Silver price rise predicted to last year’s performance

By David Duval

Silver mine production fell for the fourth consecutive year in 2019 coincident with rising demand. According to the World Silver Survey, strong expectations exist for a rise in total silver demand in 2021 of 15% to 1.03 billion ounces, with a 26% increase in physical investment to 252.8 million ounces.

Silver mine production fell for the fourth consecutive year in 2019 coincident with rising demand. According to the World Silver Survey, strong expectations exist for a rise in total silver demand in 2021 of 15% to 1.03 billion ounces, with a 26% increase in physical investment to 252.8 million ounces.

Often described as the “poor man’s gold”, most of the silver produced is a by-product of mines that primarily produce copper, gold or other metals. What few primary silver producers that do exist are generally very small and contribute marginally to aggregate global silver production

Silver has some unique characteristics that set it apart from other metallic elements, especially gold. It is malleable and ductile making if perfect for jewelry and silverware and it is one of the world’s most reflective substances.

Silver is also one of the world’s best conductors of electricity, allowing its use in electronic components such as wires, switches and printed circuit boards. The combination of ductility and electrical conductivity makes silver perfect for micro-electronics devices such as smartphones where it can be bent and squeezed into tiny spaces without breaking.

The metal also exhibits the unique property of penetrating bacteria cell walls – while not harming mammalian cells – and destroying the ability of the microbe to reproduce. This allows silver ions to be employed as a biocide, which is growing increasingly important as overuse of chemical antibiotics is causing some bacteria to become immune.

Over the millennium, silver has been prized as an investment and storehouse of wealth and used as a medium of exchange in much the way that gold has been used. However, because of its lower value, silver is more available to a greater number of people who choose to keep physical silver instead of paper currency.

The chief driver of silver’s 27% average price gain in 2020 was the growth in silver investment led by exchange-traded products (ETPs) which took global holdings above one billion ounces for the first time since their introduction in 2006. In addition, strong demand for silver bars and coins pushed physical investment demand up 8% to a four-year high.

Institutional and retail investor demand, fueled initially by the onset of the pandemic, combined with intermittently lower silver prices, as well as an unprecedented wave of quantitative easing and fiscal stimulus across all major economies, led to the sizeable silver investment recorded in 2020.

Silver-backed ETPs grew last year by 331 million ounces, an increase of 298% to end 2020 at 1.067 billion ounces. Physical silver investment jumped 8% to 200.5 million ounces led by the U.S., which was up 69% and Europe at plus 23%. Physical investment demand would have been stronger if not for pandemic-related supply disruptions which caused sharply higher wholesale and retail premiums.

Strong investor interest was also evident in commodity exchanges last year with several exchanges achieving record trading volumes including the Shanghai Futures Exchange which overtook COMEX to become the largest exchange for silver futures trading in 2020. The 2020 annual average silver price was US$20.55/oz, up 27% from 2019, the highest average silver price since 2013.

The gold:silver ratio topped 127 in March, an all-time-high that was 27% higher than the previous record seen in the early 1990s. Later in the year, however, the silver price gathered momentum, rallying to a peak of nearly US$30/oz in August outpacing gold’s performance. As a result, the gold:silver ratio ended the year at 72.

According to the Silver Institute, a non-profit industry association, silver demand for printed and flexible electronics is forecast to increase 54%, from 48 million ounces in 2021 to 74 million ounces in 2030, consuming 615 million ounces for these applications during the 10-year timeframe as this market continues to mature and expand.

Printed and flexible electronics are vital to the evolution of electronic technologies as they are mainstays in a wide range of products including sensors for temperature, pressure, motion, lighting, moisture/relative humidity, radar, heart rate, and carbon monoxide. Other applications include their use in internet-connected devices, medical and wearable electronics, displays for appliances, mobile phones, computers and tablets, medical devices, automotive, solar panels and consumer electronics.

With the global economy reopening and vaccinations accelerating in many countries, economic growth in 2021 is expected to strengthen. In fact, the International Monetary Fund recently projected 6% global GDP growth for this year.

