Tartisan Nickel Corp. Announces Updated Measured, Indicated and Inferred Mineral Resources for the Kenbridge Nickel-copper-cobalt Project, Nw Ontario

Tartisan Nickel Corp. (CSE:TN; US-OTC: TTSRF; FSE:A2D)Â (“Tartisan”, or the “Company”)is pleased to announce that P&E Mining Consultants Inc. has completed a review and re-estimation of the historic NI 43-101 compliant Technical Report and Updated Mineral Resource Estimate of the Kenbridge Nickel-Copper-Cobalt Project, Atikwa Lake Area, NW Ontario.

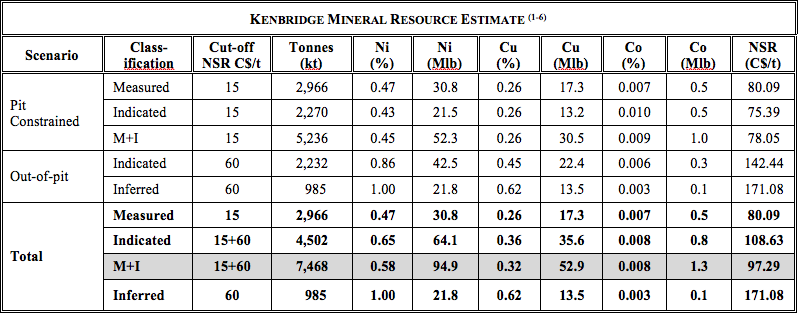

Updated estimates were done for pit constrained and out-of-pit nickel, copper, and cobalt Mineral Resources. Total Measured & Indicated Mineral Resources based on a Net Smelter Return (NSR) cut-off value of CDN$15 per tonne for pit constrained Mineral Resources and CDN$60 per tonne NSR for out-of-pit Mineral Resources is 7.5 Mt at 0.58% Ni and 0.32% Cu for a total of 95 Mlb of contained nickel. An additional 0.985 Mt at 1.0% Ni and 0.62% Cu (22 Mlb contained nickel) were calculated as Inferred Mineral Resources. The pit constrained Measured & Indicated Mineral Resources total 5.27 Mt of 0.45% nickel; 0.26% copper; and 0.009% cobalt at an NSR cut-off value of CDN$15/tonne. The out-of-pit Measured & Indicated Mineral Resources total 2.23 Mt of 0.86% nickel; 0.45% copper; and 0.006% cobalt. Inferred Mineral Resources out-of-pit total 0.985 Mt at 1.00% nickel; 0.62% copper; and 0.003% cobalt, at an NSR cut-off value of CDN$60/tonne. Details of the Mineral Resource Estimate are shown in Table 1.

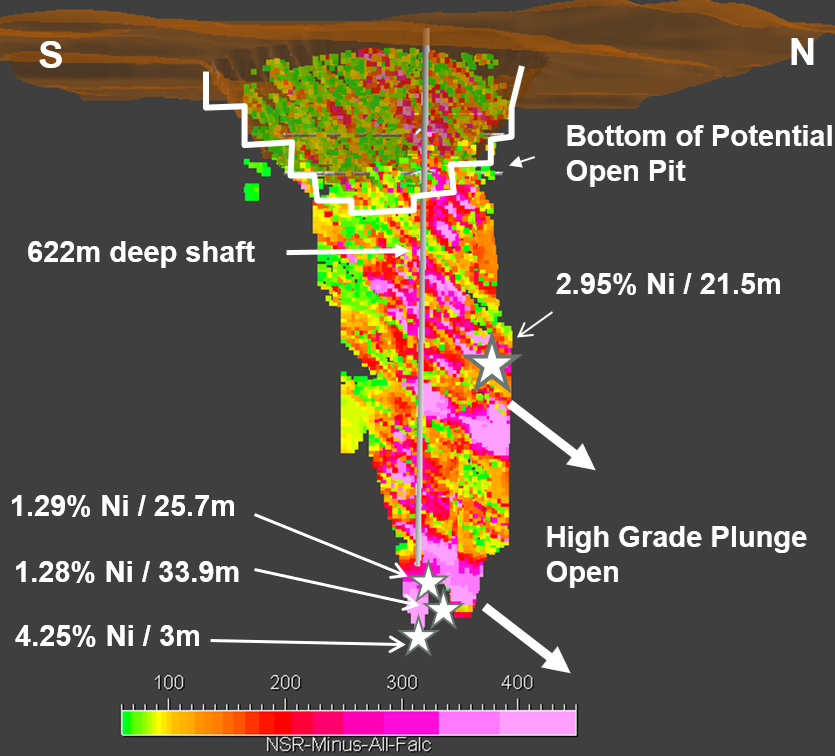

The Kenbridge Property is located in the Kenora – Fort Frances, Ontario area with good access to roads and power. It has a shaft to a depth of 2,042 ft (622 m), with level stations at 150 ft. (45 m) intervals below the shaft collar and two levels developed at 350 ft (107 m) and 500 ft (152 m) below the shaft collar.

