Tarachi Announces Positive Results of Magistral PEA and Mineral Resource Estimate

Press Release Highlights:

- Projected average annual gold production of 16,000oz + copper concentrate

- Cash operating costs of $648/oz and AISC of $705/oz Au, net of copper and silver by-product credit.

- Pre-tax IRR of 120% and post-tax IRR of 85% at $1600/oz Au.

- Pre-tax annual free cash flow of $15.3M USD ($19.3M CAD) in peak years

Tarachi Gold Corp. (CSE: TRG) (OTCQB: TRGGF) (Frankfurt: 4RZ) (“Tarachi” or the “Company”) is pleased to announce the results of the Preliminary Economic Assessment (“PEA”) for the Company’s Magistral Mill and Tailings Project (“Magistral” or the “Magistral Project”) in Durango, Mexico.

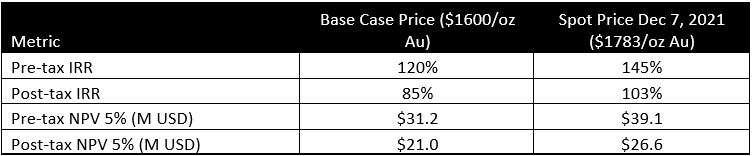

Preliminary Economic Assessment Metrics:

- Initial capital costs of $11.1M USD and after-tax payback in 1.0 years

- Development timeline of 12 months

- Cash operating costs of $648/oz and AISC of $705/oz Au, net of copper and silver credits

- Pre-tax IRR of 120% and after-tax IRR of 85% at base case prices of $1600/oz gold, $22/oz silver, and $3.40/lb copper

- Pre-tax annual free cash flow of $15.3M USD ($19.3M CAD) and post-tax cash flow of $11.3M USD ($14.3M CAD) during years of full-rate production

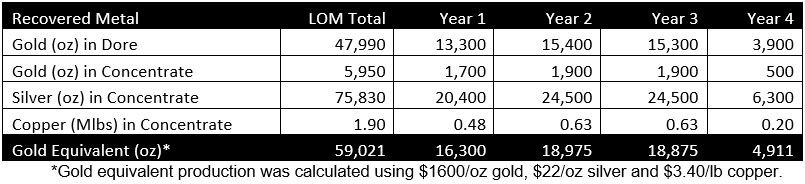

- LOM of 3.4 years with total production of 53,900oz Au, 75,800oz Ag and 1.9Mlbs Cu

The PEA was completed by Ausenco Engineering Canada Inc. (Ausenco) and provides an attractive preliminary economic case for the development of the Magistral Project. The PEA is based upon an updated Mineral Resource Estimate, also included in the PEA report, completed by AGP Mining Consultants Inc. (AGP) of Canada. The report outlines a potential low capex, low operating cost, and low environmental impact tailings reprocessing operation that can be brought into production in a 12-month time frame.

The current mine plan incorporates approximately 89% of the Measured and Indicated resources, however management believes additional tonnage may be scavenged from the remaining tailings to provide additional mine life. The Company is also looking to acquire other local tailings materials that could potentially be processed at the Magistral facility and ultimately extend the cash generating life of the asset.

Cameron Tymstra, President and CEO, commented, “We are incredibly pleased with the results of the Magistral PEA. This report confirms our previous expectations for this project in that it has the potential to generate significant free cash flow for Tarachi in a short timeframe with minimal capital investment. This project will allow us to self-fund future exploration programs on our projects in Mexico and help to reduce the risk of future shareholder dilution.

Not only does this represent an opportunity to establish Tarachi as a producer of both gold and copper in Mexico, but to do so while also cleaning up and rehabilitating a legacy tailings site. We will be excavating material that is contaminated with mercury and other metals essentially from the backyard of the Magistral community, removing those metals, and storing the tailings in an engineered and permitted tailings storage facility. Without the need to mine waste or crush and grind the plant feed, we expect to be producing from Magistral with a significantly smaller environmental footprint and lower carbon emission profile per ounce of gold than what is typical of the gold industry.

