Robust Ontario mining sector benefits many communities and other industries

By David Duval

Ontario ranks as Canada’s largest producer of gold, platinum group metals and nickel, and the second largest producer of copper. In 2019, the value of mineral production in Ontario was $10.7 billion, not quite 25% of the $48.2 billion for all of Canada.

Over the past decade, it also ranked first in the production of metallic minerals for eight of the 10 years, and first in the production of non-metallic minerals every year. Key metal minerals include gold, nickel, copper, and PGMs while top non-metal minerals include diamonds, salt and structural materials. The province is also one of the safest mining jurisdictions in the world and mining is one of its safest industries, achieving a 96% improvement in lost time injury frequency over the past 30 years.

With growing global demand for clean energy and other low-carbon, environmentally-friendly technologies, Ontario has positioned itself to be a reliable supplier of the raw materials that are essential to the green economy. In fact, the Ontario government is developing its first-ever Critical Minerals Strategy to help generate investment, increase the province’s competitiveness in the global market, and create jobs and opportunities in the mining sector. The strategy will also support our transition to a low-carbon economy both at home and abroad.

Much effort is being devoted to making Ontario’s mines energy efficient – the industry has a low carbon footprint, which will become smaller over time, allowing Ontario to produce some of the lowest-carbon commodities in the world. With society shifting away from fossil fuel dependence and relying on more alternative energy sources, global use of mining products will only grow.

In addition to being a key contributor to Ontario’s economy, mining is also an engine for regional development and value-added generation. Although the number fluctuates with shifting commodity prices, mining in Ontario produces revenues of around $10 billion per year. When taking into account indirect and induced benefits, the value of mineral production grows considerably. For instance, Ontario’s $10.8 billion in mineral production in 2015 almost doubles in value to $18.5 billion given its multiplier effect. Ultimately, Ontario’s mineral production, including indirect and induced impacts, provides for more than $12 billion in Canadian GDP and creates 78,800 jobs.

Mining is linked to many other industries and sectors in the economy including transportation, construction, equipment manufacturing, environmental management, geological services, education and research, among others. The industry also provides a major boost to our financial sector, largely through the Toronto Stock Exchange (TSX), the leading global mining exchange which lists more of the world’s public mining companies and raises more mining equity capital than any other exchange.

Transportation plays a key enabling role for the minerals sector, not only in delivering mineral products to markets, but also in bringing equipment and supplies to mining operations. The transportation industries benefit from a vibrant mining sector-mostly rail, as mining accounts for over half of Canada’s rail-freight tonnage annually.

The sector makes significant tax contributions to all levels of government which pay for public priorities like health care, education and infrastructure, supporting Ontarians’ standard of living. The industry offers versatile and rewarding careers and is actively working to attract an increasingly diverse workforce.

Wages in the mining industry are 67% higher than the average industrial wage in Ontario. With links to other industries and sectors in the economy (including manufacturing, engineering, education, legal services, transportation, construction, environmental management and geological surveying/analysis, among others), mining contributes an economic multiplier effect.

In some parts of the province, especially in the Far North, mineral resource development is critical to creating high-value jobs and entrepreneurial opportunities with worker health and safety always a top priority. Over the past 30 years, Ontario miners have built a robust safety culture, achieving a 96% improvement in lost-time injury frequency.

Ontario’s enviable geology provides exploration and mining opportunities across all parts of the province. As the largest private sector employer of Indigenous people, mining contributes significantly to the well-being and development of remote communities. The province hosts 18 active precious metal (gold and the platinum group of metals) mines, 11 base metal (nickel, copper, zinc) mines and ten operations producing diamonds, salt and other non-metal minerals.

Despite its many positive attributes, Ontario has high labour and energy costs which serve to limit revenue potential and dampen investment. Nonetheless, mining creates more economic value (as measured by GDP) for the energy used than most other industries in Ontario. Unlike in traditional manufacturing, mines have an extremely long timeline and large capital expenditures are needed to discover a viable ore deposit and bring it into production. So the complex regulatory environment that mining companies deal with today results in a particularly expensive and time-intensive process.

Ontario led all Canadian jurisdictions in mineral production in 2015. The province’s mineral production was valued at $10.8 billion, representing 32.9% of Canada’s metallic minerals and 19.6% of Canada’s non-metallic minerals and, more than 50% of the metal mined in Ontario is processed in Ontario. Overall, Ontario had the greatest share of mineral production in 2015, accounting for 25% of the Canadian total.2 The top four minerals by value were gold, nickel, copper and the PGMs.

Ontario’s top mineral was gold, with a value of $3.4 billion. Ontario ranks first in Canada for gold production and Canada ranks fifth in the world. Nickel was Ontario’s second mineral with a value of $1.5 billion. Ontario ranks first in Canada for nickel production and Canada ranks fourth in the world. Copper ranked third with a value of $1.3 billion. Ontario ranks second in Canada (BC is first) and Canada ranks ninth in the world. The Platinum Group of Metals (PGMs) ranked fourth with a value of $900 million, Ontario ranks first in Canada and Canada ranks third in the world.

