Precious Metals sell-off not expected to seriously impact copper prices; demand to ramp up

By David Duval

The recent sell-off in the precious metal market has only marginally impacted copper which has been on a virtual tear in 2021. LME prices ranged from a low of $2.09/lb during the initial stages of the COVID-19 pandemic in March 2020 to a high of $3.61/lb in December 2020. All figures in US$. Since then, prices have traded as high as $4.30 and potentially could go higher as global economic activity rebounds following the inevitable end of the Covid-19 pandemic.

Government-mandated lockdowns negatively impacted supply and demand for copper, with many mines around the world forced to temporarily suspend operations. These shutdowns were particularly acute in Chile and Peru, leading to an estimated production loss of over 500,000 tonnes of copper concentrate.

Global mine output in the first 10 months of 2020 was estimated to be 0.5% lower than 2019 levels, according to the International Copper Study Group (ICSG). What was supposed to be a year of mined supply growth turned out to be the second consecutive year of zero growth.

According to Thomson Reuters, “treatment and refining charges, which are what a smelter levies for processing copper concentrates into refined metal, are the best indicator of what is going on in the opaque raw materials market.”

“And the message is clear. There’s not enough concentrate to go around. The benchmark terms for this year’s shipments fell to $59.50 per tonne and 5.95 cents per pound from what was already a lowball $62.00 and 6.2 cents in 2019. They haven’t been this low since 2011, another year of mine supply stress, when they were settled at $56.00 and 5.6 cents.”

It’s worth noting that when copper smelter terms were previously at such low levels, the copper price was at record highs.

Scrap copper supplies, which typically account for 16% of annual refined copper production, fell by approximately 980,000 tonnes. However, purchases of copper for China’s strategic stockpile, coupled with an unexpectedly robust recovery in fundamental demand in China in the second half of 2020, brought the market into relative balance, supporting a strong price recovery in the second half of the year.

Nonetheless, the outlook for global refined copper markets and copper prices in 2021 is considered to be mixed due to the continued threat of interruptions to both copper supply and demand posed by the ongoing COVID-19 pandemic. What is reasonably certain is the fact the economic disruption caused by the pandemic has prompted governments around the world to commit to massive spending on a wide variety of “green” recovery plan – all of which involve copper-intensive technologies.

Over the next decade, the world economy is expected to move towards renewable energy sources (wind, hydro, solar), carbon neutrality and the adoption of electric vehicles, which is projected to drive significant additional demand for copper.

Strong future demand for copper will necessitate the development of new mines from the world’s existing inventory of undeveloped deposits which are inherently higher cost than existing producers due to lower grades, higher strip ratios and higher development costs. Analysts foresee that bringing on higher cost mines to meet increasing demand, in conjunction with the long timelines associated with permitting and obtaining social license for new greenfield mines, leading to a prolonged period of higher copper prices.

According to CRU Copper, a commodities research group, “For the major mining companies in particular this presents a conundrum: invest now in an attempt to maximize future cash flows while risking the ire of short-term focused shareholders or wait until the copper price recovers but then potentially miss out on the most lucrative years of the next upturn.”

“The concern is that if growth in supply does not keep pace with demand, rising prices will encourage the use of other materials in place of a more expensive copper. In the 2020s and beyond, copper needs to remain competitive, or it will become a higher value but much smaller industry with significantly reduced capacity. This is the competitiveness challenge.”

The potential growth in electric vehicles (EVs) as justification for immediate higher copper prices has been recognized for years. However, CRU estimates that EVs will not meaningfully affect global copper demand until the mid-2020s. It’s worth noting that full battery electric vehicles consume four times as much copper as an internal combustion engine vehicle and the associated infrastructure requirements (chargers and grid storage and infrastructure) are also copper intensive.