The addition of a SART (sulphidation, acidification, recycling and thickening) plant into the flowsheet will reduce our operating costs and improve our environmental profile by recycling at least 70% of the cyanide used in leaching while producing a high-grade copper concentrate by-product. With the PEA now complete and a clear pathway to production on the table, we will be fast tracking the development of Magistral in the New Year.”

Project Economics

The project’s key economic metrics are summarized in Table 1 with additional metrics and assumptions used in the PEA summarized in Table 2.

Readers are cautioned that the PEA is preliminary in nature. It includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 1 – Key Economic Metrics

Table 2 – Other Project Metrics and Assumptions

Mining

The tailings materials contained in the Mineral Resource Estimate are located adjacent to the existing processing facility at Magistral. Tailings will be mined using a Cat 330D class excavator and two 20-tonne dump trucks to move material to the mill. The average one-way trucking distance is estimated to be only 250m to the mill. Material will be dumped into a 24-hr stockpile and fed into a hopper using a front-end loader. Tailings will be fed into the mill at a rate of 1,000tpd.

Metallurgy and Processing

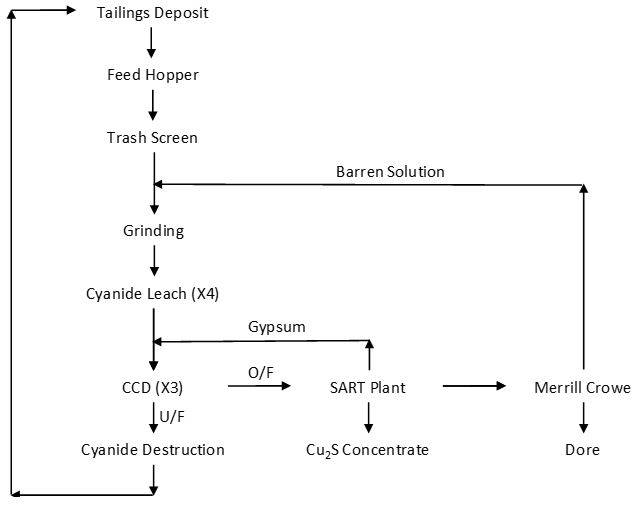

Metallurgical test work completed earlier in 2021 indicated that 83% of the gold contained in the tailings material can be leached within 12 hours without the need for additional grinding (see press release dated Nov. 2, 2021). Total global gold recovery of 80.7% was used for the PEA. The project will be maximizing the use of the existing 1,000tpd leaching facility already on site, which was built in 2018. The existing facility (Figure 1) consists of a ball mill, primary feed thickener, four agitated leach tanks with a capacity to leach 1,000tpd of tailings material for 16 hours at a slurry density of 40%, two stages of counter-current decantation (CCD), tailings cyanide destruction and a Merrill Crowe recovery circuit.

Figure 1 – Existing Magistral Processing Facility

Ausenco has identified several modifications and additions to the existing facility that once implemented are expected to achieve similar gold recoveries to those seen in the PEA metallurgical test work, reduce cyanide consumption, produce a copper concentrate by-product, and improve the quality of the final gold doré.

Plant modifications & additions:

- The existing plant onsite is considered to be in very good condition

- All feed material will pass through the existing, unused ball mill to ensure all tailings feed is sufficiently broken up and slurried prior to leaching. Use of the ball mill is only expected to provide minimal additional particle size reduction.

- The existing primary feed thickener will be re-piped to serve as a third stage of CCD, improving global gold recovery.

- A small SART circuit will be added to the facility. The SART circuit will allow for the recycling of at least 70% of the cyanide consumed in the process, production of a high-grade saleable copper concentrate and ensure the Merrill Crowe circuit can operate efficiently and with significantly lower zinc powder consumption by removing the majority of cyanide-soluble copper prior to zinc addition.

The feed will be processed in the existing plant, by refurbishing the existing equipment and adding new equipment including a SART circuit, gold room and oxygen generation unit. The process includes grinding, leaching, SART and Merrill Crowe to produce two final products (Figure 2). The Merrill Crowe circuit will produce a gold doré and the SART circuit will produce a high-grade Cu-Ag precipitate.