Overall, the outlook for precious metals is more optimistic than for base metals and non-metallic minerals. This correlates with the commodity market forecast that predicts metal prices will increase by 4% in 2017, as most markets continue to rebalance.8

Ontario’s $10.8 billion in mineral production in 2015 almost doubles in value to $18.5 billion when indirect and induced benefits are accounted for (Table 31 and Figure 31). Ultimately, Ontario’s mineral production including indirect and induced impacts provides for more than $12 billion in Canadian GDP. On the employment side, total employment for the mineral sector is 78,800.

Labour makes up about 41% of the costs of a mining operation.22 An industry payroll in excess of $1.6 billion23 generates hundreds of millions of dollars annually in personal income tax revenues for government coffers. Payroll taxes such as Employer Health Tax, Workplace Safety and Insurance Board premiums, Employment Insurance and Canada Pension Plan totalled more than $138M in 2015.24 Benefits make up 13% of employee pay and they are distributed as 22% taxable and 78% non-taxable.25 In Ontario, mining and mining support activities workers consistently earned a higher average weekly wage over the period from 2001-2015, compared with workers in construction, manufacturing, motor vehicle parts manufacturing, forestry, and wood products manufacturing.

In 2015, the average weekly wage for mining workers was $1,611 and $1,815 for mining support workers, compared to $963 for the average industrial worker. The average weekly wage in Ontario mining is 67% higher than the average industrial wage in the province and has increased at twice the rate of inflation over the past decade. 26 High-value mining jobs are distributed across Ontario, with the bulk of regional distribution in the Sudbury areas (42%).

The mining workforce in Ontario is primarily between the ages of 36 and 55, male, non-unionized and non-Indigenous, and located in northeastern Ontario. Ontario mines have broadened the presence of underrepresented groups, such as women and Indigenous people, which account for 10% and 11% of the workforce respectively. However, greater representation is still needed.

Mining is the largest private-sector employer of Indigenous Canadians, accounting for about 6% of the total mining labour force, while Indigenous people account for 3% of the Canadian population.33 In Ontario, Indigenous employment accounts for 11.2% of total mining jobs – up from 9.7% in 2011.

In 2015, Ontario mining companies contributed more than $90 million to local Indigenous governments and communities.35 Many of these contributions come as part of Indigenous mining agreements that cover a range of provisions related to financial payments, employment and training programs, community and social programs, donations and/or contributions, etc.