CRU expects that once an inflexion point in EV sales is reached, “subsequent growth rates are likely to be spectacular, taking related copper demand to 2.8 Mt in 2030 and over 5 Mt in 2035”. Fifty percent of growth in EV-related copper demand is expected to occur over the next 15 to 20 years, making it a critical component in demand outlook. Copper will also benefit from fiscal stimulus packages applied across the globe, particularly in China, where industries such as infrastructure and construction are typically favored to stimulate the economy, CRU emphasizes.

Consolidated Woodjam Copper Corp. [WCC-TSXV] may never experience a better time to be developing new copper and gold resources in British Columbia.

The company finds itself in that favourable situation after the price of copper recently surged to a 10-year high above US$4 per pound after staging a remarkable recovery from pandemic lows. There are plenty of analysts who say that copper and gold could be headed even higher in the near future.

Trading at $0.135 cents in a 52-week range of 30 cents and $0.015 (on March 30, 2021), Consolidated Woodjam shares offer investors a low-risk window on this scenario in what could be an exciting year for the company and its experienced management.

President and CEO Bill Morton has been a geologist for 35 years, CFO David Douglas with over 30 years in corporate finance and accounting and VP Exploration Glen Garratt with 45 years as an exploration geologist make up the management team. Each of the three hold identical management positions at Eastfield Resources Ltd. [ETF-TSXV, ETFLF-USOTC, 35E-FSE], which owns a 9.5% interest in Consolidated Woodjam. Another key shareholder is Gold Fields Ltd. of South Africa with 13.3%.

The company’s flagship Woodjam copper-gold-molybdenum property covers 64,088 hectares and is located in the Cariboo region of south-central B.C., about 50 kilometres east of Williams Lake. That puts it in an area that is prolific with copper gold mineralization, about 49 kilometres south of Imperial Metals Corp.’s [III-TSX] Mount Polley mine and 60 kilometres south of Taseko Mines Ltd.’s [TKO-TSX] Gibraltar mine.

The company’s flagship Woodjam copper-gold-molybdenum property covers 64,088 hectares and is located in the Cariboo region of south-central B.C., about 50 kilometres east of Williams Lake. That puts it in an area that is prolific with copper gold mineralization, about 49 kilometres south of Imperial Metals Corp.’s [III-TSX] Mount Polley mine and 60 kilometres south of Taseko Mines Ltd.’s [TKO-TSX] Gibraltar mine.

The project is located within the prolific Quesnel Trough, which extends for at least 1,500 kilometres northward from the U.S. border and contains the Copper Mountain, New Afton, Highland Valley Copper, Mount Polley, Mount Milligan and Kemess mines.

Exploration dates back to 1974. Since then, the project has been explored by a number of companies, including Placer Dome and Noranda, and Phelps Dodge Corp. of Canada Ltd. Gold Fields invested about $30 million in exploration before exchanging its interest in the property for shares in Consolidated Woodjam in 2015

So far, six zones of porphyry mineralization (Megabuck, Deerhorn, Takom, Three Firs, Southeast, Megaton) have been identified by Woodjam via drilling (95,092 metres in 281 holes since 2009).

These six mineralized zones host a large resource of 2.31 billion pounds of copper equivalent at 0.40% copper equivalent and form a cluster approximately 5.0 kilometres in diameter. A seventh zone was found north of the cluster.

These six mineralized zones host a large resource of 2.31 billion pounds of copper equivalent at 0.40% copper equivalent and form a cluster approximately 5.0 kilometres in diameter. A seventh zone was found north of the cluster.

Four of the zones are located in the Woodjam North area. The Woodjam South area contains the Southeast Zone, a porphyry copper-gold molybdenum discovery with significant size potential, and Three Firs.

The Southeast Zone is estimated to contain a National Instrument 43-101-compliant inferred resource of 221.7 million tonnes grading 0.31% copper or 1.51 billion pounds of copper, and 383,700 ounces of gold. In 2020, drilling has focused on the Deerhorn Zone, which ranks as the largest of the four gold-enriched satellite deposits related to the Southeast Zone.