Average feed grade is expected to be 1.87g/t Au, 3.1g/t Ag and 0.17%Cu. Total plant recoveries for gold, silver and copper are estimated to be 80.7%, 68.4% and 46.2%, respectively.

Figure 2 – Flow diagram of updated process at Magistral

Production

Approximately 89% of the recovered gold is expected to report to the Merrill Crowe precipitate where it will be smelted into doré on site and sold to refiners. The remaining 11% of recovered gold, the majority of the recovered silver and the recovered copper will report to the SART precipitate to be sold as a high-grade (approx. 60% Cu) copper concentrate with gold and silver credits.

Table 3 – Expected Metal Production

Capital Expenditures

Initial Capital

The initial capital of $11.1M will be incurred in Year -1 (year before start of production) for installation of new equipment in the process plant, restart of the existing geomembrane-lined tailings storage facility (TSF) and infrastructure. It also includes project indirect costs, owner’s costs, and contingency.

Table 4 – Capital Expenditure Breakdown by Area

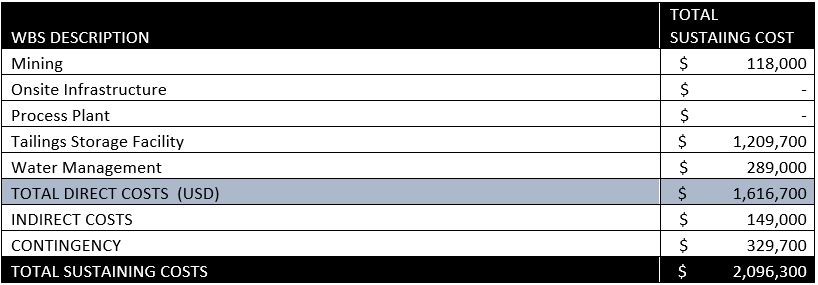

Sustaining Capital

A sustaining capital of $2.1M will be spent during the LOM. The sustaining capital includes mining, TSF and water management. Since waste stripping is not required, all mining costs except infrastructure costs will be incurred in Year 1, the same year of production.

Table 5 – Sustaining Capital Expenditure Breakdown by Area

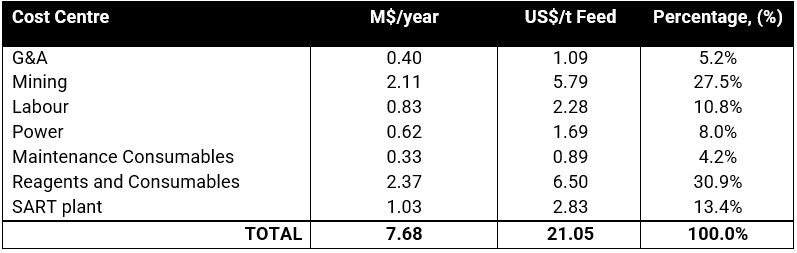

Operating Costs

Mining

Mining is assumed to be completed by the owner with rental equipment. The mining costs are based on local labour rates together with the equipment rentals.

Processing and G&A Costs

Processing costs were developed by Ausenco from first principles. The largest component of the operating costs is anticipated to be the consumption of cyanide, lime and other reagents in the processing plant.

G&A cost estimates were based on a small administration office onsite. The close proximity of the project to the towns of Magistral del Oro (pop. 200) and Santa Maria del Oro (pop. 5,000) subdues the need for an onsite camp. The workforce is expected to be sourced locally from these communities.

