Roxgold Announces New High Grade Discovery at Séguéla Hitting 19m at 26.1 gpt Au and 12m at 32.1 gpt Au at Koula Prospect

Roxgold Inc. (“Roxgold” or the “Company”) (TSX: ROXG) (OTCQX: ROGFF) is pleased to announce the discovery of a new high grade prospect, Koula, at the Séguéla Gold Project (“Séguéla”) located in Côte d’Ivoire.

Séguéla Gold Project, Côte d’Ivoire:

Highlights from Reverse Circulation (“RC”) drilling

Koula

• 19 metres (“m”) at 26.1 grams per tonne gold (“g/t Au”) in drill hole SGRC877 from 189m including

– 2m at 23.0 g/t Au from 192m and

– 2m at 52.6 g/t Au from 195m and

– 1m at 283 g/t Au from 202m

• 12m at 32.1 g/t Au in drill hole SGRC854 from 84m including

– 4m at 92.1 g/t Au from 90m

• 8m at 14.8 g/t Au in drill hole SGRC875 from 45m including

– 2m at 46.2 g/t Au from 45m and

– 1m at 14.4 g/t Au from 50m

• 12m at 4.7 g/t Au in drill hole SGRC876 from 95m including

– 2m at 20.4 g/t Au from 100m

“Rarely do you see results of this tenor in the very first drill holes into a new target,” stated John Dorward, President and Chief Executive Officer. “Koula is a recent addition to what is already a considerable portfolio of prospects, yet with these first batch of holes, Koula is demonstrating many similarities to Ancien – with comparable consistency and style of the high grade core, alteration style and steep southerly plunging nature.

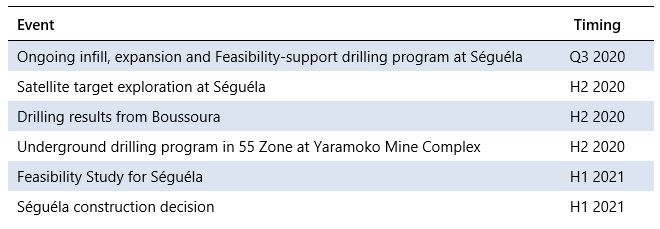

“Our goal this year at Séguéla has been to build upon the PEA and demonstrate the potential for the project to grow in quality, scale and scope. We believe that this year’s stream of exploration results, coupled with today’s announcement of a discovery, reinforce the potential for Séguéla to achieve this goal. With three rigs currently turning, we are confident that further exploration upside will continue to be realized. Permitting discussions continue to progress well and the Feasibility Study remains on track for completion early next year.”

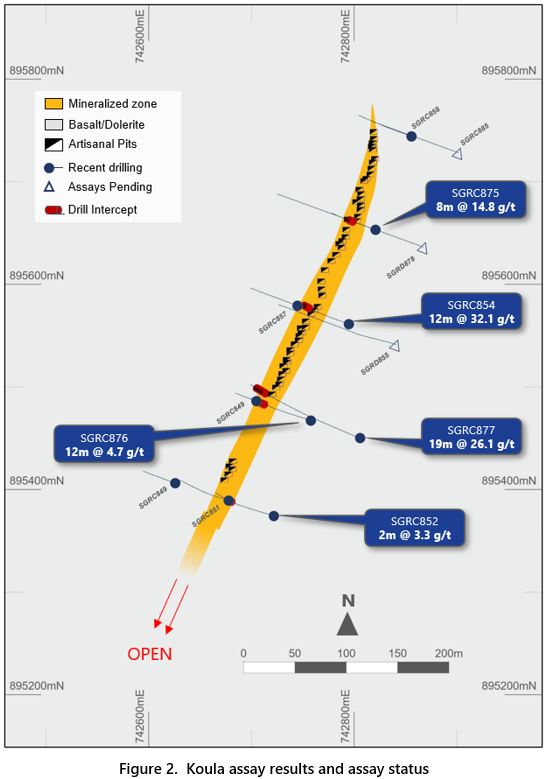

Paul Weedon, Vice President Exploration commented “I am very pleased with the success of the Séguéla exploration team in discovering and rapidly advancing this new discovery. Results from an initial 10-hole RC reconnaissance program have been very successful in defining high grade mineralization extending over a projected strike of more than 300 metres across 5 drill lines, with the deepest intersection approximately 150 metres below surface. I look forward to the results of the Scout RC drilling program which will progressively work across the high priority Séguéla prospects. This drilling program is following up on the mapping and reconnaissance sampling at Séguéla which continues to emphasise the regional prospectivity of the property.”