Visual inspection of the NSR Block Model for the Kenbridge Deposit shows the highest nickel grades (>2.0%) appear to have a strong down-plunge orientation as illustrated in Figure 1.

A historical Preliminary Economic Assessment (PEA) for the Kenbridge Deposit was completed by Buck et al. in 2008 for Canadian Arrow Mines Limited (now a 100% wholly owned subsidiary of Tartisan Nickel Corp). The PEA was updated by WMT Associates Ltd. in a Canadian Arrow Mines Limited news release dated January 21, 2008, and subsequently updated again in a news release dated September 4, 2008.  The Updated PEA was completed by WMT Associates Limited, based on an updated NI 43-101 Mineral Resource Estimate by P&E Mining Consultants Inc. (Canadian Arrow Mines Limited news release dated August 19, 2008) and improved metallurgical recoveries (Canadian Arrow Mines Limited news release dated June 26, 2008). Highlights of the Updated PEA were: average Ni recovery life of mine was 86%; recovered Ni was 84.6 Mlb; NPV 7.5% pre-tax was $253M; and IRR% pre-tax was 65%.  The cost, value and financial assumptions used in the Updated PEA were unchanged from the original January 2008 PEA (Buck et al., 2008), including average life of mine, US$10/lb nickel and US$2.50/lb copper prices, and a CD$1.00:US$0.90 exchange rate. Although this PEA is deemed to be historical by the Company, it is thought to be important.

Table 1.

Note:Â Â Ni =Nickel Cu = Copper, Co = Cobalt, NSR = Net Smelter Return.

1.   Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. Â

2.   The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3.   The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

4.   The Mineral Resources in this report were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5.   The Mineral Resource Estimate was based on US$ metal prices of $7.42/lb nickel, $3/lb copper and $25/lb cobalt.

6.  The out-of-pit Mineral Resource grade blocks were quantified above the $60/t NSR cut-off, below the constraining pit shell and within the constraining mineralized wireframes. Additionally, only groups of blocks that exhibited continuity and reasonable potential stope geometry were included. All orphaned blocks and narrow strings of blocks were excluded. The longhole stoping with backfill mining method was assumed for the out of pit Mineral Resource Estimate calculation.

Figure 1. Kenbridge Deposit 3D view illustrating calculated NSR blocks and drill hole intersections of significance.Â

CEO Mr. Mark Appleby stated, “The Updated Mineral Resource Estimate was necessary to determine if Kenbridge mineralization is potentially extractable under current metal prices and exchange rates. This is a major milestone achieved by the Company as the market conditions for Class 1 nickel sulphide deposits improve. The differences between the previous P&E Mineral Resource Estimate (2008) and the current P&E Updated Mineral Resource Estimate are attributed to changes in metal prices and recalculation of NSR values. The Kenbridge Deposit shows there is great potential to expand the Mineral Resource down-plunge of high-grade intersections such as hole KB07-180 (2.95% Ni, 0.82% Cu/21.5m including 7.2% Ni, 0.67% Cu/5.5m) and also at depth. The deepest hole (end of hole K2010 = 880 m below surface) intersected mineralization grading 4.25% nickel and 1.38% copper over 10.7 ft (3.3 m), indicating that the Deposit remains open at depth. Tartisan plans to expand on these intersections, upgrade the Indicated and Inferred Mineral Resources and test high potential nickel exploration targets, such as the Kenbridge North Target. Additionally, given the market interest in Class 1 nickel deposits, we will look to update the historic Preliminary Economic Assessment completed in 2008 based on this very positive Mineral Resource update.”

The Company plans an aggressive surface exploration and definition drilling plan, in addition to geotechnical, metallurgical and environmental work to advance the Kenbridge Nickel-Copper-Cobalt Project in the upcoming 2020 winter season and into the summer of 2021.

The effective date of the 2020 Updated Mineral Resource Estimate is September 2nd, 2020 and the Technical Report relating to the Updated Mineral Resource has now been filed on SEDAR.

Qualified Person

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in NI 43-101 and reviewed and approved by Eugene Puritch, P.Eng., FEC, CET, a Qualified Person as defined by NI 43-101.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company which owns; the Kenbridge Nickel Project in northwestern Ontario, the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

The Company has an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies

Limited and Peruvian Metals Corp.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN; US-OTC:TTSRF; FSE: A2D). Currently, there are 101,603,550 shares outstanding (103,303 ,550 fully diluted).

For further information, please contact Mr. D. Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan can be found at the Company’s website at www.tartisannickel.comor on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.