Trevali posts record zinc production

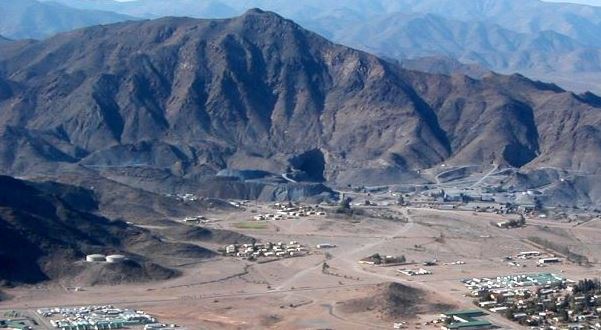

The Rosh Pinah zinc mine in Namibian, Africa. Source: Trevali Mining Corp.

Trevali Mining Corp. [TV-TSX, LMA; TREVF-OTCQX; 4T1-FSE] said Monday January 20 that it is positioned to be a 400-million-pound annual zinc producer with a reduced cost profile until 2022.

The prediction came as Trevali released its preliminary fourth quarter and full-year production results as well as operating, capital and exploration spending guidance for 2020.

Trevali is a Vancouver-based mining company. The bulk of its revenue is generated from base metals mining at four operations. They are the 90%-owned Perkoa Mine in Burkina Faso, the 90%-owned Rosh Pinah Mine in Namibia, the wholly-owned Caribou zinc-lead-silver mine in New Brunswick, and the wholly-owned Santander Mine in Peru.

On Monday, the company said it exceeded its 2019 zinc production guidance by producing a record 417 million payable pounds of zinc last year.

Total lead and silver production also exceeded 2019 guidance with 50 million payable pounds of lead and 1.49 million payable ounces of silver produced in 2019.

The company also launched the T90 program, inclusive of the digital transformation program aimed at realizing $50 million in annual sustainable efficiencies and reducing all-in sustaining costs to $0.90 a pound by the beginning of 2022.

“In 2019, we started the transformation of Trevali,” said Trevali’s President and CEO Ricus Grimbeek. “The company meaningfully beat annual production guidance, the board was refreshed, a new management team was assembled and we launched the T90 program to modernize our operations and bring them down the cost curve,” Grimbeek said.

“The company is well positioned to be a 400-million-pound annual zinc producer with a reducing cost profile until 2022 when we intend to make a step change in production and cost as the RP2.0 expansion project at Rosh Pinah in Namibia is commissioned,” he said.

Trevali shares advanced on the news, rising 1.96% or $0.005 to 26 cents on volume of 1.19 million. The shares are currently trading in a 52-week range of 16 cents and 49 cents.

Consolidated production guidance for 2020 is estimated at between 380 million and 410 million pounds of payable zinc, 51 and 57 million pounds of payable lead, and 1.44 million and 1.58 million ounces of payable silver.

Consolidated cost guidance for 2020 for C1 cash costs is estimated at between $0.85 and $0.93 per pound of zinc. The all-in-sustaining cost (AISC) is expected to range between $0.98 and $1.08 per pound of zinc.

Capital expenditures for the group is forecast at $81 million, consisting of $57 million in sustaining capital, $12 million in exploration capital and $12 million in expansionary capital, which relates to initiatives under the T90 program, including deploying technology to improve productivity and decision making.