Koula

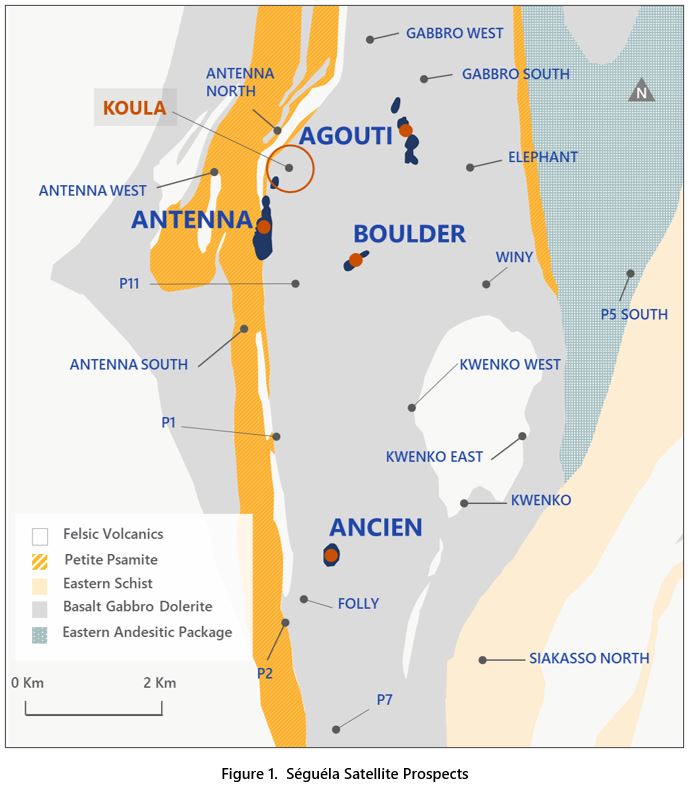

Located approximately 1km to the east of Antenna, Koula was discovered through field reconnaissance and mapping in an area previously considered to be a lower exploration priority.

Results from an initial 10-hole RC reconnaissance program were successful in defining high grade mineralization over a projected strike of greater than 300m across 5 drill lines, with the deepest intersection approximately 150m below surface. Three diamond core holes will be completed in September, testing further depth extents as well as providing diamond drill core for structural interpretation, and will form part of a program of infill drilling to approximately 50m centres.

Displaying similar characteristics to those of Ancien in terms of host geology, mineralization style, high grade tenor and coarse visible gold, Koula remains open to the south with an interpreted southerly plunge remaining to be fully tested. The weathering profile at Koula is very shallow with oxidized material generally less than 15m below surface.

Highlights from the first 10-hole reconnaissance drilling program at Koula include:

• 19m at 26.1 g/t Au in drill hole SGRC877 from 189m including

– 2m at 23.0 g/t Au from 192m and

– 2m at 52.6 g/t Au from 195m and

– 1m at 283 g/t Au from 202m

• 12 m at 32.1 g/t Au in drill hole SGRC854 from 84m including

– 4m at 92.1 g/t Au from 90m

• 8m at 14.8 g/t Au in drill hole SGRC875 from 45m including

– 2m at 46.2 g/t Au from 45m and

– 1m at 14.4 g/t Au from 50m

• 12m at 4.7 g/t Au in drill hole SGRC876 from 95m including

– 2m at 20.4 g/t Au from 100m

• 2m at 3.3 g/t Au in drill hole SGRC852 from 89m

Exploration activities at Séguéla have continued to infill and test the extensions of the existing Inferred Mineral Resources at Antenna, Ancien, Agouti and Boulder in support the upcoming Feasibility Study, while scout RC drilling and auger drilling continues on other high priority prospects within the project land package.

Click here to view the full listing of drill results from the recent drilling programs at the Séguéla Gold Project. Note: all results are reported as down-hole intervals which represent approximately 80% of true width.

Catalysts and Next Steps

Quality Assurance/Quality Control

All drilling data completed by Roxgold utilized the following procedures and methodologies. All drilling was carried out under the supervision of Roxgold personnel.