Deerhorn is estimated to contain an inferred resource of 32.8 million tonnes, grading 0.49 g/t gold and 0.22% copper, containing 516,200 ounces of gold. On November 10, 2020, Woodjam issued a press release stating that drilling at Deerhorn had returned 110 metres of 2.57 g/t gold, including 26 metres of 5.89 g/t gold in drill hole DH-20-71.

Drilling in 2020 was designed to test continuity at depth in the steeply-dipping system with an interpreted feeder zone of the higher-grade portion of the deposit. However, work was suspended late last year due to high rainfall and flooding.

The next phase of exploration is scheduled to start in April with an initial budget of $1.5 million. Work will be divided between the gold-rich Deerhorn Zone and the Megaton target which is on strike in the same IP anomaly that covers the copper-rich Southeast Zone. The company has said it expects to drill seven to 10 drill holes (each averaging 500 metres) totaling 4,000 to 6,000 metres. These programs will be designed to test both the depth and lateral extensions of those deposits.

On December 30, 2020, the company said it had closed a non-brokered private placement. The offering consisted of the sale of 5.78 million flow-through shares at 23 cents per share, that raised $1.33 million as well as 3.23 million units priced at 20 cents each that raised $646,500. Each unit consisted of one common share and one share purchase warrant, with each warrant entitling the holder to purchase one additional common share at 30 cents until June 30, 2022.

The private placement added $1.9 million to the treasury. But it is likely that the company may elect to do another financing to expand the program.

GSP Resource Corp. [GSPR-TSXV; OYD-FSE] is a southwest British Columbia-focused exploration company that is working to prove once again that the best place to find a new mine is in the vicinity of an existing one.

GSP Resource Corp. [GSPR-TSXV; OYD-FSE] is a southwest British Columbia-focused exploration company that is working to prove once again that the best place to find a new mine is in the vicinity of an existing one.

