New Pacific Metals: The discovery of Bolivia’s most promising new silver deposit

Dr. Feng and Mr. Salman standing in front of New Pacific’s Silver Sand Project.

When New Pacific Metals CEO Dr. Rui Feng and his long-time friend, Terry Salman, walked through the rolling hills of southwest Bolivia in 2017, they could see both the past and the future of the central South American country. For Terry, it was his first time visiting the county, having heard ancient Incan tales of a mountain made of silver, and silver deposits laying on the ground. But then he saw the evidence firsthand – a collection of ramshackle bricks-and-mortar buildings dating back to the mid-1500s at the base of a hill.

Salman, who has been chairman of the board since 2022, is a superstar in the mining industry, having raised more than $20 billion for more than 400 mining and exploration companies. Having visited Bolivia at the request of Dr. Feng, the memory of walking through the pastoral setting evokes a smile.

“There was one building that was in better shape and still had a roof on it,” recalls Salman. “I said ‘What’s that?’ And they said it was the bank. They made coins there.”

The coins were made from the silver found on site. An impressed Salman agreed to help finance exploration of the area with Vancouver-based New Pacific Metals Corp (TSX: NUAG | NYSE-A: NEWP). He is such a believer in the project that he has now become chairman of the company’s board of directors.

“Silver Sand (the company’s flagship project) has grown to be one of the top 10 pre-development assets in the world,” Salman says.

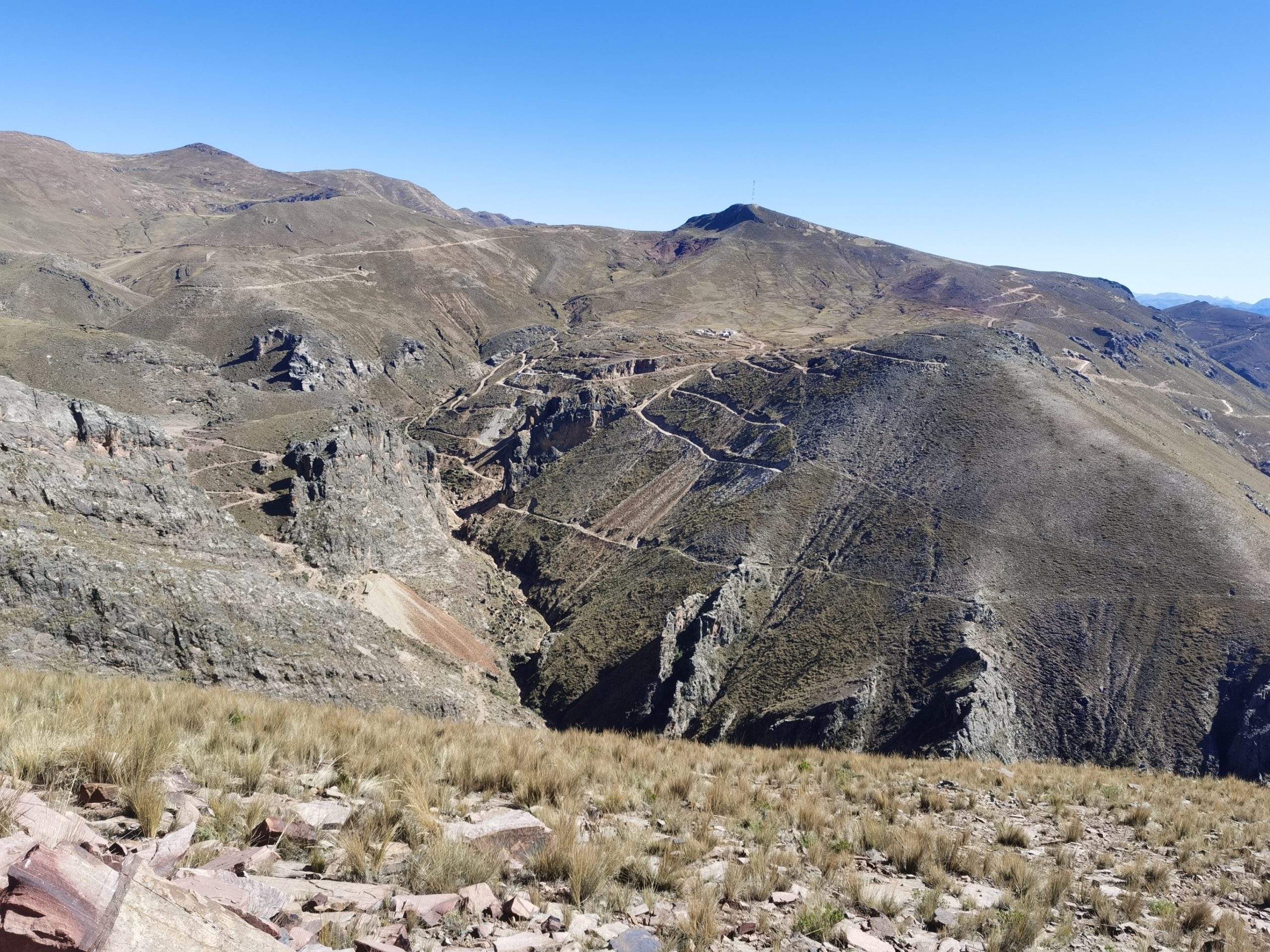

Silver Sand is part of a freakish geological area, with high-grade silver very close to the surface. It is part of a large swath of silver-rich land. Just 33 kilometres away is a silver deposit called Cerro Rico, which has been mined continuously for centuries.