For the silver market, industrial fabrication is forecast to increase by 8% to a record annual total, led by electrical and electronics offtake. However, this forecast is predicated on a recovery in vehicle manufacturing, strong consumer electronics demand, and further gains from the solar sector. Jewelry and silverware demand is expected to enjoy double-digit increases in 2021.

Silver investment is projected to have another strong year in 2021 with demand for silver bars and coins expected to post its highest annual figure since 2015. In the meantime, mine production is forecast to rise by 8% as output recovers after last year’s pandemic-related disruptions. Overall, supply, including recycling, is expected to increase by 8% in 2021.

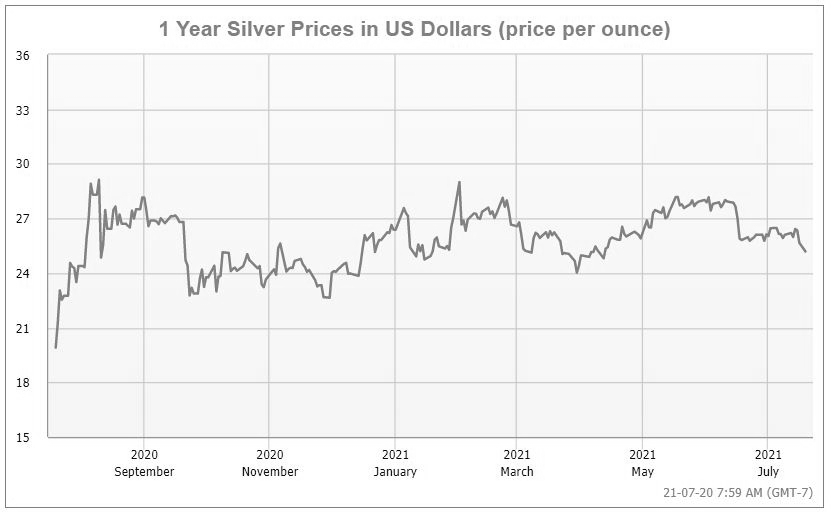

Metals Focus, an independent precious metals research consultancy, expects the silver price to rise to a peak of US$32/oz later this year and average US$27.30/oz overall in 2021, a 33% increase over the 2020 average price.

Aurcana Silver Corp. [AUN-TSXV] has reached an exciting phase in its development as it works to put one of the world’s highest grade silver mines back into production.

Aurcana Silver Corp. [AUN-TSXV] has reached an exciting phase in its development as it works to put one of the world’s highest grade silver mines back into production.

Aurcana owns the Revenue-Virginius (RV) Mine in Colorado and the Shafter-Presidio Silver Project in Texas. The primary resource at both mines is silver. Both mines operated in the past 8 years and both have new mills and are fully permitted for production.

By bringing the RV mine into production this year, Aurcana is taking a key step on the road to becoming a mid-tier silver producer. Assuming it can get the Shafter project on line within the next three years, Aurcana hopes to be generating annual production of up to 9.0 million ounces of silver.

The company’s highly experienced management team is led by President and CEO Kevin Drover, who has over 50 years of both domestic and international experience including spells at Iron Ore Co. of Canada, Noranda, Lac Minerals and Sr VP of Worldwide operations at Kinross.

He is leading a team with an operating background, and a lot of prior experience of building and operating mines like the ones that the company is developing now.

“The silver price is the wind at our back at the moment,” Drover said recently “The RV mine feasibility study and economic numbers are based on a silver price of US$18.50 cents. Silver is currently trading at US$26 an ounce. “It’s a huge, huge bonus for us to have that kind of difference in our economics,” he said.

“The silver price is the wind at our back at the moment,” Drover said recently “The RV mine feasibility study and economic numbers are based on a silver price of US$18.50 cents. Silver is currently trading at US$26 an ounce. “It’s a huge, huge bonus for us to have that kind of difference in our economics,” he said.

“We are probably the only company in the silver space that is this close to production, certainly in the United States.”

RV is a high grade fully permitted mine (plus 1015 g/t AgEq), with six years of reserves, plus additional resources and significant mine life extension and exploration opportunities identified.

