The Golden Triangle: Perhaps the World’s Greatest Area Play

Photo courtesy of American Creek Resources Ltd.

By Rod Blake

Investment knowledge comes from the accumulation many inexact criteria or factors. The net result of this knowledge enables the investor to decide whether to buy, avoid or exit a particular investment or sector. Sometimes investment knowledge becomes profitable quite quickly such as those who foresaw the future electrification of the auto industry and invested in an upstart new auto company  – Tesla Inc. ‘TSLA’. Sometimes this knowledge can be expensively painful if one invests in a rising market that is about to turn – think of those who followed and thought the American housing market was a solid investment that could only go up and purchased Mortgage Backed Securities prior to housing collapse in 2008. Most often though – investment knowledge comes from watching the success or failure  of companies or sectors over time and various economic cycles.

Resource exploration and investment is much the same. Sometimes, but rarely, an orebody is discovered with the first few drill holes. I was lucky enough to be involved with such a discovery with the Afton copper discovery near Kamloops, BC in the early 1970s.. Sometimes an investment is too good to be true such as the Bre-X gold debacle of the mid 1990s. But for the most part, orebodies and by extension, mining companies are built over years of trial & error and economic cycles. As noted above – investment knowledge is enhanced with time. One of the benefits to being a broker for over three decades was the ability to identify and deal with various economic  and mineral cycles. And as a broker who focused a good portion of his time on resource investments, I got to see firsthand how mineral companies or sectors performed during these cycles. I feel The Golden Triangle in Northwest British Columbia fits this enhanced investment criteria.

The Golden Triangle is in a very unique mineral occurrence. It is not a one or two drill hole discovery wonder. It is certainly not the result of a new or suddenly in vogue market niche.

The Golden Triangle is a relatively complex mineral camp that has been worked by many miners since the turn of the last century. The main minerals in the camp, gold, silver and copper, are well known and have been mined for centuries. The uniqueness of the camp comes from the number of orebodies within the triangle and the  relatively high grade of those orebodies. A comparison to the Golden Triangle might be the high grade nickel mines in Sudbury, Ontario or the many gold mines near Val-d’Or, Quebec.

The historical longevity of the Triangle has also been a benefit to companies involved due the wealth of geologic and mineral knowledge accumulated over time. One of the unique characteristics of the mining industry is that companies have to file ongoing reports of their exploration and production activities. These reports are recorded and kept on file by governments and are made available as historic building blocks to enhance current activity. That is – a geologist in 2021 can reference field reports from many years ago to better position the drill for this season’s program. Most orebodies are discovered this way, with each successive company building on the knowledge of preceding explorers who held and then dropped the property due to less than expected results or failing to raise funds in a bear market. Case in point – just prior to the Afton discovery, Kennecott Mining had dropped the property due to poor drilling results. As it turned out their exploration program missed the edge of the orebody by only a few hundred feet. Many of the orebodies in the Triangle are the result of the same scenario. That is – multiply companies exploring and advancing promising geologic occurrences only to drop the property due to less than expected results or a poor economic or mineral cycle. Then, when mineral prices and economics improve, another company acquires the same ground and begins their exploration journey with benefit of the accumulated recorded data of previous explorers.

My exposure to the Golden Triangle began as a young broker in the mid to late 1980s. The area wasn’t as well defined as it is today and was mainly referred to as the Eskay Creek or Iskut Area. Back then there were two dominate players in the area – Â noted mining man Don McLeod with his Newhawk Gold’s Sulphurets Property Brucejack Project and famous promoter/financier Murray Pezim and his Calpine Resources’ Eskay Creek Project,

Brucejack was a very highgrade but erratic deposit. The very high grade globular or nugget like nature of the gold required a major underground development via a very expensive declining ramp to recover bulk samples and to keep the drill bits as close to the ore as possible. And while the orebody was well defined, the project needed higher gold prices to warrant a production decision and lay dormant until only a few years ago as the flagship mine of Pretium Resources ‘PVG-T’.

As of yesterday, Newcrest Mining Limited [NCM-ASX, TSX] announced it intends to acquire all of the outstanding shares of Pretium for C$18.50 per share, a premium of 23%.