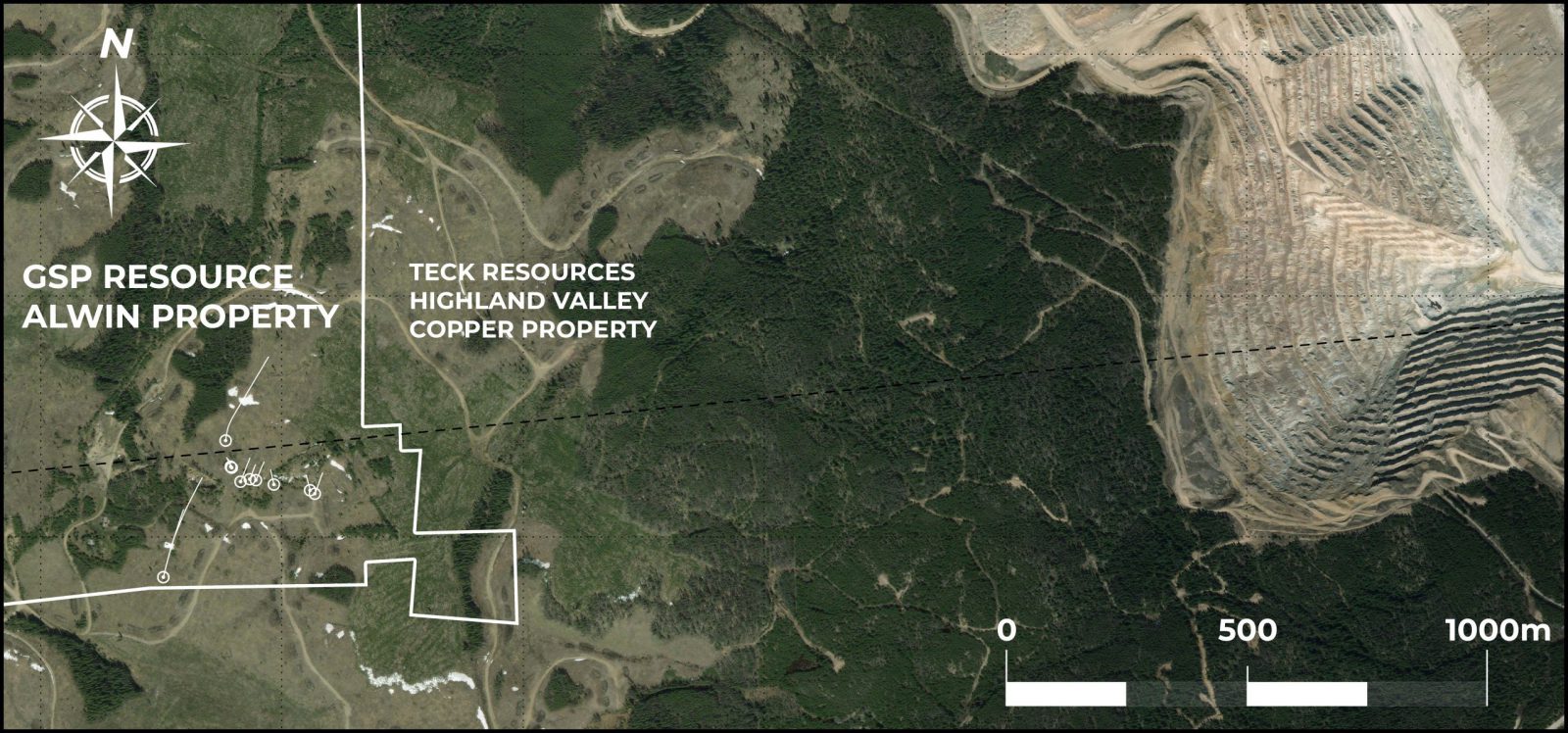

It GSP’s case, the company is hoping that its Alwin property, optioned last year from B.C. prospectors Dick Billingsley and Gaye Richards, will attract the attention of Teck Resources Ltd. [TECK.B-TSX; TECK.A-TSX; TECK-NYSE], which has increasingly been mining low grade ore at its adjacent Highland Valley copper mine.

Any sign of success would likely garner investor interest, especially with the price of copper trading north of US$4 a pound, and expected to go higher.

Highland Valley Copper is the largest open-pit copper-molybdenum mine in western Canada. The mine was expected to close in 2028. But Teck recently applied to extend its lifespan to 2040.

In January 2020, GSP announced that it has signed an option to acquire a 100% interest in the Alwin copper-gold-silver project, which covers 575.72 hectares and is adjacent to the western boundary of the Highland Valley Mine. Alteration and mineralization of the Highland Valley hydrothermal system extends westward from Highland Valley onto the Alwin property, GSP has said.

GSP can exercise the option by making $250,000 in cash payments, delivering 4.5 million shares to the vendors who will continue to holds a 1.8% gross smelter return royalty (GSR) on the property. However, GSP can repurchase 0.8% of the royalty for $1.5 million.

On March 15, 2021, GSP shares were trading at 31 cents in a 52-week range of 67 cents and $0.08, leaving the company with a market cap of $5.7 million based on 18.5 million shares outstanding.

The Alwin property hosts a past-producing underground copper mine and includes a 270-metre below surface development decline and about 2,600 metres of underground tunnels. A previous operator outlined a historical (non-NI-43-101-compliant) resource around the mine workings of 390,000 tonnes grading 2.5% copper. But due to low copper prices, the mine was shut down before any of those historic resources were extracted.

The Alwin property hosts a past-producing underground copper mine and includes a 270-metre below surface development decline and about 2,600 metres of underground tunnels. A previous operator outlined a historical (non-NI-43-101-compliant) resource around the mine workings of 390,000 tonnes grading 2.5% copper. But due to low copper prices, the mine was shut down before any of those historic resources were extracted.

GSP is headed by CEO Simon Dyakowski, a CFA charterholder and former investment adviser. His father Chris Dyakowski, GSP’s Chairman and director, ran San Marco Resources which explored the Alwin property between 2005 and 2008. San Marco drilled five shallow holes into the main mineralized trend near the eastern part of the mine workings. Three more holes tested IP (induced polarization) anomalies north and northwest of the mine.

