Wesdome names Anthea Bath as CEO

Wesdome Gold Mines Ltd. [WDO-TSX] said Monday it has appointed Anthea Bath as President and CEO, effective July 1, 2023. Warwick Morley-Jepson, who has been leading the company since the retirement of former CEO Duncan Middlemiss, will continue to act as Interim CEO until Bath takes up her new position. He will then resume his role as Independent Board Chair.

“I look forward to working with the Wesdome team in what I consider to be one of the best gold opportunities in the world,’’ Bath said in a press release, Monday.

The company said Bath has demonstrated her capabilities in both the operational and business aspects of mining, including new business development, supply chain, business optimization, and marketing.

Most recently, she was Chief Operating Officer of Ero Copper Corp. [ERO-TSX, NYSE], Ero is a Brazil-focused base metals mining company. Its key asset is a 99.6% stake in Mineracao Caraiba S.A. (MCSA), a long-established Brazilian copper mining company with 40 years of operating experience in the Curaca Valley of Bahia, Brazil.

Wesdome said her efforts contributed to the impressive growth of Ero Copper, from a junior mining company to a $2 billion international mining company. She started her career with Anglo American Platinum as Head of Market Development and Intelligence.

On June 2, 2023, Wesdome shares closed at $7.76 and currently trade in a 52-week range of $13.50 and $6.00.

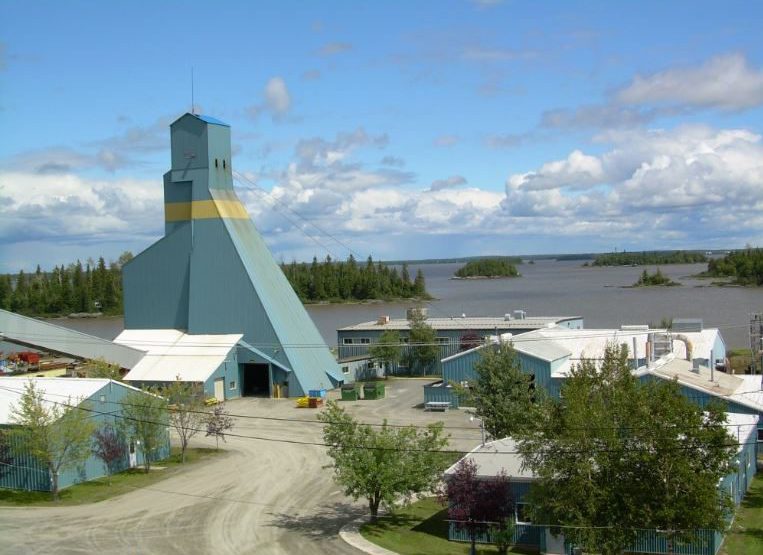

Wesdome is a Canadian gold producer with two high-grade underground assets, the Eagle River mine in Ontario and the recently commissioned Kiena mine in Quebec. The company also retains meaningful exposure to the Moss Lake gold deposit in northwestern Ontario via its 27% equity position in Goldshore Resources Inc. [GSHR-TSXV, GSHRF-OTCQB, 8X00-FSE].

Wesdome reported full year 2022 production of 110,850 ounces of gold in 2022, compared to 123,843 ounces in 2021. The company has guided investors to anticipate annual production this year of between 110,000 and 130,000 ounces.

Bath becomes CEO after a challenging year for the company, with production misses at both assets. “At Eagle, underperformance was primarily related to the variability of the Falcon Zone, which negatively impacted our ability to accurately forecast near-term production,’’ Middlemiss said. “The Falcon Zone mineralization has a high nugget effect and we have experienced both positive and negative reconciliations since we commenced mining in this area in the fourth quarter of 2021,” he said.

Production in the fourth quarter of 2022 was below expectations as a result of higher planned grades at the Falcon Zone slipping into the first quarter of 2023, partially due to severe snowstorms hindering the company’s ability to truck the high-grade ore to the mill.

At Kiena, the company said supply chain delays left it approximately six months behind schedule on the original commercial production date, and nine to 12 months behind on ramp development, thereby limiting mining operations to lower grade areas of the mine.

However, Bath said the team has done an excellent job of optimizing and advancing two quality high grade assets exclusively in Canada. She said Wesdome is at a very exciting inflection point with the Kiena Mine on its way to full production and corresponding cash flow benefits.