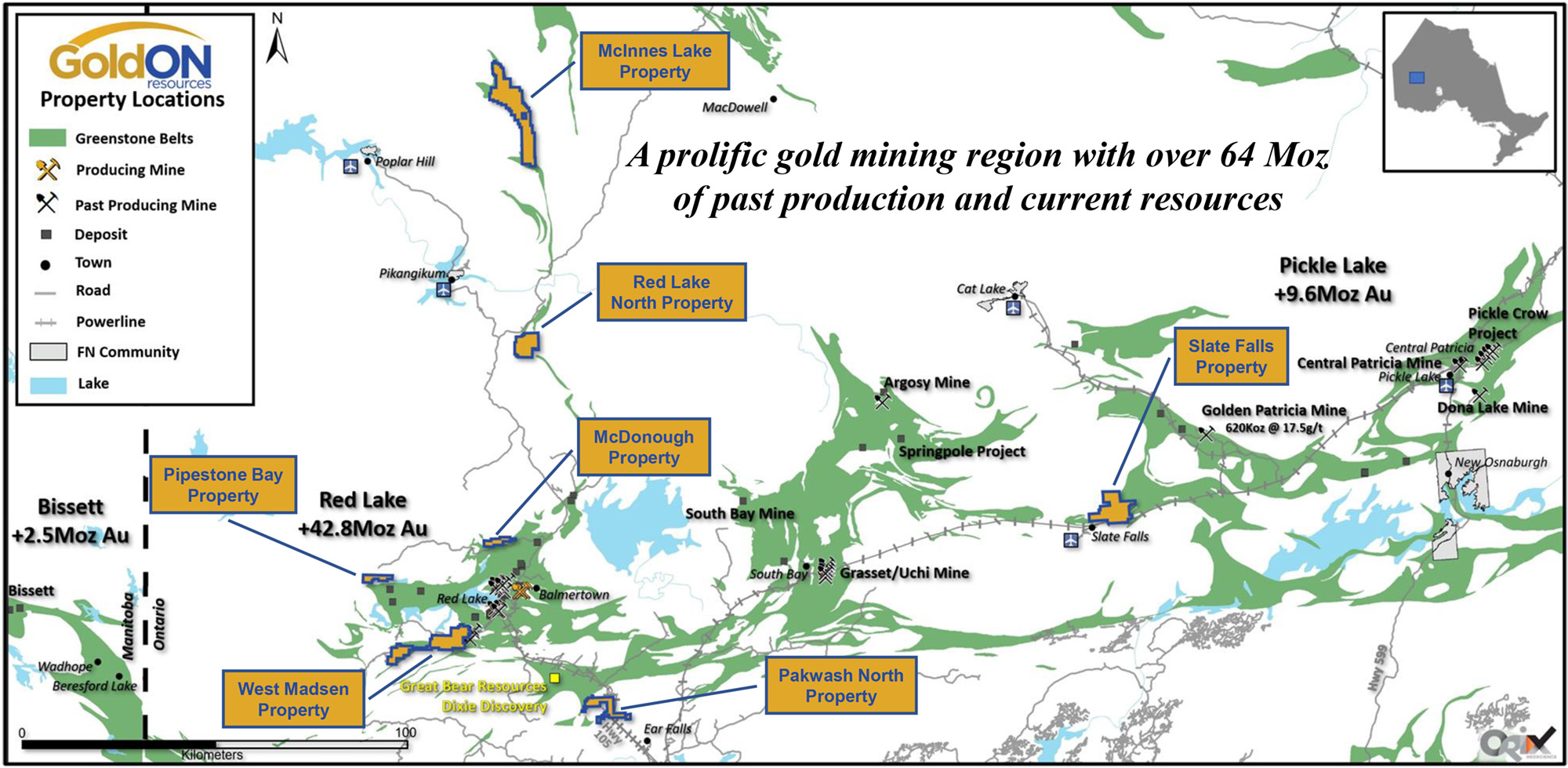

GoldON Resources Ltd. [GLD-TSXV; NCMBF-OTC; 6NR-FSE] is an exploration company with a focus on discovery stage properties in prolific mining belts in northwestern Ontario.

GoldON Resources Ltd. [GLD-TSXV; NCMBF-OTC; 6NR-FSE] is an exploration company with a focus on discovery stage properties in prolific mining belts in northwestern Ontario.

The company’s management group recognizes that while mineral exploration is a high-risk business, it has consistently been success in the discovery phase of a project’s lifespan that has created the greatest shareholder wealth in the resource sector.

“Our goal with every project is to define (or re-define) the exploration opportunity, maintain ownership control during the value creation phase of discovery, and then source a well-financed partner capable of accelerating resource definition and development,” the company has said.

It’s a strategy that is backed by some high-profile strategic investors, including billionaire financier Eric Sprott and Goldcorp founder Rob McEwen. Insiders and close associates hold 35% of the issued shares, which were trading at 32 cents on June 9, 2021, in a 52-week range of $1.14 and 27 cents leaving the company with a market cap of $7.8 million based on 24.3. million shares outstanding.

GoldON President Michael Romanik is the largest individual shareholder. He is getting strategic advice from Perry English, an accomplished prospector who is referred to as a ‘One man project generator’ and specializes in the Red Lake area.

GoldON President Michael Romanik is the largest individual shareholder. He is getting strategic advice from Perry English, an accomplished prospector who is referred to as a ‘One man project generator’ and specializes in the Red Lake area.

GoldON has a diversified portfolio of seven gold projects, all of which are located in northwestern Ontario, one of the most mining-friendly jurisdictions in Canada.

