Outlook 2021: Déjà vu all over again

By Rod Blake

Now would be an appropriate time to offer a perspective of the junior resource markets going into 2021. Following a COVID-19-driven crisis year such as 2020, this is no easy challenge. But after observing the market data from the past year and drawing from some 30-plus years in the brokerage business, my first and most striking observation is that I’ve seen this type of market before – and I liked it. Certainly not the initial crisis, of course, but the resulting recovery. My optimism is based on recent and repeated history.

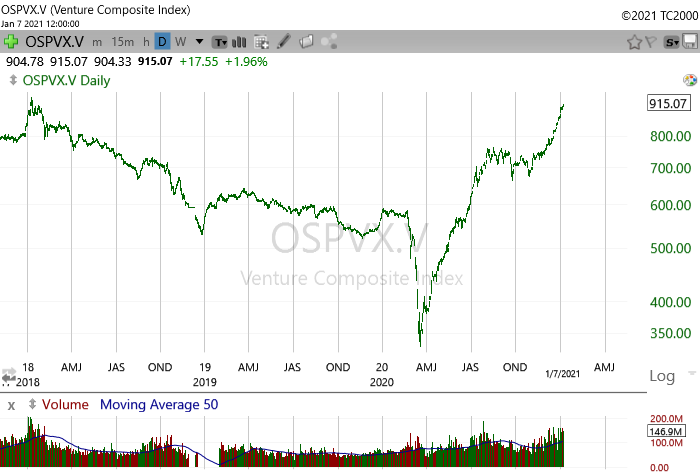

First, let’s look at last year that began with the usual sense of optimism that greets most resource markets. The Venture Exchange was at 585 and while not high by any measure, it was above the multi-year low of 530 experienced the previous November.

Resource prices were historically favourable with gold bullion at about US$1,550 an ounce, copper was about US$2.80 a pound and crude oil was over US$63 a barrel. Junior resource companies were attracting financings and were active in many camps throughout the world. All was looking pretty good – and then, as I used to warm my clients – “Bad things can happen”.

This time the bad thing was the Corona Virus outbreak in March, the resulting pandemic and economic lockdown. The net result to the junior markets saw gold fall to US$1,480/oz, copper dropped to US$2.10/lb while crude oil actually went negative by plunging to -US$38/bbl as the Venture Exchange sank to a new record low of 340. Resource activity abruptly halted as companies and investors focused on personal survival rather than on mineral development and shareholder value.

Almost immediately, the world’s central banks swiftly injected massive amounts of money into the system and dramatically lowered key interest rates to not only to stave off an economic collapse but to also encourage economic expansion and innovation.

Gradually the people of the world got used to the new reality of living with COVID-19 and the wheels of economic activity began to turn gain and, in some cases, very impressively so. As I write this in early 2021, gold bullion is US$1,915/oz, just slightly below the new record high of US$2,070/oz it achieved last August. Copper is at an eight-year high US$3.70/lb and crude oil has recovered to US$50/bbl. Meanwhile, the lowly Venture Exchange has more than doubled to 915. Remarkably, the Venture Exchange’s 51.6% net gain in 2020 outperformed even the technology weighted NASDAQ Exchange’s 2020 gain of 43.6%.

But where have I seen this before? How about the financial market meltdown or 2008-09 and the resulting economic recovery?

While not exact, the markets of Great Recession and the COVID-19 pandemic are very similar. In both cases, the junior resource markets were enjoying a sustained uptrend and resource stocks were well financed and fairly valued.

Then suddenly events unrelated to the recourse industry pulled the rug out from under these markets and their share prices plunged with the rest of the financial and commodity markets. Then, just as now, central banks injected massive amounts of money into their economies and dropped their key interest rates. It is generally agreed that the massive amounts of economic stimulus along with the drop in interest rates contributed significantly to the resulting rise in resource prices and renewed interest in resource issues. And in both scenarios the resource markets and their underlying commodities not only recovered but actually outperformed the broad markets.

In the Great Recession crisis, the TSX Venture cratered from a lofty 3,400 to just 700 as gold bullion dropped from US$1,000 to US$730/oz, copper plunged to just US$1.30/lb and crude oil fell to only US$36/bbl. The resulting recovery in resource prices and resource stocks lasted two-years.

During that time gold climbed to a then record high of US$1,900/oz. Copper rose to a record high of US$4.60/lb and crude oil rose to US$114/bbl. Meanwhile, the Venture Exchange gained more than 300% over the next two years to peak in 2011 at over 2,400. The recovery from the COVID-19 crisis has not reached a year.

The first quarter of the year is generally favourable to resource stocks as new money and optimism enters this market at this time. The real test will be as we enter the second quarter and beyond. So far, the recovery looks very similar to that of the financial crisis. If the gains to date hold and history repeats itself, then this rally in resource prices and the resource markets should last for at least another year. The main variation this time is that the amount of central bank stimulus was far greater that in 2008 and there may be more to come. If the markets react to this new stimulus in a proportionate manner then the length and magnitude of this recovery could be far greater.

As noted above, I’ve seen this market before. I liked it then and I like it even more now.