“It was the biggest silver mine in the history of the world, it financed the Spanish empire, and it’s there to this day. It has been producing for 500 years,” says Andrew Williams, President of New Pacific Metals.

Thanks to that rich heritage, mining is a huge part of Bolivian culture. In the town near Cerro Rico, there is a local parade every year in which the children dress up in miners’ caps and belts, with fake sticks of dynamite in their pockets. That acceptance of mining as a pillar of the community helps ensure productive negotiations with the Bolivian government. New Pacific now has an administrative mining contract, which grants the company the right to mine, subject to receipt of its environmental permits.

Since New Pacific started in 2017, the company has spent $47 million dollars on exploration, drilling 551 exploratory holes. The result? A project generating a post-tax net present value of US$726 million with 171 million ounces of payable silver to be produced through an open-pit mine over 14 years, as calculated by the preliminary economic assessment (PEA) delivered in January of this year.

One of the central objectives for New Pacific is to work collaboratively with the local communities and establish strong ties. Williams says the company is building relationships with these communities by engaging in open and transparent communication about the project and contributing to local infrastructure and programs. These relationship-building efforts are central to New Pacific’s vision to build a sustainable, modern mining operation that contributes positively to the local communities and environment and is a source of pride for Bolivians.

New Pacific understands that some investors may look at Bolivia and see a South American country with a history of political turmoil.

“With these countries, you go through periods of turmoil, and then the dust settles,” Williams says. “And then you make an assessment of whether you can operate there or not. New Pacific is confident that it can.”

Salman agrees, adding “This is a good story. I think there’s a good source of tax revenue and other types of revenue for the people of this country. I met with our team, and I was pretty bullish to start building and producing because it will mean a lot of jobs. It will mean a good source of income, and it will also open up the country to other mining investments because once success happens, other people enter the area.”

Salman was recently awarded the Order of Canada in part for his extensive philanthropy. He points out the definition of philanthropy is improving mankind. And that is another reason he believes in New Pacific’s work in Bolivia.

“It’s a great story because Silver Sand will improve the community through the jobs, the income, and through the ideas that develop out of this. Bolivia needs the income; they need the development to help their people.”

And the future demands silver, which is one of the most essential minerals for the expanding green energy sector. Take solar panels, for example. They look black because of the silicon wafers, but if you zoom in, there are little wires running across that collect the electrons that start moving once the sun hits them. Those wires are made of silver – the best electrical conductor of any element.

Then there is the demand for silver from the burgeoning electronics industry in general. Your cellphone has a tenth of a gram of silver in it, and there are billions of them around the world. Silver is arguably the most desirable metal being mined today.

Williams recounts an experience he had at a recent gold conference in Zurich, where he asked someone from the World Gold Council what challenges the gold industry is facing.

“He said the biggest one is trying to convince people of the social value of gold mines because, for the most part, you end up just digging the rock out of the earth and processing it, just so you can turn it into a bar and put it in a vault, underground again.”

Williams points out that only 8% of the demand for gold is industrial, as opposed to the 50% of silver used in industry. It is hard to argue with the idea of bringing responsible new sources of silver production online to enable the world’s decarbonization and electrification efforts.

New Pacific is not one to dismiss the value of gold though, as its neighbouring early-development Carangas project has drilling results indicating substantial silver, lead, zinc, and – you guessed it – gold.

From July 2021 to the end of 2022, the company drilled 150 holes to determine the value of the area. Every single hole intercepted silver near the surface, and holes in the Central Valley area continuously hit gold underneath the silver.

It’s a big reason that Salman and Williams believe New Pacific is a solid investment.

“In my view, there is no better time to get involved,” Salman says. “The value has not been fully realized – not even a fraction.”

Williams points out the power of the company’s finds.

“Silver Sand is a company-making asset that is rare, given its size, its scale, its pure silver content, and its high grades. And to have a second one at Carangas, we have the fundamental ingredients that any mining company needs to be successful, which is a deposit to finance, develop, and operate.”

“I don’t think there is really any other junior mining company with two projects of this quality sitting within the same jurisdiction.”

It will be a busy year for New Pacific Metals, with a mineral resource estimate expected to be released for Carangas mid-year and the completion of a preliminary economic assessment (PEA) by year-end. At Silver Sand, things are moving quickly, with a PEA already done, and permitting efforts and pre-feasibility studies underway.

“It’s a very large property and a very large resource,” Salman says. “So, what better time to get in?”

To read more information on New Pacific’s projects, please visit: www.newpacificmetals.com