Skyharbour Signs Option Agreement with Medaro Mining Corp to Option the Yurchison Uranium Project

Skyharbour Resources Ltd. (TSX-V: SYH) (OTCQB: SYHBF) (Frankfurt: SC1P) (“Skyharbour” or the “Company”), is pleased to announce that it has entered into an option agreement (the “Option Agreement”) with Medaro Mining Corp. (CSE: MEDA) (“Medaro or the “Optionee”) which provides Medaro an earn-in option to acquire an initial 70% interest and up to a 100% interest in the Yurchison Uranium Property located in the Wollaston Domain of Northern Saskatchewan, Canada (the “Property”). The Property contains twelve (12) mineral claims, comprising approximately 55,934 hectares.

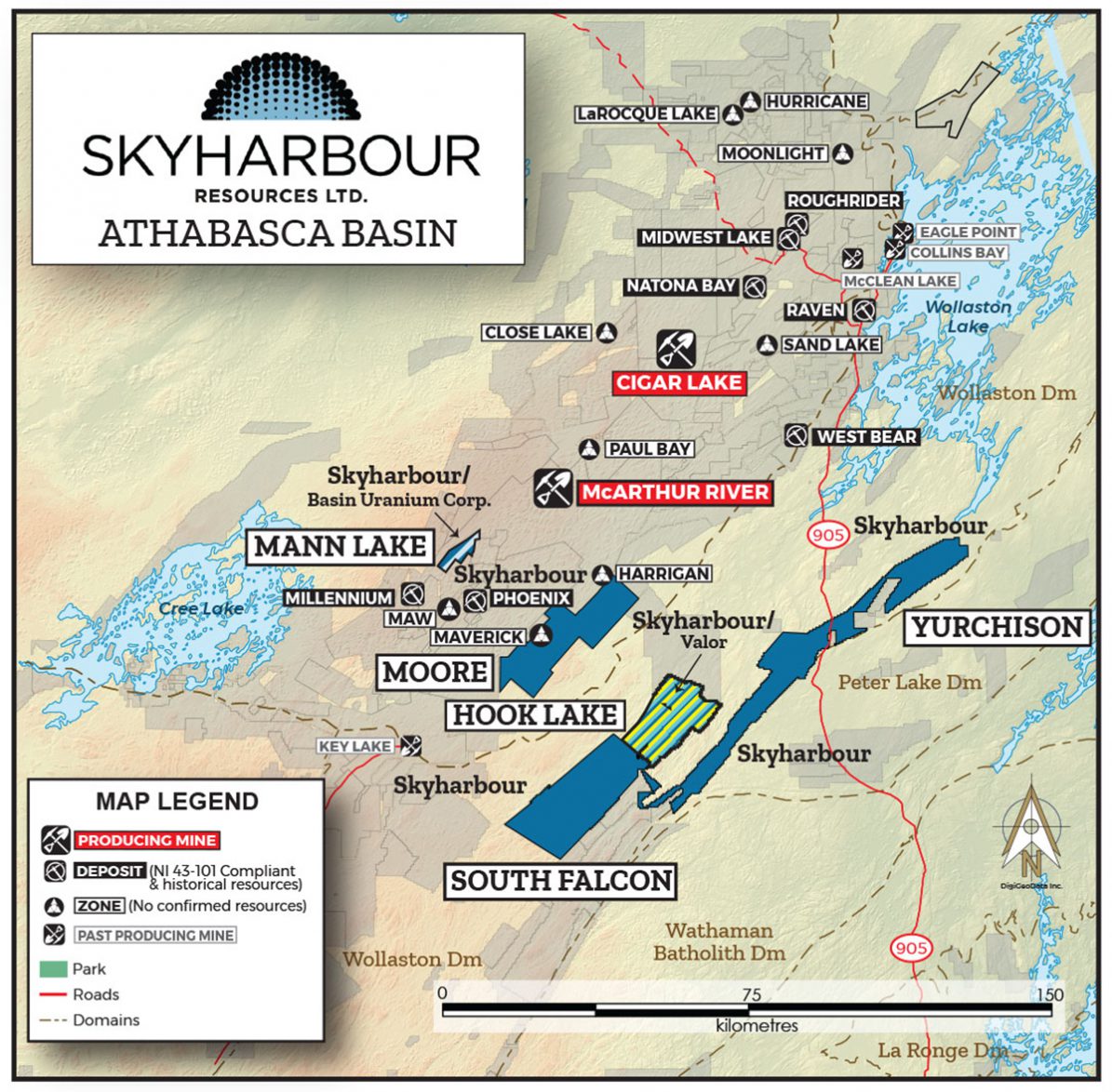

Location Map of Yurchison Project:

https://www.skyharbourltd.com/_resources/images/athabasca-map-skyharbour.jpg

Yurchison Uranium Project:

Historical prospecting near old trenches returned significant uranium (ranging from 0.09% to 0.30% U3O8) and molybdenum (ranging from 2,500 ppm to 6,400 ppm Mo) mineralization in both outcrop and float samples. Two historical holes drilled beneath the trenches returned highly anomalous molybdenum values, up to 3,750 ppm and anomalous uranium values up to 240 ppm. The Property boasts strong discovery potential for both basement hosted uranium mineralization as well as copper, zinc, and molybdenum mineralization. Regionally, Rio Tinto entered into a $30 million, seven-year, option agreement with Forum Energy Metals Corp. to acquire an 80% stake in their Janice Lake property which is located on-strike to the southwest of the Property.