Table 6 – Operating Cost Breakdown

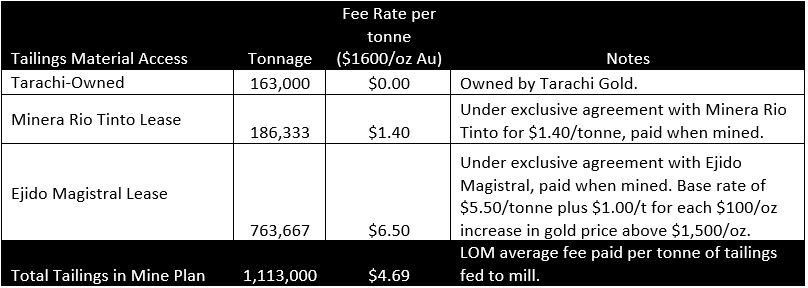

In addition to the costs listed in Table 6, the operation will also incur tailings leasing fees on some of the tailings material to be mined, paid when mined on a tonnage basis. These fees are expected to average $4.69/tonne over the LOM at a gold price of $1600/oz. The Company has access to the tailings materials included in the Mineral Resource Estimate and mine plan through a combination of ownership and exclusive leasing rights as detailed in Table 7.

Table 7 – Tailings Leasing Fee Schedule

Net of copper and silver credits, the cash operating costs, including leasing fees, are estimated at $648/oz Au with all-in sustaining costs (AISC) of $705/oz Au.

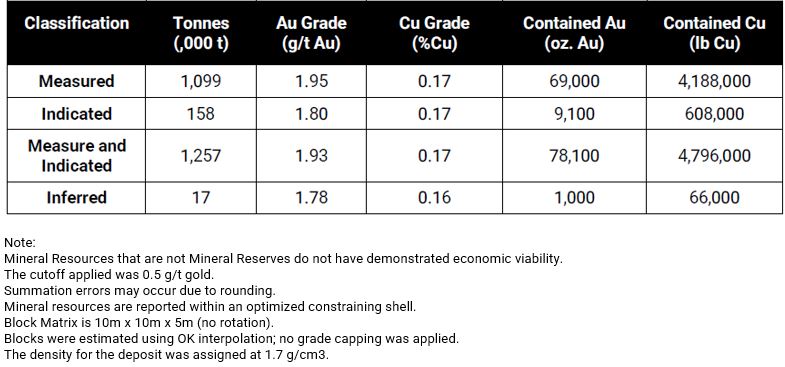

Mineral Resource Estimate

The Mineral Resources for the project are reported at a 0.50 g/t Au cut-off grade within a constraining shell. The mineral resources are summarized in Table 8 and the resource classifications are defined by the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council. The effective date of the Mineral Resources is 15 November 2021.

Table 8 – Mineral Resource Estimate for Magistral Tailings

The drill hole database used for the mineral resource estimate consists of 37 drill holes and 178 assays. Bulk density measurements were collected during the drill campaign using only samples with 100% recovery for the calculation. The median bulk density of 1.70 was used for the tailings deposit mineral resource estimate. A block size of 10x10x5m was used to model the deposit. Resource classification parameters for measured, indicated, and inferred resources can be found in Table 9.

Table 9 – Resource Classification Parameters

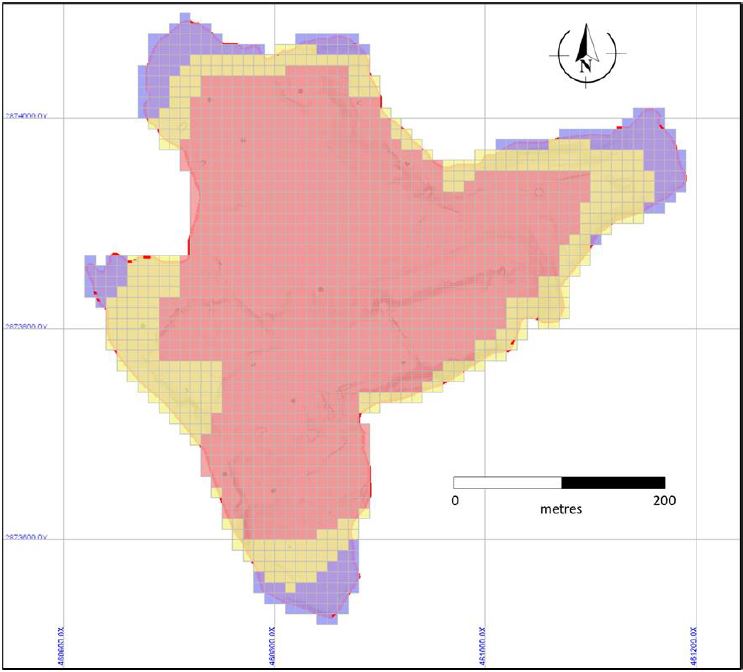

Figure 3 – Magistral Tailings Model Classification; plan view

(Red-measured, Yellow-indicated, Purple-inferred)