The ore at Eskay Creek was also very illusive and explored with numerous drill holes. Many thought that Calpine should drop the property and move on, but Mr. Pezim persisted and inevitably the now-famous hole 109 returned a 682-ft. interval grading an average of 0.87 oz. gold, 0.97 oz. silver, 1.12% lead and 2.26% zinc. The Eskay Creek Mine was ultimately bought and put into production by Barrick Gold and was North America’s highest grade gold producer between 1994 and 2008. This mine produced over 3 million ounces of gold and nearly 160 million ounces of silver from 2.2 million tonnes of ore.

Due to limited access, the Triangle was much more of a seasonal play in those days. Remember, this was pre-internet and brokers and investors waited anxiously for the season’s drilling results to be reported. In the process, Calpine’s spectacular #109 drill hole triggered a trading frenzy on the Vancouver Stock Exchange which brought many more companies into the fray. We had regional maps of the area on our walls and would mark off the geological and structural trends of the various companies or properties of interest as assays came in. Many other mineral occurrences were discovered but few were developed and the area play wound down as financings became difficult as mineral prices declined into the late 1990s.

The area became known as The Golden Triangle early this century as mineral prices again improved and interest in the area renewed once again. This time though – the knowledge gained from the collage of various many regional reports produced a much larger and district area of mineral interest. And just as the miners on the 1980s learned from their predecessors, the miners of today have learned from theirs. Except, there are many differences this time around. Thanks to the information age, today’s explorers have an extraordinary wealth of data to review and research in order to plan their exploration programs. Modern geologic and geophysical technology helps today’s miners to better focus in on their targets. And thanks to global warming and improved infrastructure, companies have greatly extended their exploration seasons to the point where the larger well funded projects can now work 12-months of the year.

Today’s investors also have a distinct advantage than we had back in the day. Today’s investors can also research companies and projects via the internet, podcasts and trade shows. Instead of anxiously tracking projects through maps on a wall they can follow projects very closely on their computer.

Resource brokers and seasoned resource investors know that minerals in the ground don’t disappear. They go in and out of favour based on economic, environmental or regulatory decisions. Today, mineral prices are rising and exploration companies are coming back in vogue. For a shrewd investor, an area play in is a great way to participate in this trend. Instead of investing in one company and hoping for a long shot discovery, an area play, much like an Exchange Traded Fund or ETF, Â gives investors many more chances of success as companies in the area trade off each other’s successes.

The Golden Triangle is a very unique area play that differentiates itself from many others. It is in one of few mineral friendly regions of the world with good and improving infrastructure. It has a storied history of great discoveries and wealth. It’s orebodies are some of the richest in the world and as a result have attracted a broad range of companies and investors. The projects are concentrated in a relatively small area in interest so that the results of one can influence others nearby. There are a variety minerals  such as gold, silver, copper and others in play. Over the years, I have followed and invested in many area plays. And from my perspective – I would suggest that because of the history, concentration, grade and variety of its mineral occurrences – The Golden Triangle of British Columbia is perhaps  the world’s greatest area play.

Of the dozens of resource companies exploring the Golden Triable, here are a few notable stocks to watch:

American Creek Resources Ltd. [AMK-TSXV] is a Canadian exploration company with a front-row seat in one of the hottest gold exploration projects in northwestern British Columbia’s Golden Triangle area.

American Creek Resources Ltd. [AMK-TSXV] is a Canadian exploration company with a front-row seat in one of the hottest gold exploration projects in northwestern British Columbia’s Golden Triangle area.