The Option Agreement:

Pursuant to the Agreement, Medaro may acquire an initial 70% interest in the Property by (i) issuing common shares of Medaro (“Shares”) having an aggregate value of CAD $3,000,000; (ii) making aggregate cash payments of CAD $800,000; and (iii) incurring an aggregate of CAD $5,000,000 in exploration expenditures on the Property over a three year period.

Schedule to earn an initial 70% interest:

Once Medaro has earned an initial 70% interest in the Property, Medaro may acquire the remaining 30% interest in the Property, within 30 business days of earning the initial 70% interest, by (i) issuing Shares having a value of CAD $7,500,000, and (ii) making a cash payment of CAD $7,500,000.

Skyharbour will retain a NSR of two percent (2%) on 11 of the 12 claims with Medaro holding a buyback option whereby Medaro can purchase one percent (1%) of the NSR for CAD $1 million. A separate NSR of two percent (2%) on the other claim is payable to a third party (payable pro-rata based on ownership interest in the Property).

Jordan Trimble, President and CEO of Skyharbour, stated: “We look forward to working with the Medaro team at the Yurchison Project having just signed this Option Agreement. With another accretive property transaction announced, we continue to execute on our business model by adding value to our project base in the Athabasca Basin through strategic partnerships and prospect generation, as well as focused mineral exploration at our flagship Moore Uranium Project. News will be forthcoming on exploration plans at Yurchison and Medaro is well positioned to advance the Project with a strong management and technical team as well as a healthy treasury.”

Qualified Person:

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Richard Kusmirski, P.Geo., M.Sc., Skyharbour’s Head Technical Advisor and a Director, as well as a Qualified Person.

About Medaro:

Medaro Mining is a lithium and uranium exploration company based in Vancouver, BC, which holds options on the Superb Lake lithium property located in Thunder Bay, Ontario, the Cyr South lithium property located in James Bay, Quebec, and the Yurchison uranium property in Northern Saskatchewan. The Company is also involved in the development and commercialization of a new process to extract lithium from spodumene concentrate through its Global Lithium Extraction Technologies joint venture.

About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of uranium exploration projects in Canada’s Athabasca Basin and is well positioned to benefit from improving uranium market fundamentals with six drill-ready projects covering over 250,000 hectares of land. Skyharbour has acquired from Denison Mines, a large strategic shareholder of the Company, a 100% interest in the Moore Uranium Project which is located 15 kilometres east of Denison’s Wheeler River project and 39 kilometres south of Cameco’s McArthur River uranium mine. Moore is an advanced stage uranium exploration property with high grade uranium mineralization at the Maverick Zone that returned drill results of up to 6.0% U3O8Â over 5.9 metres including 20.8% U3O8Â over 1.5 metres at a vertical depth of 265 metres. The Company is actively advancing the project through drill programs.

Skyharbour has a joint-venture with industry-leader Orano Canada Inc. at the Preston Project whereby Orano has earned a 51% interest in the project through exploration expenditures and cash payments. Skyharbour now owns a 24.5% interest in the Project. Skyharbour also has a joint-venture with Azincourt Energy at the East Preston Project whereby Azincourt has earned a 70% interest in the project through exploration expenditures, cash payments and share issuance. Skyharbour now owns a 15% interest in the Project. Preston and East Preston are large, geologically prospective properties proximal to Fission Uranium’s Triple R deposit as well as NexGen Energy’s Arrow deposit. Furthermore, the Company owns a 100% interest in the South Falcon Point Uranium Project on the eastern perimeter of the Basin, which contains a NI 43-101 inferred resource totaling 7.0 million pounds of U3O8Â at 0.03% and 5.3 million pounds of ThO2Â at 0.023%.

Skyharbour has several active option partners including: ASX-listed Valor Resources on the Hook Lake Uranium Project whereby Valor can earn-in 80% of the project through CAD $3,500,000 in exploration expenditures, $475,000 in cash payments over three years and an initial share issuance; CSE-listed Basin Uranium Corp. on the Mann Lake Uranium Project whereby Basin Uranium can earn-in 75% of the project through $4,000,000 in exploration expenditures, $850,000 in cash payments as well as share issuances over three years; and CSE-listed Medaro Mining Corp. on the Yurchison Project whereby Medaro can earn-in an initial 70% of the project through $5,000,000 in exploration expenditures, $800,000 in cash payments as well as share issuances over three years followed by the option to acquire the remaining 30% of the project through a payment of $7,500,000 in cash and $7,500,000 worth of shares.

Skyharbour’s goal is to maximize shareholder value through new mineral discoveries, committed long-term partnerships, and the advancement of exploration projects in geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the Athabasca Basin:

http://skyharbourltd.com/_resources/maps/SYH-Athabasca-Map.jpg

To find out more about Skyharbour Resources Ltd. (TSX-V: SYH) visit the Company’s website at www.skyharbourltd.com.

SKYHARBOUR RESOURCES LTD.

“Jordan Trimble”

Â

Jordan Trimble

President and CEO

For further information contact myself or:

Riley Trimble

Corporate Development and Communications

Skyharbour Resources Ltd.

Telephone: 604-687-3376

Toll Free: 800-567-8181

Facsimile: 604-687-3119

Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

This release includes certain statements that may be deemed to be “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. The Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change. Factors that could cause actual results to differ materially from those in forward-looking statements, include market prices, exploration and development successes, continued availability of capital and financing, and general economic, market or business conditions. Please see the public filings of the Company at www.sedar.com for further information.