New Mines from Old Mines

Dusting off old past-producing mines can be a profitable business strategy

By Alf Stewart

Many of British Columbia’s operating mines are built on the foundation of previous mines, which were shut down for a variety of reasons. Presented here are three currently operating mines that were shut down by their former owners but have received new lives under new management.

In all three of these cases, it is smaller entrepreneurial companies which seized the opportunity to revive the mines, and at the present, are all profitable operations contributing significantly to B.C.’s economy and employment opportunities.

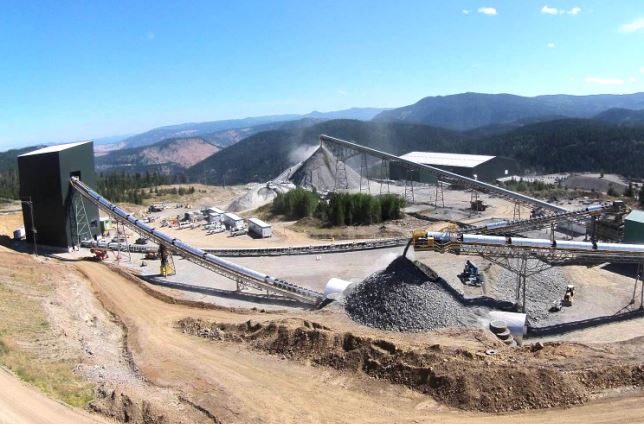

Copper Mountain Mine, Copper Mountain Mining Corporation

This is a primarily an open pit, truck and shovel copper mine with by-products of gold and silver located 20 kilometres south of the town of Princeton, southwest British Columbia, and 300 km east of the port of Vancouver. It has a long and storied history, commencing operations as an underground mine in 1923, then as an open pit mine from 1979 to 1993. The mine historically consisted of two deposits on either side of the Similkameen River, the Copper Mountain main pit and Ingerbelle pit.

It had an extended shut down in the late 1990s before a re-engineering and redevelopment by its current owner, Copper Mountain Mining Corporation [CMMC-TSX; CPPMF-OTC; C6C-ASX]. The mine was re-started in 2011.

It currently processes 40,000 tonnes of ore per day with a 45,000 tonnes per day expansion currently underway. The mine annually produces approximately 90 million pounds of copper, 30,000 ounces of gold and 500,000 ounces of silver. The mine employs around 500 people.

Gibraltar Mine, Taseko Mines Limited

The Gibraltar Mine is located 65 km north of Williams Lake in the Cariboo region of British Columbia. It was originally established as a mine by Placer Development Corp in 1972 and operated by that company until 1993, when it was shut down due low copper prices. It was then sold to Boliden AB as Placer shifted its focus to gold mining. Boliden operated the mine from 1994 to 1999 when it was again shut down.

At that point, Taseko Mines Limited [TKO-TSX, LSE; TGB-NYSE American] stepped in and bought the mine, and re-established production at Gibraltar in 2004. In 2010, Taseko sold a 25% interest to a Japanese consortium comprising Sojitz, Dowa & Furukawa.

Russ Hallbauer, CEO of Taseko, said, “I joined Taseko in 2005, shortly after Gibraltar was restarted. I recognized the potential value of that asset but to unlock that value we needed to prove out additional reserves to increase the mine life to at least 15 years. We were able to do that with some additional drilling and resource conversion. The longer mine life then justified spending the capital to expand and modernize the concentrator, as well as replace the mining fleet.”

From 2006 until 2012, the company invested ~$700 million to expand and modernize the operation which was originally scheduled for demolition when the company acquired it in 1999. The Life-of-Mine average annual production is 140 million lbs of copper and 2.6 million lbs of molybdenum (100% basis). The operation employs approximately 700 people and is the second largest open pit copper mine in Canada and the fourth largest in North America.

New Afton Mine, New Gold Inc.

New Afton is an underground mine on the site of a former Afton open pit mine 10 km west of Kamloops British Columbia, currently operated by New Gold Inc. [NGD-TSX, NYSE American]. It processes 13 thousand tonnes of ore per day from underground mining. It produces 87 million pounds of copper annually and 98 thousand ounces of gold.

The revived operations at the New Afton Mine represent an engineering innovation because the company employs a block caving extraction technique which allows relatively low cost mining relative to underground mining techniques.

Previous operations at the old Afton mine were conducted by conventional surface open pit extraction methods. The limiting factor with open pit mining is the strip ratio. As open pits mine deeper, more barren waste rock must be stripped from the flanks of the ore body to maintain safely sloping pit walls.

As the pits go deeper, this waste rock stripping volume of rock increases relative to the amount or ore that can be extracted, ultimately limiting the depth that the mine can go using surface methods.

New Gold was able to restructure the extraction technique with bulk tonnage underground mining technology

What can we learn from these three examples of new companies bringing new life from old mines?

Firstly, it is often the case that when mines are shut down the ore is not exhausted, but rather that commodity prices are weak. It is interesting that all three of these mines were shut down in the 1990s but are profitable now.

Secondly, it is apparent that new companies can bring new approaches to known mines, and it clear that smaller companies are entrepreneurial, as demonstrated by these three examples, although there are other examples to be found in other parts of Canada and in the United States.