GSP wants to examine the possibility of an open-pit mine being developed on the property by targeting higher-grade mineralization around the #4 Zone, as well as lower-grade porphyry-style mineralization to the north.

GSP wants to examine the possibility of an open-pit mine being developed on the property by targeting higher-grade mineralization around the #4 Zone, as well as lower-grade porphyry-style mineralization to the north.

If GSP can prove up a near-surface, high-grade copper deposit and/or the existence of a copper porphyry system at Alwin, the company could become a target for Teck.

The company could also look at custom milling arrangements with nearby mills such as Craigmont and Afton, which have spare capacity. Billingsley has said Alwin ore could be used as a high-grade feedstock mixed with lower-grade ore that Teck is currently mining at Highland Valley copper.

On March 2, 2020 GSP announced the final diamond drilling results from the Phase 1, 2020 program comprised of 2,000 metres of drilling. The program was expanded to test targets north and south of initial shallow targets near the Alwin Mine #4 Zone. Highlights included a deep medium-grade bulk tonnage intersection of 0.313% copper equivalent over 61.7 metres under the partially mined #6 and #3 zones in hole AM20-10E.

“Initial results have confirmed the presence of shallow, high-grade copper as well as its potential for bulk tonnage mineralization,” Simon Dyakowski said in a press release.

The company said it plans to complete additional drilling at Alwin using cash on hand. It will also complete further 3-dimensional modelling to integrate recently completed drilling data into an existing Alwin Mine 3-D model.

GSP also has an option to acquire a 100% interest in and title to the Olivine Mountain property, which is located in the Similkameen Mining Division, about 25 kilometres northwest of Princeton. In a press release on November 12, 2019, GSP said it was planning a 1,000-metre inaugural drilling program to test five separate massive copper/nickel sulphide targets across the 3,021-hectare property.

GSP recently granted Full Metal Minerals Ltd. [FMM-TSXV] an option to acquire a 60% interest in the Olivine Mountain property. GSP will be the operator for exploration programs determined by Full Metal.

Solaris Resources Inc. [SLS-TSX; SLSSF-OTCQB] reported impressive assay results for three drill holes from its ongoing diamond drill program at its 100%-owned flagship Warintza Project in south-eastern Ecuador. All three holes, once again, returned long intervals of high-grade copper mineralization at least 1km deep and up to 1% CuEq, with the highest grades starting from or near surface and extending mineralization well beyond historical drilling.

Solaris Resources Inc. [SLS-TSX; SLSSF-OTCQB] reported impressive assay results for three drill holes from its ongoing diamond drill program at its 100%-owned flagship Warintza Project in south-eastern Ecuador. All three holes, once again, returned long intervals of high-grade copper mineralization at least 1km deep and up to 1% CuEq, with the highest grades starting from or near surface and extending mineralization well beyond historical drilling.

Warintza is presently defined by a pit-optimized 2019 Mineral Resource estimate of 124 Million tonnes of Inferred Resources grading 0.70% CuEq (0.56% Cu, 0.03% Mo and 0.1 g/t Au) based on historic drilling totaling less than 7,000 metres and averaging less than 200 meres in depth. The resource is open laterally and at depth, at Warintza Central alone, and is set within a 5km x 5km cluster of copper porphyries.

Warintza was discovered by David Lowell in 2000. At the time, Ecuador was a frontier jurisdiction with no commercial mining industry. Things began to change in 2014 when the government shifted its policy in the wake of the collapse of the oil sector to encourage mineral development. The change was fuelled by Lundin Gold acquiring the Fruta del Norte project, 45 km south of Warintza, and developing it in a socially and environmentally responsible manner. This improved sentiment toward mining development and created conditions for Solaris to successfully restart a dialogue with the communities surrounding its Warintza Project in 2018.

With support of local communities, Solaris resumed exploration at Warintza in early 2020 and has been conducting a 40,000-metre drill program at Warintza Central designed to pick up where David Lowell left off. This is the first drill program completed in over 20 years with recent drilling demonstrating the massive potential of this extensive, but largely un-tested porphyry system.