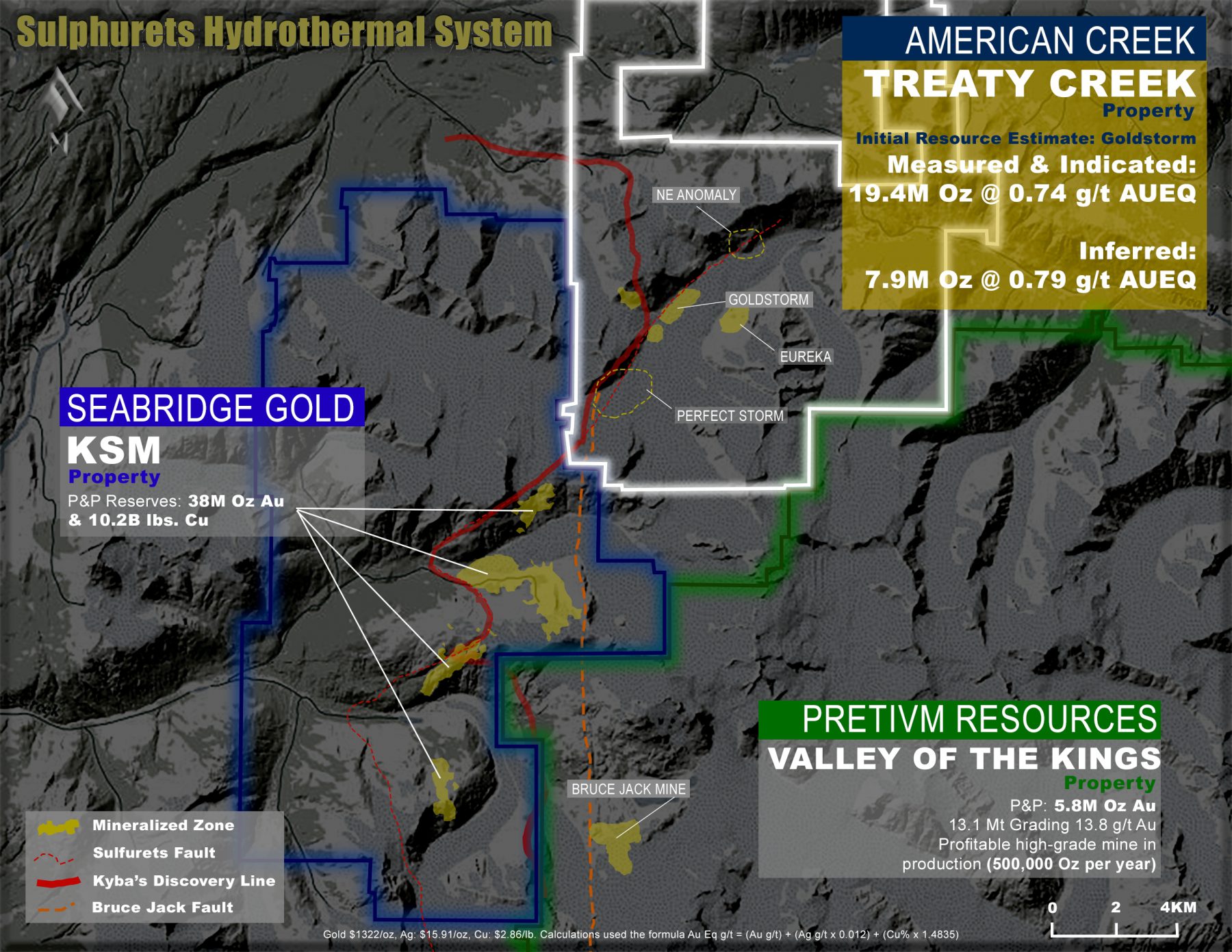

The company’s key asset is a 20% interest in the Treaty Creek joint venture project located in the same hydrothermal system as Seabridge Gold Inc.’s [SEA-TSX, SA-NYSE] KSM property and Pretium Resources Inc.’s [PVG-TSX] Brucejack gold mine.

KSM is one of the world’s largest undeveloped gold projects as measured by reserves, containing 38.8 million ounces of gold and 10.2 billion pounds of copper in proven and probable reserves.

Exploration at Treaty Creek is led by Ken Konkin, Vice-President corporate development and exploration at Tudor Gold Corp. [TUD-TSXV, TUC-Frankfurt], which holds a 60% interest in Treaty Creek and is the project operator. The other 20% is held by Teuton Resources Corp. [TUO-TSXV].

Konkin is best known for his instrumental role in the discovery of Pretium Resources “Valley of Kings” deposit and taking the Brucejack mine into production in 2017. Brucejack is expected to produce between 325,000 and 365,000 ounces of gold this year.

If Konkin can repeat his earlier success in the Golden Triangle, it would put American Creek and its joint venture partners in a very favourable position. American Creeks 20% interest is fully carried until a production notice is given.

This view is obviously shared by key investors, including Bay Street financier Eric Sprott, who continues to fund the drilling effort, including a placement last month and currently holds a significant position in all three companies, including a 17.8% partially diluted stake in American Creek.

American Creek offers investors a low-cost entry to the Treaty Creek story as its share of the M&I resource is currently being valued close to $19/oz gold equivalent. In comparison, the operators’ share is valued close to $32/oz gold equivalent for the same ounces in the ground. As noted above, American Creek will incur no development costs (dilution) for Treaty Creek, and the project may be sold prior to a notice of production is given.

