Spearmint moves to fund lithium and vanadium projects in Nevada, Quebec

Spearmint Resources Inc. [SRJ-TSXV, SPMTF-OTCBB, A2AHL5-FSE] said it hopes to raise $1 million via private placements of flow-through and non flow-through units.

Spearmint Resources Inc. [SRJ-TSXV, SPMTF-OTCBB, A2AHL5-FSE] said it hopes to raise $1 million via private placements of flow-through and non flow-through units.

The company said proceeds will go towards forwarding its Nevada lithium property, Quebec vanadium properties and British Columbia gold properties, as well as general working capital.

Spearmint shares were among the most actively traded stocks on the TSX Venture Exchange Friday, with over 3.7 million shares changing hands. The shares were unchanged at $0.065.

“With this placement, we will be in a position to immediately start work in Nevada on our lithium property and in Quebec on our vanadium assets,” said Spearmint President James Nelson.

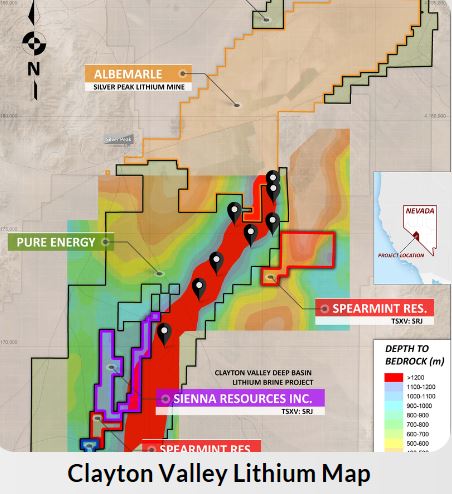

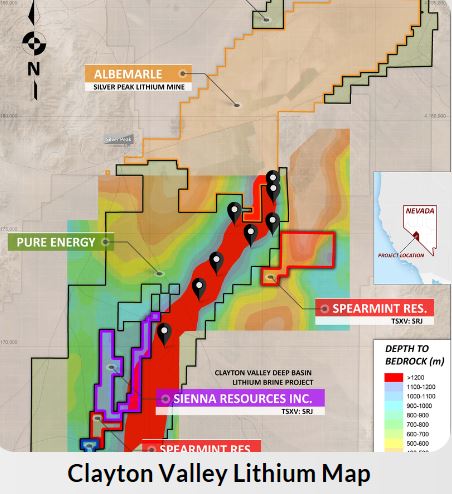

Spearmint’s property portfolio includes lithium prospects in the Clayton Valley of Nevada, comprising two claim blocks covering 800 acres. The claim blocks border properties held by Cypress Development Corp. [CYP-TSXV, CYDVF-OTCBB, C1Z1-FSE] and Pure Energy Minerals Ltd. [PE-TSXV, HMGLF-OTC, AHG1-FSE].

On December 6, 2017, Cypress released the first three holes from a 2017 drill program at the Dean and Glory Lithium properties. Pure Energy holds a 26,000-acre Lithium Brine Project, which hosts an inferred resource of 247,000 tonnes of lithium hydroxide monohydrate (218,000 tonnes Lithium Carbonate Equivalent).

Spearmint also has three lithium projects in Quebec, which are located near projects held by Nemaska Lithium Inc. [NMX-TSXV, NMKEF-OTCQX, NOT-FSE] and Critical Elements Corp. [CRE-TSXV, CRECF-OTCQX, F12-Frankfurt]. The Vanadium projects are located in Chibougamau, Quebec and consist of five separate claim blocks, covering 9,735 acres.

“We feel that lithium is at the forefront of the battery metals sector as the electric car market is exploding and the vanadium grid storage growth is in the early stages of a bull market,” Nelson said. “We look forward to a very active 2018,” he said.

In addition, Spearmint has a focus on gold exploration in British Columbia’s Golden Triangle region.

Spearmint said it intends to complete a private placement of up to 3,846,154 flow-through units at a price of $0.065 for total gross proceeds of $250,000 and a private placement of up to 15 million non flow-through units at $0.05 per net unit for total proceeds of $750,000.