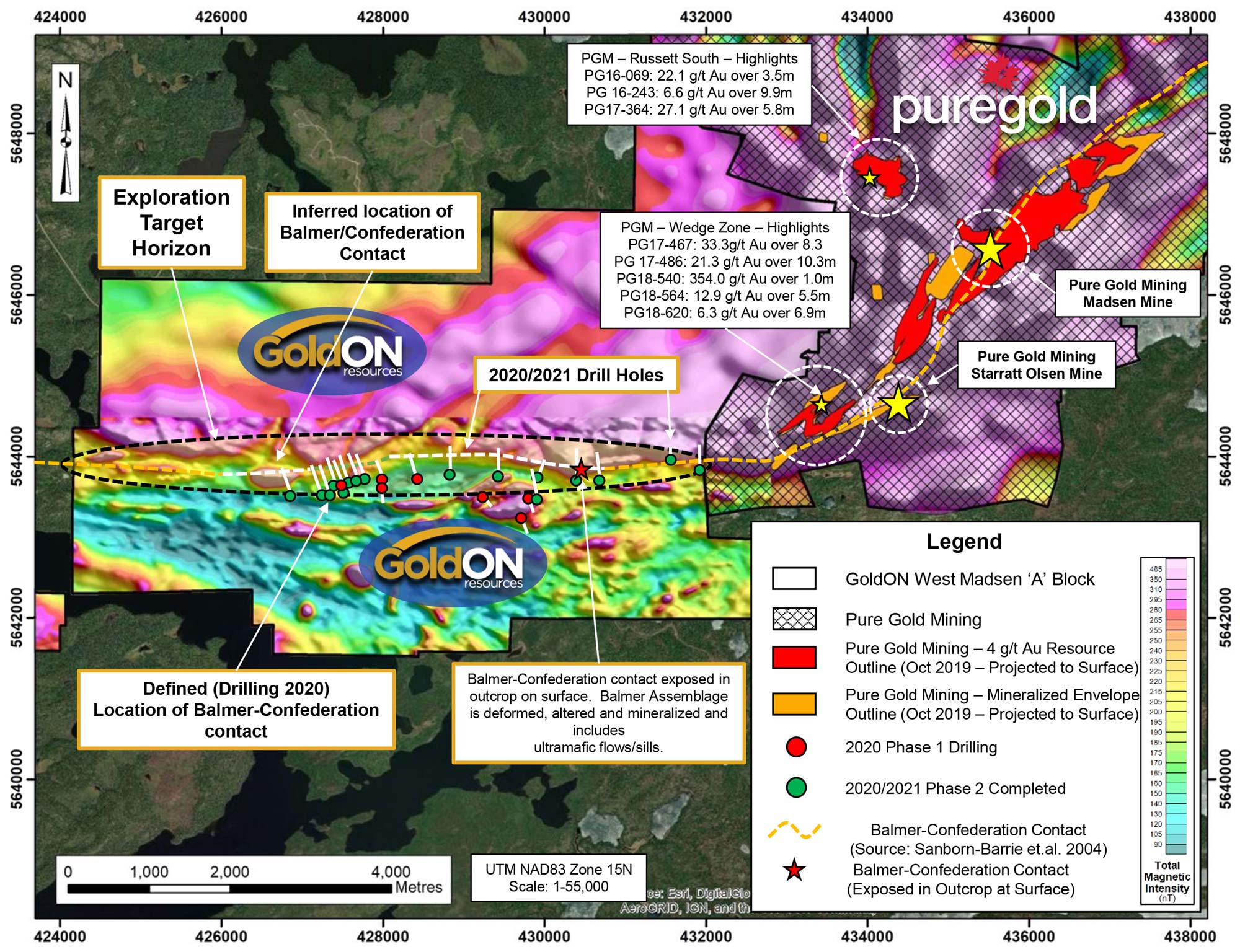

They include the West Madsen Gold property which adjoins Pure Gold Mining Inc.’s [PGM-TSXV] recently restarted Madsen mine in the Red Lake area. Red Lake is an established mining district with more than 29 million ounces of gold production to date.

Interest in the region is being fueled by high grade gold discoveries at Great Bear Resources Ltd.’s [GBR-TSXV] 100%-owned Dixie Lake project.

GoldON’s portfolio includes six properties in the Red Lake Mining Division, including West Madsen, Red Lake North, Pipestone Bay, Pakwash North, McInnes Lake, McDonough and and a seventh property known as Slate Falls in the Patricia Mining Division between the Red Lake and Pickle Lake gold camps. These properties vary from grass roots to the drill-ready stage of exploration.

GoldON recently said a 7,000-metre Phase II drilling at the West Madsen project returned consistently anomalous gold values and highly prospective geology. Drill crews were successful in identifying rocks of the Balmer Assemblage in 10 of 16 holes. The Balmer Assemblage rock package hosts most of the current gold resources and historical production in the Red Lake Greenstone Belt.

GoldON recently said a 7,000-metre Phase II drilling at the West Madsen project returned consistently anomalous gold values and highly prospective geology. Drill crews were successful in identifying rocks of the Balmer Assemblage in 10 of 16 holes. The Balmer Assemblage rock package hosts most of the current gold resources and historical production in the Red Lake Greenstone Belt.

Pure Gold’s reserves and resources, for example, are hosted in a seven-kilometre-long gold system that follows the major crustal break or contact between the Balmer and Confederation assemblages. GoldON’s recent drilling intersected the same Balmer Confederation contact on its property approximately 7 kilometres west of the Pure Gold property boundary.

This prospective contact is interpreted to continue for around 8.0 kilometres across Block A of GoldON’s property.

The West Madsen property covers 5,862 hectares in the heart of the Red Lake camp, and includes the original Block A and B claim groups where GoldON is earning a 100% interest under an option agreement with Great Bear Resources.

In late March, 2021, GoldON said it has granted BTU Metals Corp. [BTU-TSXV] an option to acquire an 80% interest in GoldON’s Pakwash North (formerly Bruce Lake) property. The property consists of 152-cell mining claims covering 3,103 hectares and is located approximately 36 kilometres southeast of the Town of Red Lake in an unexplored area of the Uchi Greenstone Belt. In a June 1 news release, BTU reported: “The strongest geophysical targets from the TNT geochemical-geophysical study are on the Pakwash North property and plans are being made to drill these targets in the coming months.”

Under the option, BTU has agreed to spend up to $1 million on exploration within 36 months and pay $75,000 in cash and issue up to 1.4 million shares to GoldON.

Meanwhile, GoldON is poised to begin drilling on its McDonough gold property after recently completing an induced polarization survey (IP). The property is located `15 km north of the Town of Red Lake and straddles a key structural signature of many deposits within the Red Lake Greenstone Belt.