American Creek offers investors a low-cost entry to the Treaty Creek story as its share of the M&I resource is currently being valued close to $19/oz gold equivalent. In comparison, the operators’ share is valued close to $32/oz gold equivalent for the same ounces in the ground. As noted above, American Creek will incur no development costs (dilution) for Treaty Creek, and the project may be sold prior to a notice of production is given.

The largest gold and copper deposits in the Golden Triangle are hosted by the Sulphurets Hydrothermal System and include the KSM and Brucejack deposits, which are located in the southern half of the geological system.

The 17,913- hectare Treaty Creek property covers the northern half of the system, where geology, geophysics, and exploration results show that the known mineralization in the southern half continues north.

That would be in line with the thinking of Konkin, who has referred to deposits in the Sulphurets Hydrothermal System as a “string of pearls….just really big pearls.”

Exploration of the Treaty Creek area over the past 30 years by various junior companies resulted in the discovery of a number of surface mineral showings, some with very high gold and silver values.

However, it is only recently that drilling revealed the potential for a large-scale porphyry-style gold deposit at the Copper Belle and Goldstorm zones, which are located on-trend and just five kilometres northeast of the KSM deposits.

A resource calculation announced in March 2021 for the Goldstorm zone contained *19.4 million ounces of 0.74 g/t gold equivalent (AuEq) in the Measured & Indicated resource category as well as 7.9 million ounces of 0.79 g/t AuEq of inferred resources and open in all directions.

In a September 28, 2021 news release, Tudor Gold said the latest set of results from the 2021 resource expansion and definition drill program indicate that the Goldstorm system is expanding to the northeast.

Optimism is driven by results from four drill holes, including step-out hole GS-21-119, which returned 196.5 metres of 1.76 g/t gold equivalent (AuEq) within a broader zone of 564.0 metres containing 1.09 g/t AuEq, along with previously announced hole GS-21-113 which intersected 927m of 1.265 g/t gold equivalent.

Optimism is driven by results from four drill holes, including step-out hole GS-21-119, which returned 196.5 metres of 1.76 g/t gold equivalent (AuEq) within a broader zone of 564.0 metres containing 1.09 g/t AuEq, along with previously announced hole GS-21-113 which intersected 927m of 1.265 g/t gold equivalent.

However, Goldstorm is only one of several potential deposits on the Treaty Creek project.

In the same press release, the company said near-surface mineralization was encountered at the Eureka Zone, which is located approximately 1,000 metres southeast of the Goldstorm Deposit.

Drilling at Eureka returned 67.5 metres of 1.13 g/t AuEq within 217.5 metres averaging 0.76 g/t AuEq. Like Eureka, Goldstorm remains open in all directions and at depth as drilling continues.

Tudor Gold has postponed drilling on the Perfectstorm zone, located just two kilometres southwest of Goldstorm, enabling them to concentrate their efforts on Goldstorm given the grades are getting richer to the north. It appears that 2021 drilling will expand the resource extensively.

The hope is that the higher-grade material in the first 300-400 metres from surface in the 300 horizon could help to improve the economics of Goldstorm by reducing the Cap-X payback period of an open pit operation.

American Creek’s other key asset is the Austruck-Bonanza in central British Columbia. The property is contiguous to WestKam Gold Corp.’s [WKG-TSXV] Bonapart gold property, where two open pits yielded a 3,700-tonne bulk sample grading 26.5 g/t gold.

* Metal prices used were US$1,625/oz Au, US$19/oz Ag, US$2.80/lb Cu with process recoveries of 88% Au, 30% Ag and 80% Cu. A C$16.50/tonne process and C$2 G&A cost were used. Approximately 90% of the AuEq is gold.

Benchmark Metals Inc. [BNCH-TSXV, BNCHF-OTCQX, 87CA-FSE] is working to unleash the potential of its 100%-owned Lawyer’s gold silver project located in the prolific Golden Horseshoe region of northern British Columbia. The project continues to be on track for a 2022 feasibility study and potential construction readiness in 2024, the company has said.

Benchmark Metals Inc. [BNCH-TSXV, BNCHF-OTCQX, 87CA-FSE] is working to unleash the potential of its 100%-owned Lawyer’s gold silver project located in the prolific Golden Horseshoe region of northern British Columbia. The project continues to be on track for a 2022 feasibility study and potential construction readiness in 2024, the company has said.

