Saturn Oil & Gas Inc. Announces Successful Drilling Results at Oxbow Asset

Saturn Oil & Gas Inc. (TSXV: SOIL) (FSE: SMKA) (“Saturn” or the “Company“) is pleased to provide the preliminary results of its light oil development program at its Oxbow Asset in Southeast Saskatchewan, for wells initiated in November 2021 and completed in January 2022.

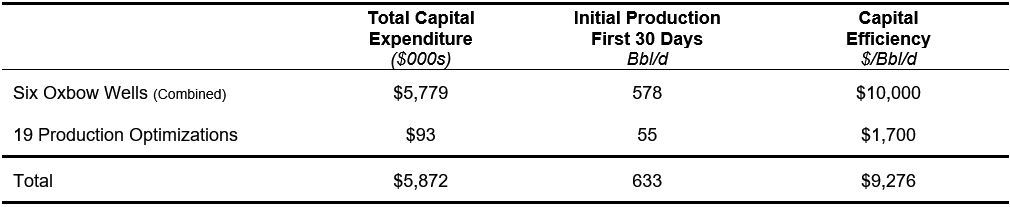

The Company drilled six horizontal wells targeting the Frobisher formation in the Glen Ewen area of Southeast Saskatchewan, where it achieved a 100% success rate and strong aggregate initial flow rates. In addition, the Company initiated a successful production optimization program where to date it has brought 19 previously inactive wells back onto production (the “Production Optimization Program“). In total, between the new well development program and the Production Optimization Program, the Company added production, on a stabilized IP30 basis, at an all-in capital efficiency of less than $10,000 per flowing barrel of oil. A summary of the capital expenditures and results of these expenditures is set out below:

“Our first drilling program at the Oxbow Asset has exceeded our expectations. By targeting the drilling program towards the development of our established light oil pools, we have reduced the program’s geological risk profile, while achieving meaningful new production additions,” commented Justin Kaufmann, Senior Vice-President, Exploration. “The top producing well of the recent Oxbow drilling program, the Glen Ewen 101/7-26 well, is the best performing well in Saturn’s history.”

The Glen Ewen 101/7-26 well, delivered average light oil production of over 220 bbl/d for the first 30 days. Based on public data, this well had the highest oil deliverability of all 550+ wells drilled in Saskatchewan in Q4 2021 with over 500 hours of production data.

Highlights of the six Saturn Oxbow wells include:

- average initial production of 96.3 bbl/d per well, for the first 30 days, representing a 40% increase above the average type curve of all wells drilled in Southeast Saskatchewan Mississippian play in the past 5 years (sample size of 1,400 wells);

- expected to produce a combined rate of return of >150%, based on current strip pricing;

- forecasted to produce over 250,000 bbls of net light oil over their economic life, for an implied (half cycle) development cost of $23.00 per bbl; and

- projected to produce aggregate undiscounted free cash flow of $15.2 million on a total investment of $5.8 million, for an implied recycle ratio of 2.6, based on current strip pricing.

Saturn is also continuing its focus on returning inactive wells back onto production, as the Production Optimization Program has proven to be one of the most capital efficient and low risk sources of production growth available to the Company. The Company estimates that the return on invested capital directed to the Production Optimization Program to date is more than 500%. These strong initial results have led the Company to increase its future allocation of capital to production optimization.

The Company continues to proactively manage the decline of its producing wells and is currently operating two full time service rigs at the Oxbow Asset for active wells. While theses expenditures fall outside of the capital budget and are allocated to operating costs, the value contribution of these activities to the Company is tremendous. Over 300 bbl/d of light oil production has been added from enhancing 90 operating wells at a highly economical cost of approximately $1,600 per bbl/d. In credit to our experienced and effective operations team, the incremental production per well has significant combined impact in offsetting Saturn’s already industry leading low corporate decline rate, estimated at 13%. Corporate production in March 2022 to date has averaged 7,500 boe/d (96% oil and NGLs).

Saturn is also focused on its ESG initiatives to reduce environmental liabilities by abandoning and remediating inactive wells that are beyond their economic life. To date, the Company has abandoned 22 wells with an expectation of over 100 additional wells to be remediated in 2022. Saturn is committed to returning formerly leased land to its surface partners and farmers in pristine condition.

Saturn is currently drilling the 12th horizontal well in the current Oxbow program with this last well scheduled to be added to production prior to break up.

Listing of Warrants

Further to its recently completed bought-deal and concurrent non-brokered financings, Saturn also wishes to announced that its has received the approval of the TSX Venture Exchange (“TSXV“) for the listing up to 6,871,000 common share purchase warrants of the Company (the “Warrants“). For more information about the offering, please see the Company’s press release dated March 10, 2022, which is available under the Company’s SEDAR profile at www.sedar.com.