“The setting at McDonough is ideal for gold mineralization,” said Romanik. “We have our permits in place and are awaiting drilling bids to test the coincident gold-in-soil anomalies in this very favourable geological setting,” Romanik said.

In a corporate update released in February 2021, GoldON said it had no debt other than trade payables and had raised $2.85 million in the previous five months at an average price of 73 cents per share. Learn more.

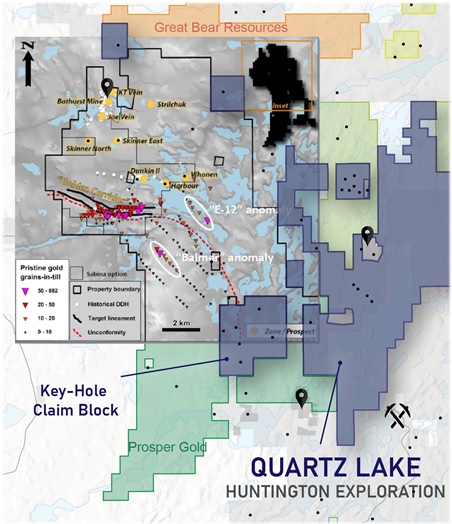

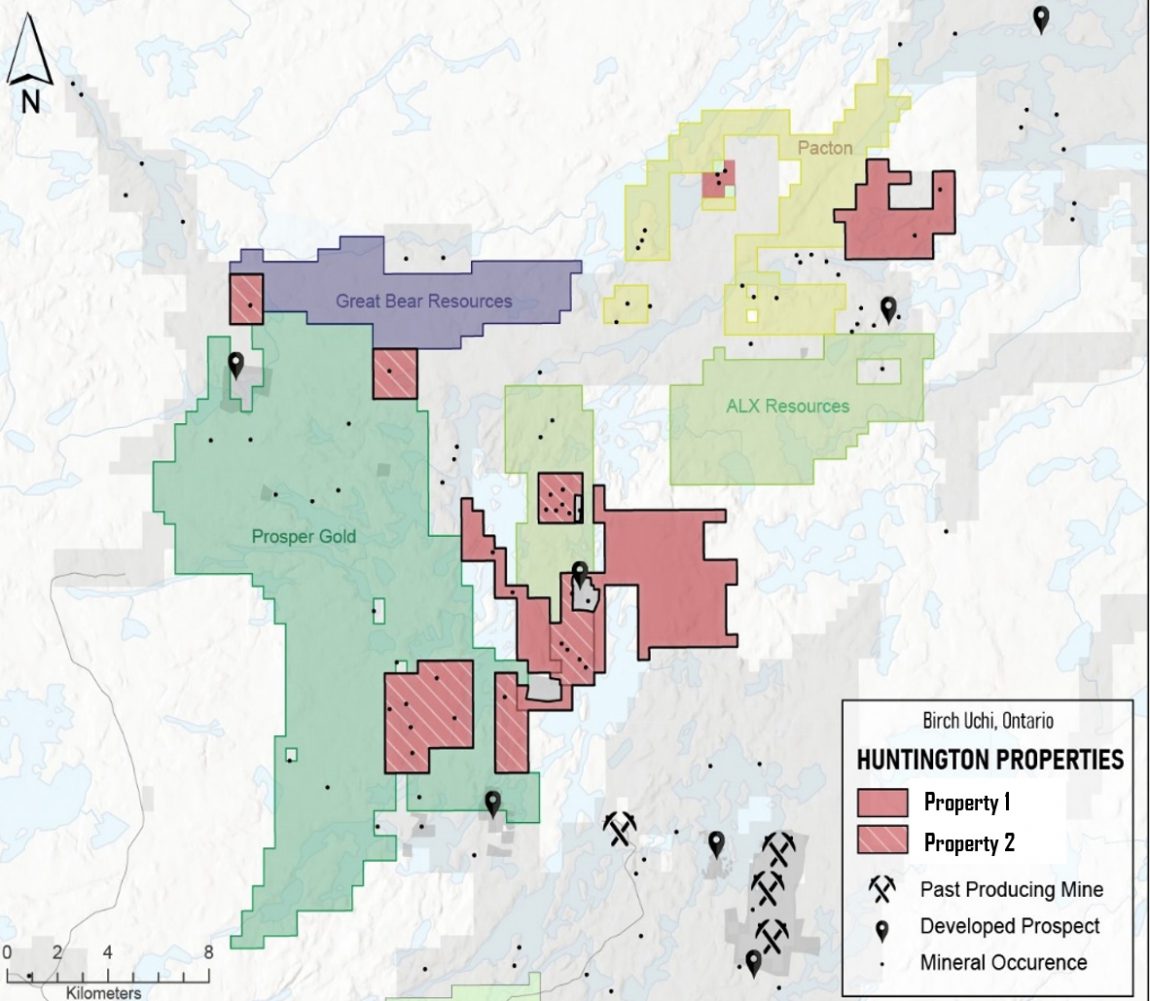

Huntington Exploration Inc. [HEI-TSXV] is a Toronto-based mineral exploration company with a focus on the Red Lake geological district in northwestern Ontario.