Benchmark is part of the Metals Group of companies, which is managed by an award-winning group of professionals with a proven ability to capitalize on investment opportunities and deliver shareholder returns. Bay Street financier Eric Sprott remains the company’s largest single shareholder with a 14.8% of Benchmark’s outstanding common shares.

Its flagship Lawyers property is located in the Toodogone region of the Omineca Mining Division of B.C. and consists of 37 contiguous mineral claims. The claims cover 114 square kilometres of land that encompass the Lawyers group of prospects, including the former Lawyers underground gold-silver mine and the Silver Pond group of prospects, and includes over 16 gold-silver mineral occurrences.

The property is situated 45 kilometres northwest of Centerra Gold Inc.’s [CG-TSX, CAGDF-OTC] Kemess Copper-Gold mine, where underground development and construction is under way.

Exploration in the area began in the late 1960s and peaked in the 1980s, identifying numerous showings, prospects and deposits culminating in the development of the Lawyers gold-silver mine. It operated between 1989 and 1992, producing 171,200 ounces of gold and 3.6 million ounces of silver.

Exploration in the area began in the late 1960s and peaked in the 1980s, identifying numerous showings, prospects and deposits culminating in the development of the Lawyers gold-silver mine. It operated between 1989 and 1992, producing 171,200 ounces of gold and 3.6 million ounces of silver.

However, the deposit was never fully mined, and the surrounding area was never thoroughly explored for gold-silver mineralization. An estimated $50 million in infrastructure remains in place, including year-round road access.

Five underground developments also remain in place, in addition to historical resources and new targets. Benchmark is now working to establish a world class gold-silver mine at the site.

In a May 14, 2021 press release, Benchmark announced a bulk-tonnage mineral resource estimate for the project. The estimate includes 2.1 million ounces grading 1.62 g/t gold equivalent (AuEq) in the indicated category. On top of that is an inferred resource of 821,000 ounces, grading 1.58 g/t AuEq. The resource is amenable to both open pit and underground mining methods.

The mineral resource estimate will form the basis of a preliminary economic assessment (PEA) that is expected to be completed later this year.

“This initial multi-million-ounce mineral resource has exceeded all expectations and has significant expansion potential with the planned 2021 drill program,” said Benchmark CEO John Williamson.” In addition, the regional exploration drill program will be targeting zones for new satellite deposits.”

“This initial multi-million-ounce mineral resource has exceeded all expectations and has significant expansion potential with the planned 2021 drill program,” said Benchmark CEO John Williamson.” In addition, the regional exploration drill program will be targeting zones for new satellite deposits.”

The company has said it planned to complete a fully funded drill program, at a cost of up to $30 million this year, to move the project towards the feasibility study stage. That includes drilling on six targets including the Marot zone, which yielded 101.00 metres core length of 0.82 g/t gold equivalent in drill hole 20MLDD005.

Of the 100,000 metres of drilling planned for this year, 50,000 metres will be for mineral resource definition drilling to both expand current mineral resources and to upgrade the current inferred mineral resources to measured and indicated classifications for inclusion in an anticipated feasibility study in 2022.

In addition, to expanding the mineral resource zones at depth and along strike, a regional exploration program will consist of 50,000 metres to drill test and expand existing and new discovery targets, including Marmot, Marmot East, Lala, Silver Pond, Guildfords Edge.

An initial series of drill holes on the Connector Zone have successfully delineated near-surface continuity of gold and silver mineralization between the Cliff Creek Deposit and Dukes Ridge Deposit.

The company said the discovery of new broad mineralization and high-grade material at surface has the potential to increase gold-silver ounces in an updated mineral resource estimate and provide the potential for a higher-grade starter pit in near-term engineering studies.

In a September 28, 2021 press release, the company said all of the 10.47 million share purchase warrants that were due to expire on September 23, 27 and October 7, 2021, have been fully exercised, providing $13 million of working capital to the treasury, including financier Eric Sprott’s exercise of 6.7 million warrants that generated proceeds of $2.7 million.

On October 25, 2021, Benchmark shares were trading at $1.10 in a 52-week range of $1.64 and 83 cents, leaving the company with a market cap of $176 million, based on 187 million shares outstanding.

