The Mexican Mining Industry: A Mecca for Mining

By Luke Holland

Mexico has a long mining tradition that extends to the present day. Mexico is the largest producer of silver globally, producing some 6,300 tonnes in 2022 and a top-ranking producer of gold, copper, and zinc. The potential for discovery within this jurisdiction remains strong, with a diverse geologic landscape ideally suited for metal explorers. Boasting a population of 128.9 million, Mexico, with its geographic location close to the United States, enables easy access to foreign markets and international trading routes. A strong national GDP (US2.487 trillion in 2022) coupled with political stability enhances Mexico’s attractiveness for foreign investment.

In the past, the Mexican mining industry has reliably been strong. According to Mexico’s Ministry of Economy, mining production in Mexico represents 2.4% of Mexico’s GDP and 8.2% of its industrial GDP. In 2020, Government data states that the sector employed nearly 350,000 people and contributed $1.5 billion in taxes, with an additional $1.84 billion generated from exports of metals and minerals. This all bodes well for the Mexican mining industry; however, political change has affected the sector of late.

The current Mexican president, Andrés Manuel López Obrador (AMLO) of the Morena party, has taken a firm approach to the mining and exploration sector. In some instances, López Obrador’s government has rejected project permits and declared a moratorium on new mining concessions. The president of the Mexican mining chamber Camimex, Fernando Alanis, has stated publicly in an interview that he has “growing doubts on government policies like permitting and concessions will lead to at least a dozen companies shifting new investments to more inviting countries like Peru and Chile.”

The president’s attitude towards mining has been described as distrustful by CEO of the Mexican Mining Centre, Douglas Coleman. The decision to ban new mining concessions has caused significant negative impacts to the mining industry, as exploration efforts have been greatly hampered. During the pandemic, President ALMO, released a statement outlining only essential industries should be allowed to function, in which mining was not included. However, President ALMO reversed this decision after three months, possibly shedding some light on the importance of the industry to the Mexican economy.

Whilst the governing powers that be may not fully support the mining industry, they are but temporary enigmas. On the other hand, geology continues to be favorable for discovery. In 2021, Latin America was recognized as being the top region for mining and exploration investment, receiving 24% of the global investment funds, of which Mexico received a quarter, making it the most attractive jurisdiction in the region. The Fraser Institute conducts an annual survey ranking countries by their attractiveness for mining investment. In 2021, Mexico rose several places from 42 to 34, which is Mexico’s best ranking since 2018. Mining has been a focal point in Mexican economy for over 500 years and will continue to do so for many years to come, irrespective of political ideology.

With that all being said, stepping away from the political arena, what has been going on in this space? Mexico, being the top global producer of silver, has attracted both majors and juniors the world over in hopes of new discoveries. One such major who has set up shop in this tier one jurisdiction is Grupo Mexico [BMV: GMEXICOB] – a Mexican mining conglomerate with a host of subsidiary companies that operate nine mines, four processing plants and a pipeline of mining prospects. Grupo Mexico has taken full advantage of the region’s diverse and highly prospective geology, operating both copper porphyry and vein hosted deposits, Grupo Mexico has a diverse portfolio encompassing copper, lead, zinc and silver commodities.

Elsewhere within the jurisdiction, we see Newmont [NYSE: NEM] laying claim to the polymetallic Peñasquito mine, the largest gold mine, second for silver and one of the largest for lead/zinc in Mexico. Located in central Mexico, Peñasquito boasts total proven and probable reserves estimated to be 15.69 Moz of gold, 911.8 Moz of silver, 2.63 Mt of lead and 6.3 Mt of zinc. With active prospects like this it’s hard not to be optimistic for future discoveries.

Southern Silver Exploration’s [TSX-V: SSV; OTCQX: SSVFF] flagship Cerro Las Minitas project is located in Durango State and has caught investor’s eyes. The company has conducted extensive exploration at Cerro Las Minitas and has identified several high-grade mineralized zones. The company has completed a preliminary economic assessment (PEA) on the project (with an after-tax net present value (NPV) of 5% – US$349M and IRR (Internal rate of return) of 17.9%), which demonstrates its potential to be a low-cost, high-margin operation.

Southern Silver Exploration’s [TSX-V: SSV; OTCQX: SSVFF] flagship Cerro Las Minitas project is located in Durango State and has caught investor’s eyes. The company has conducted extensive exploration at Cerro Las Minitas and has identified several high-grade mineralized zones. The company has completed a preliminary economic assessment (PEA) on the project (with an after-tax net present value (NPV) of 5% – US$349M and IRR (Internal rate of return) of 17.9%), which demonstrates its potential to be a low-cost, high-margin operation.