Huntington Exploration Inc. [HEI-TSXV] is a Toronto-based mineral exploration company with a focus on the Red Lake geological district in northwestern Ontario.

The Red Lake District is renowned for having one of the highest gold endowments in the world, boasting ~30 million ounces of historic production, and exciting new deposits that are currently being found (e.g. Great Bear’s Dixie project) and developed (Pure Gold’s Madsen mine).

Huntington’s project portfolio includes the 11,280-hectare Quartz Lake property, located 60 km east of Red Lake which Huntington acquired in several strategic acquisitions in early 2021. The project claims cover a significant package of geological formations believed to have similar characteristics to the Red Lake camp to the east.

The Quartz Lake claims are contiguous, for example, with Great Bear Resources Ltd.’s [GBR-TSXV] Red Lake North project, Prosper Gold Corp.’s [PGX-TSXV] Golden Sidewalk project and Cross River Ventures Corp.’s [CRVC-CSE, C6R-FWB] Dent-Jackson project.

The Quartz Lake property has 29 mineral showings documented by the MNR of Ontario with notable results including a drill intercept of 63.5 g/t over 0.7 metres at Surprise Lake. Other highlights include 30.6 g/t gold over 1.3 metres from a channel sample at the Heine showing.

Huntington has said it will begin exploration for gold on its Key-Hole claim block on the Quartz Lake property by employing similar till sampling geochemical techniques used to locate gold grains and till as reported by the Geological Survey of Canada, Teck Resources Ltd. [TECK.B-TSX; TECK.A-TSX, TECK-NYSE] and Prosper Gold Corp [PGX-TSXV].

The Key-Hole claim block is essentially an isolated island on the south-east part of Prosper’s Golden Sidewalk project, where Prosper recently launched its drilling as part of a 10,000-metre program. Drilling will focus on the newly identified Golden Corridor target area north of the Key-Hole claim block boundary

The Key-Hole claim block is essentially an isolated island on the south-east part of Prosper’s Golden Sidewalk project, where Prosper recently launched its drilling as part of a 10,000-metre program. Drilling will focus on the newly identified Golden Corridor target area north of the Key-Hole claim block boundary

The Golden Sidewalk target is a district-scale gold exploration project covering over 160 km2 of contiguous mineral claims and mining leases in the western Birch-Uchi Greenstone Belt.

The vehicle-accessible project straddles 12 km of the Balmer Assemblage-Narrow Lake Assemblage unconformity, a regional-scale feature that is used as an exploration guide in the Red Lake District. That’s because the Balmer Assemblage rock package hosts most of the current gold resources and historical production in the Red Lake Greenstone Belt.

Prosper has said till samples extracted from Golden Sidewalk contained up to 882 pristine gold grains that were extracted from a large scale (+5.0 km) conceptualized gold target referred to as the “Golden Corridor.” Channel sampling near this sample site returned 32 g/t gold over 2.0 metres.

Exploration results released by Prosper contain some key findings that could have implications for the same geological environment found on the Huntington Key-Hole claim block. The Prosper results indicate that an interpretation of gold-in-till dispersion along the projection of the Balmer/Confederation unconformity trends onto the Huntington Key-Hole claim block.

Huntington has said field work at the Key-Hole claim block was set to commence in June 2021 and will include basal till sampling, line cutting, detailed geological mapping of the six known gold showings and geophysics. The focus will be on the 3,200-metre-long portion of the projected geological unconformity. Learn more.

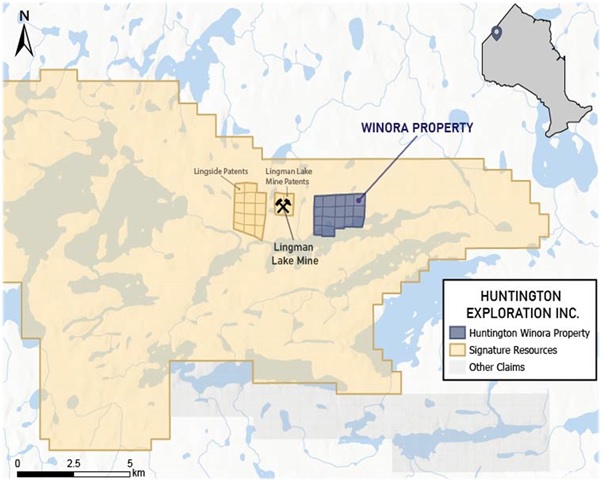

Huntington’s other key asset is the Winora project, which is located 325 km north of Red Lake. In May 2021, the junior said it had signed a letter of intent to acquire a 100% interest in the project for 4.0 million shares and a 2% net smelter royalty.

