Teck Chairman Emeritus Norman Keevil issues statement

Teck Resources Ltd. (TECK.B-TSX, TECK.A-TSX, TECK-NYSE) Chairman Emeritus Norman Keevil on Sunday said that he would support any kind of transaction, an operating partnership, merger, acquisition, or sale, but with the right partner and on the right terms for Teck Metals after separation.

“I believe that pursuing a sale or merger transaction now would rob shareholders of significant post-separation value,” Keevil said in a statement, adding that “Glencore Plc’s proposal is the wrong one, as well as at the wrong time.’’

Keevil released the statement on April 16, 2023, days after the after the Vancouver-based mining company rejected an unsolicited $23 billion takeover bid from Swiss metals trading giant Glencore, which Glencore has revised to allow shareholders who do not want to own shares in a combined coal operation to receive cash plus 24% of the combined metals-focused business.

Keevil was also commenting on Teck’s pending separation which the company has said provides shareholders with a greater set of options to maximize value, while minimizing execution risk.

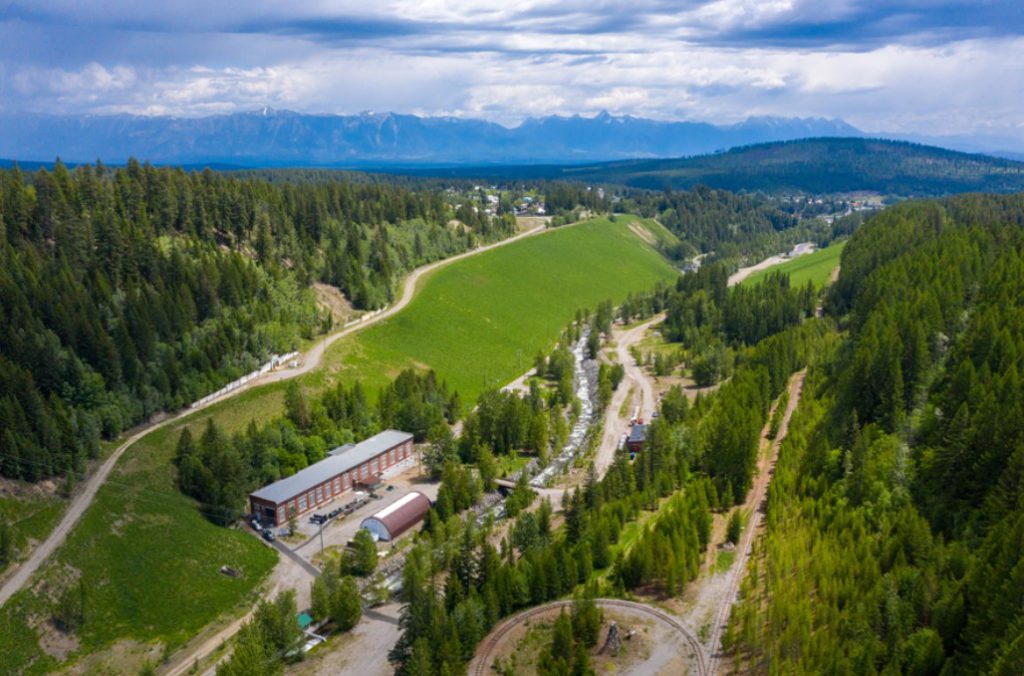

The was refering to a plan that would see Teck reorganizing its business into two independent, publicly-listed companies. Teck Metals Corp. will contain the metal operations while Elk Valley Resources Ltd. (EVR) focuses on steelmaking coal production.

The separation is structured as a spin-off of Teck’s steelmaking coal business by way of a distribution of EVR common shares to Teck shareholders. As part of the separation, Teck will change its name to Teck Metals Corp.

Teck shareholders are set to vote on the planned spin off of the British Columbia coal operations in April 26, 2023. The deal requires the support of two thirds of both the Class A and Class B shares. The Class As carry 100 votes per share while the Class B common shares carry a single vote.

According to a Globe and Mail report, Teck has been approached by Vale [VALE-NYSE], Anglo American [AAL-LON], and Freeport McMoran [FCX-NYSE] on potential deals for the Canadian miner’s base metals business if shareholders approve the planned split.

Keevil said he wanted to provide a clear statement about his perspective following media commentary regarding his views.

“My colleagues and I are proud of what we have achieved through 30 years of building Teck, growing the company 500-fold from a $25 million market cap to $12.6 billion, with double digit compounded growth in shareholder value, and continuing growth in recent years to $25 billion today.

“I am confident that [Teck CEO] Jonathan Prices and his team have every chance of duplicating that strong growth phase again, perhaps doing even better,’’ Keevil said. “Based on my decades of experience, building a successful mining company, I believe that pursuing a sale or merger now would rob our shareholders of significant post-separation value.’’

On April 14, 2013, Teck’s Class B common shares closed at $60.43. The shares trade in a 52-week range of $62.38 and $32.68.