The mine remains on track to reach full production by September, 2021. Ore throughput will be ramped up to 110 tons per day during August, 2021, and then to full production of 270 tons during September.

Concentrate shipments are expected to begin in early August. Trafigura Trading LLC is the off-taker for 100% of the concentrates and will pay 95% of the contained metals value based on the mine site concentrate assays at the time of shipment, with the final settlement based on smelter return

A June 2018 feasibility study is based on measured and indicated resources of 30 million ounces of silver equivalent (AgEq), plus an inferred resource of 13.2 million ounces. Proven and probable reserves at the site stand at 21.2 million ounces of AgEq.

Initially, the RV mine is expected to produce an average of 3.1 million ounces of AgEq annually. That is based on a throughput rate of 270 tons per day. But Drover says he hopes to boost production to 4.5 million ounces in 2022 and 5.5 million ounces in 2023 by increasing the throughput rate by utilizing an available mill with a capacity of 550 tons per day.

Initially, the RV mine is expected to produce an average of 3.1 million ounces of AgEq annually. That is based on a throughput rate of 270 tons per day. But Drover says he hopes to boost production to 4.5 million ounces in 2022 and 5.5 million ounces in 2023 by increasing the throughput rate by utilizing an available mill with a capacity of 550 tons per day.

Drover said the company hopes to bring on the Shafter mine on stream by 2023, a move that would add another 2.5 million to 3.0 million ounces of silver to the Aurcana’s annual production total.

The Shafter silver project is located in Presidio County, southwest Texas. The project was advanced and substantially built prior to being placed on care and maintenance in December, 2013.

A revised PEA envisages production of 7.7 million ounces of silver over four years, peaking at 2.26 million ounces in the first year, falling to 1.24 million ounces in the fourth year. This is expected to generate total revenue of $118 million and cash flow of $28 million. The total estimated capital cost is $22 million.

Back in February, the company raised $33.4 million from the sale of 33.4 million units priced at $1.00 per unit. Each unit consists of one common share of the company and one full common share purchase warrant entitling the holder to purchase one common share at $1.25 for a period of 36 months from the date of issuance.

Lascaux Resources, a resources fund in Connecticut owns 33% of the Aurcana stock.

Net proceeds of the private placement will be used to provide contingency funding for the restart of the RV mine, reactivate the already built and previously operated mills and will also support the examination of value creation opportunities on multiple fronts.

On July 20, 2021, Aurcana Silver shares were trading at 83 cents in a 52-week range of $1.25 and 48 cents, leaving the company with a market cap of $231 million, based on 278.2 million shares outstanding.

Southern Silver Exploration Corp. [SSV-TSXV, OTCQB-SSVFF] is focused on the Cerro Las Minitas (CLM) silver-copper-lead-zinc project in Durango, Mexico.

Southern Silver Exploration Corp. [SSV-TSXV, OTCQB-SSVFF] is focused on the Cerro Las Minitas (CLM) silver-copper-lead-zinc project in Durango, Mexico.

CLM is one of the largest and highest-grade undeveloped silver projects in the world. It is wholly-owned, unburdened by royalties, fully financed and fully permitted.

The project is located in the heart of Mexico’s Faja de Plata, which hosts multiple world class mineral deposits such as Penasquito, Los Gatos, San Martin, Naica and Pitarrilla.

“We believe we are on the way to developing a very substantial silver mine with base metal credits,” said Southern Silver President and director Lawrence Page, who has a long track record of success in the exploration sector.

Page has been a director and officer of companies which have discovered and brought into production the David Bell and Page Williams mines in Ontario, the Snip, Calpine/Eskay Creek and Mascot gold mines in British Columbia, as well as the discovery of the Penasquito mine in Mexico.

Southern Silver owns 100% of the CLM project (mineral claims and orebody) after completing an agreement with Electrum Global Holdings (privately owned New York company) to acquire Electrum’s 60% stake in the project for US$15 million in total cash and share payments.