Each Warrant entitles the holder to purchase one common share in the capital of the Company at a price of $4.00 until March 10, 2025. The Warrants are governed by the terms of a Warrant Indenture (the “Warrant Indenture“) dated March 10, 2022 between the Company and Computershare Trust Company of Canada as warrant agent, a copy of which is available under the Company’s SEDAR profile at www.sedar.com. For further details regarding the Warrants, please refer to the Warrant Indenture.

The Warrants commenced trading on the TSXV at the open of markets on March 18, 2022 under the trading symbol “SOIL.WT.A”. The CUSIP number of the Warrants is 80412L180.

About Saturn Oil & Gas Inc.

Saturn Oil & Gas Inc. is a growing Canadian energy company focused on generating positive shareholder returns through the continued responsible development of high-quality, light oil weighted assets, supported by an acquisition strategy that targets highly accretive, complementary opportunities. Saturn has assembled an attractive portfolio of free-cash flowing, low-decline operated assets in Southeastern Saskatchewan and West Central Saskatchewan that provide a deep inventory of long-term economic drilling opportunities across multiple zones. With an unwavering commitment to building an ESG-focused culture, Saturn’s goal is to increase reserves, production and cash flows at an attractive return on invested capital. Saturn’s shares are listed for trading on the TSX.V under ticker ‘SOIL’ and on the Frankfurt Stock Exchange under symbol ‘SMKA’.

Further information and a corporate presentation is available on Saturn’s website at www.saturnoil.com.

Saturn Oil & Gas Investor & Media Contacts:

John Jeffrey, MBA – Chief Executive Officer

Tel: +1 (587) 392-7902

www.saturnoil.com

Kevin Smith, MBA – VP Corporate Development

Tel: +1 (587) 392-7900

info@saturnoil.com

Reader Advisory

FORWARD-LOOKING INFORMATION AND STATEMENTS.

Certain information included in this press release constitutes forward-looking information under applicable securities legislation. Forward-looking information typically contains statements with words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “estimate”, “propose”, “project”, “scheduled”, “will” or similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information in this press release may include, but is not limited to, the drilling of development wells, workover program, timing of drilling and completion of new wells, the maintenance of base production and the business plan, cost model and strategy of the Company.

The forward-looking statements contained in this press release are based on certain key expectations and assumptions made by Saturn, including expectations and assumptions concerning: the timing of and success of future drilling, development and completion activities, the performance of existing wells, the performance of new wells, the availability and performance of facilities and pipelines, the geological characteristics of Saturn’s properties, the application of regulatory and licensing requirements, the availability of capital, labour and services, the creditworthiness of industry partners and the ability to source and complete asset acquisitions.

Although Saturn believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Saturn can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), constraint in the availability of services, commodity price and exchange rate fluctuations, the current COVID-19 pandemic, actions of OPEC and OPEC+ members, changes in legislation impacting the oil and gas industry, adverse weather or break-up conditions and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. These and other risks are set out in more detail in Saturn’s Annual Information Form for the year ended December 31, 2020.

Forward-looking information is based on a number of factors and assumptions which have been used to develop such information but which may prove to be incorrect. Although Saturn believes that the expectations reflected in its forward-looking information are reasonable, undue reliance should not be placed on forward-looking information because Saturn can give no assurance that such expectations will prove to be correct. In addition to other factors and assumptions which may be identified in this press release, assumptions have been made regarding and are implicit in, among other things, the timely receipt of any required regulatory approvals and the satisfaction of all conditions to the completion of the share consolidation. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which have been used.

The forward-looking information contained in this press release is made as of the date hereof and Saturn undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forward-looking information contained in this press release is expressly qualified by this cautionary statement.

BOE PRESENTATION AND IP RATES

Boe means barrel of oil equivalent. All boe conversions in this news release are derived by converting gas to oil at the ratio of six thousand cubic feet (“Mcf”) of natural gas to one barrel (“Bbl”) of oil. Boe may be misleading, particularly if used in isolation. A Boe conversion rate of 1 Bbl : 6 Mcf is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio of oil compared to natural gas based on currently prevailing prices is significantly different than the energy equivalency ratio of 1 Bbl : 6 Mcf, utilizing a conversion ratio of 1 Bbl : 6 Mcf may be misleading as an indication of value.

Initial production rates disclosed herein may not necessarily be indicative of long term performance or of ultimate recovery.

ABBREVIATIONS AND FREQUENTLY REOCCURRING TERMS

Saturn uses the following abbreviations and frequently recurring terms in this press release: “WTI” refers to West Texas Intermediate, a grade of light sweet crude oil used as benchmark pricing in the United States; “MSW” refers to the mixed sweet blend that is the benchmark price for conventionally produced light sweet crude oil in Western Canada; “AECO” refers to Alberta Energy Company, a grade or heating content of natural gas used as benchmark pricing in Alberta, Canada; “bbl” refers to barrel; “bbl/d” refers to barrels per day; “GJ” refers to gigajoule; “NGL” refers to Natural Gas Liquids; “Mcf” refers to thousand cubic feet.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

All dollar figures included herein are presented in Canadian dollars, unless otherwise noted.