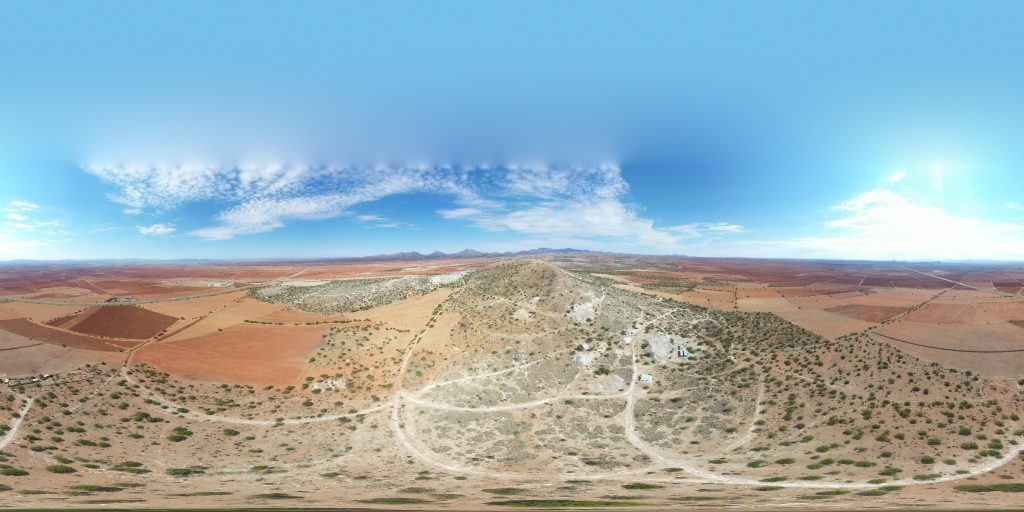

The project itself consists of a polymetallic silver-lead-zinc-copper-gold deposit that has significant exploration potential. The project is located in a renowned mining jurisdiction with excellent infrastructure. The project area is transected by two federal highways, a rail line and transmission lines. Located in the prolific Fresnillo district, Cerro Las Minitas is located in good company with the high producing Ag/Au/Zn/Pb Velardeña and San Martin skarns located only 80km and 100km distant, respectively. Southern Silver has obtained exploration permits and is well bedded in the local community, employing a locally skilled workforce.

Cerro Las Minitas is composed of a skarn type and massive sulfide chimney style deposits. Consisting of calcareous sediments surrounding the central intrusive complex of the Cerros Las Minitas dome, the project is rich in Ag/Zn/Pb and Cu. The project is located in the prospective mineral belt that stretches from the highly productive vein deposits of the Fresnillo in the south to the massive manto mineral deposits of Santa Eulalia to the north.

To date, Southern Silver has identified six high-grade silver-polymetallic deposits – the Blind zone, El Sol zone, Las Victorias Zone, Skarn Front Zone, South Skarn Zone and the Bocona Zone, which have been partially delineated, as well as several other high priority targets throughout. The Blind, El Sol and Las Victorias zones are a series of near-surface silver-polymetallic (Cu/Pb/Zn/Au) “dyke-replacement style” deposits.

To date, Southern Silver has identified six high-grade silver-polymetallic deposits – the Blind zone, El Sol zone, Las Victorias Zone, Skarn Front Zone, South Skarn Zone and the Bocona Zone, which have been partially delineated, as well as several other high priority targets throughout. The Blind, El Sol and Las Victorias zones are a series of near-surface silver-polymetallic (Cu/Pb/Zn/Au) “dyke-replacement style” deposits.

The Skarn Front Zone, South Skarn Zone and Bocona Zone are zones of silver-polymetallic mineralization found at or near the boundary between the skarn and marble alteration facies, in the halo of the central monzonite intrusion. This mineralization has been delineated up to depths of greater than 1km and is open along strike and to depth.

Mineralization at Cerros Las Minitas is hosted in two main styles:

The Blind, Las Victorias and El Sol deposits – Localized in sub-vertical structures and on dyke margins

Skarn Front, South Skarn and Mina La Bocona deposits – Semi-massive and massive sulphide lenses at the marble-skarn transition, adjacent to the monzonite contact

The Central Monzonite intrusion acts as the “heat pump” to the mineralizing system.