Southern Silver owns 100% of the CLM project (mineral claims and orebody) after completing an agreement with Electrum Global Holdings (privately owned New York company) to acquire Electrum’s 60% stake in the project for US$15 million in total cash and share payments.

Electrum Global Holdings holds a 24% stake in Southern Silver which was trading at 40 cents on July 12, 2021, in a 52-week range of 70 cents and 23.5 cents.

The property portfolio also includes the 100%-owned Oro porphyry copper-gold Project in Southern New Mexico where the company sees high potential for the discovery of a copper porphyry system at depth.

CLM contains a NI 43-101-compliant global resource of 272 million silver equivalent ounces (AgEq), including an indicated resource of 134 million ounces of AgEq at 375 g/t and an inferred resource of 138 million ounces of AgEq at 334 g/t.

In September, 2020, the company launched a 20,000-metre drill program that is currently aiming for a resource expansion of 25% to 30%. The program is targeting significant near-term resource growth on a number of targets including:

- Las Victorias Extension, were two drill holes in 2018 intersected thick and high-grade zones in both the Blind and Skarn Front Zones, demonstrating the potential for resource expansion at bulk mineable widths.

- South Skarn/La Bocona, where targets consist of Skarn Front-type mineralization, which have only been partially tested and are not included in the 2019 resource estimate.

In a July 6, 2021 news release, the company said new assay results continue to extend both shallow gold-silver enriched oxide mineralization and high-grade polymetallic sulphide mineralization at the South Skarn, and Mina La Bocona target areas.

It said newly released polymetallic sulphide intercepts from the Mina La Bocona target area include:

A 2.1 metre interval (1.8 metres east TT) averaging 161 g/t silver, 0.1 g/t gold, 4.9% lead and 3.0% zinc (445 g/t AgEq) including a 0.5 metre interval (0.4 metre est TT) averaging 422 g/t silver, 0.4 g/t gold, 13.2% lead and 9.1% zinc (1229 g/t AgEq) from drill hole 21 CLM-151

A 2.1 metre interval (1.8 metres east TT) averaging 161 g/t silver, 0.1 g/t gold, 4.9% lead and 3.0% zinc (445 g/t AgEq) including a 0.5 metre interval (0.4 metre est TT) averaging 422 g/t silver, 0.4 g/t gold, 13.2% lead and 9.1% zinc (1229 g/t AgEq) from drill hole 21 CLM-151

Exploration on the project continues with two drills on the property; the current program has now completed 54 core holes totaling 20,207 metres since drilling recommenced in September, 2020. Assay results from 11 holes are pending and are anticipated over the coming weeks.

Southern Silver has now tested over 750 metres of strike length along the east side of the Cerro to depths of up to 500 metres, primarily in the South Skarn and Mina La Bocona target areas. Three bonanza grade mineralized zones have been identified and testing of a potential fourth high-grade zone is nearing completion, results of which will be incorporated into the mineral resource update on the project.

A resource update is due in the fourth quarter of 2021, following by a preliminary economic assessment in the first quarter of 2022.

Meanwhile, the company is planning to drill this year on he 12 square kilometre Oro Project, which covers the majority of the historic Eureka Mining District in Grant County, New Mexico and is located 40 kilometres southwest of the Silver City porphyry copper district.

Meanwhile, the company is planning to drill this year on he 12 square kilometre Oro Project, which covers the majority of the historic Eureka Mining District in Grant County, New Mexico and is located 40 kilometres southwest of the Silver City porphyry copper district.

Targeting has been finalized based on geophysical surveys and permits are pending for a 5,000-metre drill program, designed to test several of the copper-molybdenum and porphyry and copper-gold skarn targets within a broad quartz-sericite-pyrite alteration zone, interpreted to overlie an unexposed porphyry centre. Drilling is expected to commence in the third quarter of 2021.

“The presence of historical base and precious metal mines from the late 19th and early 20th centuries, coupled with a relative lack of modern exploration in the area, make the Oro Project an exciting potential location for future discovery,” Page has said.

Shares of Southern Silver are trading at CAD$0.33 cents with a 52-week range of CAD$0.295 – $0.70.