Wesdome delivers positive PEA for Kiena Complex, Quebec

Wesdome Gold Mines Ltd. [WDO-TSX] has announces positive results from the independent NI 43-101 compliant Preliminary Economic Assessment (PEA) for its 100%-owned Kiena Complex in Val d’Or, Quebec. All figures are stated in Canadian dollars unless otherwise stated.

Highlights:

• After-tax IRR of 102%

• After-tax NPV (discount rate 5%) $416 million

• Preproduction capital cost of $35 million

• Sustaining Life-of-Mine (LOM)

• Capital Cost of $121 million

• After-tax payback period (after resumption of operations) 1.7 years

• Average diluted grade of 10.65 g/t gold based on current Kiena Mine Resource Estimate of September 2019

• Contained gold in Mined Resources: 709,000 ounces

• PEA Life-of-Mine of 8 years

• Total Unit Cash Operating Costs CDN$ 492/oz (US$374/oz)

• All-in sustaining costs CDN$674/oz (US$512/oz)

• Gold Price US$1,532/oz

• Exchange Rate: C$1.00:US$0.76

Duncan Middlemiss, President and CEO, commented, “We are pleased with the results of the PEA that clearly illustrates the viability to restart production at the Kiena Mine in a very short-term horizon. The PEA demonstrates a low-cost and high margin operation, with low capital requirements and a short payback period, while minimizing risks and maximizing shareholders’ return.

“The Company is well-financed to advance the project to the next level with a cash position as of the end of the first quarter of $49.4M. This PEA is based on the Mineral Resource Estimate dated September 2019 and includes only those resources proximal to the mine infrastructure, specifically the A Zone, B Zone, S50, VC Zones and the South Zone.

“Diamond drilling activities at Kiena restarted on May 11th, focusing on the continuation of converting inferred into indicated resources, exploring the A Zone up-plunge potential and expanding the resources at depth in the Kiena Deep A Zone. The success of this drill program and drilling post September 2019 will further enhance the project economics outlined above.

“An updated resource estimate is planned early in Q4 2020 followed by a pre-feasibility study and a production restart decision in H1 2021. The COVID-19 pandemic has impacted our abilities to drill and develop at our full capacity; therefore, this timeline includes contingencies until further information is available regarding the pandemic and necessary protocols going forward. Longer term, our focus will turn to the remaining resources on the Kiena property, which all together total 2.83M tonnes at 8.7 g/t gold for 788,000 ounces in the measured and indicated category, and 2.92M tonnes at 8.6 g/t for 798,000 ounces in the inferred category. There is certainly no lack of prospective targets.”

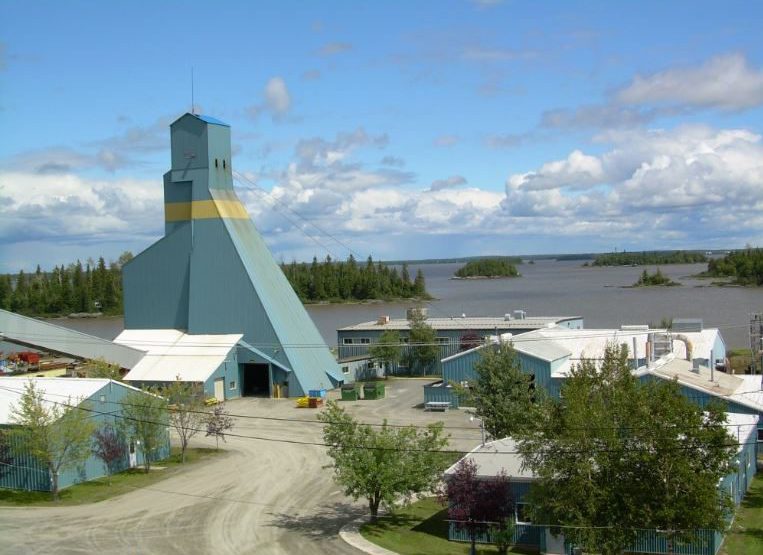

Overview The Kiena Complex is northwest of Val d’Or and covers 7,047 hectares. The project includes the milling and tailings facilities of the Kiena Mine, nine shafts including the 930-metre Kiena shaft, related underground workings from past producers and exploration projects, various surface facilities and is fully permitted.

Other than the exploration activities and underground exploration development, the principal infrastructure of the project has been under care and maintenance since mid-2013. Past production from 1981 – 2013 was 12.5M tonnes at 4.5 g/t gold for 1.75 M ounces produced. The Kiena Deep A Zone was first intersected in December 2007 and is localized within the Marbenite Fault deformation corridor and is divided into three main lenses and a fourth smaller lens.

Future mining will utilize the longhole mining method, and development will be performed utilizing standard development methods. Daily production rate commences at 450 tonnes per day (tpd) increasing to over 850 tpd. The overall strategy is to maximize throughput from the high-grade Kiena Deep A Zone and to augment the production with the South, VC and the S50 and B Zones. Ore will be hauled by trucks to the shaft ore passes already established in the mine. Waste rock from development and approximately 38% of the tailings produced at the process plant will be returned to underground workings for backfilling purposes.

In early trading on May 28, Wesdome shares were up $0.06 to $11.78 on a volume of 619,300 shares traded.