Huntington’s other key asset is the Winora project, which is located 325 km north of Red Lake. In May 2021, the junior said it had signed a letter of intent to acquire a 100% interest in the project for 4.0 million shares and a 2% net smelter royalty.

The western claim boundary of the Winora property is located approximately 500 metres from the eastern edge of defined Lingman Lake gold mineralization on the surrounding property controlled by Signature Resources Ltd.’s [SGU-TSXV; SGGTF-OTCQB; 3S3-FSE]. The Lingman Lake gold mineralization has a historical (non 43-101 compliant) resource of 234,000 ounces. Signature has said it hopes to announce a maiden NI 43-101 compliant resource next year (2022).

The Winora property hosts geology of the Lingman Lake mine and remains unexplored for possible extensions of gold zones.

Exploration at Winora is expected to include prospecting, geological mapping, sampling of basal till and soil sampling as well as an induced polarization survey. A 5,000-metre drill program could follow next year.

The exploration work proposed herein will be funded from a recently upsized private placement offering of units and flow-through units priced at 28 cents and 35 cents respectively. The offering is expected to raise a total of $8.5 million.

On June 25, 2021, Huntington shares were trading at $0.305 cents in a 52-week range of 36 cents and 4.5 cents, leaving the company with a market cap of $14.03 million, based on 46 million shares outstanding.

Kesselrun Resources Ltd. [KES-TSXV; KSSRF-OTC; CMG-DB] has been conducting a major drill program on its 100%-owned Huronian Gold Project located approximately 100 km west of Thunder Bay in northwestern Ontario.

Kesselrun Resources Ltd. [KES-TSXV; KSSRF-OTC; CMG-DB] has been conducting a major drill program on its 100%-owned Huronian Gold Project located approximately 100 km west of Thunder Bay in northwestern Ontario.

The 4,600-hectare Huronian Gold Project hosts a past-producing gold mine that saw production of 29,629 ounces grading 0.2 oz/ton gold (6.25 grams/tonne) during the 1930s. This historically mined zone has excellent potential for further discoveries down dip and along strike as well as remnant resources in the historic underground workings. In addition, there is an historic, non-NI 43-101 compliant resource estimate on three zones adjacent to the historically mined zone that was completed in 1998 by Minescape Inc. This historic mineral resource estimate consists of 44,592 ounces of gold at an average grade of 15.3 g/t in the Indicated category and 501,377 ounces of gold at an average grade of 14.4 g/t in the Inferred category. Although Kesselrun’s qualified person has not completed sufficient work to confirm the results of the historic resource estimate and Kesselrun is not treating it as a current mineral resource, it is considering it as relevant as a guide to future exploration.

Since acquiring the project in 2016, Kesselrun has completed several exploration programs including mapping, trenching, geophysics and drilling which resulted in a new geological model which is guiding the 2021 exploration program. Kesselrun is fully funded to complete its 20,000-metre drill program which is concentrating on the historically mined Huronian zone as well as the McKellar, Fisher and Fisher North zones where the historic resource estimate was focused on.

Since acquiring the project in 2016, Kesselrun has completed several exploration programs including mapping, trenching, geophysics and drilling which resulted in a new geological model which is guiding the 2021 exploration program. Kesselrun is fully funded to complete its 20,000-metre drill program which is concentrating on the historically mined Huronian zone as well as the McKellar, Fisher and Fisher North zones where the historic resource estimate was focused on.

Recently announced drilling highlights include:

McKellar Zone

- 21HUR056 7.2 g/t Au over 5.8 m, 3.3 g/t Au over 5.3 m and 4.7 g/t Au over 3.1 m all within a 67.8 m of 1.6 g/t Au

- 21HUR057 5.5 g/t Au over 4.7 m within 23.0 m of 1.4 g/t Au

- 21HUR078 113.7 g/t Au over 1.9 m within 7.3 m of 30.3 g/t Au

Fisher Zone

- 21HUR030 14.8 g/t Au over 1.0 m within 10.3 m of 4.7 g/t Au

- 21HUR031 30.4 g/t Au over 1.0 m within 5.8 m of 6.8 g/t Au

- 21HUR037 99.0 g/t Au over 0.5 m within a 3.5 m wide zone which assayed 15.6 g/t Au

- 21HUR042 17.0 g/t Au over 0.9 m within 3.3 m of 5.3 g/t Au

- 21HUR067 40.8 g/t Au over 1.6 m including 204 g/t Au over 0.3 m within 10.4 m of 6.6 g/t Au

