Shareholders of Overseas Uranium Resources Development Co., Ltd. approve UEX acquisition of JCU (Canada) Exploration Company

UEX Corporation [UEX-TSX; UEXCF-OTC] has been notified that shareholders of Overseas Uranium Resources Development Co., Ltd. (OURD) approved the sale to UEX of OURD’s wholly-owned subsidiary, JCU (Canada) Exploration Company, Limited.

The JCU Transaction

UEX will acquire 100% of the shares of JCU from OURD by paying C$41million and assuming JCU’s existing liabilities, under the terms of the share purchase agreement and amending agreement). Â The transaction is expected to close by August 3, 2021. UEX has committed to retaining JCU as a corporate subsidiary in order for JCU to meet its existing joint venture commitments.

UEX has signed a binding agreement with Denison Mines Corp. [DML-TSX; DNN-NYSE American] whereby UEX agreed to sell 50% of the JCU shares to Denison for C$20.5 million following the close of the JCU transaction.

Key terms of the UEX Denison transaction are as follows. Denison agreed to provide UEX with an interest-free three-month term loan of up to C$41 million to facilitate UEX’s purchase of 100% of the shares of JCU.

UEX and Denison will enter into a shareholders’ agreement governing the management of JCU. Â UEX will be the manager of JCU as long as Denison does not own more than 50% of the shares of JCU.

A total of C$20.5 million of the amount drawn under the loan will be retired upon UEX transferring 50% of the JCU shares to Denison following the closing of the JCU transaction.

UEX may extend the term loan by an additional three months, in which case interest will be charged at a rate of 4% from the date of the initial advance under the term loan until maturity.

All JCU shares owned by UEX will be held by Denison as security against the term loan pursuant to a pledge agreement until the term loan is repaid in full. The term loan is subject to certain customary terms and conditions and contains standard events of default that protect Denison.

Should the share purchase agreement be terminated, each of Denison and UEX have agreed to provide the other party with the opportunity to participate on a 50/50 basis in subsequent offers made in relation to an alternative acquisition of JCU.

Roger Lemaitre, President and CEO of UEX, said, “The approval of the transaction by OURD shareholders is a historic day for our company. UEX shareholders have gained exposure to a strengthened portfolio of top tier uranium development projects that combine growth and production potential in the next cycle. Â Our assets, combined with our new partnership with Denison, on the JCU projects, will make UEX a unique uranium investment opportunity, possessing a strong and sustainable portfolio of exploration, development and future production opportunities in the Athabasca Basin and elsewhere in Canada. Â The JCU assets position UEX well and complement our existing portfolio of assets, which together, can grow into more substantial pieces of our business over time, as the market, uranium price and contracting cycle, signal the need for more uranium supply.”

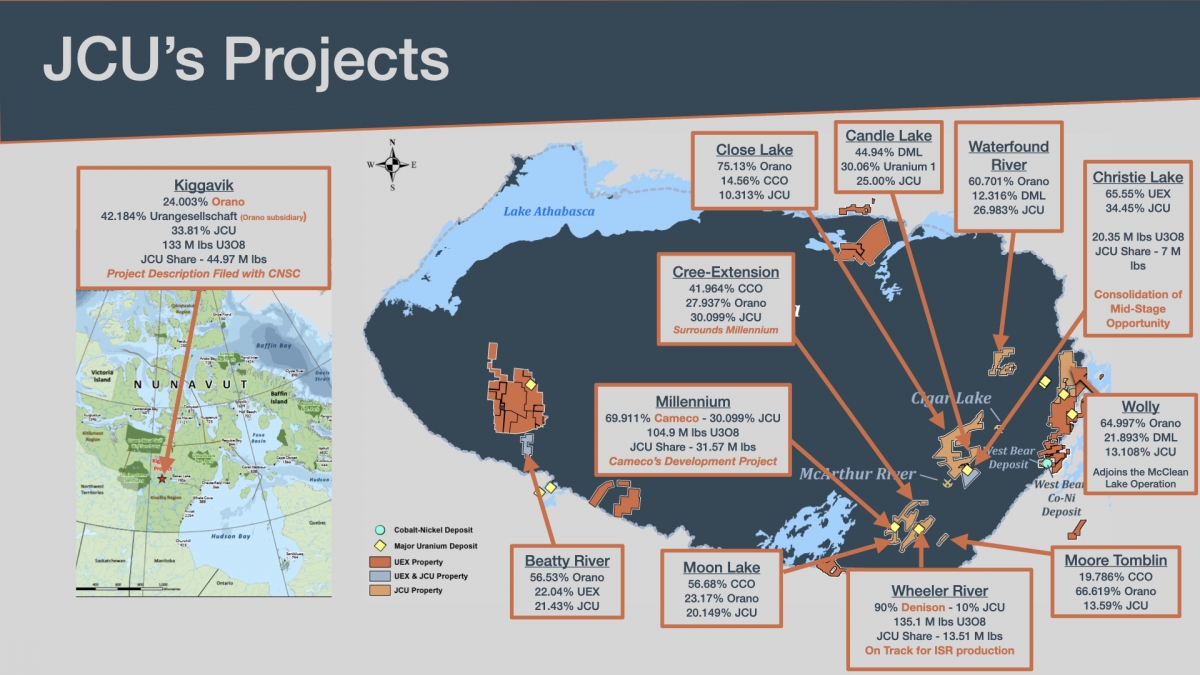

UEX is a Canadian uranium and cobalt exploration and development company involved in an exceptional portfolio of uranium projects.