Thesis Gold Inc. [TAU-TSXV] is a mineral exploration company focused on proving and developing the resource potential of its Ranch Gold Project in the highly prolific Golden Horseshoe area of British Columbia.

Thesis Gold Inc. [TAU-TSXV] is a mineral exploration company focused on proving and developing the resource potential of its Ranch Gold Project in the highly prolific Golden Horseshoe area of British Columbia.

When the company recently raised $18.4 million from an over-subscribed offering of flow-through and non-flow-through shares, Thesis CEO Ewan Webster said he expects 2021 to be a transformational year for the company.

Webster is an exploration geologist who has worked for a number of public companies in North and South America. His PhD research focused on unraveling aspects of the structure, stratigraphy, tectonics and metamorphism of southeastern B.C.

Webster leads a management team that holds a 25% stake in Thesis. On October 27, the shares traded at $1.39 in a 52-week range of $1.75 and 52 cents, leaving the company with a market cap of $63 million, based on 45.4 million shares outstanding.

Thesis offers investors a window on the Golden Horseshoe, one of Canada’s most prolific areas for mineral exploration, and home to fabled British Columbia mining operations including Red Chris, Kemess, Red Mountain and Bruce Jack. Its flagship Ranch property is also close to high profile exploration projects, including the Lawyers property where Benchmark Metals Inc. [BNCH-TSXV, BNCHF-OTCQX, 87CA-FSE] has so far outlined 3.0 million gold-silver ounces in the indicated and inferred category.

Thesis has set an exploration target of 2.0 million ounces at the Ranch project, which contains 21 known near-surface epithermal gold deposits and prospects.

The property covers 17,832 hectares and is located in the Toodoggone district about 300 kilometres north of the town of Smithers. It straddles a key stratigraphic horizon between rocks of the Upper Triassic Stuhini Group and Lower Jurassic Toodoggone Formation.

It is worth noting that property was explored in the 1980s when three small pits were excavated, producing about 41,000 tonnes of high-grade ore from the Bonanza, Thesis 111 and BV zones.

However, the property remains largely unexplored and the geological setting, coupled with historical evidence of high-grade mineralization represents a significant opportunity for a major discovery.

In an August 3, 2021 press release, the company said it had launched a fully funded and comprehensive exploration and drill program, consisting of 20,000 metres of drilling, extensive surface geochemical sampling, bedrock and alteration mapping, airborne VTEM and ground-based magnetics and induced polarization (IP) geophysics, designed to target near-surface high grade gold and silver mineralization in addition to deeper porphyry targets.

The goal is to test known zones of mineralization as well as a number of new targets which have never been drilled and have the potential for significant new discoveries. “The planned work represents a significant and extensive regional exploration program and we look forward to communicating our progress to the market over the coming months,” Webster said.

The August announcement came after the Government of British Columbia granted to Thesis a five-year work permit for exploration and drilling on the property.

On October 5, 2021, the company released initial results from the 20,000-metre drill program. It said strongly altered zones from the first three holes at the Bonanza Zone were selected for rushed analysis. These first three confirmation holes at the Bonanza Zone confirm high-grade gold mineralization extends from surface to depth,” Webster said. “We anticipate further results from both the Bonanza and Ridge Zones over the coming weeks,” he said.

Drilling highlights include hole 21BNZDD001, which returned 34 metres (core length) of 19.56 g/t gold at the Bonanza Zone, including 15 metres of 41.64 g/t gold and 7.00 metres of 82.48 g/t gold from a depth of only 26 metres down hole.

At the time that the initial results were released, the company said it has completed over 6,000 metres of the 20,000-metre program at the Bonanza and Ridge gold zones. It said two drill rigs were turning at Bonanza, but would shortly be moving to the Thesis 2&3 gold zones to complete a similar confirmation and expansion program.

It said a third drill rig (a track mounted reverse circulation drill rig) has been added and is testing over 10 new exploration targets at the heart of the project.

Thesis recently signed an early-stage exploration agreement with the Kwadacha, Takla and Tsay Keh Dene First Nations. It said the agreement provides a framework to create a collaborative working environment based on open dialogue and transparent communications.

“Even though the relationship is at an early stage, we are encouraged by Thesis Gold’s willingness to work with the Tsay Key Nay to advance our mutual interests,” said Chief Pierre of the Tsay Keh Dene.