- 21HUR068 15.8 g/t Au over 1.6 m within 4.6 m of 5.8 g/t Au

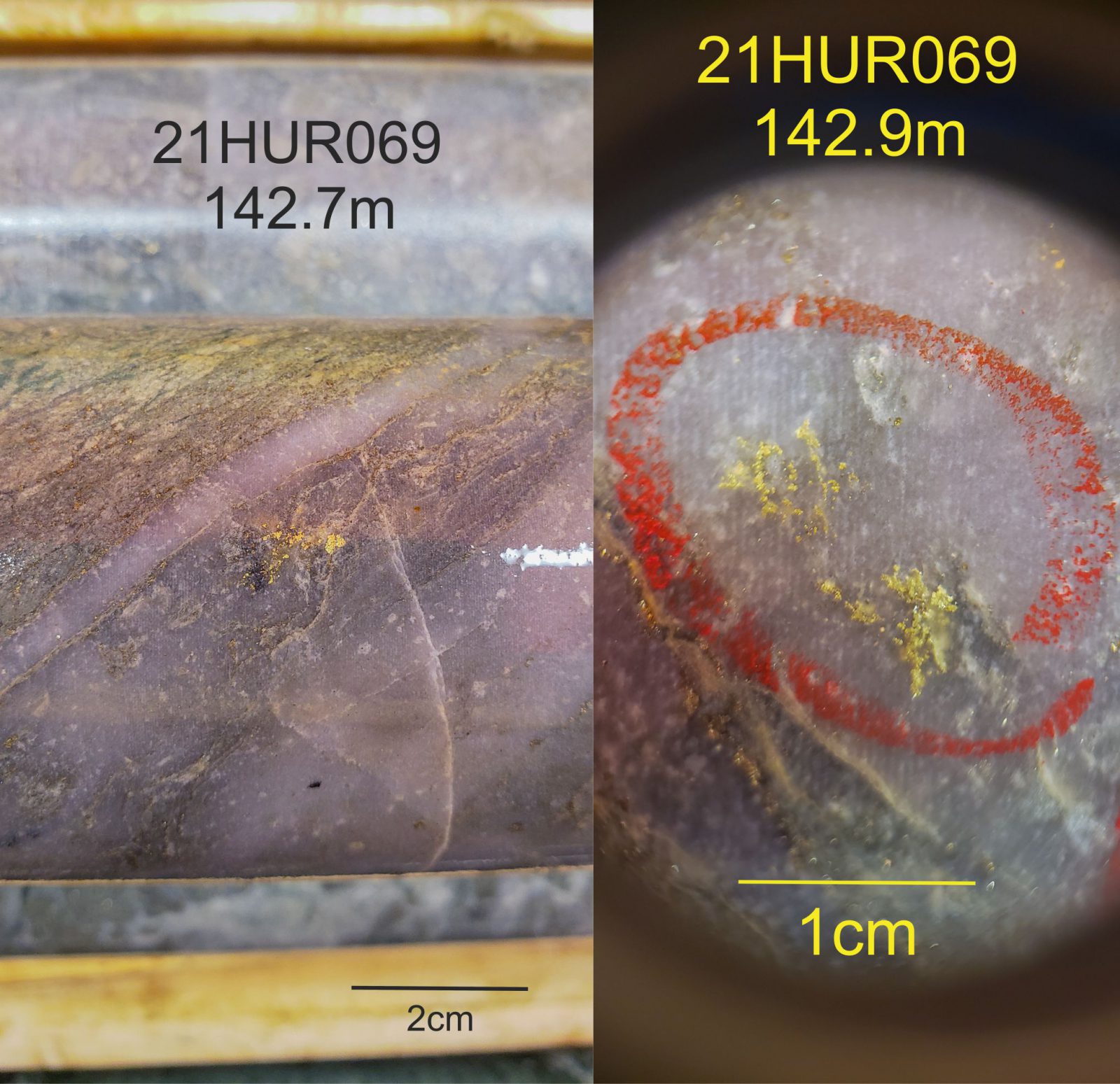

- 21HUR069 26.4 g/t Au over 1.3 m including 113 g/t Au over 0.3 m within 6.7 m of 6.4 g/t Au

Huronian Zone

- 21HUR054 81.5 g/t Au over 0.6 m within 4.1 m of 16.2 g/t Au

- 21HUR040 intercepted 0.6 m of open stope followed by 34.2 g/t Au over 0.5 m within 2.9 m of 7.3 g/t Au

These significant drill intercepts have extended the mineralization in all zones at depth and along strike. Kesselrun management is of the opinion that remainder of the drilling will continue to increase the footprint of all the zones as well as show the potential for the project to host new discoveries.

These significant drill intercepts have extended the mineralization in all zones at depth and along strike. Kesselrun management is of the opinion that remainder of the drilling will continue to increase the footprint of all the zones as well as show the potential for the project to host new discoveries.

The Huronian Gold Project is in an emerging gold district that is home to a number of significant gold deposits. Goldshore Resources’ adjacent multi-million-ounce Moss Lake Gold Project is on strike with the southern half of Kesselrun’s Huronian Gold Project where the Kesselrun exploration team feels there is tremendous potential for new discoveries.

The Huronian Project of Kesselrun Resources offers a very favorable upside as demonstrated by drilling results expanding known mineralized zones and new discoveries. The company has 73,687,358 shares outstanding.