RC drilling used a 5.25 inch face sampling pneumatic hammer with samples collected into 60 litre plastic bags. Samples were kept dry by maintaining enough air pressure to exclude groundwater inflow. If water ingress exceeded the air pressure, RC drilling was stopped, and drilling converted to diamond core tails. Aircore (“AC”) drilling was collected in one metre intervals and sampled in a similar fashion to RC methods. Once collected, RC and AC samples were riffle split through a three-tier splitter to yield a 12.5% representative sample for submission to the analytical laboratory. The residual 87.5% sample were stored at the drill site until assay results were received and validated. Coarse reject samples for all mineralized samples corresponding to significant intervals are retained and stored on-site at the Company controlled core yard.

DD drill holes were drilled with HQ sized diamond drill bits. The core was logged, marked up for sampling using standard lengths of one metre. Samples were then cut into equal halves using a diamond saw. One half of the core was left in the original core box and stored in a secure location at the Company core yard at Séguéla. The other half was sampled, catalogued and placed into sealed bags and securely stored at the site until shipment.

All Séguéla RC, AC and DD core samples were shipped to ALS Laboratories preparation laboratory in Yamoussoukro for preparation. Samples were dried and crushed by the Lab and a 250-gram split prepared from the coarse crushed material, prior to pulverization and preparation of a 200g sample. Samples are then shipped via commercial courier to ALS’s analytical facility in Ouagadougou, Burkina Faso where routine gold analysis using a 50-gram charge and fire assay with an atomic absorption finish was completed. Quality control procedures included the systematic insertion of blanks, duplicates and sample standards into the sample stream. In addition, the Lab inserted its own quality control samples.

Qualified Person

Paul Weedon, MAIG, Vice-President, Exploration for Roxgold Inc., a Qualified Person within the meaning of National Instrument 43-101, has reviewed and approved the scientific and technical disclosure contained in this news release, including the QA/QC, sampling, analytical and test data underlying this information. Mr. Weedon verified the information in the news release by reviewing the drill logs, geological interpretations and supporting analytical data. No limitations were imposed on Mr. Weedon’s verification process. For more information on the Company’s QA/QC and sampling procedures, please refer to the Company’s Annual Information Form dated December 31, 2019, available on the Company’s website at www.roxgold.com and on SEDAR at www.sedar.com.

About Roxgold

Roxgold is a Canadian-based gold mining company with assets located in West Africa. The Company owns and operates the high-grade Yaramoko Gold Mine located on the Houndé greenstone belt in Burkina Faso and is advancing the development and exploration of the Séguéla Gold Project located in Côte d’Ivoire. Roxgold trades on the TSX under the symbol ROXG and as ROGFF on OTCQX.

For more information, contact:

Roxgold Inc.

Graeme Jennings, CFA

Vice President, Investor Relations

416-203-6401

gjennings@roxgold.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities laws (“forward-looking statements”). Such forward-looking statements include, without limitation: economic statements related to the PEA, such as future projected production, capital costs and operating costs, statements with respect to Mineral Reserves and Mineral Resource estimates, recovery rates, timing of future studies including the feasibility study, environmental assessments and development plans. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. In certain cases, forward-looking information may be identified by such terms as “anticipates”, “believes”, “could”, “estimates”, “expects”, “may”, “shall”, “will”, or “would”. Forward-looking information contained in this news release is based on certain factors and assumptions regarding, among other things, the PEA, the estimation of Mineral Resources and Mineral Reserves, the realization of resource estimates and reserve estimates, any potential upgrades of existing resource estimates, gold metal prices, the timing and amount of future exploration and development expenditures, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Company’s properties in the short and long-term, the progress of exploration and development activities, the receipt of necessary regulatory approvals, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include: delays resulting from the COVID-19 pandemic, changes in market conditions, unsuccessful exploration results, possibility of project cost overruns or unanticipated costs and expenses, changes in the costs and timing of the development of new deposits, inaccurate reserve and resource estimates, changes in the price of gold, unanticipated changes in key management personnel and general economic conditions. Mining exploration and development is an inherently risky business. Accordingly, actual events may differ materially from those projected in the forward-looking statements. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements, including the factors included in the Company’s annual information form for the year ended December 31, 2019. These and other factors should be considered carefully and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.