyses. The program collected samples for both gold and base metal multi-element analysis. Gold analyses are obtained via industry standard fire assay with ICP finish using 30 g aliquots. For samples returning greater than 10.0 g/t, gold follow-up fire assay analysis with a gravimetric finish is completed. Based on initial fire assay gold indications as well as visual indication of mineralization and alteration, intervals are selected for re-assay by the screen metallic fire assay method. Base metal samples were analyzed for 48 trace and major elements by ICP-MS following a four-acid digestion. ALS Global are ISO/IEC 17025:2017 accredited (Lab No. 579) for the preparation and analyses performed on the New Break samples.

Qualified Person

Peter C. Hubacheck, P. Geo., consulting geologist to New Break, and a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical disclosure in this news release.

About New Break Resources Ltd.

New Break is a Canadian mineral exploration company with a dual vision for value creation. In northern Ontario, New Break is focused on its Moray Project, in a well-established mining camp, within proximity to existing infrastructure, while at the same time, through our prospective land holdings in Nunavut, we provide our shareholders with significant exposure to the vast potential for exploration success in one of the most up and coming regions in Canada for gold exploration and production. New Break is supported by a highly experienced team of mining professionals committed to placing a premium on Environmental, Social and Corporate Governance. Information on New Break is available under the Company’s profile on SEDAR at www.sedar.com and on the Company’s website at www.newbreakresources.ca. New Break began trading on the Canadian Securities Exchange (www.thecse.com) on September 7, 2022 under the symbol CSE: NBRK.

For further information on New Break, please visit www.newbreakresources.ca or contact:

Michael Farrant, President and Chief Executive Officer

Tel: 416-278-4149

E-mail: mfarrant@newbreakresources.ca

And follow us on Twitter, LinkedIn and Facebook

Appendix I

Table 1: New Break Grab Sampling Program Assays – Trench 12, Voyager Area

(July to October 2022)

Overall, a total of 21 grab samples were taken by New Break in 2022 at Trench 12, with the following 18 samples grading 1.0 g/t Au or higher:

The gold value of the other three samples were 0.053, 0.945 and 0.899 g/t Au.

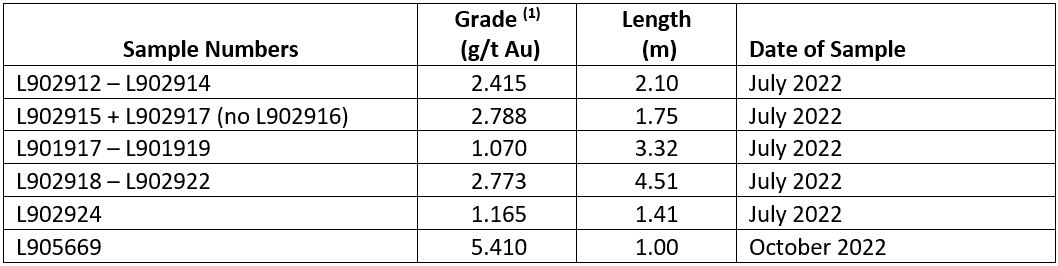

Table 2: New Break Channel Sampling Program Assays – Trench 12, Voyager Area

(July to October 2022)

Overall, 12 channel samples were taken at Trench 12, with the following 6 samples grading 1.0 g/t Au or higher:

¹ Weighted average grade over entire length from individual samples.

Appendix II

Table 3: SGX Resources Ltd. – Historical Grab Sampling Program Assays – Trench 12, Voyager Area (2012)

Overall, a total of 30 historical grab samples were taken by SGX in 2012 at Trench 12, with the following 17 samples grading 1.0 g/t Au or higher:

No stock exchange, regulation securities provider, securities commission or other regulatory authority has approved or disapproved the information contained in this news release.

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to receipt of regulatory and stock exchange approvals, grants of equity-based compensation, renouncement of flow-through exploration expenses, property agreements, timing and content of upcoming work programs, geological interpretations, receipt of property titles, an inability to predict and counteract the effects global events on the business of the Company, including but not limited to the effects on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains etc. Forward-looking information addresses future events and conditions and therefore involves inherent risks and uncertainties, including factors beyond the Company’s control. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to update publicly or otherwise any forward-looking information, except as may be required by law. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s financial statements and management’s discussion and analysis (the “Filings”), such Filings available upon request.