With support of local communities, Solaris resumed exploration at Warintza in early 2020 and has been conducting a 40,000-metre drill program at Warintza Central designed to pick up where David Lowell left off. This is the first drill program completed in over 20 years with recent drilling demonstrating the massive potential of this extensive, but largely un-tested porphyry system.

Last month Solaris announced the discovery of a second significant copper porphyry deposit at Warintza West, located 1km west of Warintza Central. In addition, geophysical survey results revealed a continuous high-conductivity anomaly covering Warintza West, Warintza Central and Warintza East measuring ~3.5km x 1 km x 1 km – a volume that encompasses 10 billion tons of rock to be tested. Importantly, the Warintza West discovery interval lies adjacent to this anomaly. In addition, a separate large-scale high-conductivity anomaly at Warintza South measuring ~2.3km x 1.1km x 0.7km – a volume that encompasses an additional 5 billion tons of rock, appeared to be around three times larger than the surface geochemical footprint previously outlined. Finally, a completely new target, named Yawi, was identified to the east of Warintza East with an anomaly covering ~2.8km x 0.7km x 0.5km – a volume that encompasses 2.5 billion tons of rock.

It is expected that Warintza Central and Warintza West are just the beginning of a series of discoveries within the Warintza cluster of porphyries. Further drilling is expected to produce additional discoveries within the Warintza cluster at Warintza East and Warintza South, and possibly the new Yawi anomaly, all which have never been drilled.

It is expected that Warintza Central and Warintza West are just the beginning of a series of discoveries within the Warintza cluster of porphyries. Further drilling is expected to produce additional discoveries within the Warintza cluster at Warintza East and Warintza South, and possibly the new Yawi anomaly, all which have never been drilled.

To date, 20.2 km have been drilled at Warintza Central in 25 holes of which results have been reported for 16. Drilling is ongoing with six rigs currently operating (increasing to 12 by mid-year). Maiden drilling targeting new discoveries at Warintza East and Warintza South is expected to begin in Q2.

At Warintza Central alone, the objective of the 40-km drill program, which is half completed, is to drill test some 1.35 billion tons of rock which will form the basis of an updated resource estimate expected to be completed in Q3. Solaris is expected to deliver a Preliminary Economic Assessment (PEA) in early 2022 which will encompass a zero emissions approach to project design and environmental leadership in decarbonization, with renewable hydroelectric grid power supply, electrified transport and materials movement, and cutting-edge autonomous technologies.

The 268km² Warintza property has access to excellent infrastructure including abundant low cost hydroelectric power, ample fresh water, and road access connecting to a main highway. With recent drilling demonstrating robust grades at least 1km deep and up to 1% CuEq and open laterally for kilometres, the Warintza Project is clearly an outstanding porphyry project on its way to economic status.

Daniel Earle, President and CEO, stated that there is the potential to develop one of the largest, highest grade open pit copper projects held by an independent company.

The rise in the Solaris share price has been an ongoing realization that a large, high-grade open pit copper porphyry system has been discovered and is in the early stages of making multiple world-class discoveries among its cluster of porphyries on the Warintza property. The stock is expected to continue to re-rate higher as the company demonstrates the growth potential of the project which could see at least a five-fold increase in resources at Warintza Central alone, with significant further upside as drilling steps out to Warintza West, East, South and Yawi.

Solaris continues to receive steadfast support by its insiders (and strategics) with recent purchases from Executive Chairman, Richard Warke, who invested ~C$44M of shares in the open market in Q4/2020 and a further ~C$58M in March. The company has a portfolio of six mineral projects in the Americas assembled by the late legendary geologist, David Lowell. Solaris partnered with the Augusta Group to develop the value of its exploration assets. The Augusta Group has an unrivaled track record of value creation in the mining sector that includes over C$4.5B in exit transactions over the last decade.

A very informative view of the future of the copper industry.