The PEA is preliminary in nature, includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Opportunities

Work completed during the preparation of the PEA outlined a number of opportunities that have the potential to improve the economics and ESG performance of the project:

- Mine life extension: potential to mine additional material with higher dilution which has not been considered in this study

- Dry stack tailings: an evaluation of using dry stacked tailings to reduce TSF costs and improve ESG performance will be completed during the next phase of study

Quality Assurance/Quality Control

Tailing samples were selected by company geologists with each sample placed into plastic bag. Sample tags were inserted into each bag before being sealed and stored at the campsite in a secure area. At the completion of the program the samples were transported by company trucks directly to Tarachi’s secure facility in Hermosillo, Mexico for transport to Canada.

All 178 samples from the 37 vertical, auger drill holes completed were shipped to Activation Laboratories Ltd. in Kamloops B.C. Canada for sample preparation and analysis. 30 grams from each sample was analyzed for gold by Fire Assay Fusion with an AA (atomic absorption finish) as well, 0.5 grams of each sample was digested by Agua Regia and then analyzed using an ICP for a 38 element suite. Activation Laboratories is ISO/IEC 17025:2017 and ISC 9001: 2015 accredited and/or certified.

Control samples comprising of certified reference samples, duplicates and blanks were systematically inserted into the sample stream and analyzed as part of the company’s quality assurance / quality control protocol.

The remainder of the samples were then delivered to Base Metallurgical Laboratories, also in Kamloops to complete all metallurgical studies requested.

About Tarachi Gold

Tarachi Gold is a Canadian-listed junior gold exploration company focused on exploring and developing projects in Mexico. Tarachi acquired the Magistral Mill and tailings project in Durango, Mexico in 2021. Magistral includes a 1,000 tpd mill and access to a tailings deposit with Measured and Indicated resources of 1.26 million tonnes at a grade of 1.93g/t Au. The Company expects to bring the asset into production in early 2023.

The Company is also exploring on 3,708ha of highly prospective mineral concessions in the Sierra Madre gold belt of Sonora, Mexico in close proximity to Alamos Gold’s Mulatos mine and Agnico Eagle’s La India mine.

About Ausenco

Ausenco is a global company based across 26 offices in 14 countries, with projects in over 80 locations worldwide. Combining deep technical expertise with a 30-year track record, Ausenco delivers innovative, value add consulting studies, project delivery, asset operations and maintenance solutions to the mining and metals industrial sectors.

Qualified Person

The PEA for the Company’s Magistral project as summarized in this release was completed by Ausenco with support from AGP. A full technical report supporting the PEA will be prepared in accordance with NI 43-101 and will be filed on SEDAR within 45 days of this press release. Lorne Warner, P.Geo, VP Exploration and Director of the Company is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

Contact Information: For more information and to sign-up to the mailing list, please contact:

Cameron Tymstra, CEO

Email: cameron@tarachigold.com

Â

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forwardâ€Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forwardâ€looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forwardâ€looking statements or information. These forwardâ€looking statements or information relate to, among other things: future exploration programs, development of mining assets, acquisition of additional resources, future production, future cash flows, and the completion of drill holes; and receipt of assay results.

Forwardâ€looking statements and forwardâ€looking information relating to any future mineral production, liquidity, timing of completion of reports and studies, enhanced value and capital markets profile of Tarachi, future growth potential for Tarachi and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Tarachi’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Tarachi’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forwardâ€looking statements or forward-looking information and Tarachi has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Tarachi’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forwardâ€looking statements or forward-looking information. Although Tarachi has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Tarachi does not intend, and does not assume any obligation, to update these forwardâ€looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.