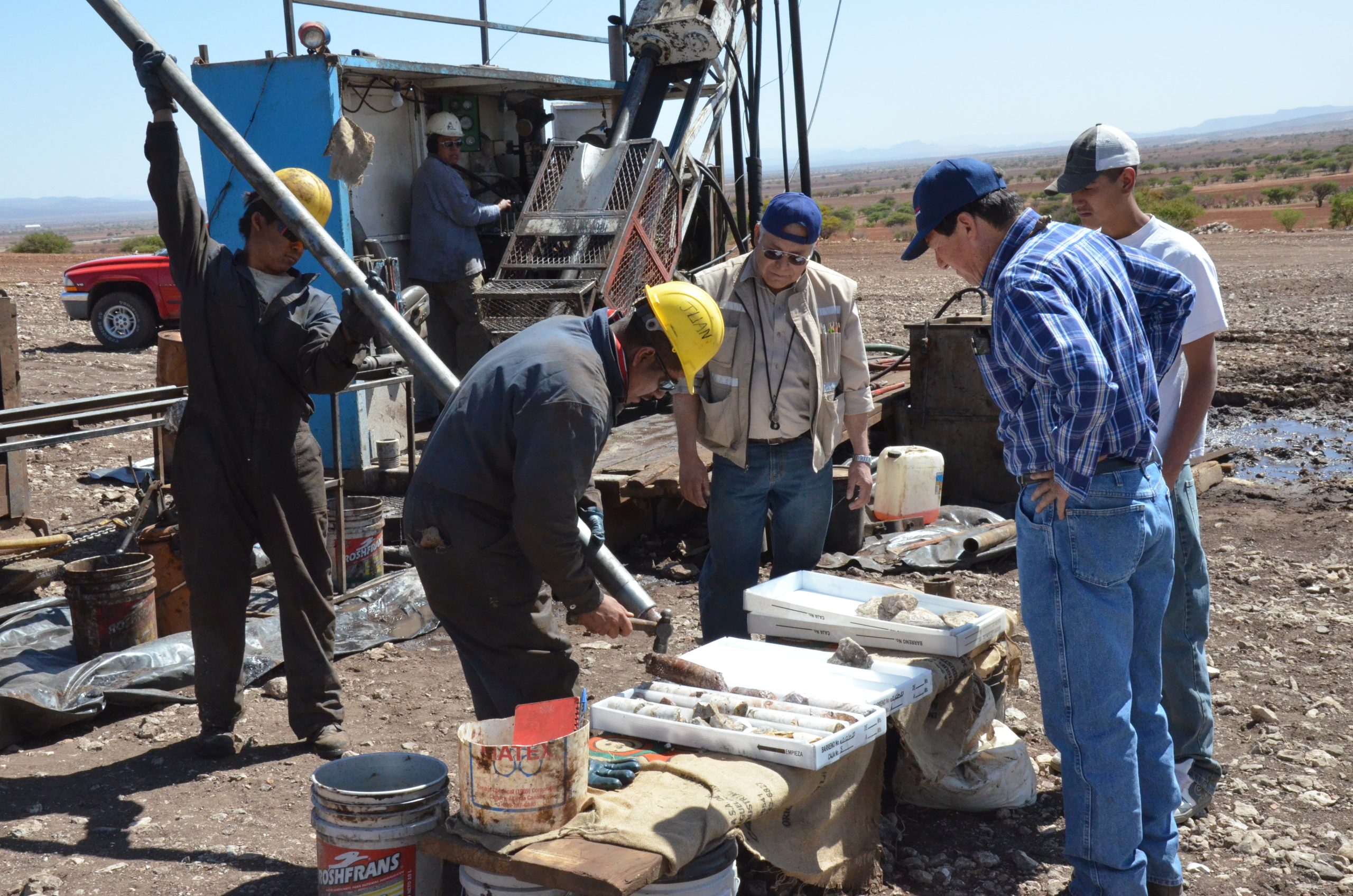

In 2021, Southern Silver released an updated NI 43-101 resource for the Cerro Las Minitas Project. The updated 43-101 is based on a total of 186 holes, for 80,650 metres. A US$60/t NSR cut-off is utilized.

Highlights include:

Indicated Resources of 137Moz AgEq, 42.1Moz Ag, 44Mlb Cu, 358Mlbs Pb & 895Mlbs Zn.

Inferred Resources of 198Moz AgEq, 73.6Moz Ag, 98Mlb Cu, 500 Mlbs Pb & 1.0 Blbs Zn.

The mine plan focuses on Zn/Pb/Ag/Cu concentrates with ongoing metallurgical testing to establish the feasibility of sulphide and oxide related gold concentrate. An underground method of mining is postulated, with an approximate life span of 15 years, yielding a maximum cash outlay of $341M.

The mine plan focuses on Zn/Pb/Ag/Cu concentrates with ongoing metallurgical testing to establish the feasibility of sulphide and oxide related gold concentrate. An underground method of mining is postulated, with an approximate life span of 15 years, yielding a maximum cash outlay of $341M.

So, what’s next for Southern Silver and their emerging polymetallic deposit?

One of the challenges facing the project is obtaining permitting for mining. This is achievable, even with President ALMO at the helm, good community relations coupled with the project’s location in a proactive mining state, enhances the chances of success.

Additionally, infill drilling is in the pipeline coupled with additional exploration drilling to further delineate and add to mineral resources. Moreover, supplementary metallurgical work is planned to upgrade the project economics and evaluate the possibility of gold recovery from both sulphide and oxide sources, and its potential impact on the established cash flow model.

The Cerro Las Minitas project holds serious credentials and has the potential to be a premier polymetallic Zn/Pb/Ag/Cu project. The ongoing work focused on both exploration and engineering fronts further de-risks the project, this coupled with the recent PEA, low market cap (CAD$49.5M), and latest resource estimate (Indicated/Inferred) adds to the blue-sky investor opportunity on offer.